Fahroni

Vroom (NASDAQ:VRM) is a national online auto retailer that offers services for all phases of the used car buying and selling process, including at-home pick-up and delivery. VRM is considered one of the pioneers in disrupting the large used car market. However, the auto sector has been crushed by the market recently. I think VRM may offer some opportunities in the short term, but long-term prospects still appear bleak. Here I will discuss some of my thoughts.

Huge macro headwinds and lower used car demand

It is widely known that the used car market has gone through huge headwinds from inflation and rising interest rates recently. Cars are expensive products. Customers are definitely feeling the pressure right now. Although prices have dropped more than 10% this year, the 2022 Q3 may be one of the most unaffordable points recently for people using financing options. Demand will likely be significantly affected. In the next several quarters, more vehicle depreciations were expected to bring back car prices in line with other goods. This should further bring down demand as some consumers are waiting for a lower point to buy.

Vroom’s surprising quarter has shown a lot about its business model

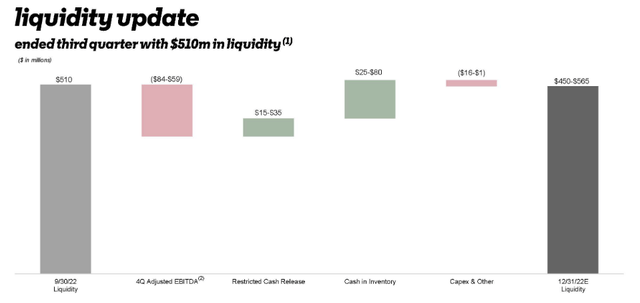

For companies like VRM and Carvana (CVNA), one of the key questions is whether their business model is durable. Can they achieve the escape velocity toward free cash flow? In the recent 2022 Q3 results, VRM presented a very bad performance on business growth, with the Ecommerce units sold dropping from 19k to 6k (-67.3% YOY). However, gross profit per eCommerce unit (GPPU) went up from $2560 to $4206 (64% YOY). SG&A expenses decreased by 18.3M and Adjust EBITDA improved from -85.6M to -73.3M. This is a huge quarter for improvement in profitability. Now, VRM’s burn rate was reduced, and the company is projecting an increase in year-end liquidity (as below).

One surprising element here is the GPPU number of $4206, and VRM has never achieved such a level before. Even during FY2021, one of the best years in terms of market environments, VRM only had a GPPU of $2206. For FY2019 and FY2020, VRM GPPUs were only at the $1700 level. After all the ups and downs of the market, I think VRM has a clear understanding of where the profitable niche will be for them. As they continue to downsize, the upward trend of profitability is very noticeable. This is also a very difficult quarter for other retailers with government stimulus gone, car prices going down, and interest rates going up. VRM showed how the eCommerce auto business could be profitable through careful assortment optimization, regional vs national pricing, assortment optimization, and price optimization.

I thought used car business costs were hard to cut given lots of items such as repairing cars, logistics, titles, and registrations, etc., as these fundamental operations won’t be changed substantially.

Vroom’s decision to give up market share

Previously, VRM was very aggressive to get market share and lead the auto market. It bought Texas direct auto in 2015, a huge online eBay seller focused on helping people looking for higher-end cars (30k). Now, VRM seems to understand its limitations and has to downsize the business. It also has changed its strategies back and forth. It tries to use built-in eCommerce tools in the beginning, then they spin off what they have and integrate with platforms like AutoFi. It was also excited to be a partner with Rocket Auto for its finance arm last year, but they stopped that recently and chose to insource. I felt VRM tried to fix its problems but never found good solutions. Personally, I don’t like the constant changes of business directions that they had.

Third-party network vs built-in model

When compared with CVNA, VRM differentiates with its low fixed-cost model and asset-light strategy. Its operations depend on the third-party network in logistics and reconditioning. This is also a little bit concerning to me. Using third-party vendors like Mannheim may sound like a very reasonable idea when you only sell 5K cars a month. But it won’t help customer experiences and will become difficult as the business scales. For example, most car logistics are for long-haul routes between dealers or manufacturers. Most drivers cannot deliver a car on time. Last-mile car delivery is also very difficult to work with. Similar issues can be found in third-party reconditioning centers where it is difficult to ensure quality.

Management change

In the short period since VRM’s IPO in mid-2020, it has gone through many changes in its management teams and board. Robert R. Krakowiak, former CFO of Stoneridge, replaced David Jones as the new CFO in late 2021. Thomas Shortt, a VP at Walmart (WMT), has been appointed as the chief operating officer in early 2022. Then he replaced former CEO Paul Hennessy as the new CEO. Its board has also changed multiple times, with 5 of its 7 board members replaced after 2020. Only Robert Mylod and Michael Farello have served the board for more than 3 years. This is very different from other Auto retail companies, which usually have a long tenure of services. CarMax’s (KMX) officers are all promoted internally. CVNA’s senior team and board members are all original since its IPO. A low turnover rate in senior management could ensure long-term value creation and consistency with business strategies. VRM’s relatively high turnover rate is a little concerning to me.

Bottom line

VRM’s recent improvement in profits somewhat alleviated the fear of potential bankruptcy in my view. The stock is looking cheaper given the total equity value 445M while the market cap is only 153M. There is also 1372M in current assets with 533M cash and equivalents. I think VRM could be a great opportunity for short-term gains. However, I am skeptical about its capabilities in generating long-term returns. CVNA might be a better option for patient investors.

Be the first to comment