neilkendall

Shares of Eastman Chemical (NYSE:EMN) have lost about one third of their value over the past year as weakening global growth has hit cyclical stocks. Chemicals companies are direct suppliers into key industrial products, particularly in autos and construction, making their businesses closely tied to the global economy. While shares have just a 7.5x multiple based on management guidance, I see downside risk to earnings and would wait for the mid-$60s before buying.

Seeking Alpha

As the economic cycle turns, cyclical stocks can appear quite cheap as earnings estimates are not yet revised but the stock begins to discount weaker results in the future. The question becomes how low earnings go and for how long. In the company’s Q2 results, there were signs the business is beginning to turn, and when Q3 results come out in a few weeks, investors should look for a downside surprise. While EMN is better positioned than European-centric companies, I can see shares pushing into the mid-$60s, at which point valuation would be sufficiently compelling to consider stepping in.

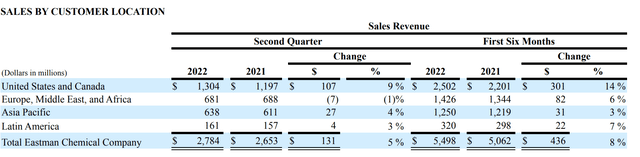

In the company’s second quarter, revenue rose 5% to $2.78 billion as a 15% increase in price offset a 10% drag from divested business. EBIT margins did contract from 17.1% to 16.8%–the first sign that demand is beginning to crack as price increases could not fully offset higher costs. Adjusted EPS was $2.83 with FX a 2% headwind that I fear could get worse.

We are starting to see weakness in its leading unit, advanced materials, which provides plastics and chemicals products for consumer goods, construction, and autos. Margins compressed 120bp as volume fell 1% and a 13% price increase could not offset higher input costs and an FX headwind. The company is seeing weakness in global auto demand and slowing in construction.

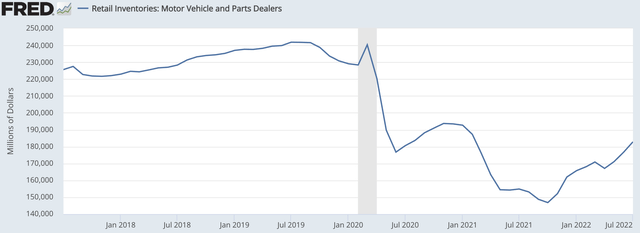

There is a lot of discussion of how US auto inventories are very light as semiconductor issues slowed production—indeed there is a $50 billion gap between where inventories were pre-COVID and where they are now. It may be surprising then to hear EMN say they are seeing auto demand slow. I would emphasize that EMN emphasized “global” auto demand. In China (a market 70% bigger than the US for cars), “the recovery trend is far lower than our expectations,” according to industry experts. In Europe, auto sales are down 12% from last year. These weaknesses are offsetting demand in the US, given the global nature of EMN’s business.

St. Louis Federal Reserve

In fact, this week PPG, a key provider of paints to the auto industry, cut guidance given weakness in China and Europe. PPG is often a “canary in the coal mine” for the chemicals sector. Combined with weak auto data and other headwinds I will discuss, this adds to my concern than EMN will face a decline in earnings.

On the bright side though, its additive business held in better given 40% of contracts have cost pass-throughs. Price was a 20% tailwind with volumes up 11%, though semiconductor demand could be turning. In fact, sentiment on chip volumes seems to get worse by the day, particularly with US-China tensions building. EBIT margins expanded 80bp, but this may prove temporary if that demand sinks. Its intermediates business, which is geared toward agriculture, saw margins contract 160bp from very elevated levels in 2021 to a more normal 18%. With crop prices off of their highs, this normalization is set to continue.

In the first half of this year, the company generated $4.89 in adjusted EPS. Given guidance of $9.50-$10, that essentially a similar pace in the second half of the year. That initially struck me as optimistic given the economic environment is seemingly worse today than six months ago. Indeed, this forecast assumes 3% global GDP growth, which given faster central bank interest rate hikes may not be achieved. Looking out over the next 12 months, Europe likely faces recession in my view, given higher energy prices, China’s COVID-zero policy is a wildcard, and while the US may avoid recession, growth will likely be sluggish. I don’t expect the company to earn in 2023 what it was doing in H1 2022.

Here, I think the company’s geographic footprint is critical to note. From a revenue perspective, EMN is a global company. 47% of sales come from the US, 24% Europe, 23% Asia, and 6% Latin America. The Europe and Asia exposure is a clear headwind, not only because economic activity is cooling there, but also because the US Dollar is so strong that this will weigh on overseas operations (a problem for most multinationals not just Eastman). Below you can see that US remains a relative source of strength, but Europe is beginning to roll over and Asian growth is soft.

Eastman

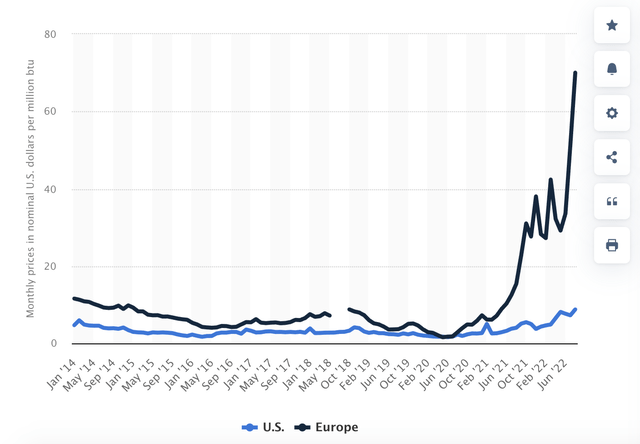

The European economy is particularly exposed to higher energy prices. Due to Russia’s halting of gas exports, their natural gas prices have entirely decoupled from ours as European buyers scramble to secure any LNG cargos they can to avoid running out of natural gas this winter. I fear this will be more than a one-winter phenomenon as Russia was sending gas to Europe in H1 2022; they are unlikely to be in H1 2023 given Nordstream 1 was blown up. Europe will need to source even more natural gas next year than this year.

Statista

This surge in prices will squeeze consumers’ income, likely reducing economic activity. The jump in input costs will also like cause a decline in industrial activity as it may not be economic to run some factories when natural gas prices are 10x higher than normal. All of this will weigh on EMN’s sales to Europe.

One thing that is positive is that while EMN sells a lot to Europe; it does not produce as much in Europe. Natural gas is a critical input cost for many chemical manufacturing processes, so the fact US prices are lower than in Europe gives firms here a relative cost advantage as CEO Mark Costa noted, “You’ve got a shift in the cost structure on a global basis where the European agents are going to be paying a lot more natural gas relative to the U.S., even though our prices are really high right now in the U.S., they’re exceptionally high everywhere else. And so that’s the advantage that is going to help us going into the future.”

Given my view European natural gas may stay elevated for quite some time, European-centric companies like BASF (OTCQX:BASFY) will struggle and should be avoided. Similar to how the 2014-2016 oil and gas boom facilitated a shift in global chemicals activity to the US, I expect something similar will happen in coming years. Fortunately, Eastman has divested its European tire and adhesives plant. 11 of its 37 manufacturing sites are in Europe, though they tend to be smaller with management flagging its two in Belgium as its primary risk. So while a quarter of its revenue comes from Europe, just a fraction of that sum is produced inside Europe. This will not mitigate the demand problem, but at least investors in EMN do not need to worry about significant disruptions to its operations if gas is rationed this winter.

At the company’s guidance, shares trade just 7.5x earnings, and its $1.5 billion in normalized operating cash flow (holding working capital constant) would translate to about $800 million in free cash flow for a 9% FCF yield, and with proceeds from divestitures, the company is doing a $1 billion buyback, which has reduced the share count by 7% over the past year.

With PPG cutting guidance, European headwinds building, and currency a headwind, I see risks skewed to the downside, especially with margins starting to contract and chip demand faltering. A 100bp margin contract combined with a 1% decline in revenue from H1’s pace given these constraints is a reasonable expectation for the next year. That would imply EPS of about $8.25 and free cash flow of about $650 million. In a more meaningful downturn, revenue could fall by 6% like during the European slowdown and energy bust of 2016, which would likely push EPS towards $6.50-7 as some operating leverage is lost, hitting margins.

Using my $650 million go-forward free cash flow expectations, I would see support in the 8% free cash flow yield area, or about $66 a share. At that price, you are being compensated sufficiently to buy into a cyclical economy as the economy downshifts. At $72, risk is skewed to the downside as potential negative earnings revisions for wait, and I would continue to avoid the stock for now.

Be the first to comment