MarsBars

Who says you should take emotions out of investing? As a buy and hold type of investor, I take pride in ownership, especially in companies whose products I use on a regular basis. This brings me to Hanesbrands (NYSE:HBI), whose namesake and Champion clothing I have worn for many years, and recently, I became a shareholder in the company. In this article, I highlight why HBI is currently trading at an appealing price for income and growth, so let’s get started.

Why HBI?

Hanesbrands is a consumer goods company that produces a range of basic apparel for men, women, and children. It operates through the business segments of Innerwear, Activewear, and International, and over the last 12 months, generated $6.9 billion in total revenue.

Hanesbrands’ stock has seen plenty of pain over the past year, posting a 37% decline since the same time last year as the initial exuberance over work-from-home trends have worn off. Moreover, inflationary pressures and general concerns around supply chain disruptions and economic recession have further piled on the pressure. Plus, a strong dollar doesn’t help when the company translates its international sales back to the USD.

It would seem as if the company is doing horribly based on the stock price performance, but that doesn’t appear to be the case. This is considering the modest but respectable 5% YoY revenue increase (7% on a constant currency basis) during the first quarter, driven by strong Champion brand sales of 6% YoY (constant currency).

While U.S. Innerwear sales increased by just 1.5% YoY, it’s worth noting that sales have held up well against a difficult comparable last year, when many consumers worked from home and loaded up on the company’s products. Notably, sales on a 2-year stacked basis grew by an impressive 37%.

Looking forward, management expects strong growth for the Champion brand, and is guiding for $3.2 billion in annual sales by 2024, up from $2 billion last year. This includes seeking to grow its market share through expanded product offerings for younger female consumers in this brand. It also leads with product innovation, which includes its X-Temp technology, providing cooling and wicking benefits that especially help during hot summertime weather.

HBI also has key competitive advantages in its supply chain, through ownership of its own manufacturing facilities. This operating flexibility enabled HBI to simultaneously launch recent products in both the U.S. and Australia, with coordinated support from regional marketing campaigns. This strength was noted by Morningstar in its recent analyst report:

Another key strategy for Hanes is to improve the efficiency of its supply chain. It has already made progress in this area, having achieved a 15% increase in manufacturing output over the past four years. Hanes, unlike many rivals, primarily operates its own manufacturing facilities.

More than 70% of the more than 2 billion apparel units sold by the company each year are manufactured in its own plants or those of dedicated contractors. We believe the combination of strong pricing and production efficiencies should allow Hanes to maintain operating margins around 20% for its American innerwear business despite somewhat inconsistent sales.

Moreover, it appears that HBI has plenty of greenfield opportunities internationally, as noted by management during the recent conference call:

Looking specifically at Champion, we continued our expansion in China adding new stores in the quarter through our partners. In Europe, we continue to reach new consumers with new styles and silhouettes for kids. And we doubled our spring summer footwear sales driven by an expanded product offerings across channels and geographies.

Meanwhile, HBI continues robust shareholder returns, having repurchased 5.8% of its outstanding shares over the past 5 years ($25 million worth during Q1) and pays a well-covered 5.3% dividend yield with a 33.7% payout ratio. While HBI has just a BB rated balance sheet, management has made meaningful debt reduction, with a $414 million reduction in long-term debt since January of 2021.

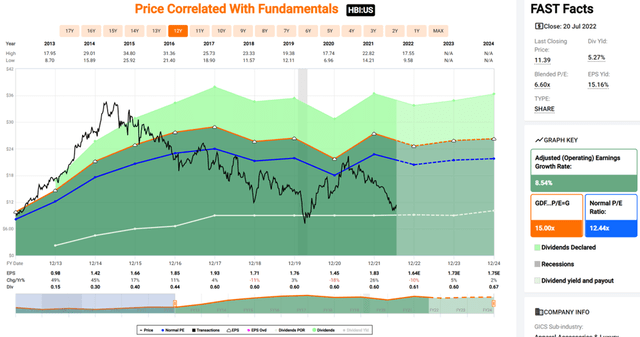

Lastly, I see value in HBI at the current price of $11.39, with a forward PE of just 7.1, sitting well below its normal PE of 12.4 over the past decade. Sell side analysts have a consensus Buy rating with an average price target of $14.46, implying a potential one-year 32% total return including dividends.

HBI Valuation (FAST Graphs)

Investor Takeaway

I believe HBI is a compelling investment at the current price, with plenty of upside potential as the company grows its Champion brand internationally and continues to return cash to shareholders. While the balance sheet is a bit leveraged, management has taken steps to reduce debt and I believe the company can continue to generate strong growth going forward. Meanwhile, HBI throws off an attractive dividend yield for income-focused investors. HBI is a Buy.

Be the first to comment