malerapaso/iStock via Getty Images

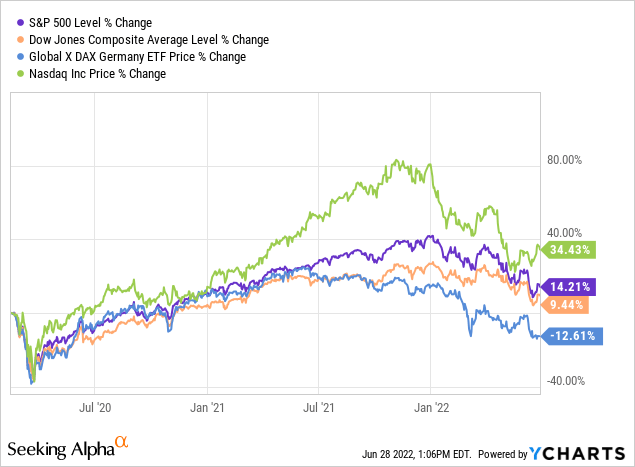

Sentiment on the stock markets remained poor in June. Although the major indices have made up some ground, overall, the S&P 500 (SPY), Nasdaq (COMP.IND), Dow Jones (DIA) & Co. are all still at 2020 levels, meaning that the gains from 2021’s bull run have mainly evaporated.

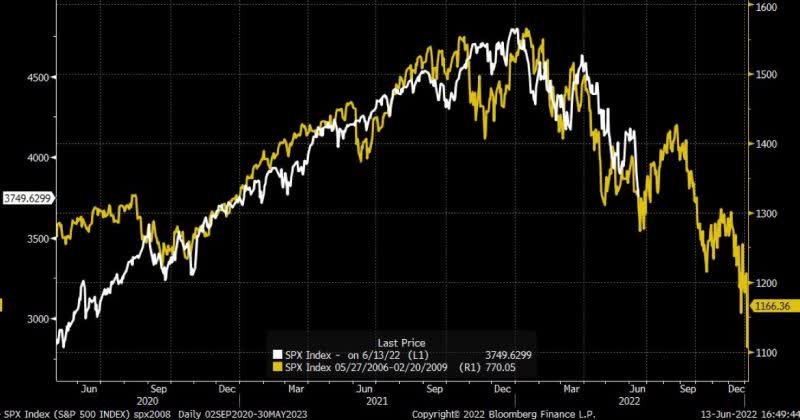

But these are all snapshots. Tomorrow, things can already look completely different again. Perhaps the recent consolidation is even the beginning of a new bull market? Nevertheless, we must warn against too much euphoria because, as we explained in our last article, painful bear markets usually proceed in several waves. At least interesting, although hardly suitable as a forecasting tool, is the parallel between the course of the S&P 500 today and the course during the financial crisis of 2008/2009.

Parallel between the course of the S&P 500 today with the course during the crash in the financial crisis (Bloomberg Finance)

However, such pictures and corresponding scenarios do not scare us dividend hunters, because our focus is on rising profits and dividends. We are happy to ride price increases, and when prices are weak, we are pleased and take advantage of dividend shares at a discount. The menu of stocks with historically comparatively high dividend yields is currently richly filled. In the following table, we have again listed 20 dividend stocks whose current dividend yield has risen significantly over the last 12 months.

| Ticker | Name | Div.% | Dividend Stability | Δ Div. 12 Months |

| (OTC:TAGOF) | Tag Immobilien | 7.94% | 0.95 | 4.15% |

| (OTC:VOYJF) | Valmet Oyj | 5.27% | 0.98 | 2.18% |

| (OTCPK:RBSFY) | Rubis | 8.35% | 0.98 | 2.07% |

| (OTCPK:PGPHF) | Partners Group Holding | 3.69% | 0.93 | 1.61% |

| (OTCPK:LEGIF) | Leg Immobilien | 4.81% | 0.96 | 1.54% |

| (OTCPK:FUPEF) | Fuchs Petrolub Vzg. | 4.04% | 0.98 | 1.36% |

| (OTCPK:GGDVF) | Guangdong Investment | 6.85% | 0.96 | 1.16% |

| (OTCPK:SMFTF) | Smurfit Kappa | 3.80% | 0.98 | 1.14% |

| (MO) | Altria | 8.29% | 0.98 | 1.13% |

| (NSA) | National Storage Affiliates Trust | 3.78% | 0.98 | 1.09% |

| (VIH1) | VIB Vermögen | 2.98% | 0.99 | 1.07% |

| (WHR) | Whirlpool Corporation | 3.79% | 0.94 | 1.07% |

| (PETS) | PetMed Express | 5.51% | 0.99 | 1.06% |

| (OTCPK:HOKCY) | Hong Kong And China Gas | 4.18% | 0.96 | 1.03% |

| (KALU) | Kaiser Aluminum | 3.86% | 0.98 | 1.03% |

| (SWK) | Stanley Black & Decker | 2.84% | 0.99 | 1.03% |

| (OTCPK:LGGNY) | Legal & General Group | 7.56% | 0.92 | 1.02% |

| (TGT) | Target | 2.39% | 0.98 | 0.98% |

| (SAP) | SAP | 2.65% | 0.98 | 0.93% |

| (IPG) | Interpublic Group | 4.00% | 0.99 | 0.92% |

Some explanations on how we scan the yields: The selection of discount dividend stocks is based on the algorithms of our Dividend Turbo tool. With the tool, we examine hundreds of the world’s most popular dividend stocks and compare the current dividend yield with the historical yield. Since a yield below 2 percent is uninteresting for many dividend investors, we only take stocks with a dividend yield of at least 2 percent into account. In addition, we list only reliable dividend payers, which we measure by a dividend stability ratio of at least 0.8. The ratio ranges from -1 (consistently lower dividend every year) to +1 (consistently higher dividend every year). Furthermore, we only considered stocks with a dividend history of at least five years without cuts.

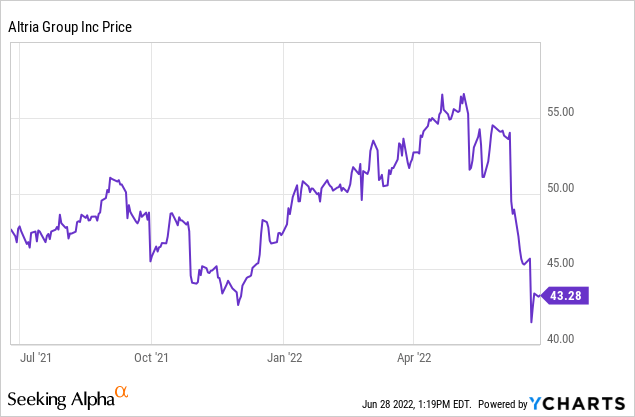

Altria – unbelievable destruction of shareholder value!

The stock has had a decent run in recent months. However, the U.S. Food and Drug Administration (FDA) has banned the sale of e-cigarettes in the U.S. by Altria’s subsidiary Juul, accusing it of improper advertising to young people, after which Altria’s share price plunged by almost 10 percent. This has broken the run, and the share is trading more than 40 percent below its all-time high again.

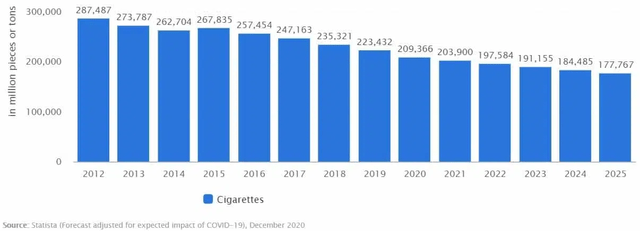

The dividend yield of over 8 percent associated with the share price loss is undoubtedly tempting, but Altria’s business model also has an equally high risk. Disappointingly, but in the end, not entirely surprisingly, the share price has barely moved from where it was 18 months ago. The problems are well known. Altria is struggling with declining cigarette sales volumes in the U.S., the only market in which Altria is active after the Philip Morris spinoff.

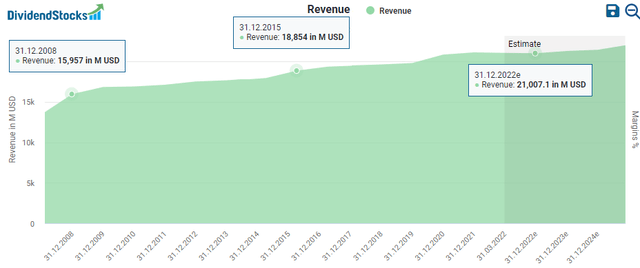

Altria must cushion falling sales with higher prices, although Altria cannot forever raise prices to the extent required by volume losses. Sales have developed correspondingly weakly in recent years, with growth rates in the low to mid-single-digit percentage range.

Revenue development for Altria (www.dividendstocks.cash)

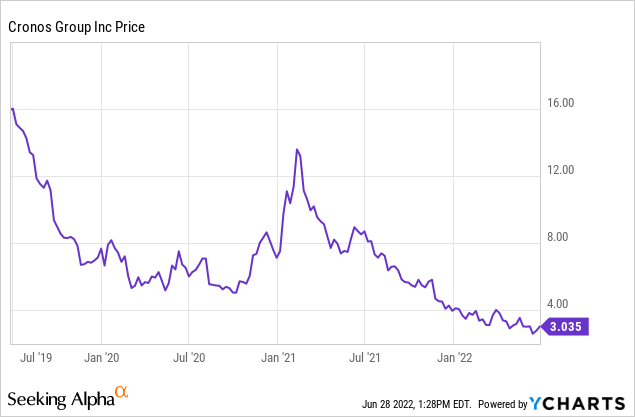

Attempts to diversify the business and steer it away from pure cigarettes have so far failed to bear fruit, and gradually the full extent of the debacle is becoming apparent. Altria put a full $13 billion on the table for e-cigarette supplier Juul in 2018. That same year, amid the cannabis hype, the company bought a 45 percent stake in Canadian cannabis producer Cronos for $1.8 billion, with an option to buy another 10 percent stake for a price of $19 per Cronos share. Cronos stock stands at $3 today!

Altria has already written off most of this investment in Juul and Cronos (CRON). Just for comparison, Altria paid dividends of $6.4 billion for all of 2021. From the investment that went into Juul alone, Altria could have paid out a double dividend to shareholders (i.e., the company owners) for two years.

In addition, Altria sold its Ste. Michelle Wine Estates subsidiary to private equity firm Sycamore Partners for $1.2 billion to focus on its cigarette alternatives business. The weal and woe of the company will therefore depend solely on cigarettes and their alternative products in the future. The FDA’s ban seems to weigh all the more heavily. But the events are not quite so dramatic.

For one thing, a ban was to be expected. For another, Juul has appealed the ban. In fact, the court of appeal immediately stopped the FDA ban. In this respect, the last word has not yet been spoken. In addition, when Altria acquired the Juul shares, it undertook via a non-compete clause to invest in the e-cigarette business only through Juul and not to develop, acquire or offer any other e-cigarettes. This clause could now fall with an FDA ban, giving Altria more flexibility to develop or acquire alternatives.

The Altria stock provides a juicy dividend, but high rates are at stake

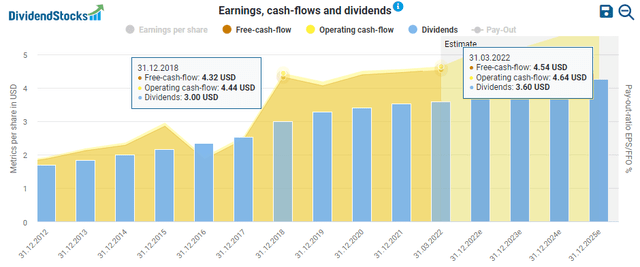

Shareholders are now asking themselves whether Altria is still in a position to pay the handsome dividends at all, given the possible need to invest in developing its alternative products or acquisitions. Fortunately, thanks to reliably flowing cash flows and a payout ratio of 80 percent on free cash flow, Altria continues to have sufficient financial resources to invest in the future while paying out total dividends.

Cash-flows and dividends for Altria (www.dividendstocks.cash)

A cut in the dividend is therefore unlikely to be imminent for the dividend aristocrat. However, it is questionable whether Altria will be able to maintain the growth rates of the last few years of around 8 percent.

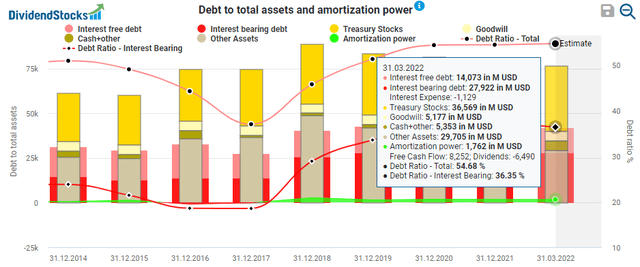

This is because Altria needs part of its free cash flow to pay off its mountain of debt. Thus, the debt ratio measured by interest-bearing debt of almost $28 billion is 36 percent. This ratio is slightly below that of Philip Morris (37.8 percent), but far above that of British American Tobacco (27.5 percent). At least some reassurance is provided by the fact that Altria is sitting on its shares worth $36 billion, which the company could use for takeovers.

debt to total assets and amortization power (www.dividendstocks.cash)

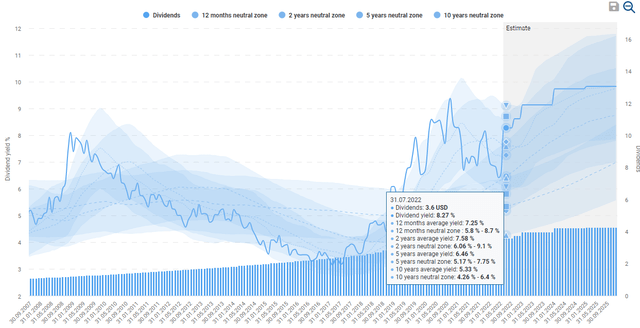

Investors who put Altria shares in their portfolio may overlook the risk of lower growth rates for the time being because Altria offers a historically high dividend yield of more than 8 percent, far above the long-term averages.

Dividend history for Altria (www.dividendstocks.cash)

Taking fundamentals into account

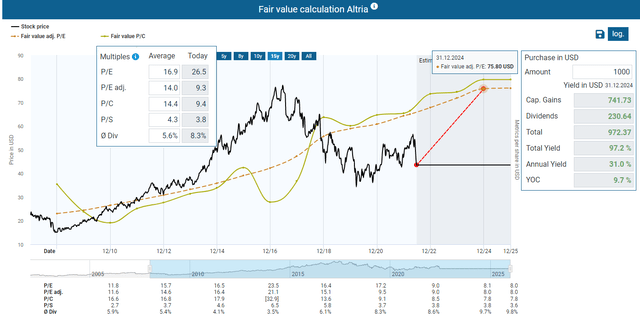

From a fundamental perspective, Altria’s stock seems to be undervalued and, with an adjusted P/E ratio of just over 9, trades far below its historical multiples. Measured against the historical earnings multiples and the expected adjusted earnings for 2024, the upside potential is almost 100 percent, corresponding to an annual performance of 30 percent, including dividends.

Fair value calculation Altria (www.dividendstocks.cash)

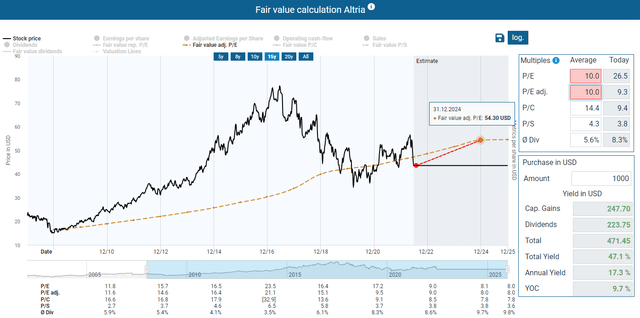

However, with the recent Juul debacle, it is clear that the market is (rightly) discounting Altria stock. The future outlook for tobacco companies is generally challenging, and Altria is essentially running behind its more innovative competitors. A lower target multiple is therefore entirely appropriate. The market thus seems to have priced in some skepticism, as even based on a 10 P/E (adjusted), the expected 2024 earnings per share yield an annual upside potential of 18 percent.

Fair value calculation Altria but with fair P/E ratio of 10 (www.dividendstocks.cash)

Conclusion

It’s amazing how even experienced managers of a billion-dollar corporation fall prey to FOMO in such a short-sighted way, letting themselves be carried away by unreasonable actions and thus massively destroying shareholder value. After all, to paraphrase a quote from Warren Buffett, Altria is probably one of those companies that even idiots can run. And so the company continues to own established brands like Philip Morris USA (PM) and John Middleton and continues to generate high cash flows unabated despite various bad investments.

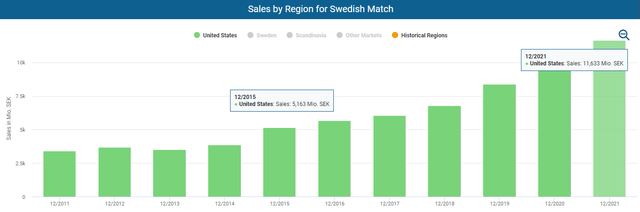

Conversely, things won’t get any easier in the future. Altria has failed to take a pioneering role in the thoroughly attractive market for cigarette alternatives and, in addition to disputes with the authorities, has to fend off competition from Reynolds American (British American Tobacco (BAT)) or Swedish Match (OTCPK:SWMAF), which Philip Morris is courting. The Scandinavian company, in particular, is shaking up the U.S. market and shining with a sustainable growth story.

Sales by Region for Swedish Match (www.dividendstocks.cash)

I believe the discount at which the share is currently trading is more than justified. I am holding on to my shares and continuing to collect dividends. However, I currently lack confidence in the management for additional purchases.

PetMed Express – Do we see a dividend cut due to a high payout ratio?

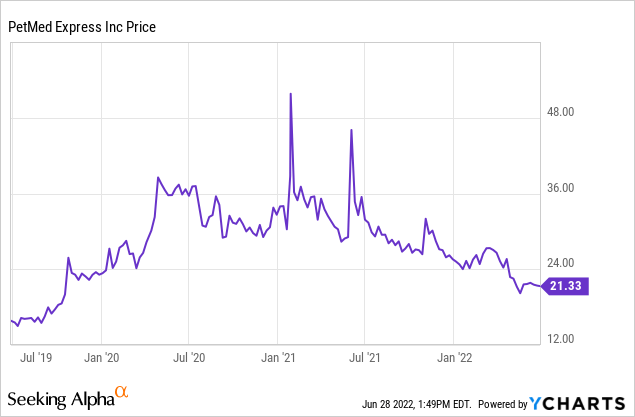

The PetMeds Express share has been extremely volatile in recent years. The price of the online pharmacy doubled from 2017 to 2018 to over $50, only to fall again by 70 percent to below $16 by the summer of 2019. In the meantime, thanks to Reddit & Co., the share price climbed back up to USD $40 and is now trading at around $22.

PetMed Express sells pet medications, health products, and accessories for dogs and cats. The medications include both prescription (heartworm medications, arthritis, thyroid, diabetes and pain medications, heart/blood pressure medications and other specialty medications, and generic substitutes) and non-prescription (flea and tick control, bone and joint care products, vitamins, treats, nutritional supplements, hygiene products, and accessories).

It is interesting to note how Pet Med Express distributes these products. In fact, they are not sold in traditional supermarkets or their stores, but only via the Internet through www.1800petmeds.com, the corresponding app, or through a telephone contact center that customers can reach through a toll-free number.

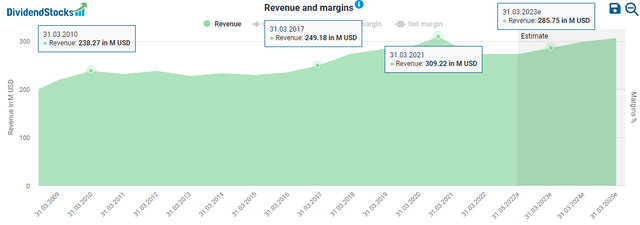

According to the American Pet Products Association, more and more people are spending more and more on veterinary care. Spending on pets increased by nearly 20 percent in 2021. The problem, however, is that PetMed Express is lagging behind that growth. Over the long term, PetMed Express has certainly been able to increase sales. However, there have been periods where sales have stagnated or even declined. From 2010 to 2016, there was almost no growth. And the fiscal year 2022, which ended in March, also saw a decline in revenue from $309 million to $273 million.

Revenue development for PetMed Express (www.dividendstocks.cash)

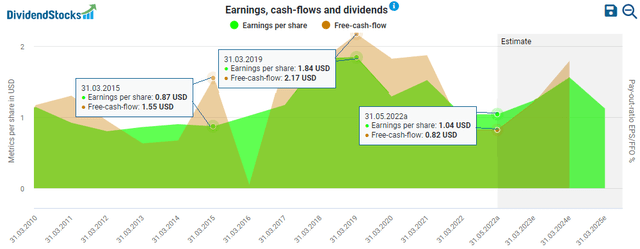

EPS also fell to $1.04 from $1.52, and for now, analysts don’t expect the company to reach its old highs from 2018 to 2021 in the next two fiscal years.

EPS and free cash flow (www.dividendstocks.cash)

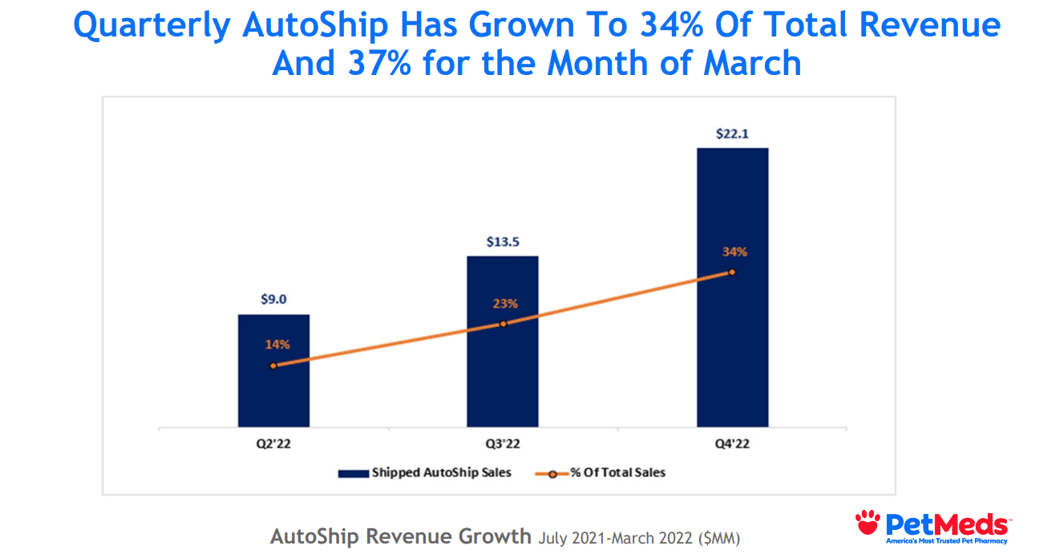

PetMeds wants to fight back with a subscription model (the “AutoShip program”) and acquisitions like the recent one of telemedicine startup Vetster. The subscription model, in fact, has gained momentum and is now responsible for almost 40 percent of sales.

Investor relations PetMed Express

Conversely, the company is struggling against the big-name competition in a highly fragmented market. Measured by its market capitalization of just USD 400 million, PetMed Express is the smallest and least diversified company compared to competitors such as Zoetis ((ZTS) $78 billion), Chewy ((CHWY) $15 billion), and PetCo ((WOOF) $5.1 billion). Incidentally, this lack of product diversity is a point that CEO Matthew Hulett freely admits:

„… we think we’re pretty good on medication and there’s other areas where we really need to fill in. And what’s driving that is really our customers really want to have more products. They want more basket from us. They want more services that are aligned around pet health.”

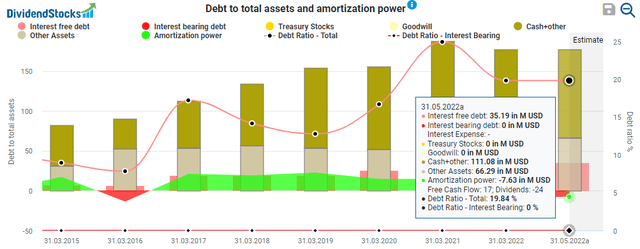

The business model does, therefore, not provide a moat. The only thing praiseworthy is the squeaky-clean balance sheet. PetMed Express is debt-free and sits on a vast cash mountain of $111 million.

Debt to total assets and amortization power (www.dividenstocks.cash)

Is PetMed Express’ dividend that safe?

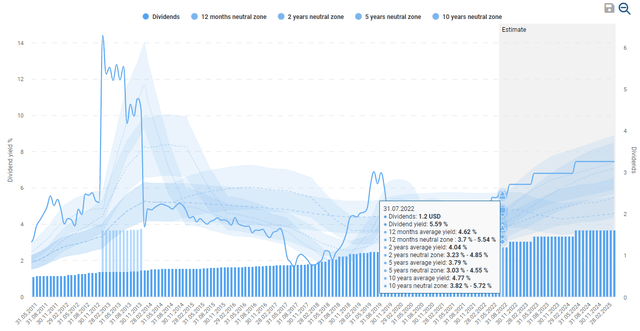

But let’s take a closer look at the dividend. The dividend yield of 5.5 percent is well above the long-term historical corridors. Apart from a special distribution in 2013, the yield was only this high in the second half of 2019.

Dividend history for PetMed Express (www.dividendstocks.cash)

However, there are some warning signs here. The payout ratio, for example, is over 100 percent, measured in terms of profit and free cash flow. This shows that the company is paying dividends from the substance of the accumulated cash flow of recent years. This is not sustainable. In addition, management is trying to generate new growth through acquisitions, which puts further pressure on the existing liquidity. Asked whether new M&A activities could lead to a dividend cut, CEO Matthew Hulett was relatively vague:

„And on the dividend side, we have a commitment to the dividend. […] But as you know, we’ve struggled with new customer growth. And so we’ve decided to support the dividend. And we’ve also decided to also not grow the company unprofitably. […] And I actually think that could be a problem as you start entering into some of these more difficult periods that we’re starting to see now. So in short, we’re going to support the dividend.”

That doesn’t sound like a clear commitment to me. Focusing on the dividend would also not make sense given the intense competition, but I would have liked to see more honesty towards the shareholders. In short, no one can see the future, but the warning signs are red for the PetMed Express dividend.

Conclusion: PetMed Express isn’t a buy

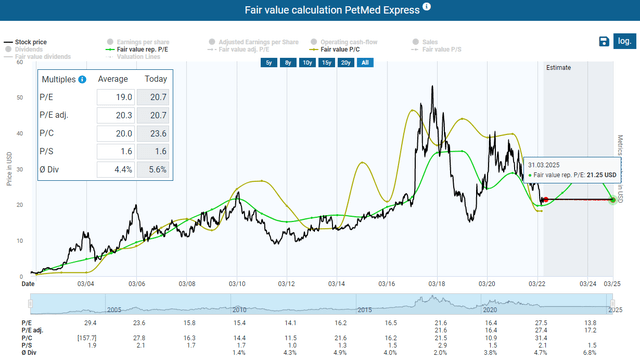

The price setback suggests that the share is now favorably valued. However, with an adjusted P/E ratio of 20, the share is just at the level of its historical multiples.

Fair value clalculation PetMed Express (www.dividendstocks.cash)

This valuation is far too high for a company in such a competitive market and with an unclear growth path. From my perspective, the stock does not provide a unique selling point. It is also interesting that many investors think the same way. Currently, 25 percent of the stock is held by short-sellers who bet on falling prices. Of course, short squeezes here can catapult the stock price upward. However, such speculation is not the focus of Stock Finder, whose readers want to profit from rising profits and dividends. Therefore, the share is not a buy for me.

Be the first to comment