aydinmutlu/iStock via Getty Images

Investment summary

We continue to rate TransMedics Group, Inc. (NASDAQ:TMDX) a speculative buy following the previous analysis (see: here). Deeper analysis of the company’s fundamentals reveals TMDX’s invested capital and return on investment trends have curled off FY21 lows and are heading towards a magnet of profitability into the coming periods. Additionally, with management’s upgraded guidance from the last earnings call, we propose that TMDX will continue to gain market share as a differentiated player in the organ transplant space. Finally, the market’s reaction to TMDX’s planned equity raise (announced in August) looked overshot and prices have immediately stabilized to the upside. Rate buy, price target $63.

TMDX equity raise – overview

During its Q2 FY22 earnings, the company outlined its intentions to raise $100 million (“mm”) in a public offering of its common stock. It is issuing 3.25 mm shares at a price of $40 per share. The issue’s prospectus outlines TMDX is seeking to raise ~$121.4mm on this parcel, or $139.7mm if the underwriters of the issue exercise their allotted options to purchase additional shares in the offering. The raised funds are to be used for “corporate purposes”, although no determination has been made on how the funds will be disaggregated for particular use.

Specifically, the prospectus mentions TMDX intends to use net proceeds to expand operations, build out the National organ care system (“OCS”) program, and to develop the company’s next-generation OCS technology. A portion of the funds is also said to be made available for strategic acquisitions of other companies or product lines, that may tuck-in nicely to the current portfolio or offer benefits from more diversified revenue distribution. Specifically, from the prospectus:

“[M]anagement will have broad discretion in the application of the net proceeds we receive from this offering, and investors will be relying on the judgment of our management regarding the application of our net proceeds. The timing and amount of our actual expenditures will be based on many factors, including cash flows from operations, the occurrence and timing of regulatory approvals and clinical trials, the anticipated growth of our business and the availability and terms of alternative financing sources to fund our growth.

Pending their use as described above, we intend to invest the net proceeds we receive from this offering in saving, certificate of deposit and money market accounts as well as short-term and intermediate investment-grade interest-bearing securities and obligations, such as money market funds, commercial paper and obligations of the United States government and its agencies.”

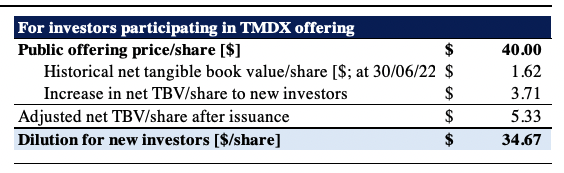

Dilution from additional equity capital

Therein lies some important facts for investors to understand with respect to the TMDX share price and this particular stock issue. New investors in the offering are to be diluted immediately. The respective dilution is calculated as the difference between the offer price and the adjusted net book value per share post-issuance. As seen in the table below, the company’s ‘historical’ net tangible book value (“TBV”) is $45.4mm, or $1.62 per share at June 30, 2022. Following the issuance of TMDX’s new stock, the adjusted net TBV/share is estimated to be $5.33 (from $166.8mm in tangible book value).

As such, this signifies an immediate increase of ~229% ($4.21/share) in TBV/share for existing shareholders participating in the issue, as observed below. The increase in TBV also means that new shareholders in the offering incur a corresponding dilution of $34.67 in TBV per share. Moreover, the market’s reaction to the news of the equity issuance speaks volumes. In the initial days post-announcement back in August, investors sold off TMDX shares. However, we propose the strength in the company’s Q2 earnings and raised FY22 guidance (and corresponding post-earnings drift) have overshadowed any potential negative sentiment from the issue of additional shares outstanding.

Exhibit 1. Existing shareholders to realize upside in TBV/share, whereas new participants in the offering will incur immediate dilution

Note: All figures in $/share. Historical net tangible book value is the amount of total tangible assets less total liabilities. Historical net tangible book value per share represents historical net tangible book value divided by the 28,023,295 shares of common stock outstanding as of June 30, 2022. Dilution per share to new investors is determined by subtracting as adjusted net tangible book value per share after the offering from the public offering price of $40.00 per share, paid by new investors. (HB Insights, TMDX prospectus supplement, August 03, 2022.)

Fair view of fundamentals

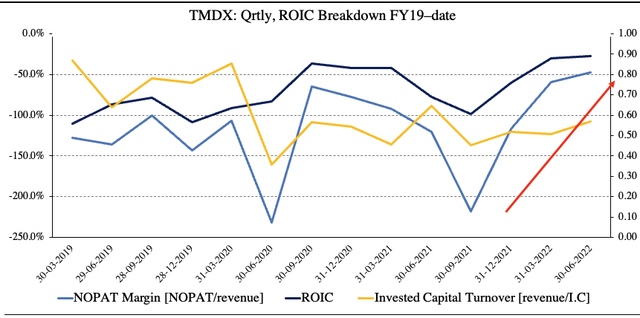

In our previous analysis (see: here), we covered TMDX’s Q2 earnings and noted strong output from the company during that period. Leading into Q3 earnings, we delved a little deeper into the company’s numbers in order to ascertain its corporate value looking ahead. Firstly, I wanted to perform an analysis on TMDX’s return on its investments and profitability, benchmarked by return on invested capital (“ROIC”). ROIC is further broken down into its sub-components of net operating profit after tax (“NOPAT”) margin and invested capital turnover in this analysis. Net-net, I wanted to observe how much NOPAT the company generates from its invested capital, by answering just what is TMDX’s underlying ROIC and ROE.

As seen in Exhibit 2, whilst return on investment trends have been flat from FY19-FY20, ROIC turned from its FY21 lows and is now tracking towards the magnet of a positive ROIC print. Breaking down the return on investment into its components, we see the majority of ROIC is contributed from TMDX’s NOPAT margin, versus the turnover of its invested capital.

This has implications on a forward-looking basis. The fact that the majority of TMDX’s ROIC is derived from the NOPAT margin tells us we should be examining the company’s differentiating factors, from an idiosyncratic level to exchange-level data. Looking ahead, we suggest this trend will continue, and the company’s upcoming Q3 numbers will serve as an accurate platform to judge this.

Exhibit 2. Quarterly return on investment trends was flat until FY21, with numbers now tracking toward the black

– We also note the majority of TMDX’s comes from its NOPAT margin, versus turnover of invested capital.

– We suggest to examine the company’s differentiating factors in this regard, versus systematic factors such as cost leadership, barriers to entry, substitutes, etc.

Note: All figures in [%] or absolute. All calculations made from GAAP earnings with no adjustments made for R&D expenditures to intangible investments. Doing so produced similar results not worthy of demonstrating here. NOPAT margin measures profit/return per sale/unit. Invested capital turnover measures capital efficiency. Both are derived for ROIC. (Data: HB Insights, TMDX SEC Filings)

Valuation

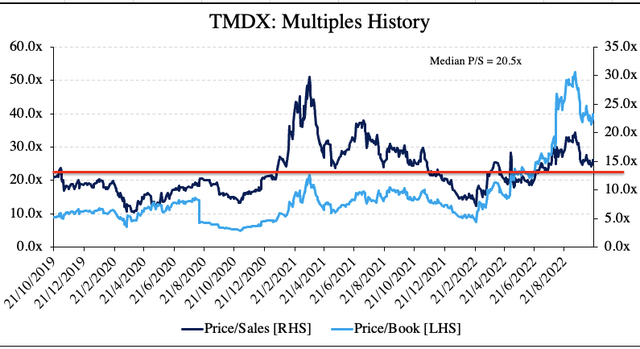

Shares are currently trading at 26x sales, and are priced at a premium of 23.2x book value, both above 3-year historical averages, as seen in Exhibit 3. P/S multiples have compressed for TMDX since from FY21 highs, however, relative to the GICS Health Care Industry median, is trading at a lofty premium of 340%. We propose that this premium to the peer group is warranted, given the company’s c.72% YoY revenue growth and the upgraded FY22 sales guidance provided on the last earnings call.

Exhibit 3. TMDX trading above historical P/S and P/B averages

Data: HB Insights, Refinitiv Datastream

We propose that normalized values are a cleaner forecasting tool in gauging price objectives. Utilizing TMDX’s normalized P/S of 20.5x and assigning this to our FY22 estimates of $75mm sets a price target of $49. Applying the same method to our internal FY23 revenue estimates of $120mm, then discounting this back at the current equity risk premium of 0.91% (current S&P500 earnings yield minus current 10-year Treasury yield) lends a price objective of $77. Combining the 2 on an equal-weight basis sets a price target of $63, currently a 50.2% return objective at the time of writing.

In short

We suggest TMDX continues to be a speculative buy following this analysis, and the recent market rout, by estimation. Whilst ROIC remains negative, trends are lifting towards positive territory, whereas earnings continue to demonstrate growth. Both of these factors serve as a solid bedrock of fundamental momentum into the forward-looking regime. We also note the equity raise is unlikely to have a material impact on the TMDX share price, and that all else equal, the company is poised to deliver continued growth at the top-line looking ahead. We price TMDX at $63 based on a blend of inputs, seeking a 50.2% return objective as of this writing.

Be the first to comment