RealDealPhoto

This article was coproduced with Mark Roussin.

In a time when market headwinds remain strong with inflation still high, interest rates rising, and a potential weakening consumer, investors must focus on high-quality businesses that can still thrive.

Apple (AAPL) already is warning of lower demand for some of their best-selling products, like iPhone and Mac.

Best Buy (BBY) is another name that could see a weak holiday season as a weakening consumer could lead to less big ticket items being sold like big screen TVs or home theater equipment.

Yet, in times like this, hospitality and gaming is still a sector that could thrive in this environment. The demand for travel to Las Vegas still remains high and the company with some of the best real estate on the strip is VICI Properties (VICI).

Las Vegas is the center of the gaming world, but it’s not the only location.

So, in today’s article, we will compare the premiere landlord on the Las Vegas strip in VICI Properties to the smaller yet well diversified Gaming and Leisure Properties (GLPI) to determine which of these gaming and hospitality REITs appear to be a better buy.

VICI Dominates In Sin City

When it comes to VICI Properties, they’re the largest landlord, in terms of properties, on the Las Vegas strip. Las Vegas accounts for 45% of the company’s real estate exposure. Here are some of those properties.

VICI Properties

VICI was created on Oct. 6, 2017, as a spin-off of real estate assets operated by Caesars (CZR) as part of the reorganization coming out of the CZR’s’ bankruptcy. VICI executed an initial equity private placement in November 2017 and its IPO shortly thereafter on Feb. 1, 2018.

Being that VICI owns some of the best real estate on the strip, they focus on having premium experiences.

Even during the pandemic, VICI has maintained an occupancy rate of 100%, which is a testament to the quality of their portfolio and operators.

Over three quarters of the company’s rental revenue comes from operators within the S&P 500 (SPY) meaning these are large companies that have access to capital in the case of slower economic times.

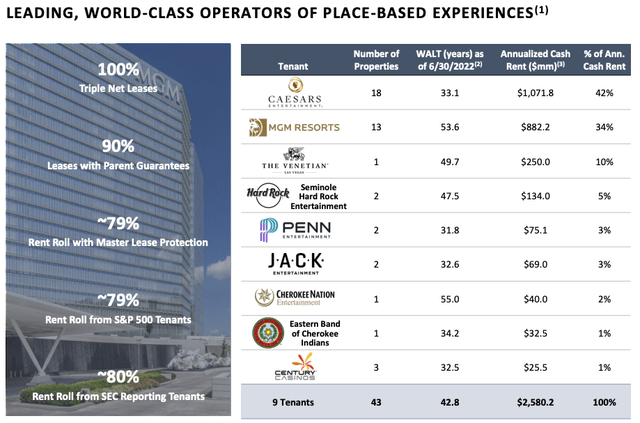

Here’s a look at these tenants for VICI:

VICI Investor Presentation

VICI owns 43 properties and four golf courses within 15 states across the US. The great thing about the gaming and hospitality industry is the high barrier of entry and with that comes long dated lease agreements.

VICI has continued to expand its portfolio over the past few years with acquisitions of the Venetian in Las Vegas as well as acquiring MGM Growth Properties LLC, which owned the famed MGM Grand.

Small retailers or small businesses can pick up shop and move regularly. Although it can be a pain, it’s feasible. However, moving an entire hotel and casino is not all that realistic without taking on major expenses. Thus, the weighted average remaining lease term for VICI stands at 43.7 years.

GLPI Spreads Its Wings Wide

GLPI takes a different approach than VICI. Where VICI has a major focus in one area, Las Vegas, GLPI is much more geographically diversified.

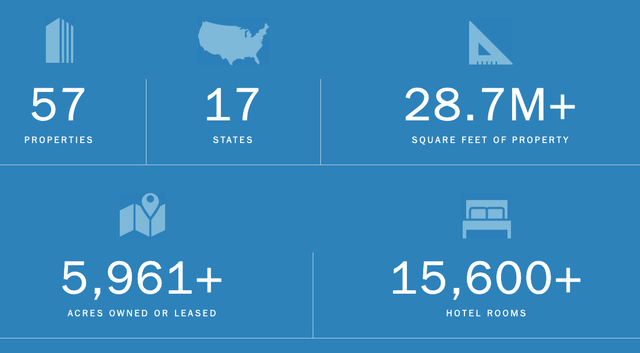

GLPI has a portfolio of 57 properties within 17 different states in the US. Only one of those properties is in the Las Vegas area, and it’s about 15 minutes south of the Las Vegas strip.

GLPI Investor Relations

GLPI is the oldest gaming REIT (six years in existence) with the greatest recognized stability through economic cycles considering its 100% regional portfolio (zero on the Las Vegas strip).

GLPI is much more spread out and in doing that, they have focused on quality within their respective regions. They have 10 casinos which are ranked No. 1 in terms of Gaming Revenue in specific regions across the country.

In terms of operators, PENN Entertainment (PENN) is by far the largest as they operate 33 of the 57 properties in the GLPI portfolio. Other operators include Caesars, Bally’s, Casino Queen, and Cordish.

The majority of the properties have master leases with the respective operators, in addition to annual rent escalators averaging ~2% per year.

Comparing The Latest Results

Now that we know a little more about each REITs portfolio, let’s compare the latest results from each company.

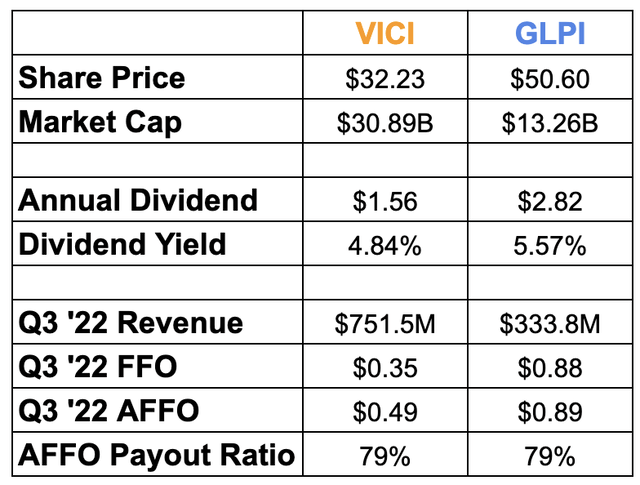

Data from Q3 Results

The actual results are in the chart above, but now let’s take it a bit deeper by looking at the growth in the following areas.

- VICI revenues increased 100% year over year due to the closing of the Venetian and MGM Growth Properties acquisitions. Growth was in the mid-20% range when you pull those two acquisitions out.

- GLPI revenues increased 11.8% year over year

- VICI AFFO grew 8.5% year over year

- GLPI FFO decreased 1% and AFFO increased 1% year over year

During the most recent quarter, VICI announced they had entered into a loan agreement with Great Wolf Resorts to provide up to $59 million of mezzanine financing. VICI followed that up a month later with an additional $127 million loan for another Great Wolf Resort in Florida.

In addition, the company entered into a definitive agreement to acquire an interest in the land and buildings associated with Rocky Gap Casino Resort for $203.9 million.

GLPI during the quarter announced the sale of its equity interest in Tropicana to Bally’s, but retained ownership of the land, turning around and entering into a five-year ground lease with Bally’s.

Gaming Continues To Expand

More states across the country are expanding the legality of gaming. Gaming apps are becoming more popular each and every year as more residents have access to them legally.

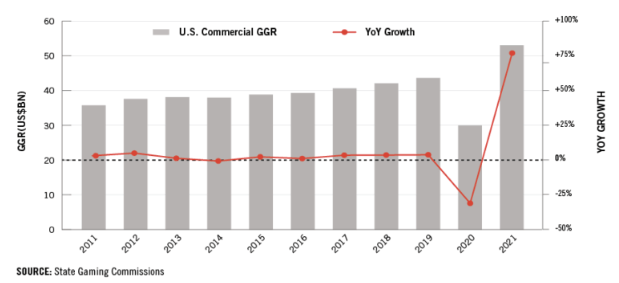

In 2021, the commercial gaming industry saw a boom like no other driving all-time high for gaming revenues, which resulted in year-over-year growth of 75%.

American Gaming

According to the American Gaming report, “All jurisdictions with commercial casino or sports betting operations reported an increase in gaming revenue compared to 2020, and 23 of 43 jurisdictions achieved record annual commercial gaming revenue in 2021.”

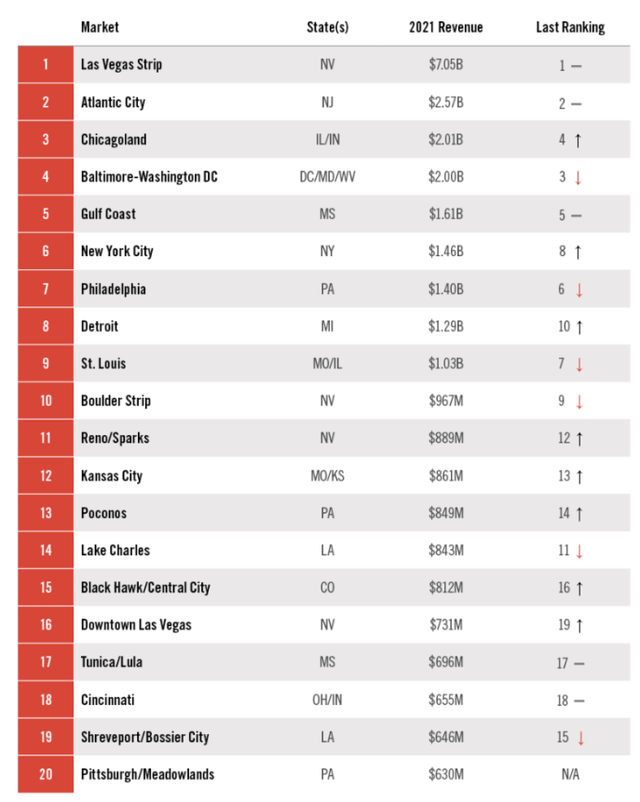

The Las Vegas strip was once again the clear market leader, hauling in over $7 billion in revenue during 2021. Here’s a look at the top 20 markets based on revenue.

American Gaming

In the top 20 markets list above, we also see many of the areas that GLPI operates in as well.

In the US, consumers have faced rapid increases in interest rates as well as high inflation for much of 2022, yet for the past few months, the Internet searches for Las Vegas travel have jumped each and every month, which bodes well for VICI properties and their operators.

A Recession Could Slow Things

For years, many have claimed that REITs like VICI are “recession proof” and they have largely been accurate.

After all, gambling can be addictive and a form of entertainment, one that continues to grow in popularity. Yet, it all comes down to the strength of the consumer.

We already are beginning to see signs of a weakening consumer with higher credit card balances and US Banks continuing to increase their loan reserves, all pointing to consumer headwinds on the horizon.

The labor market in certain sectors also is beginning to crack, with large technology companies announcing layoffs and the likes of Apple and Microsoft (MSFT) announcing hiring freezes.

These would all lead to less time and money being spent at hotels and casinos, but remember, VICI and GLPI are the landlords. The operators would feel the brunt of the weakening economy, but so long as they continue to pay rent, then VICI and GLPI will be happy.

These Dividends Are A Royal Flush

When it comes to dividends, both REITs pay high yields which are great for income-oriented investors.

- VICI dividend yield: 4.84%

- GLPI dividend yield: 5.57%

Both dividends are also well covered with a 79% AFFO payout ratio.

When it comes to dividend growth, both companies, as AFFO continues to grow, are beginning to grow the dividend. In September, VICI increased their dividend by 10%, which has been the same over the past three years.

GLPI on the other hand has been on a bit of a nice run of late in terms of dividend growth. In December 2021, the company announced a special dividend for shareholders and so far in 2022, the board has increased their dividend twice, once in February and again in May.

Gaming and Leisure Properties were forced to cut their dividend during the pandemic, but have since increased it back up above the pre-pandemic levels in a matter of two years.

Dividend growth has been moving at a much faster pace at VICI as they have increased their dividend an average of 10% per year over the past three years, whereas GLPI has been increasing their dividend at an average pace of 4% the past few years.

In terms of safety, both dividends appear well covered at the moment.

Investor Takeaway

Both VICI and GLPI are operating gaming facilities in a time when the industry is booming. However, we discussed the headwinds that the US is facing with a possible recession coming in 2023 combined with a weakening consumer.

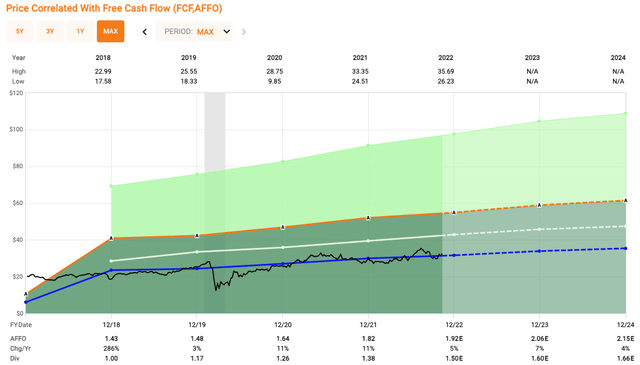

Knowing that, let’s look at valuation before deciding which is the better buy. Here is a look at VICI.

FAST Graphs

VICI currently trades at a P/AFFO of 17x, which is slightly above their five-year average of 16.5x. However, compared with other net lease REITs – like Realty Income (O) (trading at 17.5x) and Agree Realty (ADC) (trading at 18.5x) – shares are trading at a discount.

I recently spoke with Ed Pitoniak, CEO of VICI (for iREIT on Alpha) and he said,

“… we have a certain measure of our rent role that is tied to CPI, and over 40% of it is uncapped CPI. What that means is that as of today, November 1st 2022, our Caesars leases escalate at 8.1% because they are tied to CPI measured over July, August, September of this year, which yielded an overall CPI headline number of 8.33%. That translates into 8.1% for us.”

Enough said!

Analysts are looking for AFFO growth of 5% and 4% in 2023 and 2024, which equates to a forward P/AFFO of 15.8x, slightly below their (short) historical average.

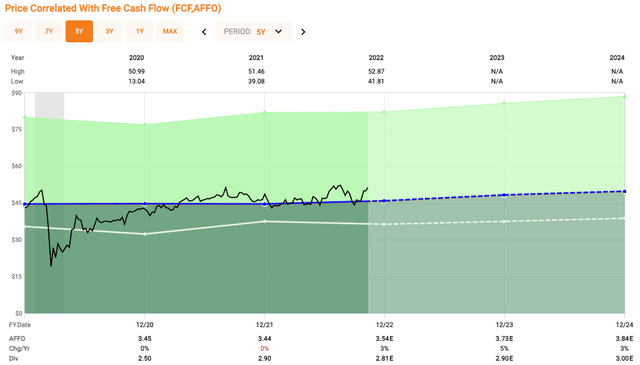

Here’s a look at GLPI.

FAST Graphs

GLPI on the other hand trades at an AFFO multiple of 14.5x compared to their five-year average of 13x, indicating shares appear overvalued currently.

Analysts expect similar growth as VICI, with 2023 expected AFFO growth of 5%, equating to a forward AFFO multiple of 13.8x.

Looking at both of these Fast Graphs charts for VICI, not only is it the best in class, but it’s also trading at a more reasonable valuation. Given the exponential growth for VICI, I believe the company will continue to grow, possibly entering Europe. I asked Pitoniak about that and he said,

” We have already been over there talking to our operating partners, visiting assets. And in this respect, we always want to learn from the great REITs, right? And whether it’s Hamid Moghadam at Prologis (PLD) or what Sumit is now doing at Realty Income, great REITs have shown the way on how to invest carefully and productively and accretively in Europe, and we’re going to learn from them all we can.”

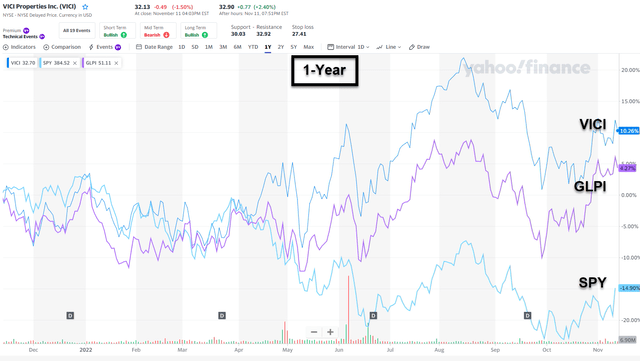

Yahoo Finance

So let me tell you what I’m betting on…

- A proven and fragmented asset class (pandemic proof)

- A proven management team that has grown faster than any REIT in history

- A solid balance sheet validated by S&P and Fitch (elevated to investment grade in April)

- A predictable dividend that should continue to climb

- A REIT that has become a core holding in my retirement portfolio.

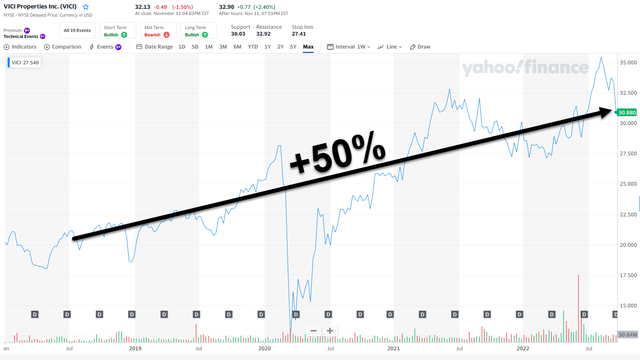

I suppose I could say veni, vidi, vici – which is a Latin phrase that literally translates to “I came, I saw, I conquered.” I was an early mover on VICI and this bet paid off handsomely, since my first article:

Yahoo Finance

And in Vegas terms, I suppose “I’ll let VICI ride“…

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment