Justin Sullivan

After the bell on Wednesday, we’ll get third quarter results from Tesla (NASDAQ:TSLA). While the electric vehicle maker set quarterly records for both production and deliveries in the period, the latter metric missed reduced expectations by a sizable margin. Interestingly enough, this report comes at a time when CEO Elon Musk needs to sell billions in Tesla shares to fund his Twitter (TWTR) purchase, so expect some fireworks this week.

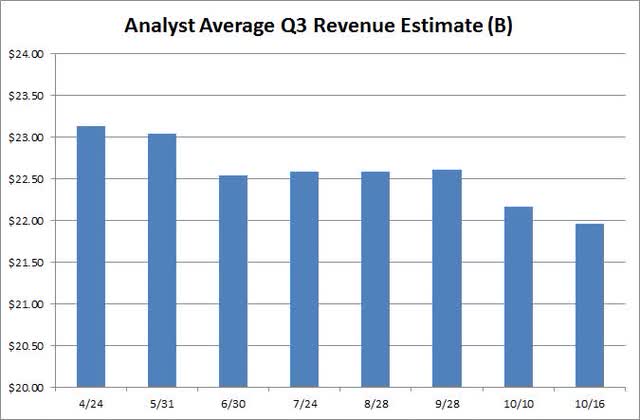

After peaking at more than $23.15 billion in late April, Q3 revenue estimates have been coming down as seen in the graphic below. With Tesla falling short of street expectations for deliveries, the top line average is $21.96 billion currently, and that includes a low estimate below $18.3 billion that’s holding the average number down a little. Still, the current average implies a little less than 60% growth over the prior-year period, thanks to a surge in deliveries but also Tesla’s numerous price raises. It will be interesting to see this quarter how the sharp rise in the US dollar impacted the international revenue picture.

Tesla Q3 Estimates (Seeking Alpha)

On the bottom line, analysts are looking for non-GAAP EPS of $1.01, a growth rate that’s a little higher than what is expected for revenues. I’ve pointed out previously that analysts usually are quite low with their estimates, as Tesla has beaten the street here in 11 of the past 12 quarters, with some decent beats in Q3 on a percentage basis. As a reminder, the stock split 3 for 1 a few months back, so some of the earnings per share numbers seen for recent periods may be rounded to the nearest whole number.

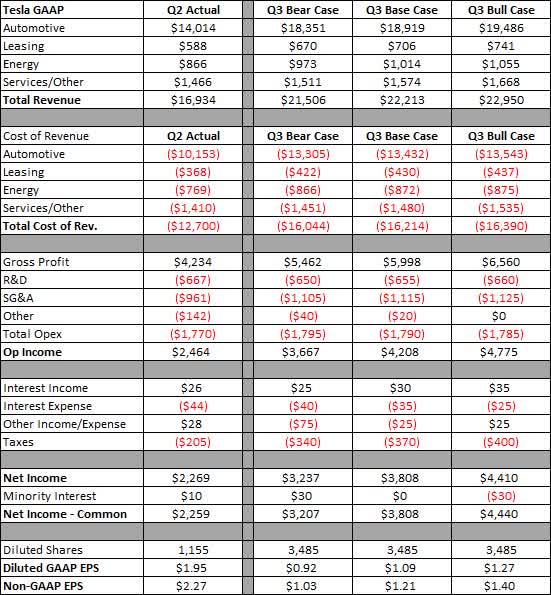

Perhaps the most important number that I’ll be looking at for Q3 will be gross margins. Tesla’s GAAP automotive gross margin came in a little under 28% in Q2 of this year. One might expect that price raises and the surge in delivery volumes will be beneficial to margins, and I’m banking on a nearly percentage point and a half increase. Commodity inflation could be a headwind, however, that would limit margin upside in the near term, which is why my bear case has margins declining a little sequentially. As I usually do, the following graphic shows my three cases for Q3 results.

Tesla Q3 Three Cases (Author’s Models)

When looking at Tesla’s balance sheet, you will find a wide range of opinions on the subject. A decent Q3 profit should lead to solid cash flow, which is why bullish investors like Gary Black are calling for Tesla to announce a share repurchase program. On the flip side, bears have suggested that the company’s cash pile isn’t what it seems, given the large amount of accounts payable and accrued liabilities, as well as the very low amount of interest income Tesla is generating each quarter. Inventory will certainly be a drag on cash flow for Q3 with production outpacing deliveries by quite a bit in the period.

Investors will also be waiting for updates on Tesla’s upcoming product and service launches. The Semi is expected to see its first customer deliveries this quarter, about three years later than expected, while we are still waiting for the second edition of the Roadster. Next year is supposed to see the release of the Cybertruck, as multiple other electric pickup trucks from competitors have already made it to the market. Analysts will probably also question Tesla management about its full self-driving efforts, to see if the Tesla robo-taxi network will be launched anytime soon.

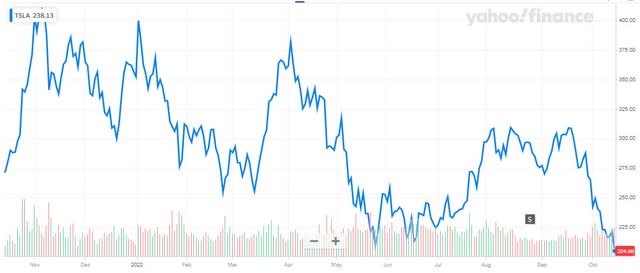

As for Tesla shares, they have not been spared during this market rout. The stock has now fallen more than 50% from its all-time high, setting a new 52-week low on Friday below $205. The average price target on the street of $301 implies tremendous upside from here, although that figure is itself off about 10% from its high. I will be curious to see how analysts react no matter what Tesla reports this week, as some valuations could be cut with the market dropping amidst Fed interest rate hike fears.

Tesla Last 12 Months (Yahoo! Finance)

The one major headwind for Tesla shares in the short term is Elon Musk’s pending purchase of Twitter. The Delaware court overseeing the legal case involving the acquisition has ruled that the deal must be completed by October 28th to avoid a trial. Thus, Elon Musk likely will need to sell billions more in Tesla shares to have enough money to finalize the deal, with the amount needed up in the air depending on how many equity partners actually stick with him. This overhang could be gone by the end of the month, unless of course Elon has another trick up his sleeve to potentially delay the purchase yet again.

In the end, look for Tesla to put on a good show this week at its Q3 earnings report. Elon Musk likely needs to sell billions in stock to fund his purchase of Twitter, so he needs shares to recover as much of their recent losses as possible. I expect the usually conservative Street will mean another headline beat, with the key being gross margins as well as the Q4 forecast. Tesla shares go into this report basically at their 52-week low, so investors are hoping Wednesday’s news can be a turning point for the stock.

Be the first to comment