Michael Vi

When are CrowdStrike’s earnings?

Cloud-based cybersecurity company CrowdStrike (NASDAQ:CRWD) will report Q2 fiscal 2023 earnings on Tuesday, August 30, 2022, after the market closes.

The company will host a conference call following the earnings release that investors can tune in to here.

CrowdStrike guided for $513 million to $517 million in sales this quarter and $2.2 billion for the full fiscal year. Revenue will achieve 52% year-over-year (YOY) growth in Q2 and for the fiscal year by reaching these numbers.

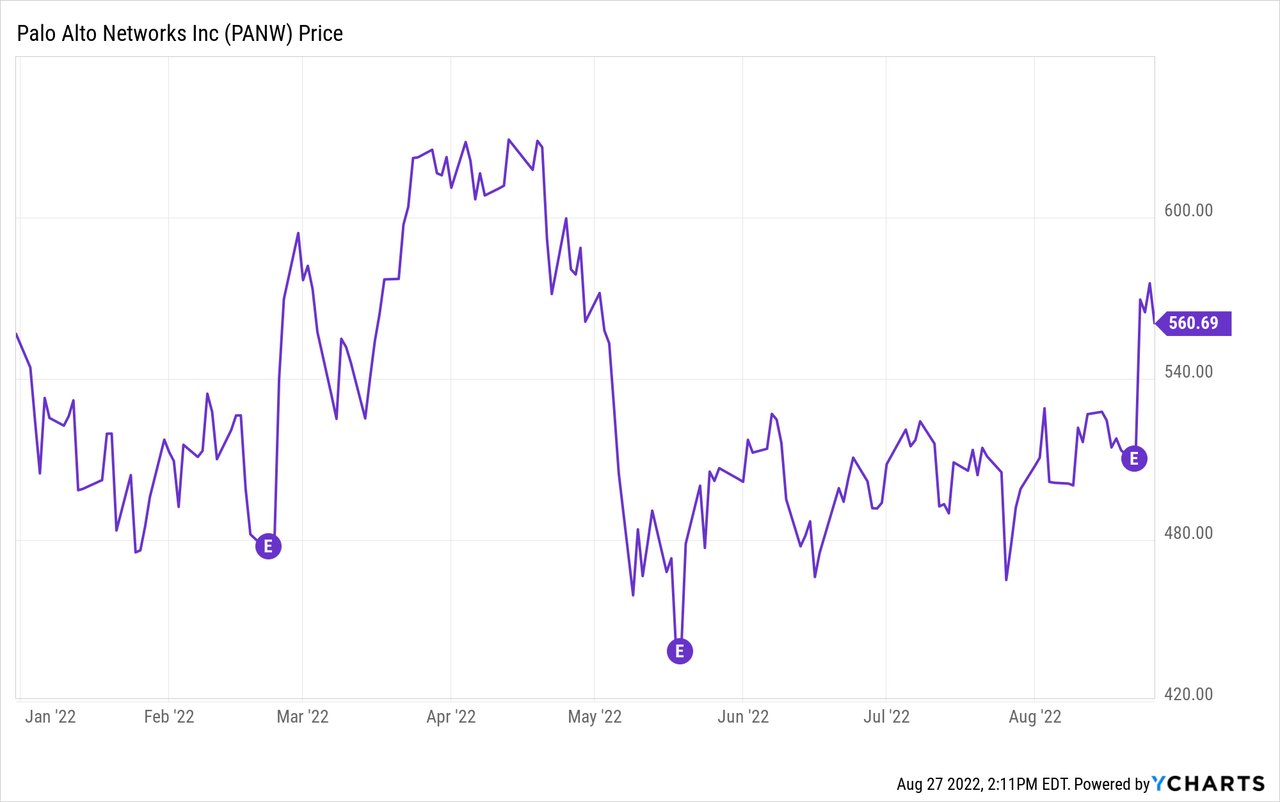

Palo Alto Networks’ (PANW) strong results and excellent guidance offer clues that are encouraging for CrowdStrike and the entire cybersecurity industry. Palo Alto beat on revenue and non-GAAP earnings-per-share, and the optimistic guidance caused the stock to jump, as shown below.

It’s too early to tell if the gains will be sustainable, especially given the market’s temper tantrum on Friday. However, one of the most encouraging metrics Palo Alto posted was a massive jump in billings.

The 44% gain in billings outpaced the 27% gain in revenue, indicating that sales should continue growing significantly. Palo Alto’s remaining performance obligation (RPO) also jumped to $8.2 billion, or 40% higher than a year ago. RPO is another leading indicator of revenue growth. Strong demand is an industry-wide trend that should buoy cybersecurity leaders.

Is CrowdStrike making a notable acquisition?

There are rumors that CrowdStrike is targeting an Israeli firm for an acquisition that could approach $2 billion. Israel is a hotbed for cybersecurity startups, and CrowdStrike faces competition from Israeli-founded companies like SentinelOne (S).

There is precedent here: CrowdStrike acquired Preempt Security in 2020 to boost Zero Trust. Alphabet (GOOG)(GOOGL) has also dipped into these waters, recently acquiring Siemplify for around $500 million. CrowdStrike needs to stay on the cutting edge and acquiring innovative startups before competitors swallow them is essential.

Reporting on CrowdStrike’s plan has been minimal, but there could be an announcement made on the earnings call or a hint from management if they are asked about the rumors.

CrowdStrike Key Metrics

As always, there are some key metrics to watch for CrowdStrike. They can indicate future catalysts or warn investors of dangerous trends. This is even more vital with a fast-growing, difficult-to-value software company.

Subscription customers

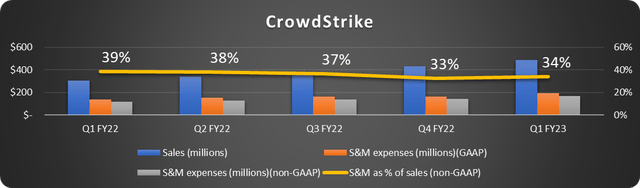

The first metric I look for in each earnings release is the number of subscription customers and the gains made in the quarter. CrowdStrike spends a tremendous amount on sales and marketing (S&M) to attract new customers, and investors need to know they are getting terrific results. The chart below shows the company’s revenue and S&M expenses for the past several quarters.

Data source: CrowdStrike. Chart by author.

As we can see, CrowdStrike spent 34% of revenue on sales last quarter on a non-GAAP basis and 40% on a GAAP basis. So far, it appears to be working.

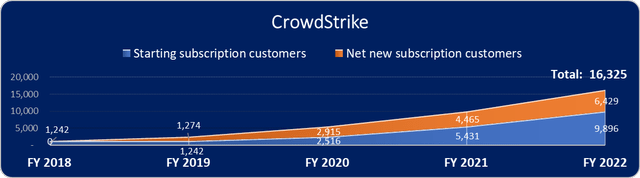

The company has been phenomenal at luring customers, as shown below.

Data source: CrowdStrike. Chart by author.

Customers reached 17,945 last quarter on 57% gains. The percentage growth will shrink as the numbers rise; however, the total number gained will hopefully accelerate. Look for CrowdStrike to report 19,300 on the low end and 20,000 if they have an absolute blockbuster.

Dollar-based retention rates

Dollar-based net retention (DBNR) rate measures the amount of revenue provided by existing clients from year to year. For instance, existing customers spend more with the company this year than last; the DBNR will be over 100%.

This is vitally important to CrowdStrike because of the massive investment in S&M and because much of its success will hinge on convincing customers to adopt more modules. Organic sales growth is less expensive than attracting new customers and entrenches clients with the business.

CrowdStrike set a goal of 120% or above for the fiscal 2023 DBNR. They achieved this in Q1, and investors should look for this in Q2 as well. In fact, CrowdStrike has exceeded 120% each quarter since Q1 FY19. Anything less than 120% would be concerning.

Free cash flow and annual recurring revenue

Of course, we can’t look at CrowdStrike’s results without discussing the top-line revenue figure and annual recurring revenue (ARR). ARR is total subscription revenue annualized. ARR is an excellent leading indicator of sales growth.

CrowdStrike reported $1.9 billion ARR last quarter, 61% YOY growth. The company would need ARR to reach $2.16 billion this quarter to keep up this pace. Anything over this would be a terrific win. This quarter, look for ARR to hit $2.1 billion as a solid benchmark.

Free cash flow (FCF) has seen a dramatic improvement as CrowdStrike has grown. This is an indication that the business model will be profitable at scale. CrowdStrike reported $293 million in FCF in FY21 and $442 million in FY22. Last quarter saw a record $158 million, putting the company on pace to exceed $600 million this fiscal year. FCF can fluctuate for several one-off reasons, but investors should expect an FCF margin above 30%.

The wrap-up

Cybersecurity is a high-growth industry with the potential to accelerate. There is always a catalyst lurking. Cyberattacks and breaches are commonplace and becoming a standard during conflicts. This means that companies, organizations, and governments must protect against criminals looking to profit, state-sponsored attackers, and everything in between.

CrowdStrike continues to be a leader in the industry and may be seeking to add to its repertoire through acquisition. If the company does not announce, an analyst should ask the question during the earnings call, and the answer could provide clues.

The price-to-sales (P/S) and price-to-free cash flow (P/FCF) ratios have come down this year but are still indicative of a company with massive growth ahead. Industry trends point to CrowdStrike beating estimates, but a miss will cause short-term pain to inventors. Beyond the headline figures, watch the metrics above closely.

Be the first to comment