Whirlpool’s acquisition of Emerson’s InSinkErator will provide another dominant brand within the kitchen to add to Whirlpool’s impressive portfolio.

JHVEPhoto/iStock Editorial via Getty Images

We last wrote about Whirlpool Corporation (NYSE:WHR) back in early May, when we discussed why we thought Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) should purchase the company due to synergies that could be realized via new home packages through the Clayton Homes subsidiary. While only Mr. Buffett knows if he will pursue that transaction, it does appear that Whirlpool’s management is continuing to look for ways to gain more market share of the household appliance market while adding products with big moats and finding ways to solidify their market positions.

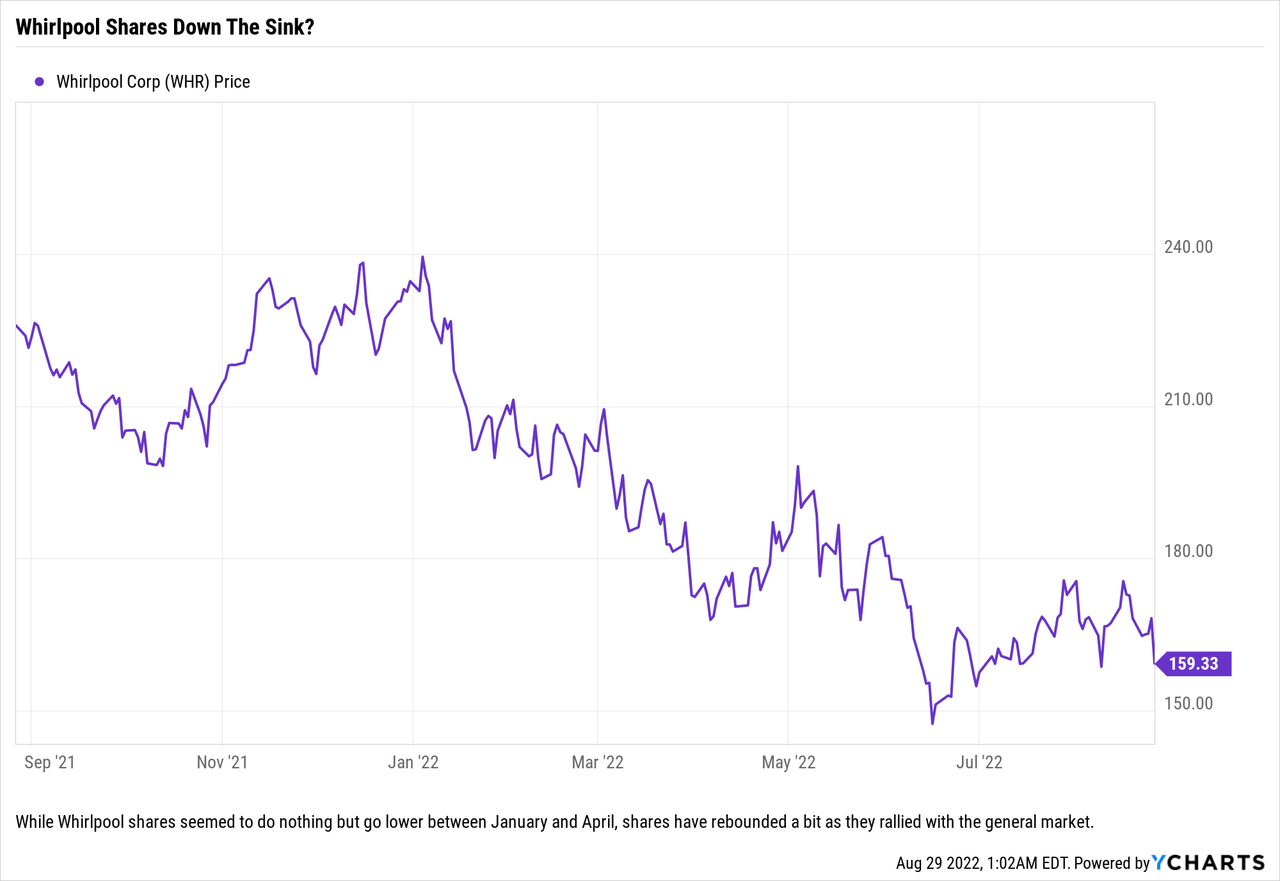

Whirlpool’s stock has fallen along with the rest of the market since we last wrote about it. While it has come off of its lows set in June, there appear to be more headwinds developing for the company with the American consumer facing persistently high inflation, the U.S. housing market having cooled considerably and signs starting to emerge (although there is conflicting data at this time) showing some U.S. consumers have stopped accessing their lines of credit or have slowed spending (we would point out that some company data shows this to be true, while other firms are showing increased spending – and we suspect that this has more to do with the type of customers those companies have). The good news is that Whirlpool has a very strong balance sheet, pays out a very respectable dividend, and has a share repurchase program which provides management with some optionality moving forward (such as the ability to slow purchases to maintain the dividend in tough times, or to do larger M&A transactions).

M&A Activity: InSinkErator

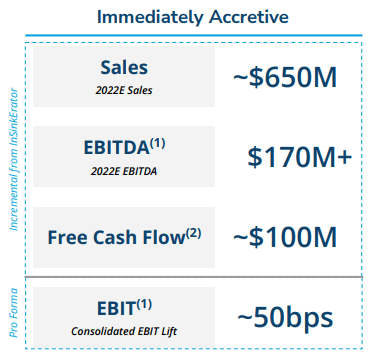

The InSinkErator purchase from Emerson Electric (EMR) in early August for $3 billion, although expensive, will provide an accretive transaction for Whirlpool as well as another avenue with which to expand their brands. One could argue that the multiple being paid makes the transaction unattractive, and when you consider that the transaction is being paid for with cash/lines of credit (for the time being) and not financed via the bond market, then yes, an argument can be made that almost any acquisition would be accretive since the bar is so low.

However, Whirlpool will be getting about $300 million in future tax benefits, should find some synergies between the two businesses to provide a boost to EBITDA and now has a new platform to utilize to expand its brand offerings with little R&D or other costs (basically it would be pretty easy for Whirlpool to not differentiate a current InSinkErator product to a future Whirlpool or Maytag offering – change the packaging, not the product).

The InSinkErator deal will be immediately accretive for Whirlpool. (Whirlpool Investor Presentation)

As the above graphic shows, InSinkErator is tiny when compared to Whirlpool and the additional $650 million in revenues amount to an increase of a little over 3% to total revenues at Whirlpool. So yes, $3 billion does seem awfully rich when looking at Whirlpool’s $8 billion+ market cap or the small increase to revenues vs. the cost being paid. While we understand the arguments, criticisms and concerns about the transaction, we want to take a more measured approach when evaluating the transaction because Whirlpool does have a history of successful M&A, and bolt-on acquisitions such as this are generally successful. We also suspect that Whirlpool’s management team has a plan in hand to improve upon InSinkErator’s current business while expanding margins further.

How Transaction Can Move The Needle For Whirlpool

Looking at the transaction, potential synergies, and how InSinkErator fits within Whirlpool leads us to believe that management might be able to add high margin growth with some low-risk moves. First, it appears that management will focus most of their efforts with using their current stable of brands to launch higher margin offerings of current InSinkErator products. This move will cause some cannibalization as consumers will switch from InSinkErator to Whirlpool or Maytag (just to give some examples of brands which could be tapped), but so long as Whirlpool can maintain the 70% market share that InSinkErator currently holds, the cannibalization caused by the new, upscale brands would provide higher margins and increase revenues, EBITDA, EPS, etc. This all makes sense, but the risk is that retailers refuse to carry the overlapping products, or do and allocate less shelf space to the company’s stable of brands which results in lost market share. So while this is really easy to pull off on a branding and packaging perspective, management still needs to execute in order to avoid hurting the dominant market position they are purchasing.

The faucet business is not a business we get too excited about, especially when you are a small player with multiple 800-pound gorilla brands that you must compete with. To put it bluntly, InSinkErator faucet products just are not well known by consumers, due in part to them being targeted as designer faucets as well as not being physically carried in many retailers (they are special order and not held in stock at physical store fronts). However, in our opinion, this might be the business segment that Whirlpool can provide the most assistance for growth in by utilizing its brands and capitalizing on consumer awareness and loyalty to those various brands. This might also encourage more retailers to allocate shelf space, as well as actually holding stock of the products, to the faucet business which could over time increase sales and hopefully drive down costs.

Lastly, the additional commercial products that Whirlpool will be able to add to its portfolio will not only add to its line-up of offerings, but will provide it with another brand that it can utilize (InSinkErator) to launch additional products to selectively grab market share within the commercial kitchen space. We do not think that this last item is a major driver of growth unless Whirlpool were to dive into the business and start competing with the likes of Illinois Tool Works’ (ITW) Hobart and others. We think at best this will remain a small, slow-growth business segment and think that the other two points will be where Whirlpool creates value.

Our Take

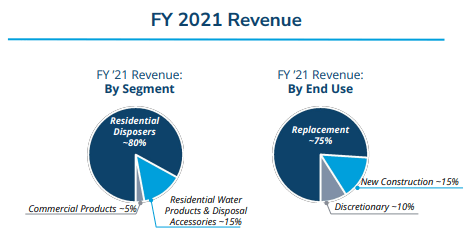

On the surface this transaction does not look like a grand slam or a home run, instead it looks boring and dull. Honestly, boring and dull can be a great combination when it comes to bolt-on M&A and we think investors should give management some time to show us what their long-term plan is. Why long-term? Because what many fail to realize is that InSinkErator is a business predicated on winning your business upfront (a small portion of their sales) in order to have your business down the road when you have to replace their, or a competitor’s, product.

InSinkErator Revenues for 2021 show a company reliant upon a dominant market position and revenues that might hold up quite well during a recession. (Whirlpool Investor Presentation)

If management can take the InSinkErator products and quickly harvest the low hanging fruit while positioning to better compete in the faucet business by using brand names that resonate with consumers and have high awareness, then we think that investors might look back in a few years and see this as a beneficial transaction that was still not a home run, but definitely something better than a single.

We still believe that Whirlpool is a name that we want to own, and view the InSinkErator transaction as a value-add play that will add stability to the company’s results in good markets and bad. With questions emerging about the housing market and the consumer’s ability and/or desire to spend, adding a business with almost three-fourths of its revenues being from recession-resistant business lines looks like a pretty solid hedge. Plus you get some potential upside with minimal R&D and/or advertising.

Be the first to comment