RgStudio/E+ via Getty Images

Penn National Gaming (NASDAQ:PENN) has faced a series of bad beats with shares losing three-quarters of their value from its 2021 high. The stock has been caught up in the broader market selloff facing a reset of expectations following some weaker-than-expected earnings compared to what was likely an environment of exuberance during the early stages of the pandemic. That being said, we highlight what are overall solid fundamentals and a positive outlook for a company that remains a leader in the emerging segment of online sports betting.

A positive development is a report that Massachusetts is moving forward with its sports betting framework that may be ready for the upcoming start of the NFL Pro Football season. Indeed, Penn National Gaming is well-positioned to capitalize on this new market adding a boost to its growth momentum. Ahead of its upcoming Q2 earnings report, we are bullish on PENN which offers a significant upside with room for the current rally to gain momentum.

Massachusetts Gaming Law

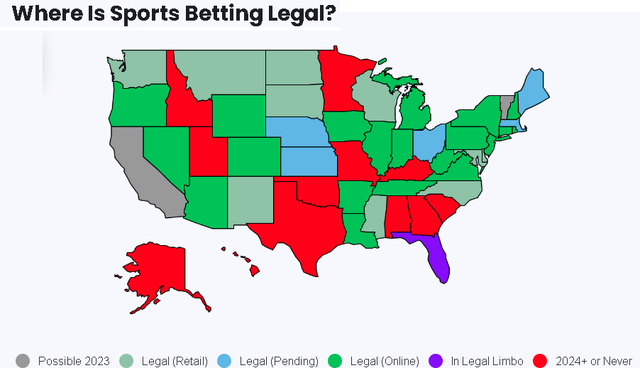

On August 1st it was announced that the Massachusetts state legislators reached an agreement on a bill to legalize professional and college sports betting. Under the bill, anyone at least 21 years old placing a wager in the state will be subject to a 15% tax on in-person wagers at casinos and a 20% rate on online betting. The state believes it will raise upwards of $60 to $65 million per year in revenue which was a selling point for the deal to go through to raise funds for budgetary items like education.

Sports betting in the state that had been in discussion for several years with the collegiate sports aspect as a point of contention. With the compromise, no betting will be allowed on games involving Massachusetts-based schools unless it’s for a post-season game like “March Madness”.

While there is still some uncertainty about when the bill will be officially signed into law, the understanding is that the sports betting operators will be prepared to move quickly to implement the services already live in other states. There is some thought it could be ready in the next few months.

As it relates to Penn National, the company will likely receive one of the seven mobile betting platforms licenses up for grabs in addition to its Plainview, Massachusetts horse racing and slot machine parlor location ready to service a sports book. What makes the state particularly interesting for the company is its subsidiary “Barstool Sports” which has roots in Boston and is recognized as being popular among the college-age mid-20s demographic.

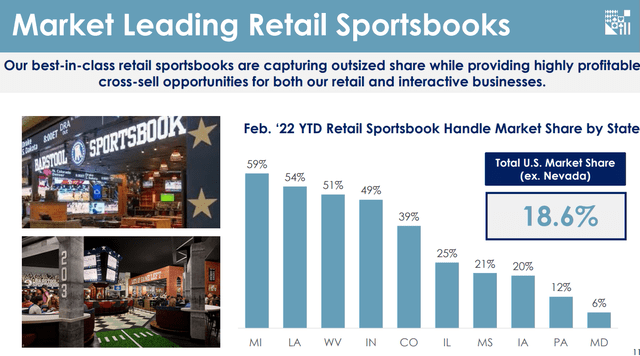

With current operations in 20 states, the company notes it has a 19% market share nationally among retail sportsbooks, excluding Nevada. This ranges from a high of 59% in Michigan to more contested markets like Maryland at 6%. In our view, Massachusetts is ideal for the company to capture a leading share position. We can look forward to updated comments from the management team during the upcoming earnings conference call.

source: company IR

PENN Q2 Earnings Preview

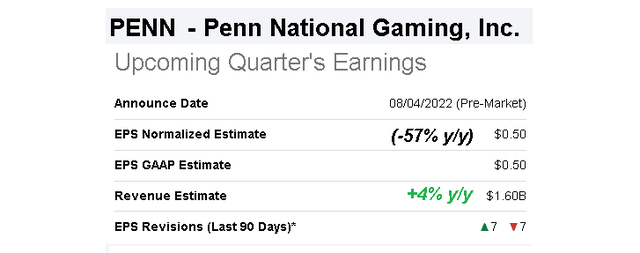

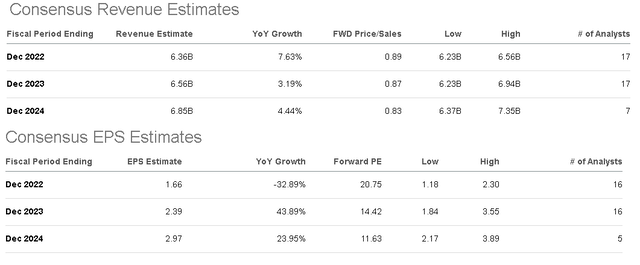

PENN is set to report its Q2 results on August 4th before the market opens. The consensus estimate for EPS of $0.50 represents a decline of 57% compared to $1.17 in Q2 2021. The revenue forecast at $1.6 billion, if confirmed, would be 4% higher year-over-year.

Seeking Alpha

For context, the period last year represents a tough comparable fueled by a strong consumer spending trend amid the federal stimulus boost that quarter. There is also a sense that the higher inflationary environment now has added to costs at its brick-and-mortar casino locations across everything from labor to food and beverages. The result has been an impact on margins highlighting some of the earnings pressure that helps explain the weakness in the stock.

Beyond the headline numbers, the big question heading into this report is if the company was able to sustain growth. A lot of macro concerns related to fears the economic environment is pressuring consumer discretionary spending and hitting gambling demand will be put to the test. We sense that there is room for the company to surprise to the upside, in a scenario where the summer season captured themes related to travel and leisure which have been strong otherwise.

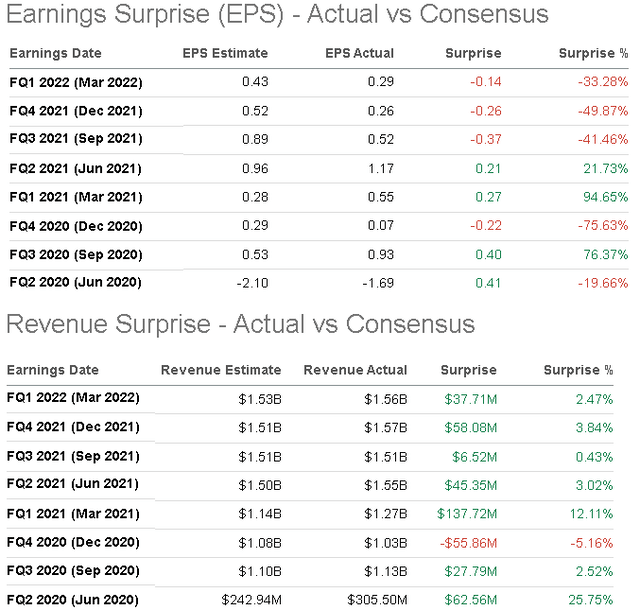

We’ll note that PENN has had an inconsistent history of earnings reports, missing the consensus estimate in each of the last three quarters although typically beating on the top line revenue figure over the last few years.

Seeking Alpha

PENN Stock Price Forecast

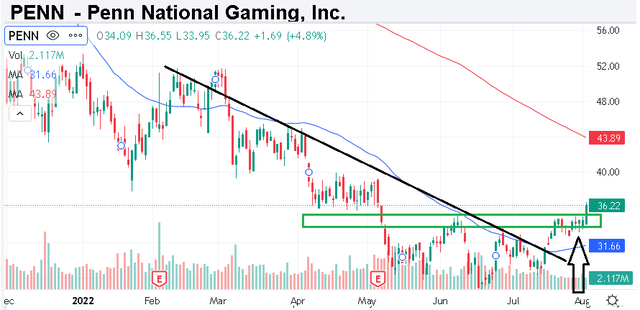

The first point here is that shares of PENN have already responded favorably to the Massachusetts bill, rallying more than 5% on the report. The setup here appears very bullish heading into Q2 earnings as the stock is effectively breaking out into a 5-month high through a level that has acted as resistance around $35.00 per share. Now trading about the 50-day moving average, the next target is likely the 200-day moving average around $42.00.

Seeking Alpha

Again, our message here is that shares may finally be turning a corner supporting a more sustained rally as the outlook improves. From a high-level perspective, the positives here are that the company remains profitable and there are several other states in the pipeline that could also move forward with a similar framework. In California, voters will have the chance to get sports betting started through a ballot initiative during the November elections. Other states including Kansas and Ohio are pending the implementation of already approved initiatives which are all markets PENN is targeting for online sports betting.

source: ActionNetwork

We note that the current consensus for PENN is calling for just modest revenue annual growth in the mid-single digits through 2024. We believe these forecasts are simply too low considering the sports betting runway. The potential that the company benefits from scale as operations launch in new states opens the door for margins and earnings to outperform. Looking ahead towards 2023 with a consensus EPS of $2.39, shares trading at just 14x appear like a bargain considering the outlook for accelerating financial momentum.

Seeking Alpha

Final Thoughts

We rate PENN as a buy with a price target for the year ahead at $44.00 per share representing a 20x multiple on the current consensus 2023 EPS. Down the line, a confirmation of earnings trending higher with firming margins can support further upside.

In the Q2 report, the operating margin and cash flow levels will be key monitoring points. Earnings are always tricky to trade. The company can beat estimates, and raise guidance, while shares could still sell-off. In this case, we like the current momentum in PENN and expect the rally to continue. That said, some volatility in the near term wouldn’t be surprising considering the big move higher this week already. As long as the stock continues to trade above ~$32, a bullish positioning makes sense. One strategy we recommend is to average into positions overtime to secure the best cost basis.

In terms of risks, Penn National Gaming and other casino operators remain exposed to broader macro conditions. Deterioration to the economic outlook, possibly driven by sharply higher inflation expectations or a surge in unemployment would undermine the bullish outlook and the company’s operating environment.

Be the first to comment