naphtalina/iStock via Getty Images

Micron Technology (NASDAQ:MU) announced that it is shipping qualification samples of its 1-beta nm process node DRAM, one year ahead of competitors Samsung Electronics (OTCPK:SSNLF) and SK hynix. The 1-beta nm process delivers around 35% of bit density improvement over 1-alpha nm process.

The introduction of 176-layer NAND and 1-alpha DRAM last year represented major technology breakthroughs for Micron. It was the first time that Micron had achieved industry leadership across these two flagship technologies, but it took some marketing manipulations for Micron to do so.

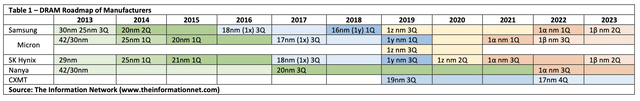

As shown in Table 1, Micron lagged the rivals by one or two years at 1xnm process and the 1ynm process, then became the first DRAM manufacturer by a narrow margin to enter production of its 1znm process chips. Micron widened the technology gap by one year for 1-alphanm process and has maintained the lead for 1-beta nm DRAM.

The Information Network

Technology Advancement a Moot Point at this time

Driven by a mix of skyrocketing consumer demand followed by pandemic supply constraints, the traditionally cyclical memory industry moved along a new cycle that started in Q1 2021 and ended in Q2 2022. The downturn was amplified by a 40-year high inflation rate and recessionary fears that dampened demand primarily for consumer electronic products.

With the Federal Reserve still behind the curve, with an interest rate at 4% because of the high inflation rate, currently 7.7%, the length of the downturn is unclear. Consumer confidence has increased as gasoline prices have decreased, and so has inflation, but that will reverse as winter sets in, and heating oil and natural gas prices rise.

Capex Spend Plans

To counter oversupply and high inventory, memory companies have talked about plans to reduce capex spend (combination of construction and equipment). Significant capex cuts on memory expansion by Micron and SK hynix will negatively impact Applied Materials (AMAT) and Lam Research (LRCX), according to The Information Network’s report entitled “Global Semiconductor Equipment: Markets, Market Shares, Market Forecasts.“

- Micron indicated it would reduce 2023 capex by 30%, which includes 50% equipment and 50% building, which would imply a 15% cut in equipment. But MU is actually cutting back WFE equipment purchases by 50% in fiscal 2023, a significant impact on equipment suppliers to the company.

- SK hynix announced in late October it plans to reduce its investment next year by more than 50 percent due to poor demand in memory chip business. The move comes after the company’s third-quarter operating profit fell to 1.7 trillion won ($1.2 billion), missing analysts’ estimates of 1.87 trillion won. Revenue fell 7 percent to 11 trillion won.

- Samsung electronics has no plan to cut dram output artificially or adjusting capex. Samsung plans a semiconductor capex spend of 54 trillion won, of which 47.7 trillion won ($38.5 billion) of which 33 trillion won (29.1 trillion won for semiconductors) has been spent so far in 2022. In its 3Q earnings call, the company noted that

“Demand is expected to weaken due to large inventory adjustments at corporate customers, but data centers are expected to expand investment next year. We do not consider making an artificial production cut, as we need to prepare for a demand recovery from a mid- to long-term perspective.”

DRAM

Shipments

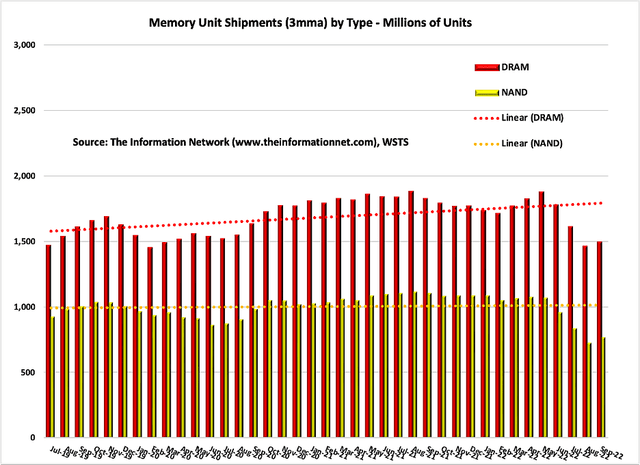

Unit shipments of DRAM and NAND are shown in Chart 1 on a 3-month moving average for the period July 2019 to September 2022. Memory MoM shipments increased 1.5% in September following an 8.3% decrease in August and a 7.4% decrease in July. DRAM shipments increased 1.5% in September following a -9.4% drop in August and a 9.2% drop in July. NAND shipments increased 5.6% in September following a -13.3% drop in August and a -12.7% drop in July.

The Information Network

Chart 1

ASP (Average Selling Prices)

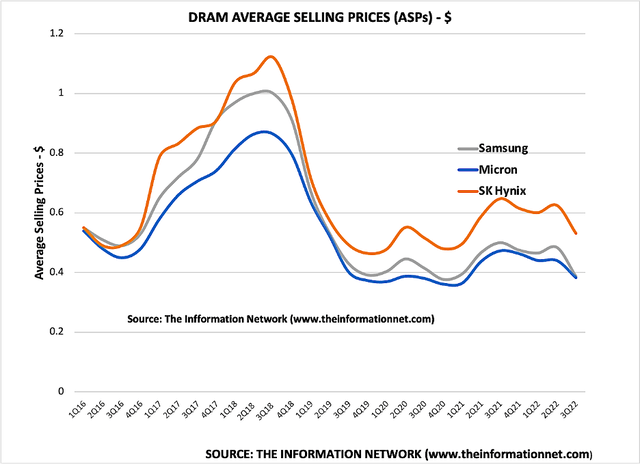

DRAM ASPs for Micron decreased 13% in the recent quarter, better than -15% for SK hynix and -20% for Samsung, as shown in Chart 2.

The Information Network

Chart 2

Revenues

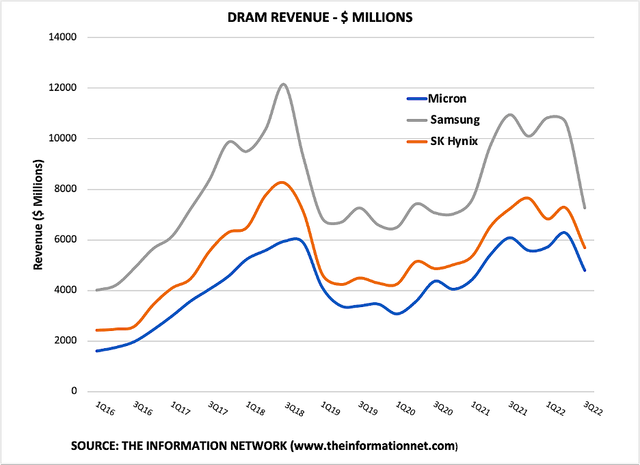

Chart 3 shows DRAM revenues by company. Micron dropped 23.4% in the recent quarter while SK hynix dropped 21.6%, and Samsung dropped 31.6%.

The Information Network

Chart 3

Investor Takeaway

In the third quarter of 2022, semiconductor production suffered a double-digit decline, the largest decline since 2008 as inventories piled up along with this price drop. The memory sector fared poorly and memory companies Micron and SK hynix provided guidance for the next quarter well below consensus.

The cuts in capex will mean memory chip makers are planning to cut shipments by reducing capacity investment in response to the decline in memory chip prices.

I estimate that based on cuts in production, Micron’s memory semiconductor inventories should peak in 1Q23 and decline after 2Q23 due to the supply cutbacks. As a result, industry conditions should improve from 3Q23. I also estimate a recovery in smartphones and demand of hyperscalers’ data center investment in 2H23. Overall demand for servers has decreased as customers reduced their purchasing budgets

One of the factors that may hurt the memory market is Samsung’s resistance to cut back on DRAM spend as the company plans to maintain its strategy of prioritizing profitability by considering cost competitiveness in determining product mix. Continual expansion of DRAM bit shipments could undermine the plan of the other two companies in the DRAM oligopoly. 90% of the global DRAM industry market share is occupied by Samsung Electronics, Hynix and Micron Technology,

Investors must recognize that memory is a cyclical industry, as illustrated in Chart 3 above. DRAM revenue reached a peak in 3Q 2018 in the last cycle and since peaking in 3Q21, the industry has been in a prolonged downturn that accelerated in recent months.

One thing to notice in Chart 3 is that the DRAM market stopped dropping in Q2 2019 and remained relatively flat until Q1 2021. That means the down part of the last DRAM cycle lasted about two years. Since this current cycle may be ending in the next two quarters, it is feasible that positive revenue growth may not start until 2025.

The consensus outlook for 2023 has been updated. The 2023 expected loss is increased from -US$0.09 to -US$0.26 per share, with revenue forecast to be unchanged at US$19.3 billion.

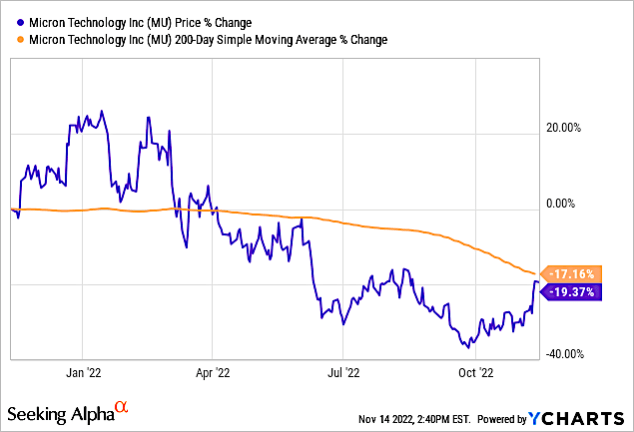

Chart 4 shows that Micron dropped significantly below its 200-day moving average following its disastrous FQ4 2022 earnings call, which I discussed in a July 18, 2022 Seeking Alpha article entitled “Post-Micron Earnings Call: What Samsung’s Pre-Announcement Tells Us.”

YCharts

Chart 4

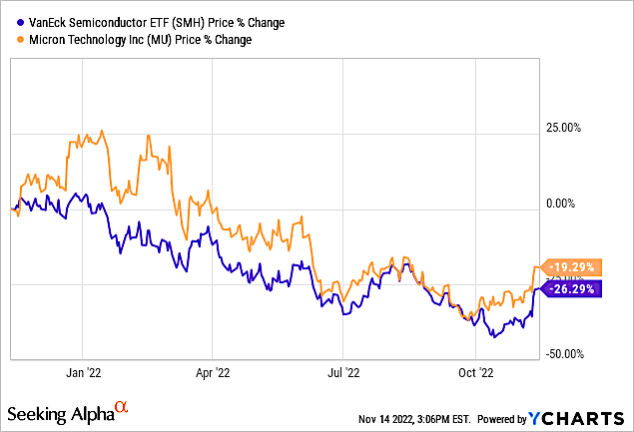

Micron has since recovered 25.7% from its September 23 low, but then again, so has the semiconductor industry, as shown in Chart 5 for the VanEck Semiconductor ETF (SMH).

YCharts

Chart 5

The consensus outlook for 2023 for MU has been updated. The 2023 expected loss is increased from -US$0.09 to -US$0.26 per share, with revenue forecast to be unchanged at US$19.3 billion. At this point, with continued macroeconomic factors, I maintain a Hold on the company.

Be the first to comment