imaginima

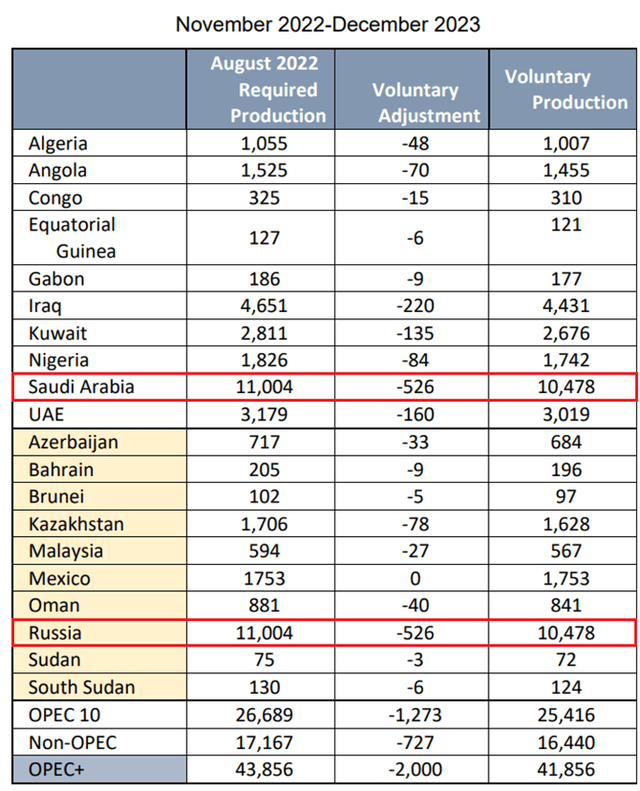

The main event this week in the oil and gas industry, which directly affects energy ETFs such as the Energy Select Sector SPDR ETF (XLE), ProShares Ultra Bloomberg Crude Oil (UCO), and The United States Oil ETF (USO), is the news of OPEC+’s decision to significantly cut oil production quotas by 2 million barrels of oil per day, starting in November 2022. Saudi Arabia and Russia are the main countries that will contribute to a sharp reduction in oil production, while other members of OPEC+ will be less involved in this decision.

Source: Author’s elaboration, based on OPEC production table

According to the U.S. Energy Information Administration, total global oil production was 98.83 million barrels of oil per day for the 2nd quarter of 2022, and its reduction of 2 million barrels per day is quite significant. At first glance, such changes should have led to a sharp rise in oil prices by about 15-20%, as it happened before. However, history rarely repeats itself, and Brent and WTI futures (CL1:COM) edged up less than 5%.

Reasons for the market’s sluggish reaction to the OPEC+ decision

In terms of technical analysis, the OPEC decision only led to a slight correction in the price of a barrel of Brent crude (CO1:COM), which continues to remain within the downtrend that began in mid-June 2022. The sluggish reaction of the market is directly related to the structure of the OPEC organization and the current situation in world markets.

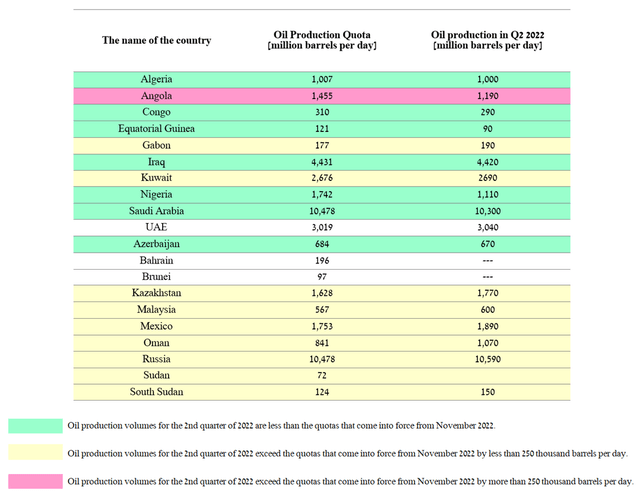

First, OPEC’s decision to cut production quotas is not the same as the decision to cut oil production. Paying attention to the new terms of the deal, production quotas will be higher than the actual oil production, which occurred between April and June 2022. For example, Saudi Arabia, which is the third largest oil-producing country, has 178,000 barrels per day of undrawn quota left even after the reduction.

Source: Author’s elaboration, based on OPEC and EIA

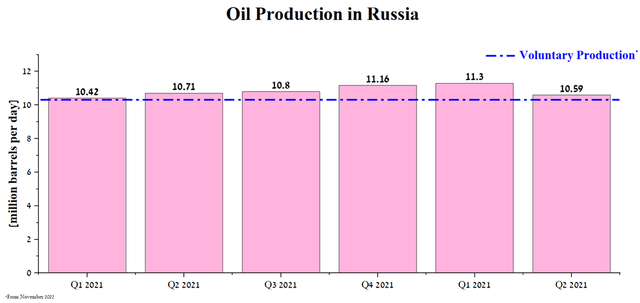

At the same time, Russia, which continues to lose its share in the European oil market due to aggressive actions against Ukraine, has reached the ceiling in oil production after quotas and cannot produce more than it is currently producing.

Source: Author’s elaboration, based on EIA

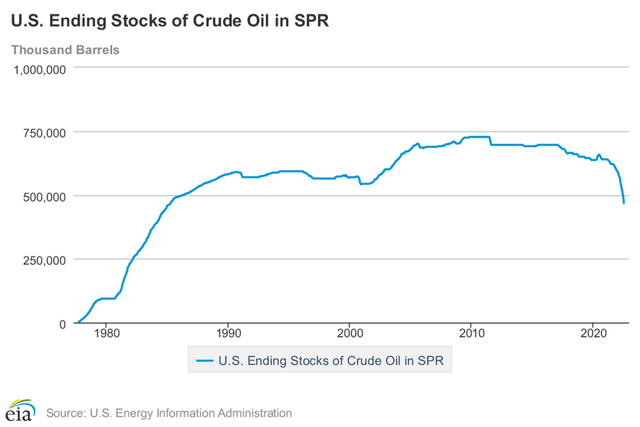

The second reason for the sluggish reaction of the market to the news about the reduction of production quotas is the world’s large strategic oil reserves, which can be used to fill the deficit that is on the market today. This policy has been adopted by the Biden administration over the past few months, using the U.S. Strategic Petroleum Reserve (SPR) to drive down domestic fuel prices.

Source: U.S. Energy Information Administration

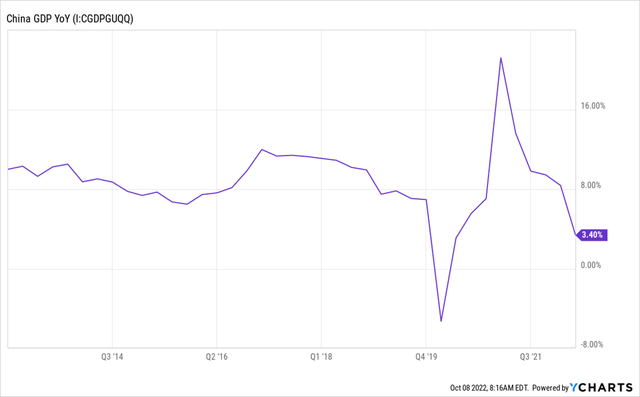

And the main reason for the lack of a sharp rise in oil prices is fears of an impending recession and an economic downturn in China, the world’s second-largest economy.

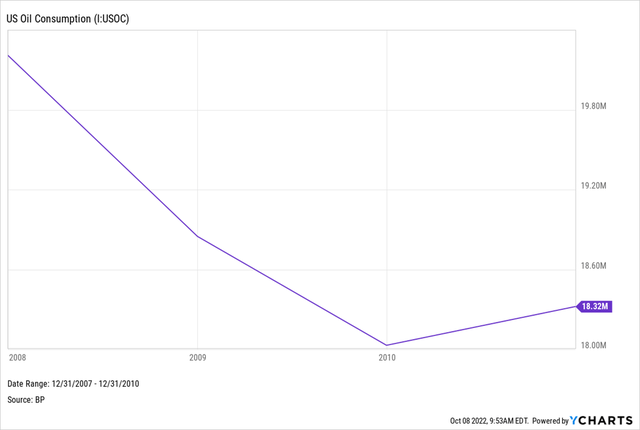

COVID-19 restrictions, which were reintroduced by the Chinese authorities in the first half of 2022, continue to negatively impact the growth rate of retail sales and industrial production. Moreover, the urban youth unemployment rate approached 20% in July 2022, setting a multi-year high since the release of these data by Beijing. As a result, I continue to expect a slowdown in the economy and a deterioration in the economic performance of the world’s second economy, which will lead to a decrease in oil demand from the beginning of 2023. Looking more globally, we have seen oil prices drop significantly in past recessions, despite a more modest decline in global oil consumption. For example, during the Great Recession, the price of crude oil fell by more than 75% from its peak, but oil consumption remained stable.

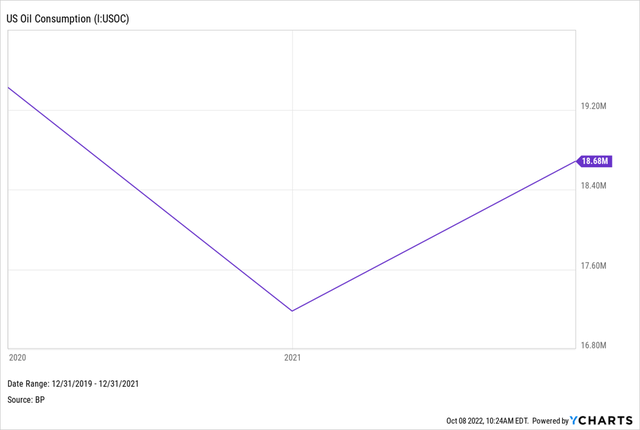

Another example of oil price fluctuations during times of crisis is the onset of the COVID-19 pandemic. During the introduction of restrictive measures and panic, WTI crude oil traded at a negative price for the first time in the history of exchange trading, despite a slight decrease in demand for it.

Conclusion

All factors except OPEC’s decision to reduce production quotas by two million barrels per day point to the continuation of the direction of oil prices down. Moreover, this decision does not change production volumes and has little effect in the long term. From a political standpoint, the US is in a better position despite President Biden’s fears that the OPEC decision could lead to a sharp increase in the price of oil. In the run-up to elections to the US Senate and House of Representatives, the Biden administration can use many tools to lower domestic fuel prices. One such tool is the introduction of export restrictions on gasoline and diesel while increasing their production. In addition to increasing production in North America, US and European Union officials are starting to negotiate more closely with Iran and Venezuela to lift sanctions to increase oil supplies and thereby neutralize OPEC’s attempts to keep the price above $90 a barrel. As a result, I believe that WTI and Brent oil prices are near their peaks, and only in the short term will the news background keep their price in the range of $80-95 per barrel. However, from the beginning of 2023, we may see a double-digit drop in the price of oil, which will negatively affect the share price of companies such as Exxon Mobil (XOM), Shell (SHEL), Chevron Corporation (CVX), and Kinder Morgan (KMI).

Be the first to comment