Justin Sullivan/Getty Images News

Costco got downgraded

Let’s tackle it directly. Financial media are reporting that Costco (NASDAQ:COST) has lost its “Buy” rating from Wells Fargo (WFC) that downgraded it to “equal weight” which is equal to a “hold”.

The reasons behind this choice by Wells Fargo analyst Edward Kelly are the following:

- comparable sales growth may be lower than forecasted as the retailer begins lapping last year’s comparable sales growth

- consumer spending is weakening

- fuel margins and currency exposure could have an impact on earnings

In addition, the analyst said he is “wary of how Costco cycles the recent period of historic EBIT margin expansion given its typical stability and customer-first reputation”.

Thus, Wells Fargo lowered its target price to $490 based on a 34X multiple of the 2023E EPS.

How I am investing in Costco

Allow me to immediately give away how I am investing in Costco. I have learned that Costco is a very difficult stock to buy since it always trade at a premium. This is why my strategy to build up a position in this stock has been to wait for sell-offs on news that cause the stock to dip for some time. Even so, I have found myself sometimes before these opportunities without having cash on hand and the stock hasn’t given me enough time to build decent enough cash position to benefit from the dip. This is why I am starting to put aside a little money month over month that is to be spent only on very selected handful of stocks that are difficult to grab. Costco, of course, is among these.

Why I am invested in Costco

But, if I say how I am investing, I need to answer another, more important question: why am I putting my money in this retailer? The reason starts from a little fact: when I was a kid, I remember my mother being enthusiastic about shopping at Costco. When I began investing a few years ago, Costco was among the first stocks I considered because of this. In a certain way, I had right before me the proof that customers were happy and kept on going there.

This got me started. I then started researching. At first, I was – I admit it- a little shocked by the financials I was seeing. Let me explain this better. Since one of the most important things I look at are margins, when I considered Costco’s I was disappointed. A gross profit margin around 12%, an EBITDA margin lower than 5% and a net income margin around 2-3% was, to me, not only disappointing, but also dangerous.

Then, I came to realize that Costco is a very different company that doesn’t have the usual approach to profitability as other retailers. My research has even led me write an article that explains how Costco came to influence Jeff Bezos and the creation of Amazon Prime (The Influence Of Costco On Amazon Prime).

Let me share a few things I learned, which I will use to reflect on Wells Fargo recent take.

Costco’s Business Model

Costco has a business model that makes it not exactly appropriate to give it a valuation only based on increasing margins.

The truth is that Costco considers itself as a buyer of good deals for its members. Thus, it is not focused on charging high prices for its goods sold. Its purpose is exactly to find good products at bargain prices in order to pass on to its members its savings. In fact, Costco simply raises its prices by 14% on the cost of the goods it sells. This is remarkable. As a side note, I don’t know many retailers that can operate on this recharge without going bankrupt.

So, the first idea I had to understand is that Costco is not a seller but rather a buyer on behalf of its members.

Secondly, I found out that Costco doesn’t focus on having on its shelves as wide a variety of goods as possible, risking to overload its inventory, but that it rather prefers to offer well-known products that consumers are familiar with and that have great demand. This leads to a very quick goods turnover of around a month. In the annual report, the company states this from the very beginning, declaring that the business is run

based on the concept that offering our members low prices on a limited selection of nationally-branded and private-label products in a wide range of categories will produce high sales volumes and rapid inventory turnover. When combined with the operating efficiencies achieved by volume purchasing, efficient distribution and reduced handling of merchandise in no-frills, self-service warehouse facilities, these volumes and turnover enable us to operate profitably at significantly lower gross margins (net sales less merchandise costs) than most other retailers. We generally sell inventory before we are required to pay for it, even while taking advantage of early payment discounts.

I read this paragraph almost every time I have to consider Costco. It discloses part of Costco’s secret: the limited selections of goods sold enables the company to produce high sales volumes and quick inventory turnover. This allows the company to collect money before paying it, creating a very efficient model that resembles, in a certain way, the restaurant industry. Costco becomes in this way a very reliable customer for its suppliers, that have come to know that Costco will always have the money to pay them. It is clear that this reliability gives Costco some further strength when bargaining prices.

A top-line company

What we have seen so far makes me say that Costco is a top-line company, as I explained thoroughly in another article (Costco’s Earnings Call First Valuable Business Lesson: A Top-Line Company).

What does this mean? Costco is not looking to find places where to harvest margins. Costco looks to drive up sales. It is all about volume. If the company is able to incrementally get just an extra percentage point of comparable sales, that generates extra profits for the company. And one of the way Costco drives up sales is by lowering prices, keeping a little margin for itself. This is a very powerful tool to use during inflationary times with the increasing risk of a 2023 recession that could hit consumers’ pockets.

This was one of the most important things I have learned so far in my research about Costco: its most important driver of profitability is increasing net sales, particularly comparable sales growth.

So, what is the metric to look at to understand Costco’s profitability? I find helpful the Seeking Alpha’s Quant Ratings page for the stock which awards Costco with an A grade, though it scores Ds and Cs for margins. In this page we see that what allows Costco to be graded with an A are the following metrics: asset turnover ratio, cash from operations and the three different ways to look at returns on equity or capital or assets.

Membership fees

However, what we have seen so far is just part of the company. In fact, a big chunk of its profits comes from the membership fees paid by its members. For those who don’t know it, in order to shop at Costco you have to be a member.

This is the second column of Costco’s business model. As Costco states:

The membership format is an integral part of our business and has a significant effect on our profitability. This format is designed to reinforce member loyalty and provide continuing fee revenue. The extent to which we achieve growth in our membership base, increase the penetration of our Executive members, and sustain high renewal rates materially influences our profitability.

Why do people become members? Because they find at Costco the best deals. Therefore, keeping margins very low on goods sold enables the company to have lots of members who pay an annual fee that Costco offers with relatively no cost for the company. When I realized this I thought it was a brilliant idea. By accepting very low margins, that is, by selling goods almost at cost, Costco manages to buy very good deals for its members, who pay to participate in Costco’s buying power. This is why Costco considers itself more of a buyer than a seller.

No surprise that Costco keeps on hitting all-time highs in terms of renewal rates. At the end of its fiscal year, this rate for the U.S. and Canada was 92.6%, 0.3 percentage points higher QoQ. Worldwide, the rate is at 90.4%. The household members are 65.8 million and they increased YoY by 6.5% which is a faster growth when compared to the fact that its new warehouses accounted for less than half of this yearly growth. Costco also has 29.1 million executive memberships and it is working relentlessly to make its members upgrade their membership.

Through the membership program, Costco receives continuing fee revenue which, after tax, generate around 58% of Costco’s net income.

The more I realized this business model, the more I started understanding why Costco is able to generate profits in every economic environment. This is why I decided to build up a position that will be a cornerstone of my portfolio.

What I think about Costco’s downgrade

Having seen all of this, we have to look at Wells Fargo downgrade to see it if is appropriate or not.

After what we have said, the warning about lower comp sales growth is indeed something to look at carefully.

In the latest sales results releases, the company reported a September sales growth of 8.5% YoY and October sales growth of 6% YoY with a slowdown of 0.7% in e-commerce during the month.

The trend may indeed suffer a from tough comparables. However, let me remind that if Costco is still able to achieve growth even when lapping outstanding results, we are before a really good result because it means that it is adding growth on top of the boost the pandemic gave to retailers in general. Not every other retailer is witnessing the same trend.

I went to the data available for the Great Recession and we can see that Costco did have a streak of 11 months of comparable sales decline that started recovering at the end of 2009.

| 2008 | 2009 | 2010 | |

|

January |

+7% | -2% | +8% |

| February | +7% | -3% | NA |

| March | +7% | -5% | +10% |

| April | +8% | -8% | +11% |

| May | +9% | -7% | +9% |

| June | +10% | -6% | +4% |

| July | +10% | -7% | +6% |

| August | +9% | -2% | +7% |

| September | +7% | -5% | +6% |

| October | 2% | +5% | +6% |

| November | -5% | +6% | +9% |

| December | -4% | +9% | +6% |

Part of the negative streak was due to low gas-prices during the Great Recession. In many months, the adjusted result that excluded gas and FX would have still given positive comparable growth.

In case of a future recession, we have to see if gas prices will go down that significantly, given the current geopolitical tensions over energy and oil. It may actually happen that we will see sustained gas prices for a while. This would benefit Costco more than it did during the last recession.

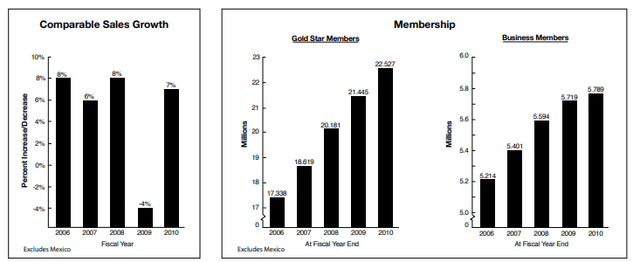

We can also look at the data available from Costco’s 2010 Annual Report. Here we see that the yearly comparable sales at the beginning of the recession did grow thanks to strong performance in the first half of 2008. Overall, the 2009 drop, which seemed from the table above a bit concerning, is actually a small drop of just -4%. Meanwhile, members kept on growing and this led Costco’s profitability upwards.

Costco comparable sales and members 2006-2010 (Costco 2010 Annual Report)

Let’s look at what happened to Costco’s profit margin: it came down from 1.92% to 1.56%, with only an 18% contraction. The EPS had a sharp drop in late 2008 till mid-2009 moving down from $0.87 to $0.48 to then recover immediately to $0.85, proving Costco’s resilience. These charts also show that when consumer spending weakens, Costco’s members keep on growing. This is why I don’t consider Wells Fargo second warning a real threat.

Conclusion

Overall, comparable sales growth is something to monitor and I agree with Wells Fargo that Costco could see some deterioration of its results. However, even if this happens, I think history has proven more than once Costco’s ability to recover quickly without losing, but actually adding members.

I still think we can expect the company to grow its top line by 10% to come close to a revenue of $250 billion that could easily generate a net income of at least $6.75 billion (2.7% margin) which would lead to a 15.5 % net income increase YoY. This makes me expect 2023 EPS of around $15.1, a bit above the $14.66 EPS estimate available on Seeking Alpha.

According to this forecast, Costco is trading at a fwd 2023 PE of 32, which is still expensive but it is good when considering that just a few months ago the stock was trading above 40.

Here is my plan. I believe there may be some temporary headwinds for Costco that might actually cause some volatility around the stock. These windows are usually short-lived and I have learned that I need to be prepared. For the, the first buy signal triggered below $500 and I bought a few shares. I will buy some more under $450 and, if we ever get there, under $400.

In any case, I am not selling a single share because I know the effort I was required to both come to understand the company and then find the opportunities to afford this premium stock.

Be the first to comment