5./15 WEST/iStock via Getty Images

It’s paradoxical that the idea of living a long life appeals to everyone, but the idea of getting old doesn’t appeal to anyone.”― Andy Rooney

Today, we take our first look at a small cap name and unique play in the financial services space. The stock appears more than cheap, analyst firms believe the shares are significantly undervalued, and a beneficial owner recently made a decent size purchase in the equity. An analysis follows below.

Company Overview:

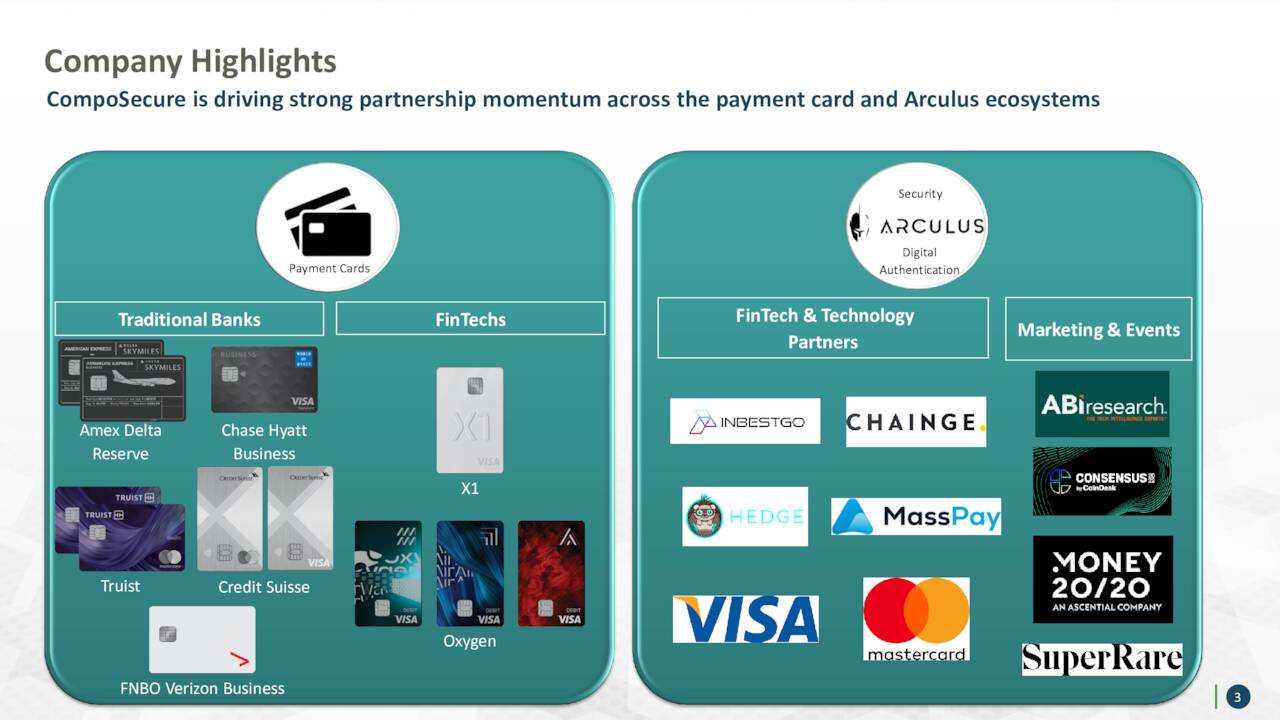

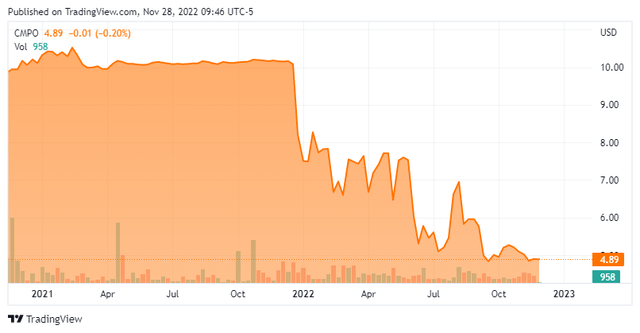

Headquartered in Somerset, New Jersey, CompoSecure, Inc. (NASDAQ:CMPO) is the largest provider of premium metal payment cards, having produced the first ever in 2003 (Amex Centurion) and selling ~114 million such cards from 2010-2021. It also launched a card for digital asset transactions in 2021. CompoSecure was formed in 2000 and went public in December 2021, when it merged into special purpose acquisition company (SPAC) Roman DBDR Tech Acquisition Corp, raising total (PIPE and sponsor) net proceeds of $188.2 million at $10 per share. Its stock trades just under five bucks a share, translating to an approximate market cap of $375 million.

August Company Presentation

The company is capitalized by two classes of stock. The 15.1 million shares of publicly traded Class A stock confer economic interest and one vote per share. The 61.0 million shares of privately held Class B shares bestow no economic interest, but impart one vote per share and are transferable into the Class A shares.

Products

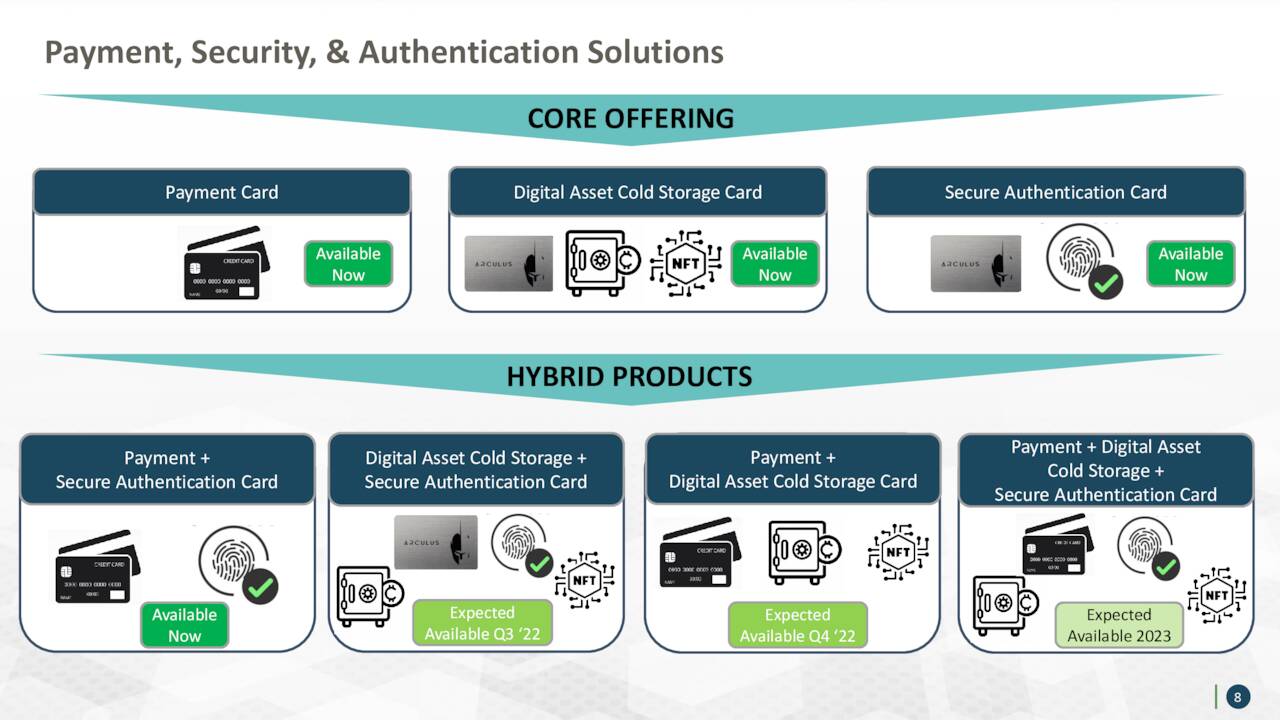

Metal Payment Card Solutions. CompoSecure derives most of its top line from the design and manufacture of premium metal payment cards, which are essentially a marketing gimmick to confer prestige on their holders. They are currently issued on Visa (V), Mastercard (MA), American Express (AXP), and China Union Pay payment networks. Once more of a novelty, these cards have become increasingly popular with end users. As such, CompoSecure has increased its number of metal card program clients from ~30 in 2016 to ~100 in 2021. According to ABI Research, 29.6 million metal cards were issued in FY21 with CompoSecure accounting for ~22 million, However, the company’s dominant share represented only 0.5% of all cards issued worldwide last year. ABI expects the number of metal cards issued annually to increase to 63.6 million by FY26, responsible for 2% of all payment cards as issuers adopt new technologies – such as dynamic card verification value and biometrics (amongst others) – for which a more durable card is better suited to house. The company’s largest clients are American Express (AXP) and JPMorgan Chase (JPM), who collectively accounted for 72% of its FY21 top line.

November Company Presentation

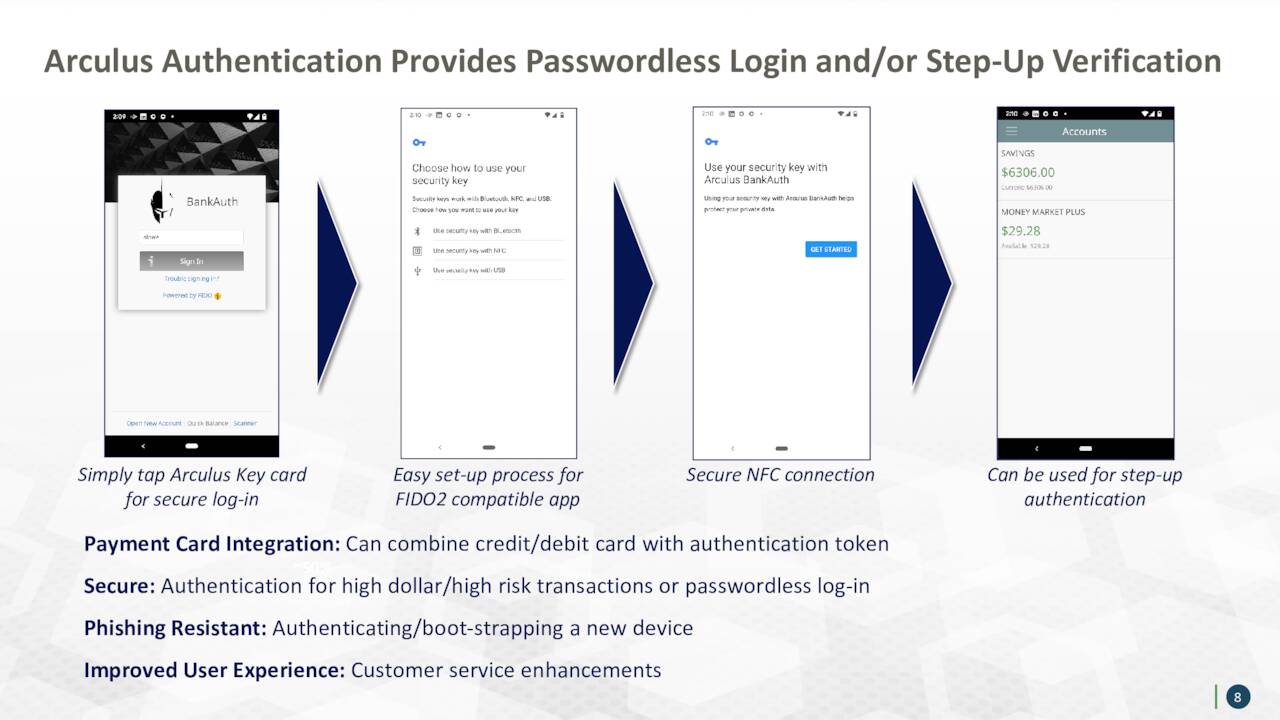

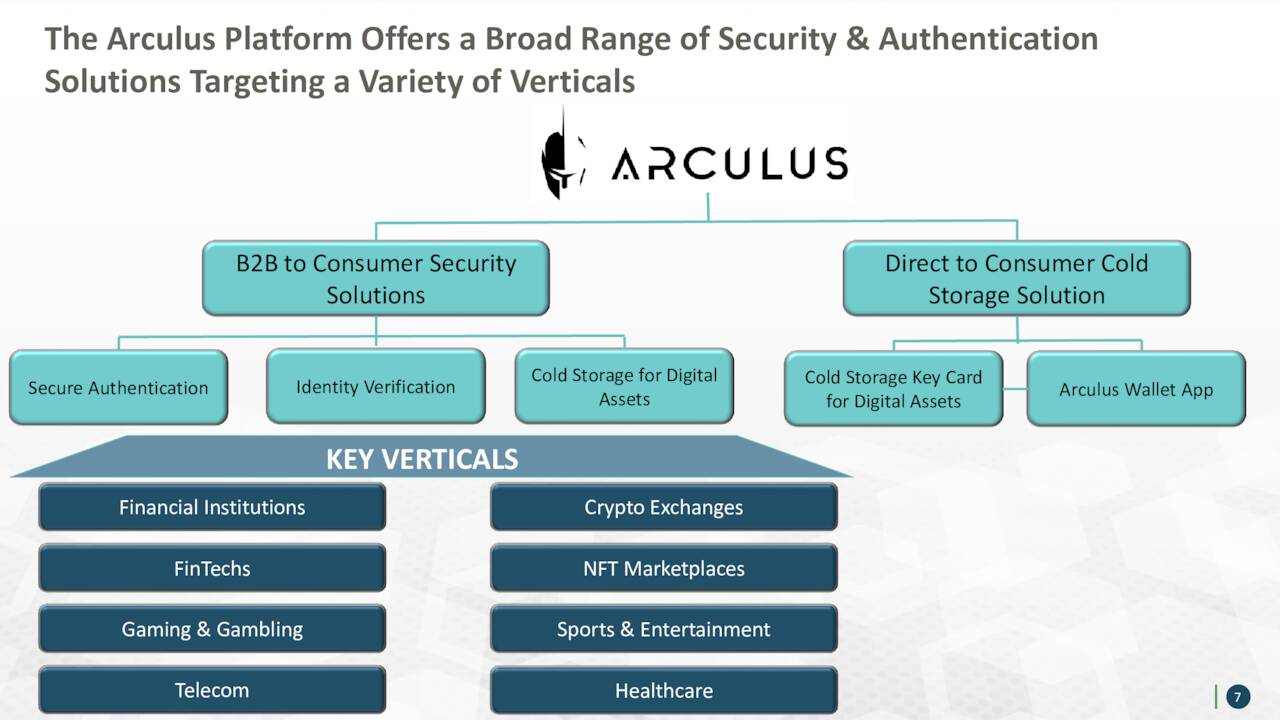

Arculus. Beginning in 3Q21, CompoSecure launched its second product. Dubbed Arculus, it is essentially a security and authentication platform (and card) for digital assets (including cryptocurrency), designed to make it simple and safe to conduct crypto-to-crypto and fiat-to-crypto transactions, as well as store blockchain-based digital assets. Its three-factor security platform is offered as an answer to the nearly $10 billion that were stolen from user wallets and cryptocurrency exchanges in 2021. A vulnerability that was highlighted again this month with the FTX debacle.

August Company Presentation

The company generates revenue from the sale of Arculus Cold Storage Wallets and from transaction processing fees. Management initially expected Arculus to breakeven on Adj. EBITDA basis in FY23, at which point it was anticipated to generate revenue of ~$127 million from the cumulative sale and use of 2.3 million wallets. The market is potentially robust, with ~110 million Bitcoin and Ethereum addresses with non-zero balances as of YE21. CompoSecure also plans to offer online gaming payment solutions in FY23.

August Company Presentation

Share Price Performance

Unlike many SPAC-sponsored entities that came to market over the past two years, the company’s poor stock performance is not a function of overpromising and underdelivering – at least in its first publicly traded year. When management was on its road show pre-merger, it projected FY22 Adj. EBITDA of $105 million on revenue of $356 million, representing 33% top-line growth over FY21. When it debuted at $10 a share, the metal card provider come fintech was moderately priced at 2.1x FY22E revenue with an EV/FY22E Adj. EBITDA of 10.6. By contrast, fintech stocks were trading double-digits times revenue with EV/EBITDAs in the multiple dozens. However, within six trading sessions of going public, its stock was down ~30% and has not recovered.

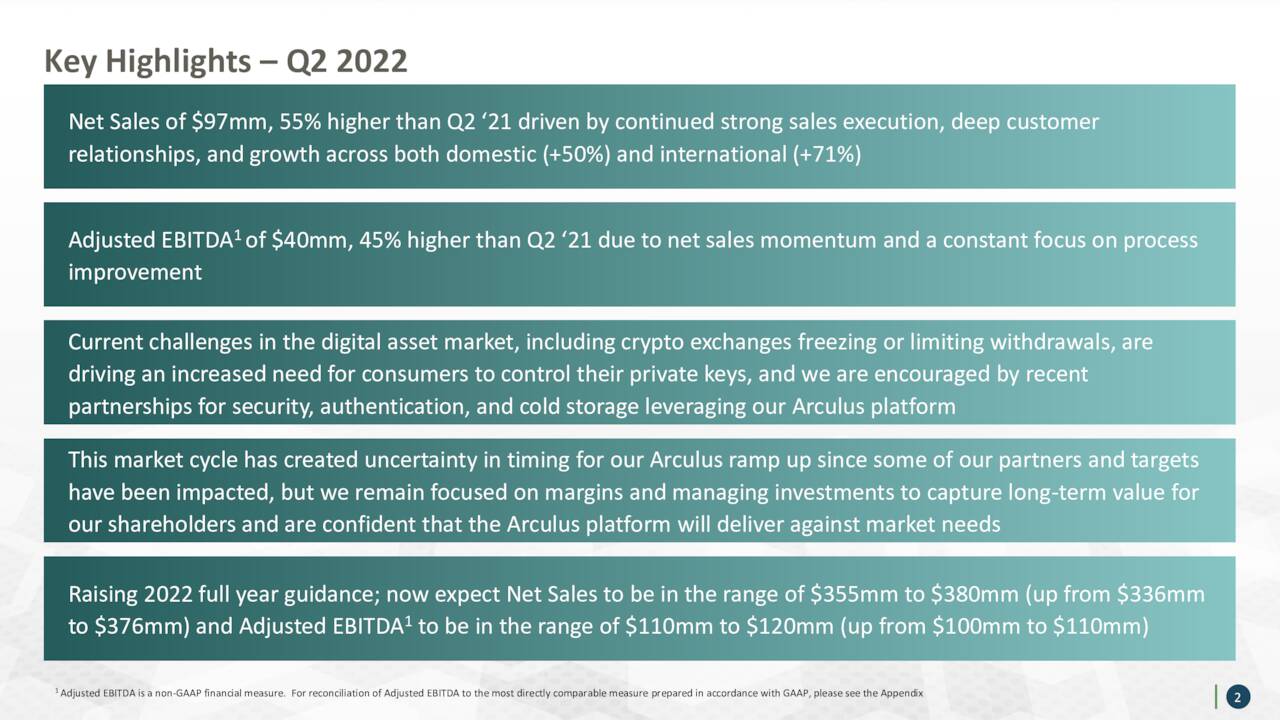

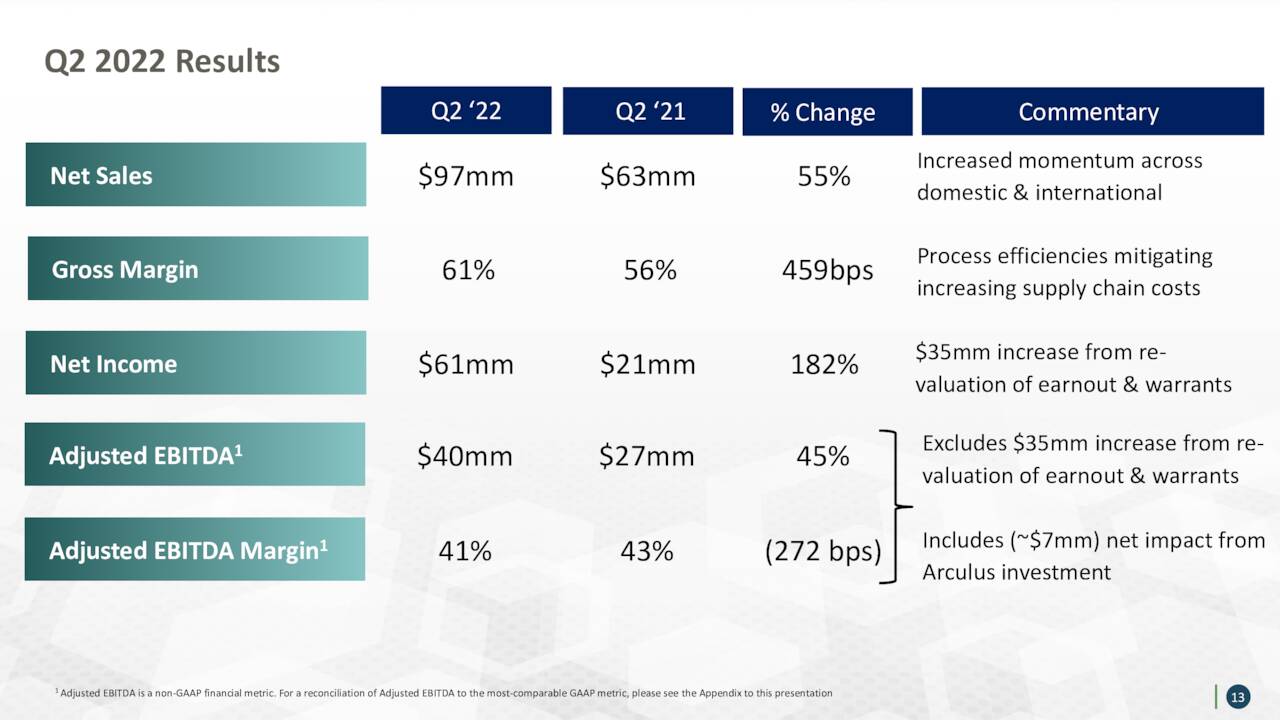

2Q22 Earnings & Outlook

As it turned out, from a financial perspective, the company under-promised and overdelivered. That dynamic was on display when it reported 2Q22 financials on August 4, 2022. CompoSecure earned net income of $60.7 million (GAAP) and Adj. EBITDA of $39.7 million on net sales of $97.2 million versus $21.5 million (GAAP) and Adj. EBITDA of $27.3 million on net sales of $62.7 million in 2Q21, representing increases of 182%, 45%, and 55%, respectively. Gross margin improved 460 basis points to 60.6%. It should be noted that the GAAP net income number was improved by $31.6 million due to favorable changes in the fair value of warrant liabilities and earnout consideration liability, offset very slightly by non-cash stock compensation. Either way, the (unannounced) non-GAAP net income metric of $0.38 a share significantly beat the Street forecast of $0.18 while the top line was $11.6 million better.

August Company Presentation

On the back of this excellent quarter, management raised its FY22 guidance from Adj. EBITDA of $105 million on $356 million in net sales to $115 million on revenue of $367.5 million as its metal card business continues to benefit from significant adoption tailwinds.

August Company Presentation

However, with the environment in the crypto markets extremely uncertain as exchanges freeze or limit withdrawals and brokers file for bankruptcy, CompoSecure’s partners have been impacted, which is hindering the Arculus ramp. Since this product represents the fintech engine of future growth, the response to its otherwise excellent quarter and upwardly revised outlook was somewhat muted, with shares of CMPO rising 9% in the subsequent trading session to $6.62. They eventually pulled back under $5 in mid-October, where they remain.

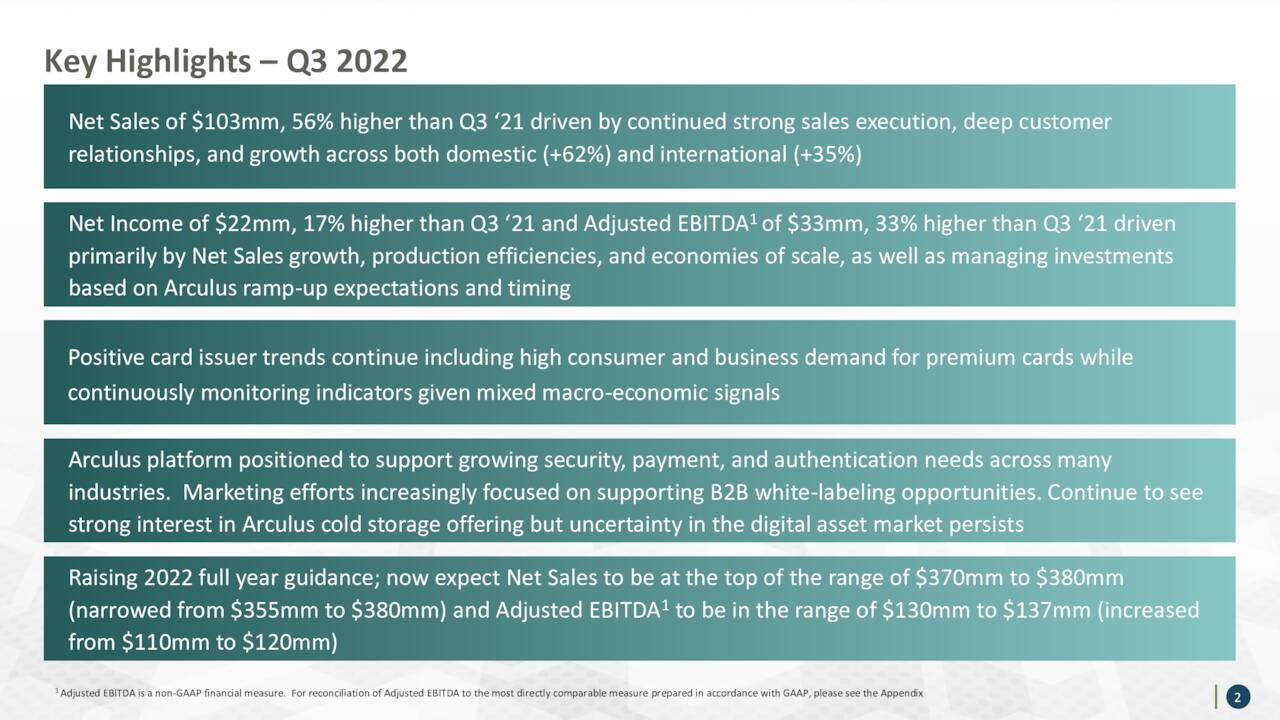

Third Quarter Results:

November Company Presentation

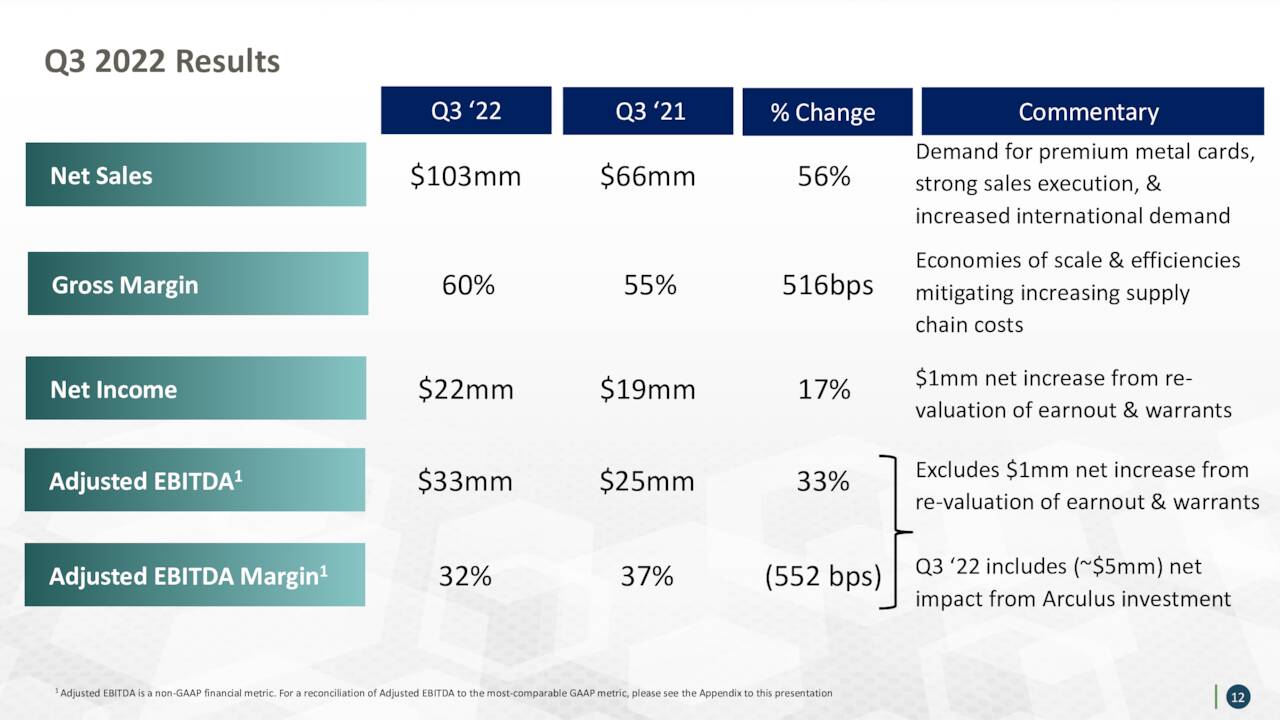

Early this month, CompoSecure posted third quarter numbers. The company has non-GAAP earnings per share of 22 cents, four pennies a share above expectations. Revenues rose just over 55% on a year-over-year basis to $103 million, $5 million above the consensus.

November Company Presentation

Adjusted EBITDA increased 33% to $32.7 million compared to $24.6 million in the same period a year ago. Leadership narrowed sales guidance and believes sales will be between $370 million to $380 million for FY2022.

November Company Presentation

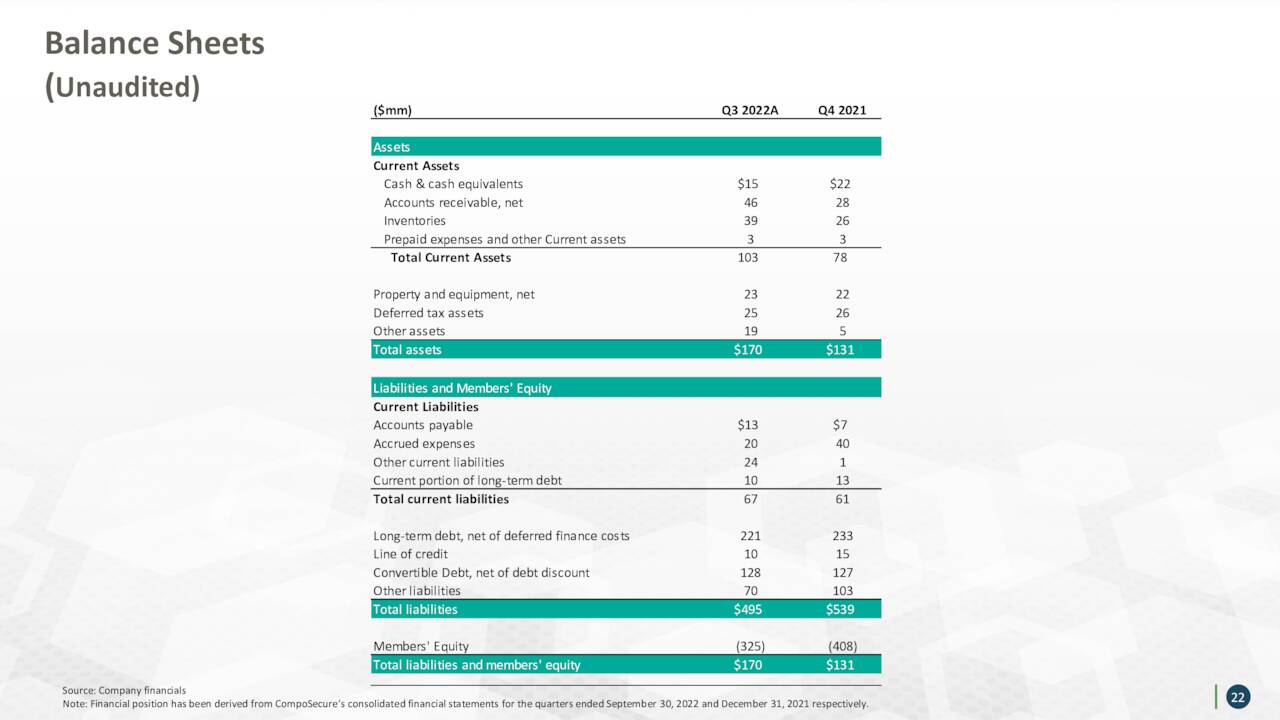

Balance Sheet & Analyst Commentary:

The balance sheet is not pristine but certainly not a cause for concern reflecting cash of $15.4 million and debt of $373.1 million, which includes approximately $233 million of term loans, a $10 million revolver, and $130 million of exchangeable notes. The company generated free cash flow of $47.5 million in 1H22. CompoSecure pays no dividend and does not (and should not) repurchase stock with a public float of only 15.1 million Class A shares.

November Company Presentation

The company has a small but enthusiastic following from the Street, featuring one outperform and two buy ratings with median twelve-month price targets of $10, $15, and $18. On average, analysts expect CompoSecure to earn $1.05 a share (non-GAAP) on net sales of $378.4 million in FY22, followed by $1.19 a share (non-GAAP) on net sales of $430.8 million in FY23.

Beneficial owner Tikvah Management agrees with the buy-side analysts, purchasing 135,421 shares at an average price of $5.19 on October 10-11, 2022.

Verdict:

With the turbulence in the crypto market, a helpful exercise is to isolate CompoSecure’s metal card business from its digital asset platform. The latter lost ~$14 million in 1H22 while the former has excellent tailwinds, and the company more or less owns the market. Even if it loses market share as the pie grows, its metal card business will grow at a CAGR of at least low double-digits (~12%) through 2025. Although not broken out by management since the road show, it can be conservatively estimated that Adj. EBITDA margin for the metal card business is 40%, or ~$145 million on revenue of ~$370 million in FY22. It should generate earnings (non-GAAP) of ~$1.20 a share in FY23 on revenue of $430 million.

November Company Presentation

At these levels, metal card is a buy, and the digital asset-crypto business is a free option. Furthermore, the rough climate for crypto should drive consumers to control the private keys to their digital assets, which is what Arculus Cold Storage Wallet permits. I do have some concerns, two clients account for over 70% of its core business. However, I believe that this risk is fully accounted for by the stock’s puny valuations.

There are no options available against this equity, so a covered call strategy is non-viable. The stock’s float is somewhat low (just over 113,000 shares a day on average), so this is one that makes sense to accumulate incrementally.

As you get older, you don’t get wiser. You get irritable.“― Doris Lessing

Be the first to comment