Douglas Rissing

Over the summer, I managed to go to Europe in August, which is the most cherished of all months of the year for most Europeans, as they simply take the month off. In the second week of August, I got all the way to Maroneia in Northern Greece, which is a lovely vacation spot, as it is not overrun by tourists and the August weather is significantly more bearable compared to the warmer South.

Our hosts, who had built a beach home on the outskirts of Maroneia, kept on asking many questions about America but the conversations always seemed to end up talking about the horrific surge of inflation, which all Europeans were experiencing in light of the war in Ukraine. Since the hosts knew what line of work I was in, they really wanted my take on where the inflation was coming from.

“It’s not the war, that’s only a part of it,” I answered. “Even if the war was not happening, there still was going to be high inflation, maybe not as high, but high. In the U.S., there is no war, and the country is more energy-independent, yet the inflation rate is still very high, the highest in 40 years. America spent $6 trillion on COVID and related issues in a short period of time. This excessive deficit spending is what kept the economy from collapsing during COVID, and we are paying for it now with higher inflation.”

“Where did they get that 6 trillion?” our host asked, as he had trouble understanding how money can appear out of thin air in a country with a developed capital market where deficit spending can result in the vast issuance of bonds at low interest rates, and that money can then be spent quickly by the government.

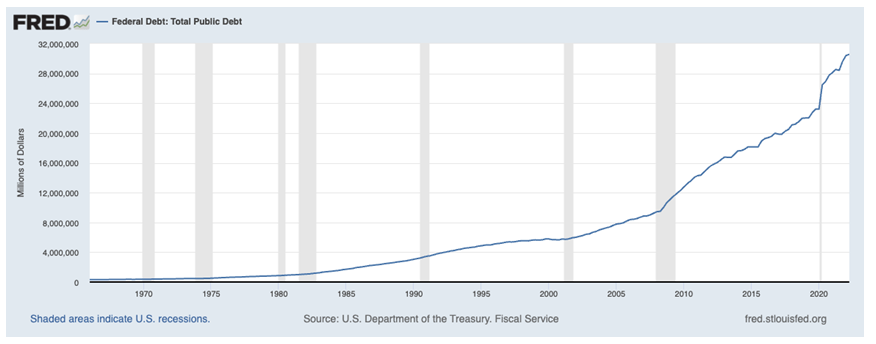

Federal Debt: Total Public Debt (St. Louis Fed)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Pre-COVID U.S. federal debt stood at $23.2 trillion. At last count, the number is $30.5 trillion. Not all of that $7.3 trillion increase is due to COVID, but most of it is. That aggressive deficit spending, monetized by the Fed, ended up circulating in the economy, ballooning the money supply.

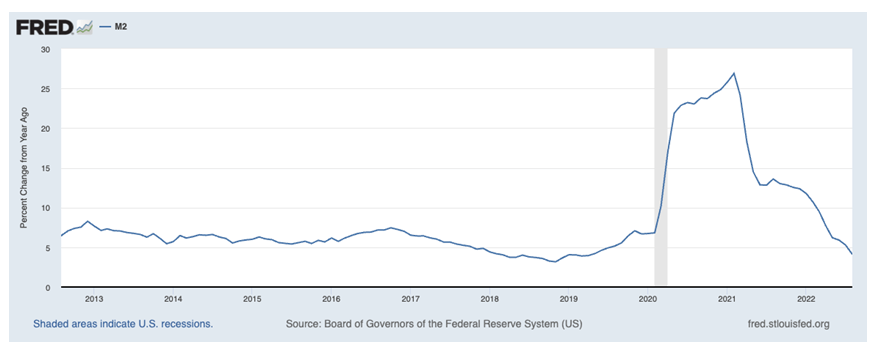

Powell has said recently that money supply does not correlate well with inflation. But when the surge is over 27% year-over-year in the middle of constrained supply chains, too much money ends up chasing too few goods. It is this historic surge in money supply, the sharpest since the creation of the Federal Reserve in 1913, that caused inflation and the present collapse in M2 money supply growth which will choke it off, when combined with Fed rate hikes.

M2 Money Supply (St. Louis Fed)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Chairman Powell’s legendary words on 60 Minutes in 2020 will end up defining his career. When asked where we got the new trillions, he said “We print it digitally.” Although I was in favor of him getting reappointed as Fed Chair (given the other options), I don’t think he will get renominated again, no matter who is in the White House when the time comes. He didn’t act in time when it became clear that inflation was not transitory, and now he is compounding his mistakes by over-tightening.

Two wrongs do not make a right.

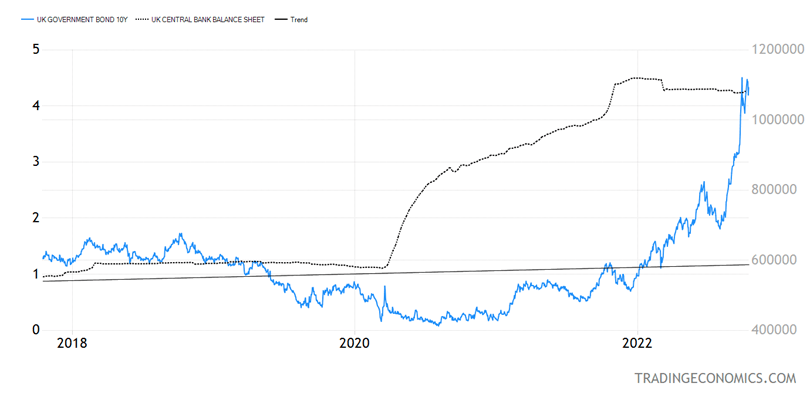

The UK Surge in Rates is Unsustainable

On August 1, the UK 10-year gilt (sovereign bond) interest rate was 1.80%. Last Friday it closed at 4.32%, up 252 basis points. The same numbers for the U.S. 10-year Treasury were 2.60% and 4%, up 140 basis points. Clearly, in an economy dependent on low interest rates and a lot of borrowing, such a surge in rates will have repercussions. Many mortgage lenders stopped giving mortgages as they had trouble locking in rates in time, so they won’t be left holding the bag. If the mortgage market in the UK stops functioning, what happens to UK home prices that collateralize the outstanding mortgages?

UK Government Bond 10-year; UK Central Bank Balance Sheet (Trading Economics)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

While the unfunded tax cuts of new Prime Minister Liz Truss already forced her to sack her Chancellor of the Exchequer, the UK bond market continues to send volatility outbursts in currency markets and stocks and bonds in the U.S. Many are beginning to fear what happens if the same type of financial market malfunctioning happens in the U.S.

I think the best course of action for the Fed is to signal a pause. That can happen with a simple speech at the time of their November FOMC meeting. If they don’t do something like this, their present course of action suggests outcomes similar to what we are seeing now in the UK.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment