solarseven

Well, the market has begun to rebound in the last few weeks, and Intel Corporation (NASDAQ:INTC) saw its stock rise nicely. This comes after we had just bought it for a rapid-return trade under $25, which on the trading side of things we exited above $30. We think this market will give you an opportunity to get back in again sub-$30, and we think you should take it. Look, this stock was left for dead, and even after the rally, is still at multi-year lows (backing out the trough in shares in October of course). The stock is cheap by many accounts now, and the company has really seen better days. But better days are ahead for the company. Their recently reported earnings were positive, though we know that semiconductor sales as a whole continue to fall. But this is short-term, it will get better long-term, and you can be paid to wait very nicely with a fat dividend yield if you get shares in the $20s, as the yield on the stock would be north of 5%. That is great in an income portfolio, and our traders can scalp capital gains on the next run up.

Darkest before dawn

Things are always bleakest before they improve, right? It is very true in stocks. Many stocks tend to bottom on bad news. Intel has seen a lot of bad news lately, but Intel is not going out of business. Just not happening. The entire sector is out of favor. But with this recent report, the headlines were really tough to swallow. It was bad. It has been bad. Making matters worse, competitors are seen as having strong catalysts and valuations and enjoying upgrades. Even with such weak headlines, the stock has held up. We believe the bottom is in, but do think another challenge of the mid $20s is in the cards, less so because of anything Intel is doing, and more so because the market has been juiced up the last few weeks. While a bullish reprieve was welcomed, we think there is another chance to buy. This is why we took our fast trading gains, but fully believe an investment will work here. We plan to come back in. Could the bottom be in? We think so.

The results were moderately better than anticipated but the year-over-year comps were just bad. The stock had been crushed. Earlier this year, the company guided for revenue of $15-$16 billion, on 46.5% margins, and was looking for EPS of $0.35 in the third quarter. It was mixed, as the company missed some expectations, but had good news elsewhere which makes us think the bottom is in. Most importantly, management seems like it is finally “getting it.” That is our opinion, but the writing has been on the wall for quarters and we wish Intel acted sooner to control the bleeding.

All that said, revenue was down 20% from a year ago, or 15% when adjusted for currency in Q3. Margins narrowed again as well and missed the company’s own targets. Ouch. Revenue was mostly in-line, though. But those expenses hurt, and operating margins were down. The company is spending more heavily actually on research and general expenses at the same time the top line is coming down. That is a double whammy for earnings power and it showed. It was ugly. Net income was down 85% from last year, or 59% when adjusted. Just gross, for lack of a better term. Earnings per share fell 85% to $0.25 on a GAAP basis in Q3, though they came in at $0.59 per share adjusted, and well, if you can believe it, that actually beat estimates.

Valuation attractive

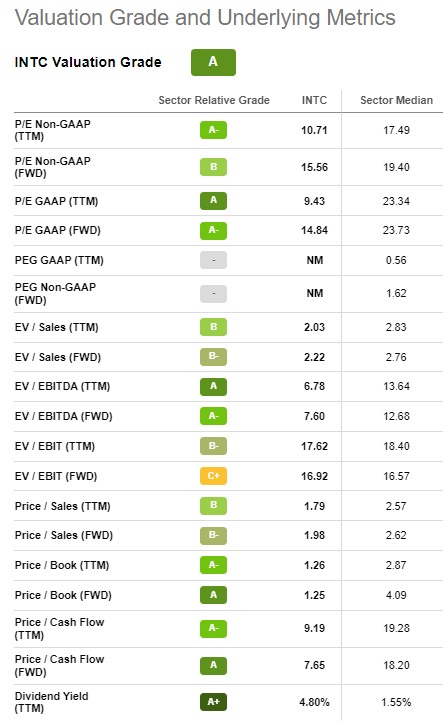

We think that while the valuation has been attractive for some time, the bottom in performance may just be about in. What is odd is that even with the declines, cheap can get cheaper if performance worsens. However, looking at the entire cycle, we think performance is bottoming out and will do so by 2023 if it has not already. The value is still attractive. Just about every metric is stellar, and we really point to the forward P/E, the attractive EV/sales, and EV/EBITDA, as well as price-to-cash flow metrics. We like value when buying dividend names, so long as the price is not set to fall more.

Seeking Alpha INTC valuation page

Now look, we do think you could get some selling again to take this back down into the $20s for better value buys. When you combine the fact that the company is getting serious about its expenses, as well as the fact that the dividend is superb, it makes a case for income investors. Right now the business has seen a slowdown, but contrary to what the alarmists will insist, the business simply is not being put out to pasture. The company is not losing money, but the company must get spending under control because the pricing of chips has been on the decline and demand is waning.

Must control costs

If you listened to the conference call, it was very telling. Management finally seems to get it. That the costs and the current climate are leading to tough decisions, like job cuts and a move to implement an internal foundry model for its customers, as well as its own chips. On the surface, of course, it suggests Intel will now become an internal customer of its other business lines, notably of its own fabs. But the tone of the call as well as the Q+A suggested heavily to us that management recognizes it needed to tighten up. This comes as the Q4 outlook was pretty downbeat relative to last year, but considering the overall climate, was not that bad.

Looking ahead

Stocks tend to bottom on bad news. Was the report and outlook bad news? It depends who you ask, and if they are long or short. To us, it was pretty darn mixed, but we think that it signaled a bottom. For Q4, the company has now guided for revenue of $14-$15 billion, on 45% adjusted margins, which should result in the company seeing EPS of just $0.20 in the quarter. Cash flow is key, and it was bad news on that front as the company guided for $2-$4 billion in adjusted free cash flow burn for the year. That hurts.

Management has indicated it is getting serious about the cuts, but we really need to see those spending cuts happen, and serious work to recapture market share. Now Intel does have some U.S. based advantages and is less exposed to some international strife relative to other companies, though mileage may vary. The bottom line is that Intel must control what it can control. That is a simple fact. If the company cannot turn things around margin-wise and especially on operating margins, then the sweet dividend could seriously be in jeopardy. If something happens to that dividend, we will be wrong in our bottom call because you will see massive selling.

But, the situation will have to stay depressed for many more quarters for this to occur. As such, the board will keep that dividend intact for as long as it can, but payout metrics are becoming less favorable, and the company is burning cash now. The dividend is secure in our opinion, for now. The sector is cyclical despite ongoing secular demand, and it will be another quarter or two at least to see a trough in demand, maybe more.

Still, we think the bottom was put in in October. If the company can deliver on spending cuts, preserve as much cash flow as possible, and keep the dividend going until better days arrive, it will be a great time to buy on the next pullback.

Your opinion matters

So, we made a fast trade on the name. It is what we do. But we like to take trading gains and invest them in our own long-term portfolios. Intel serves as both a trading stock and an income stock right now. Do you agree that it is an income stock here? Do you think they will cut that dividend? Is management doing enough to cut costs, or just paying lip service?

Let the community know below.

Be the first to comment