Avid Photographer. Travel the world to capture moments and beautiful photos. Sony Alpha User

It is easy to confuse a great product for a great business, and we think that is what is happening with many investors and Spotify (NYSE:SPOT). We find Spotify the product terrific, but the business not that attractive. There are several reasons for that, but the most important one is that its suppliers, companies like Warner Music Group (WMG) and Universal Music Group (OTCPK:UNVGY) are currently in a position to extract most of the value created by the streaming industry, and until this changes it is unlikely that Spotify can become significantly profitable. Spotify itself appears to have come to that conclusion, and we believe that is the reason behind its enormous resource allocation to initiatives like podcasts, audio-books, and other non-music efforts.

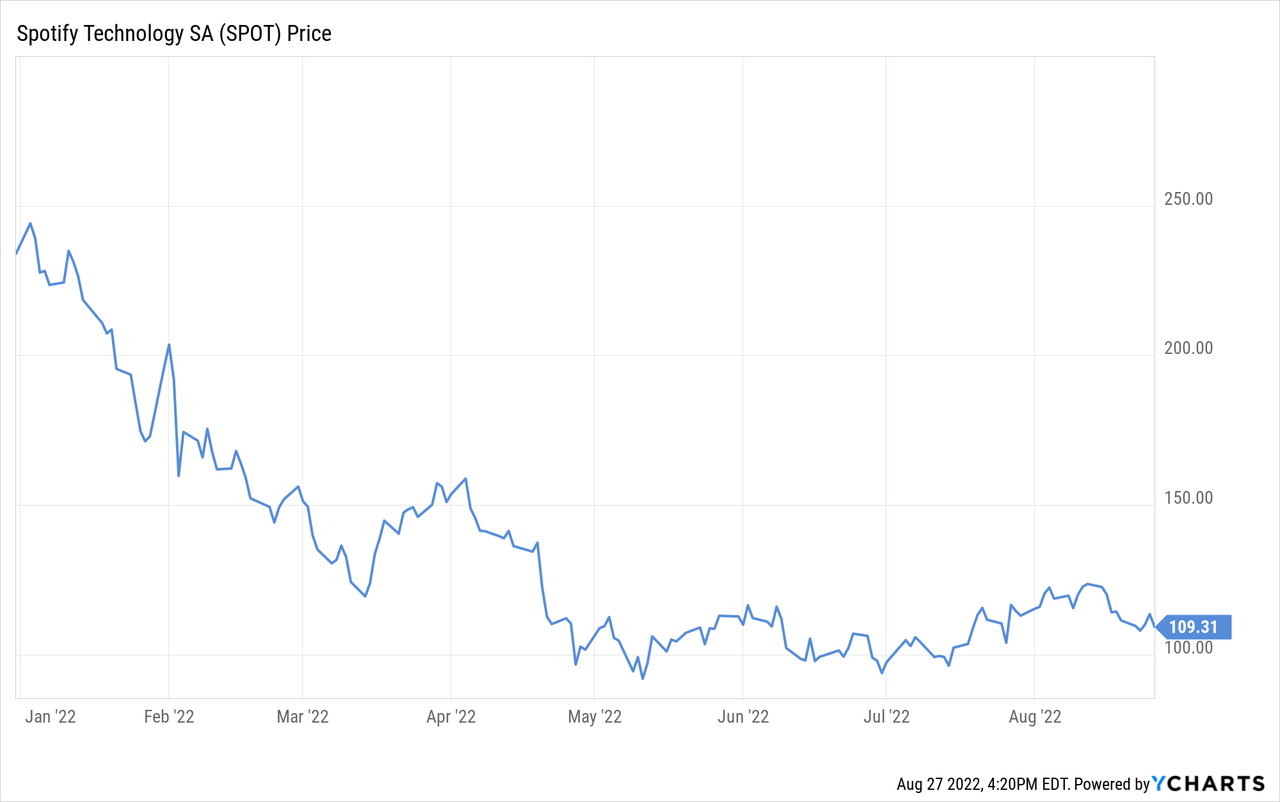

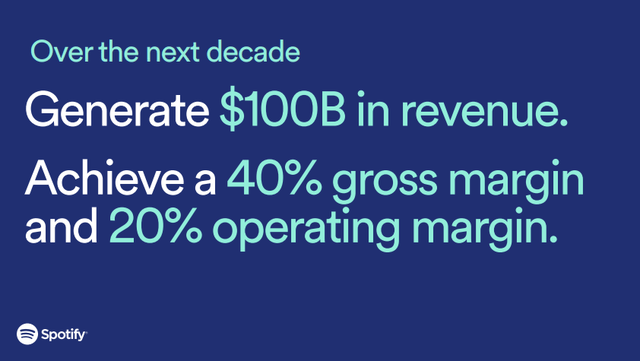

This year has been tough on the shares, which have lost more than 50% of their value. Interestingly, shares are not meaningfully higher than they were on June 8th of this year, when Spotify held its investor event and shared some jaw dropping targets.

In particular we are referring to the target they have given themselves to reach $100 billion in revenue, with 40% gross margins, and 20% operating margins, over the next decade. The reason we say the market is not buying Spotify’s narrative is that if the market believed this had a decent chance of happening, shares would be trading significantly higher today.

Porter’s five forces analysis

As we said in the intro, Spotify operates in the very tough music streaming industry, and we’ll see why it will have a hard time achieving good profitability. All of Porter’s five forces point to a complicated industry:

- Threat of new entrants: It is relatively easy to enter the music streaming industry. The technology to build a streaming app is not particularly that advanced, what is really needed is some capital and to sign licensing arrangements with the main labels. That is why companies like Apple (AAPL) found it relatively easy to launch their own streaming services. Further complicating things, the new entrants are mostly diversifying from another market and they can leverage existing expertise, cash flow, and brand identity, for example YouTube (GOOG) (GOOGL).

- Threat of substitutes: There are a few substitutes to streaming, including buying the songs on iTunes, or even a physical medium.

- Bargaining power of customers: Streaming is not like food or other necessities, it is a consumer discretionary product, and as such customers have more bargaining power in deciding to accept or not a given subscription price.

- Bargaining power of suppliers: This is probably the biggest issue for Spotify, that it basically has a handful of really important suppliers, and it cannot really operate without them. That is why Universal Music Group and Warner Music Group are able to extract so much value out of Spotify and the streaming industry in general. There have also been past examples of individual artists, such as Taylor Swift or Neil Young, deciding to remove their music from platforms at various points in time.

- Competitive rivalry: This is a tough one too for Spotify, as many of its competitors see streaming as one piece of their ecosystems, and as long as their platforms make money, they are not too worried if one of the pieces, such as streaming, loses money. In other words, Apple, Amazon (AMZN), and Google, are more worried about pulling-in users to their ecosystems than they are about making money with their streaming services. As such, they might be motivated to price their services at extremely low price-points, or even given them out as part of a bundle.

Competitive Advantages

Despite the tough industry in which it operates, Spotify does have a few things going in its favor. It has arguably the best UX/UI interface and recommendation engine of all the streaming services, and the most well known brand. Crucially, it also has attained enough scale to negotiate a slightly better deal for itself, but for the company to really be able to leverage scale, given the power the music labels currently have, it will have to become significantly bigger that the other streaming services. Otherwise it will just get commodity licensing deals, or very small concessions from the music labels.

Financials

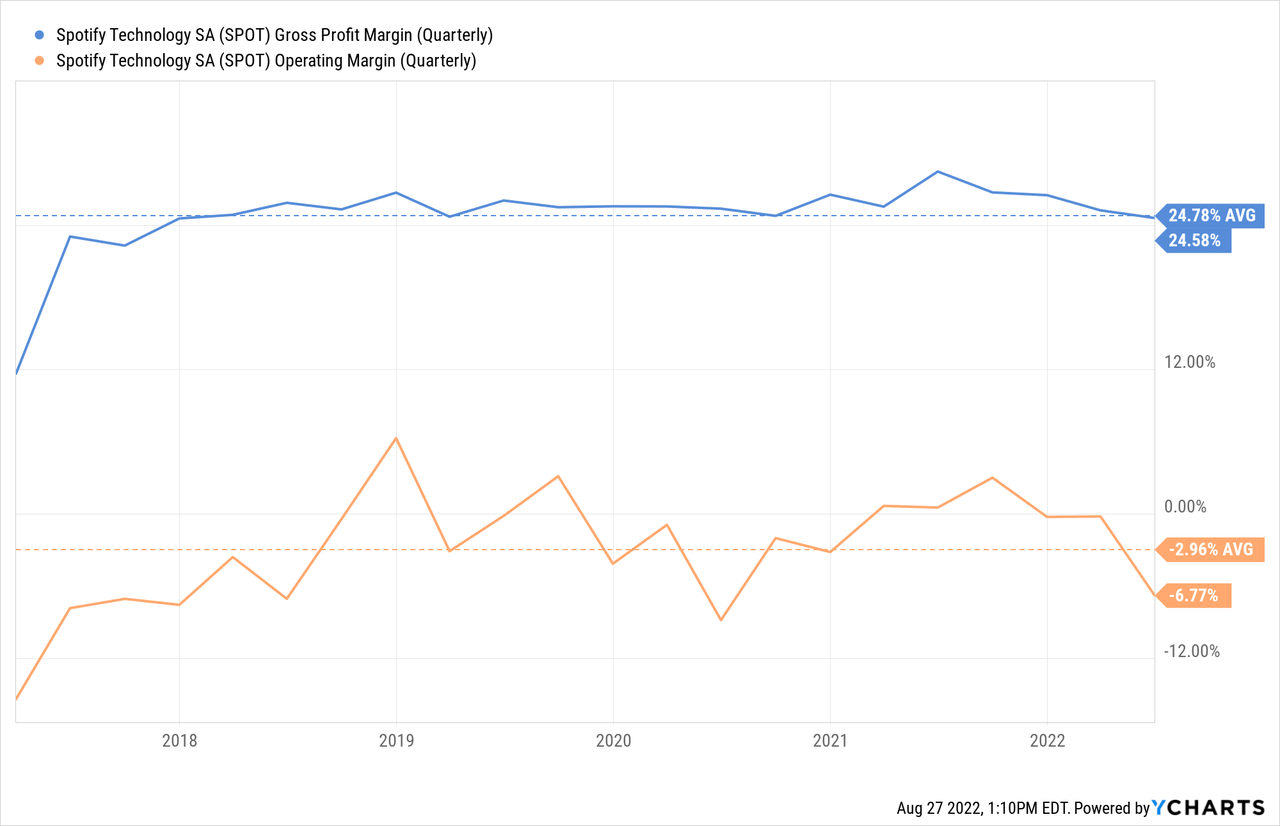

Spotify’s margins reflect the tough competitive position it is in, with relatively low gross profit margins, certainly not what you would expect to see from a software technology company. The operating margins are even worse, with a negative average since the company became public. It could be argued that at least it is operating close to break-even, but given its scale and that growth has decelerated significantly, it is definitely disappointing to see such low margins.

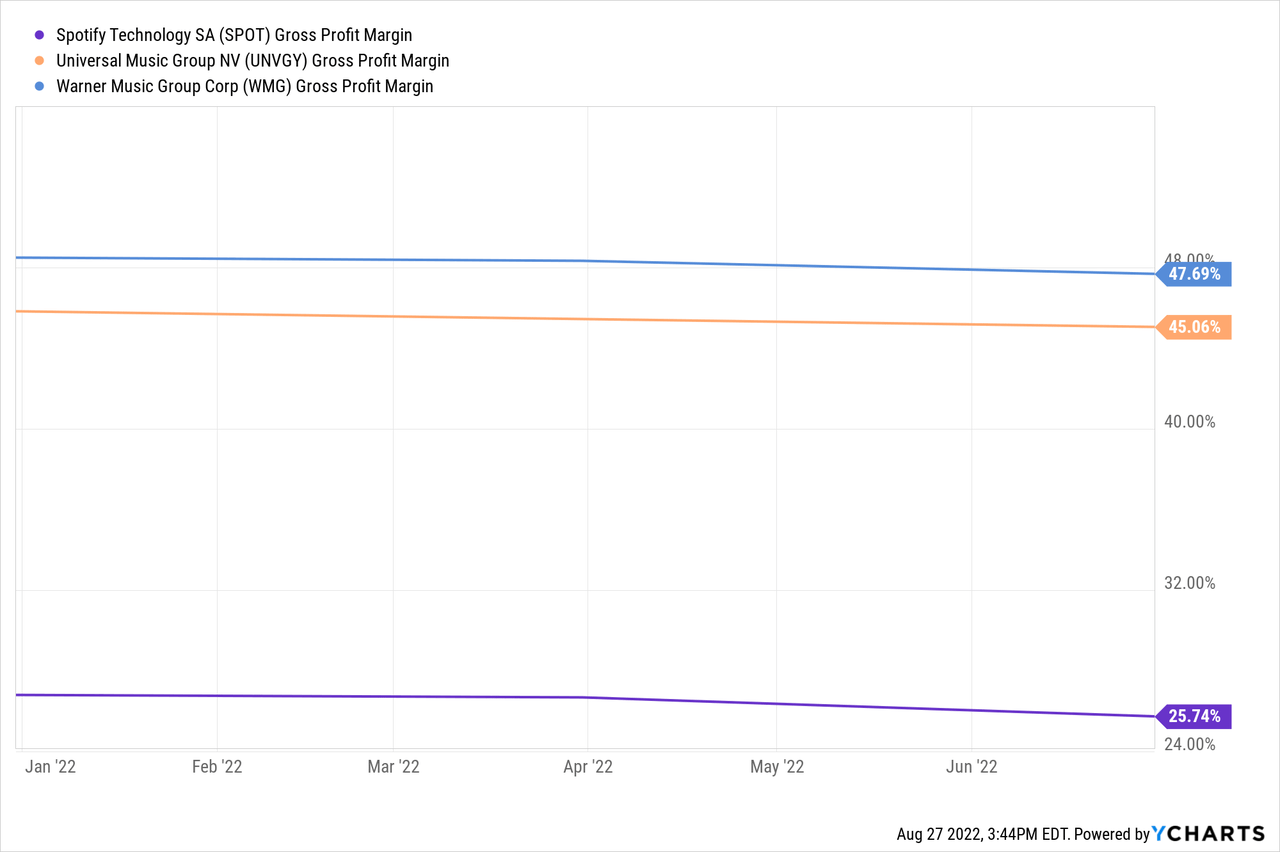

Comparing Spotify’s gross profit margins to those of Universal Music Group and Warner Music Group, it becomes clear who has the stronger negotiating position. The labels have gross profit margins that are almost 2x those of Spotify.

Growth

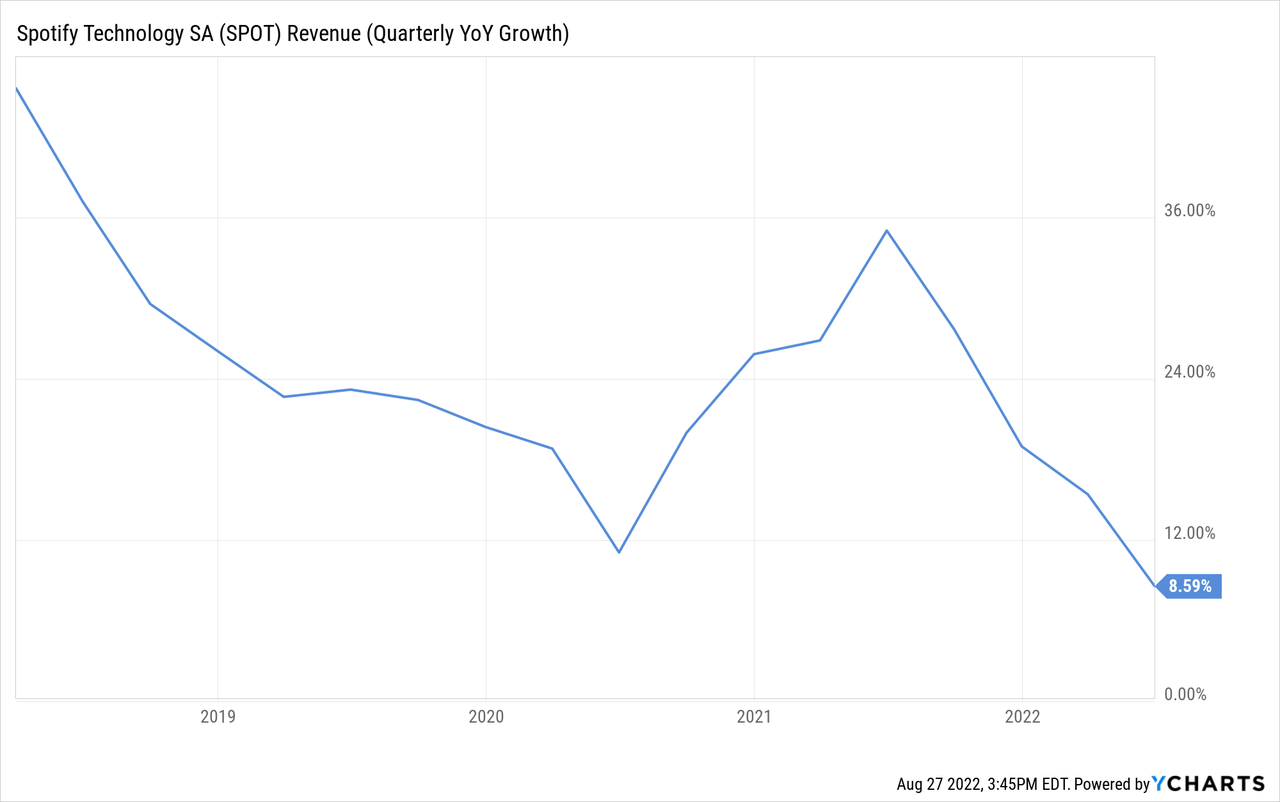

We believe that for some time investors were able to justify buying shares in a money losing operation because of the attractive growth. Unfortunately growth has decelerated significantly, and it is harder to justify the lack of profits. From the investor event it is clear that Spotify is investing in a lot of growth initiatives, including podcasts, audio-books, and other new services, but that has not yet resulted in very meaningful revenue growth.

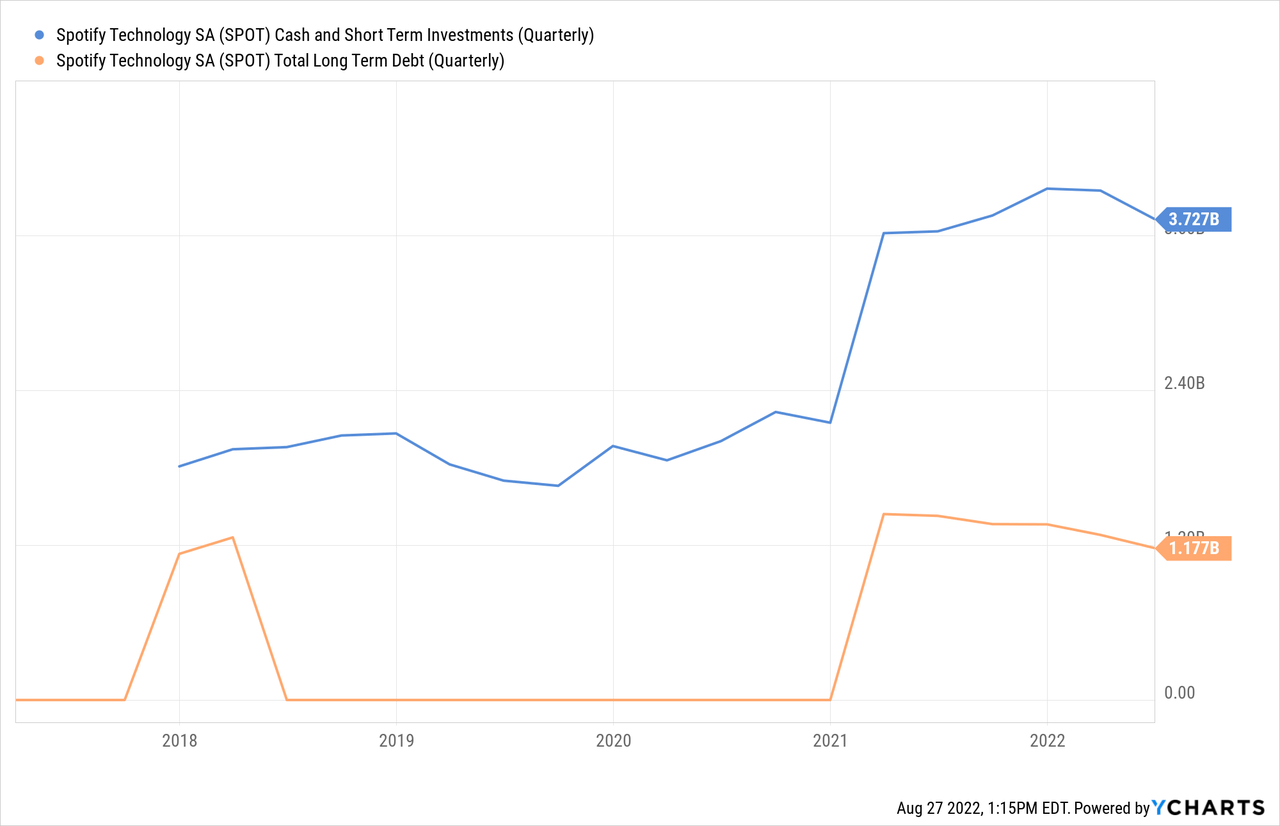

Balance Sheet

At least the balance sheet is very strong, with more cash and short-term investments than long-term debt. This gives the company some flexibility to pursue M&A or invest aggressively in the business.

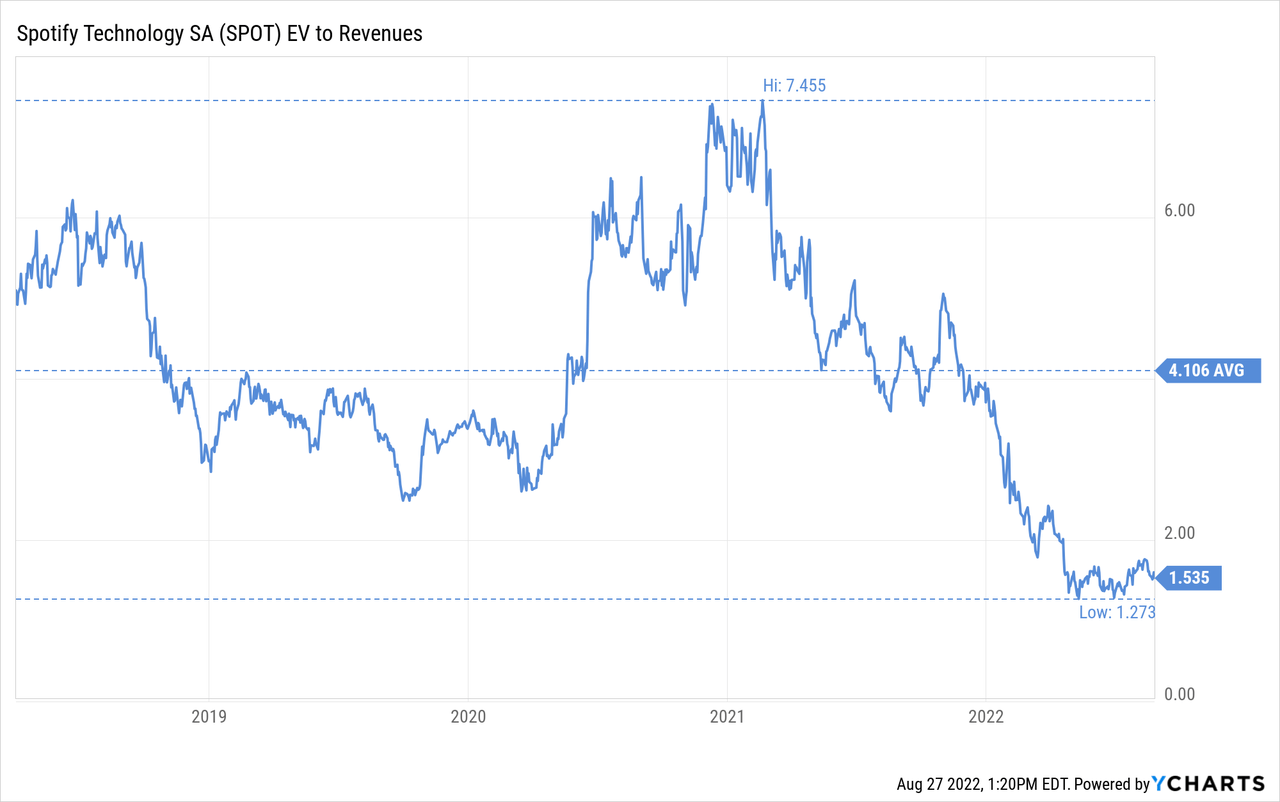

Valuation

We can see why some are saying that shares are a bargain, since they are trading at one of the lowest EV/Revenues multiples since they became public. However, given the decelerating growth and lack of profitability, we are not yet convinced that shares are worth buying at current prices.

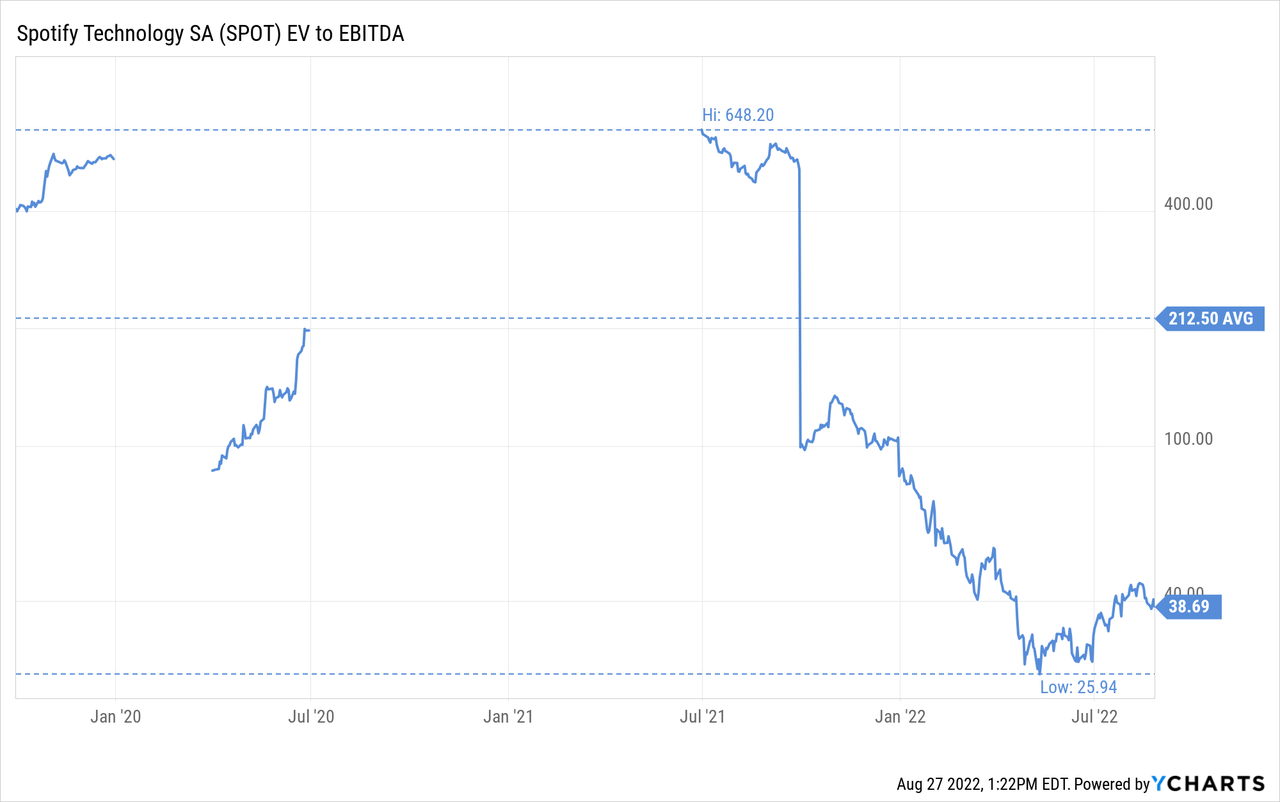

Looking at other valuation indicators, like EV/EBITDA, it becomes clear that shares are not necessarily the bargain that they seem to be when a revenue based indicator. We would need to see clear signs that much higher profit margins are attainable for the company before we buy into the bullish thesis.

Risks

The main risk we see with Spotify is that it operates in an incredibly tough industry, with competitors whose priority is not making money from streaming, but from their entire ecosystems, and from suppliers that have a much stronger negotiating position. This makes it difficult for the company to be profitable, and its attempt to branch out to new products comes with potential rewards, but also additional risks and costs.

Conclusion

It is clear that the market is not buying Spotify’s narrative that it believes it can make $20 billion in operating profit over the next decade. If the market believed Spotify had a decent chance of attaining this goal shares would be much higher today. While we like the product, and believe the company is relatively well managed, we cannot see how the company will become significantly profitable given its industry’s competitive dynamics. Until we see these competitive dynamics change, we will be staying away from the shares.

Be the first to comment