Justin Sullivan

Article Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) is a fast-growing fintech company that has seen its shares come under a lot of pressure over the last year. The company’s profitability is lacking, but if management is able to keep the growth rate high while generating operating leverage, the earnings growth potential is attractive. SoFi Technologies trades at a relatively high valuation today, but it could grow into its valuation over the years. SoFi is not a low-risk stock, but in the long run, there is share price appreciation potential – if things go right.

Is SoFi Profitable?

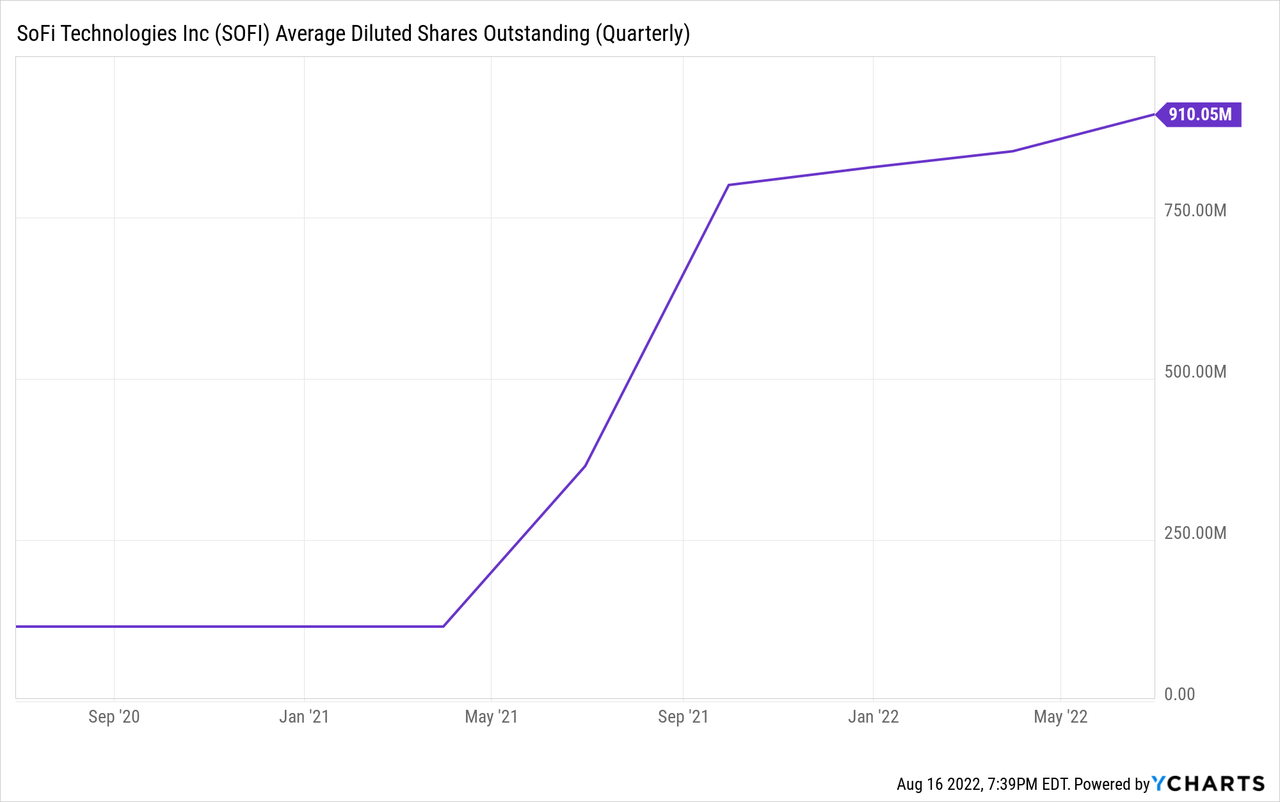

The answer to this question depends on how one defines profitability. On a reported/GAAP basis, SoFi Technologies is not profitable – at least not yet. During the most recent quarter, SOFI lost $0.12 per share on a GAAP basis. The company lost close to $100 million in total. That’s far from a great result, but the performance was way better than during the previous year’s period, when SOFI’s loss per share was $0.48, and when the company lost $170 million in total. The fact that the loss per share was cut by 75%, while total net losses were cut by less than half is explainable by the increase in SOFI’s share count. In this case, it led to a lower loss per share, but in general, a rising share count isn’t positive, as it dilutes shareholders over time.

The big jump in SOFI’s share count took place around the middle of last year, when the company went public via a SPAC:

Its share count rose by several hundred percent between early 2021 and now, but the increase has been way more benign this year. Still, SOFI is issuing new shares at a meaningful pace, which reduces each remaining share’s portion of the total over time. This works against shareholders, as not all of the company-wide growth that SOFI generates is reflected in the company’s per-share growth rate.

SoFi Technologies does, like many other companies, also report adjusted results, where certain items that are included in GAAP expenses are backed out. In some cases, this makes a lot of sense, e.g. when non-recurring costs such as intangible asset writedowns are backed out to better reflect the company’s underlying earnings power. When expenses for share-based compensation are backed out, things are a little different. SBC is a non-cash cost, but it still has a real impact on shareholders due to the dilution mentioned above. Fully backing out the company’s share issuance thus paints a rosy picture of the company’s profitability – some investors may prefer not to back out the cost of share issuance.

SOFI’s adjusted EBITDA was $20 million for the quarter, up more than 80% year over year. On the other hand, the current EBITDA run rate of around $80 million a year results in an enterprise value to EBITDA multiple of around 130, based on a current EV of more than $10 billion. That is a very high valuation, which means that even on an adjusted basis, current profitability is pretty weak relative to how the company is valued today.

SOFI Stock Key Metrics

Not everything is bad about SoFi Technologies, of course. The company’s underlying business growth is pretty attractive, for example.

SoFi Technologies

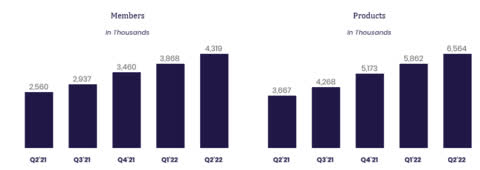

SoFi Technologies is experiencing rapid growth in both its user count as well as in its product sales. Members rose by almost 70% over the last year, while product sales rose by an even stronger ~80% in the same time frame. Most of SoFi Technologies’ business growth is thus driven by the addition of new members or users, while the company also manages to do more business with the users it already has. With a little more than four million users, there is still ample growth potential for the company in terms of adding new users. Naturally, not everyone in the world will become a member – but getting to a member count of a couple dozen million seems like an achievable goal in the long run, especially when SoFi puts more focus on international expansion. That being said, ongoing growth is not guaranteed and rests, to some degree, on solid execution both product-wise and marketing-wise. But SOFI’s past track record indicates that management knows what it’s doing, especially since SOFI has performed better than many other fintech stocks growth-wise in 2022:

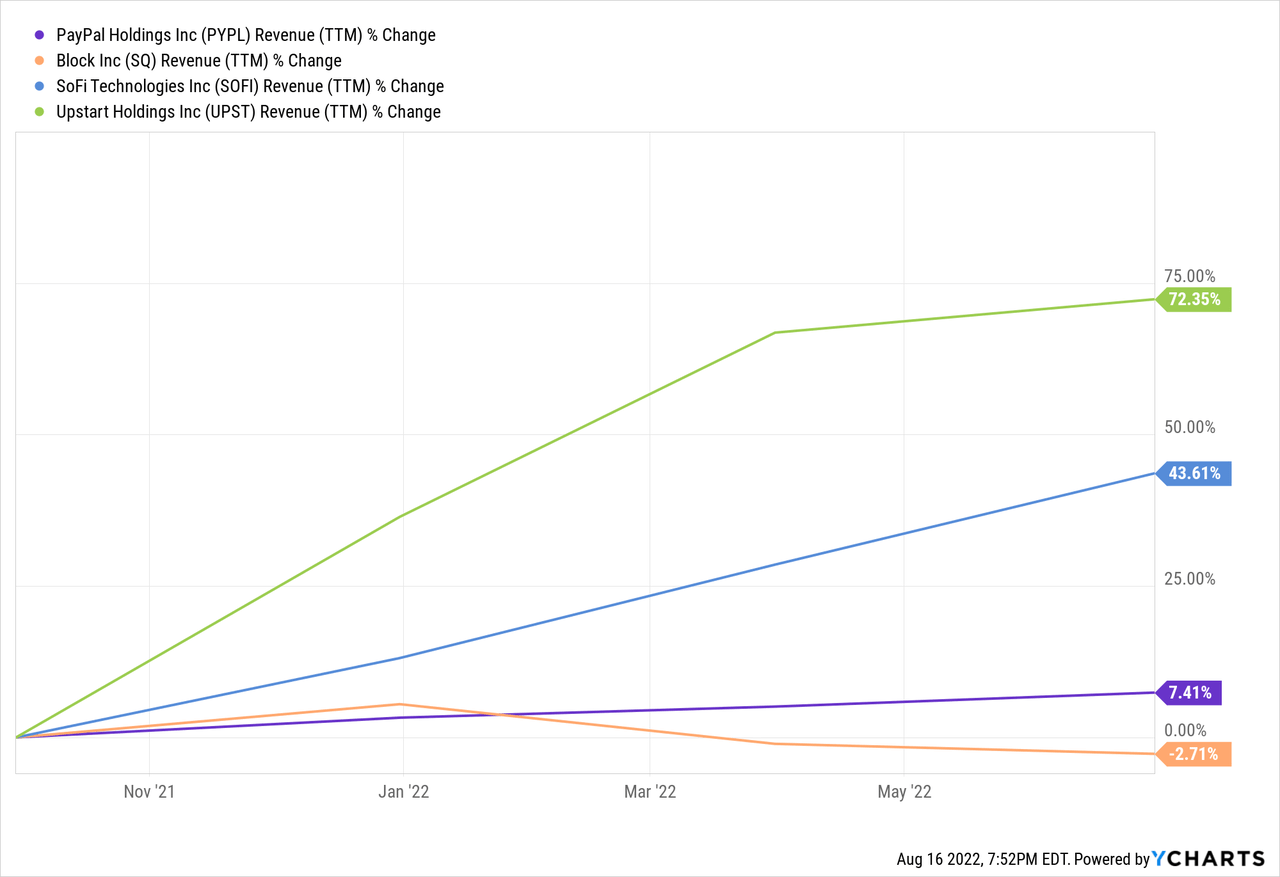

SoFi Technologies has grown its revenue by 44% over the last year (trailing twelve months versus the previous twelve months), whereas PayPal (PYPL) and Block (SQ) have a relatively flat top line over the same time frame – Block actually shrank slightly and is nevertheless trading at a very high valuation. That being said, Upstart (UPST) grew even faster than SOFI. The business models and stages of maturity of these companies are not the same, but SoFi surely doesn’t have to hide when it comes to its growth performance relative to how other major fintech companies are performing.

SoFi Technologies’ student loans business has experienced some headwinds due to political measures, i.e., student loan forgiveness, and yet the company has generated compelling growth so far this year. In a different environment, an even better growth performance might have been achieved. But even at the current growth rate, the company could see its profitability improve meaningfully over time. When companies add revenue and operate with positive gross margins, operating leverage helps them grow their margins over time. That seems to be the case with SOFI, as we have seen its margins improve – although they aren’t high yet. But if growth remains high and when management keeps costs under control, substantial margin upside exists over the next couple of years.

Where Will SoFi Stock Be In 5 Years?

Analysts are currently predicting that EBITDA will improve from $110 million to $320 million in 2023, and to $520 million in 2024. If SOFI manages to hit those numbers, which isn’t guaranteed, then the company would be trading at around 20x 2024’s EBITDA today. That sounds a lot better than the current 130x EBITDA multiple based on the Q2 EBITDA run rate. Still, even a 20x EBITDA multiple isn’t especially low, although it might make sense as SoFi should still be able to grow at an above-average rate two years from now – it most likely won’t be a mature company in 2024.

If SOFI was able to add another 30% to EBITDA in the following year, and 25% and 20%, respectively, in 2026 and 2027, then its EBITDA in 2027 might come in at around $1 billion. Put a 15x EBITDA multiple on that, and SoFi Technologies might very well be worth $15 billion five years from now – or around 50% more than today. Of course, share issuance would mean that not all of that would end up in shareholders’ pockets – the value per share would rise less. But still, this scenario analysis shows that it doesn’t take uber-aggressive estimates for SoFi Technologies to deliver some share price gains over the coming years.

Is SoFi Stock A Buy, Sell, Or Hold?

SoFi Technologies was obviously a pretty bad investment last fall when it was trading at more than 3x the current price, despite being even smaller back then. Those investors that chased the stock and the hype around it back then suffered from paying a way-too-high price. Today, the valuation based on current EBITDA and profits is still pretty high, but SoFi Technologies seems like a way better investment compared to the past.

Under the condition that management executes well and manages to control costs in order to improve profitability, the current share price could be warranted. If execution is solid, I believe SoFi could see its shares climb over the next couple of years.

That being said, I do not think that SOFI is a low-risk pick. If execution is lacking, if costs rise more than expected, or if a competitor takes market share, then SOFI could be at risk of dropping further.

I do believe that there is a solid chance that shares will trade meaningfully higher five years from now, but since that is far from guaranteed and since the total return outlook isn’t too great, I’m not (yet) interested in buying SoFi here. That might change when I see SOFI perform well operationally, or if shares pull back further and the valuation drops. For now, I’d call SOFI a hold.

Be the first to comment