Badly underwater on your position? kparis/E+ via Getty Images

Get ready for charts, images, and tables because they are better than words. The ratings and outlooks we highlight here come after Scott Kennedy’s weekly updates in the REIT Forum. Your continued feedback is greatly appreciated, so please leave a comment with suggestions.

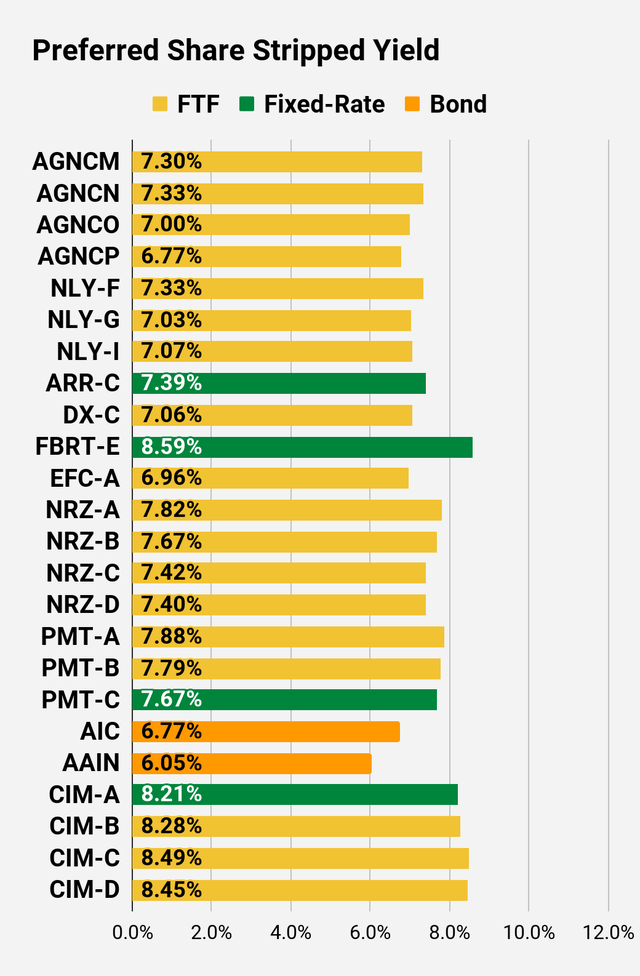

We’re back to talking about some preferred shares. Somebody tell me how NLY-F (NLY.PF) isn’t a great deal. I’ll start by telling you why it is a great deal. At $23.93, NLY-F offers a massive 18.1% yield to call (annualized). So if you get called, boo-hoo. It’s a capital gain of $1.07 plus current dividend accrual of $.24 and the extra dividend that would accrue before 9/30/2022 (the first callable date).

The stripped yield is 7.33%, which is pretty good for a relatively low risk share. But the shares switch over to a floating rate starting 9/30/2022. Let’s just assume for a moment that 3-month LIBOR looks pretty similar to the 30-day Federal Funds rate (a reasonable enough approximation). In practice, 3-month LIBOR was higher. So let’s just assume that these numbers work out to be pretty close together. The Fed Funds Rate is currently set at 25 to 50 basis points, which means 0.25% to .50%. That is lower than 3-month LIBOR at 1.04%.

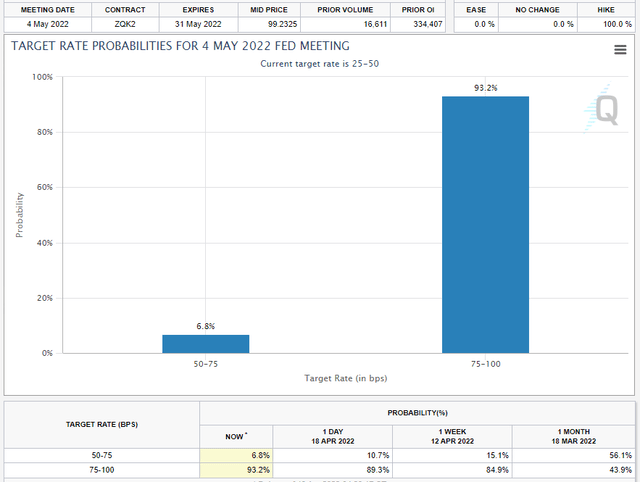

The futures market, according to the CME FedWatch Tool, is also predicting that the next meeting will hike rates to a range of 75 to 100 basis points:

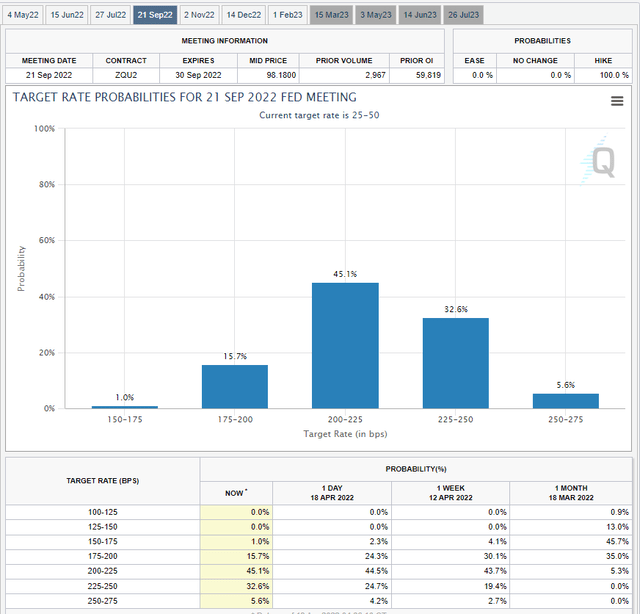

In September 2022, the expected range is for 200 to 225 basis points, with a significant chance for it to actually fall 25 basis points higher or lower:

If 3-month LIBOR runs at 2%, then NLY-F’s dividend would be set to increase. The initial coupon ration NLY-F was 6.95% and the floating rate uses the short-term rates plus 4.993%. Therefore, if short-term rates are even 2.0%, the dividend rate on NLY-F would increase very slightly. If rates were higher, such as 2.25% or 2.5% in the coming months, it would require further increases.

Some investors argue that if rates increase it just means Annaly Capital (NLY) Management will care the preferred shares. They might, but I wouldn’t treat it as a certainty. If short-term rates increase that much, where will NLY get a better deal on leverage? They won’t just be able to borrow near 0%. Yet even if they did call, remember that the investor is “stuck” eating a healthy capital gain in addition to the dividends until the call.

Thanks to the discount to call value, if shares remain outstanding investors are simply continuing to collect a much higher yield on their initial purchase. But yield on cost is irrelevant if the investor used a tax-advantaged account? Okay, we can focus on what the actual yield would be then. However, if the share price rallies to over $25.00 that’s better than a call since the investor can choose between taking the capital gain and continuing to collect the dividend. Do continue to work on your bear thesis though. I’m sure it’s wonderful.

What’s that? I’ll call on the guy in the back yelling: “NLY has a bigger dividend yield on their common shares you dummy!”

Thank you for that astute observation. You are indeed capable of determining which number is larger in a pair of two numbers. So why not Annaly Capital Management common shares? Well, believe it NLY is still trading at a material premium to our projected current book value per share (estimated for 4/15/2022). Management hasn’t confirmed their book value for 3/31/2022 yet, that comes in the earnings release. However, historically estimates on The REIT Forum have been pretty close.

So now you have to ask whether the bigger yield on NLY’s common shares is worth paying a significant premium to book value when you can buy NLY-F with a large discount to call value. The answer is no. You’re welcome.

Alright, one more question from the person who seems uninterested: “What if mortgage REITs all implode and die because I have bearish thoughts?”

Okay, first of all, you’re not part of the X-Men and you can’t make things implode or die with your thoughts. Beyond that, investors should remember that Q1 2020 was a terrible period for the mortgage REITs. Huge losses to book value. The vast majority of those REITs never recovered within 5% of their highest share price from February 2020. A few did, but only a few. How many mortgage REIT preferred shares recovered to trade very close to $25.00 or above $25.00? Almost all of them.

Just think about that for a moment. Hardly any of the common shares recovered, but almost every preferred share recovered.

How about dividends? Almost all of the common shares reduced dividends with several suspending dividends. A few of the preferred shares suspended dividends, then repaid them in full before restarting their common dividend because that’s how cumulative preferred shares work. How many of the preferred shares recovered their dividends? All. How many managed to reduce the preferred dividend? None. Again, that’s how the shares work.

How many shares had their call value reduced from $25.00 to account for a large drop in book value? None.

So where do you think the risk/reward is more appealing?

The one person who still shouts “Any amount of risk is worth it for more yield!” is going to be eating cat food for retirement.

We love earning a respectable yield on our investments, but safety comes first. We can take a few speculative positions, but we do it when the risk/reward becomes favorable.

On that note, I’ll mention that there are now quite a few mortgage REIT common shares where the risk/reward turned favorable. Not NLY, but there are plenty of others. Others where the share price fell as hard or harder, but the damage to book value was materially smaller (based on our proprietary projections). I’ll highlight a few of them in an upcoming article as we’re thinking about entering some new positions or expanding current ones. For the moment, I’m going to go with telling investors we’re bullish on NLY-F and bearish on NLY common shares.

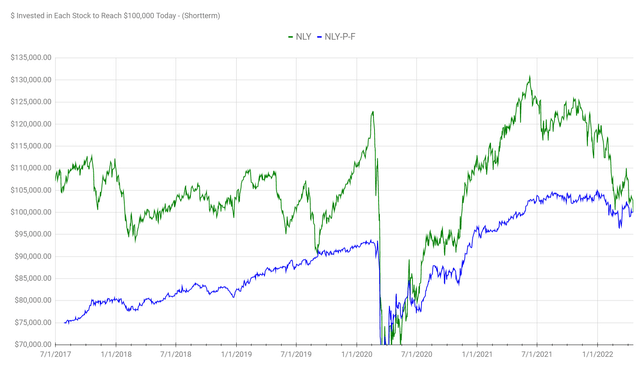

One last chart I want to provide readers, so they understand the concept of risk. Have a look at the amount invested in any prior period to reach $100k as of today (assumes dividends reinvested):

You may notice that going back to July 2017, when NLY-F was first offered, on almost any day the investor who bought NLY-F and held it outperformed the investor who just bought NLY and held it. The investor in NLY-F not only carried less risk, they also achieved superior returns without any active management. There were great opportunities to make money in the common shares, but an investor really had to understand to have some concept of when to buy and when to sell.

You prefer to buy and hold? Then you really need to be looking at the less volatile investment that generated significantly better returns rather than all this gambling on yields.

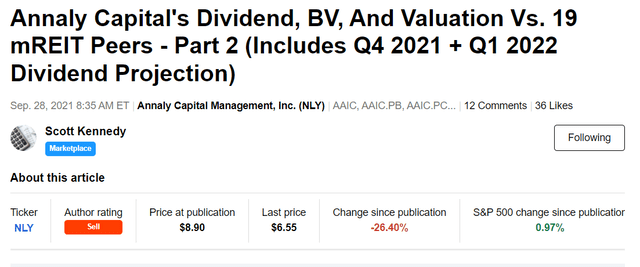

Turns out I still needed a few more images. For the investor who thinks The REIT Forum (produced by CWMF and Scott Kennedy) should’ve warned investors about the valuation in Annaly Capital Management previously, I submit this:

Seeking Alpha

For the investor who says it fell early in 2022 and we should’ve warned you even sooner, I submit this:

Finally, for the investor who believes we are simply always bearish and just got lucky, I ask how many times we should’ve told investors to buy when shares were cheap?

That’s 10 times, just in public articles that focused on Annaly Capital Management. Really, don’t blame me if you bought in at the wrong time. That’s not on us.

See you in the next article.

The rest of the charts in this article may be self-explanatory to some investors. However, if you’d like to know more about them you’re encouraged to see our notes for the series.

Stock Table

We will close out the rest of the article with the tables and charts we provide for readers to help them track the sector for both common shares and preferred shares.

We’re including a quick table for the common shares that will be shown in our tables:

Let the images begin!

Residential Mortgage REIT Charts

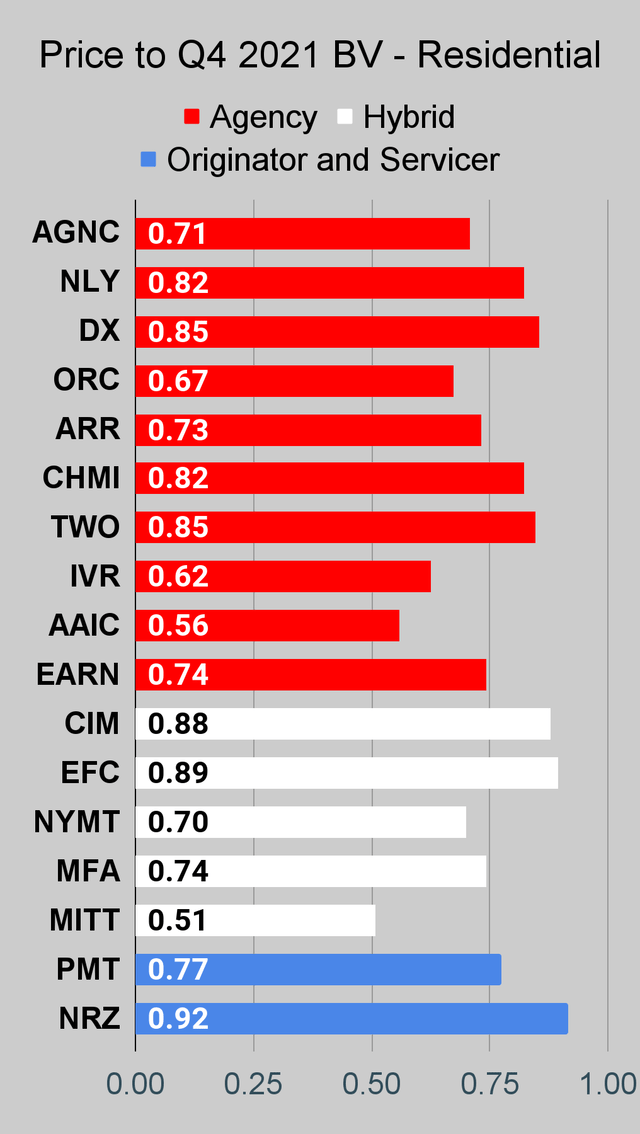

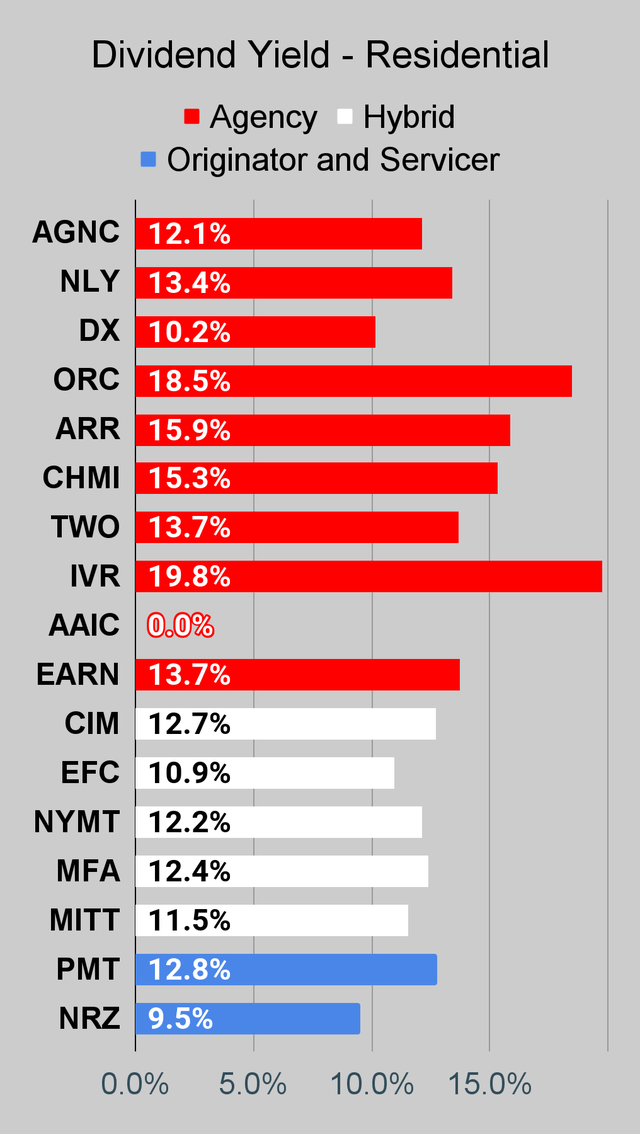

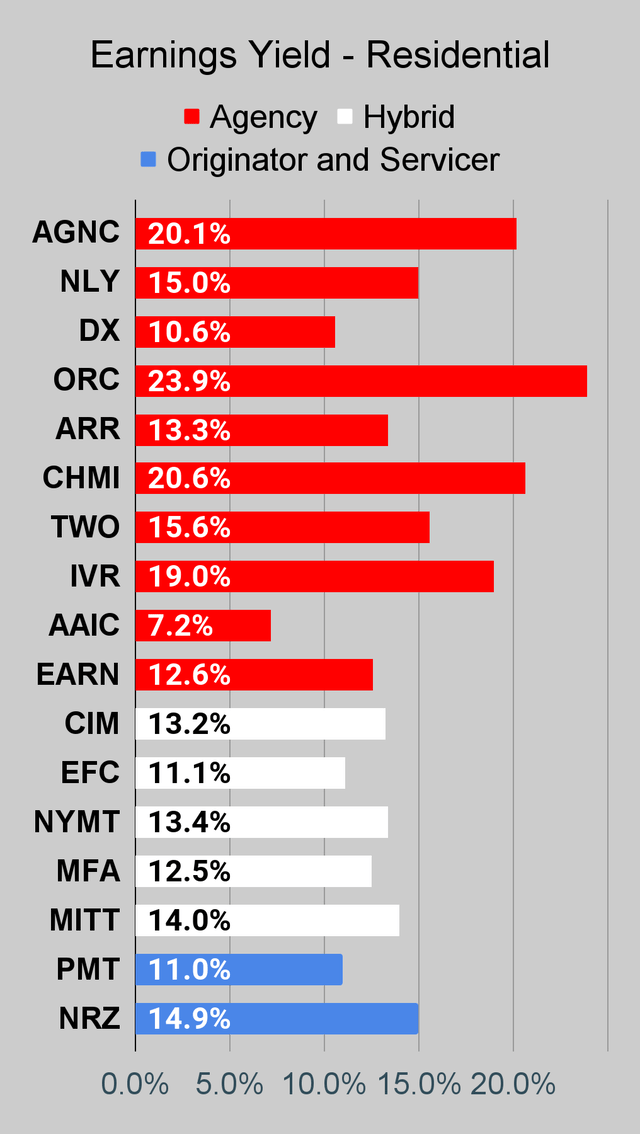

Note: We are modeling some significant changes to BV since 12/31/2021 and some management teams have already publicly indicated a material change in BV per share. The chart for our public articles uses the book value per share from the latest earnings release. Current estimated book value per share is used in reaching our targets and trading decisions. It is available in our service, but those estimates are not included in the charts below.

The REIT Forum |

The REIT Forum |

The REIT Forum |

Source: The REIT Forum

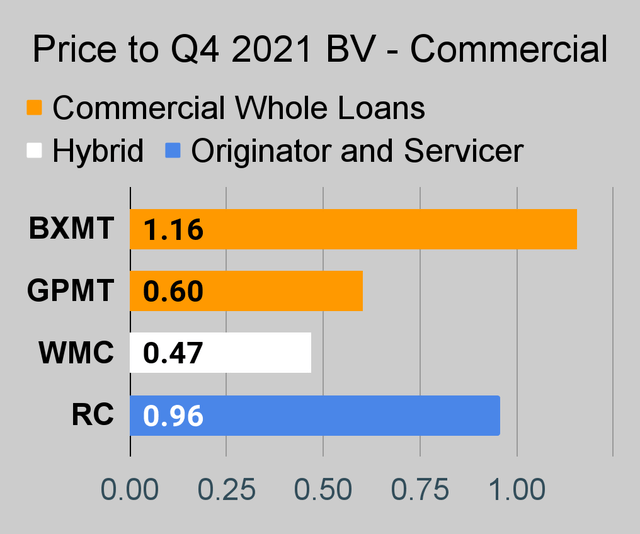

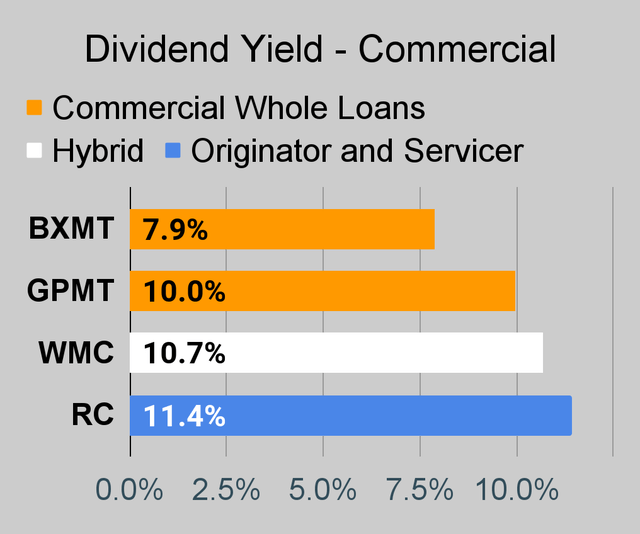

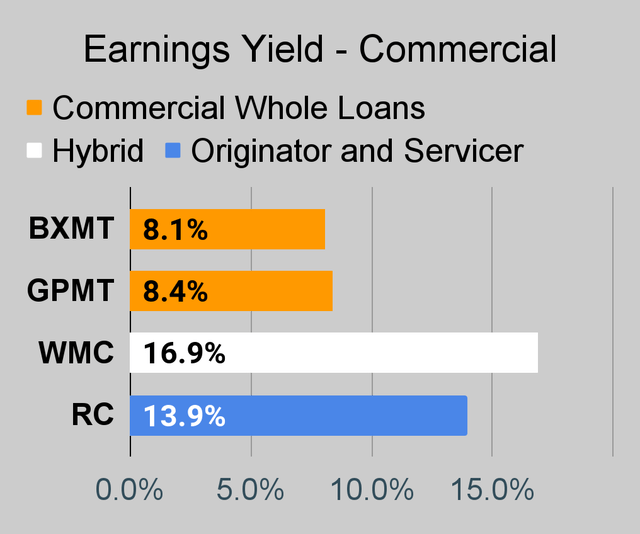

Commercial Mortgage REIT Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

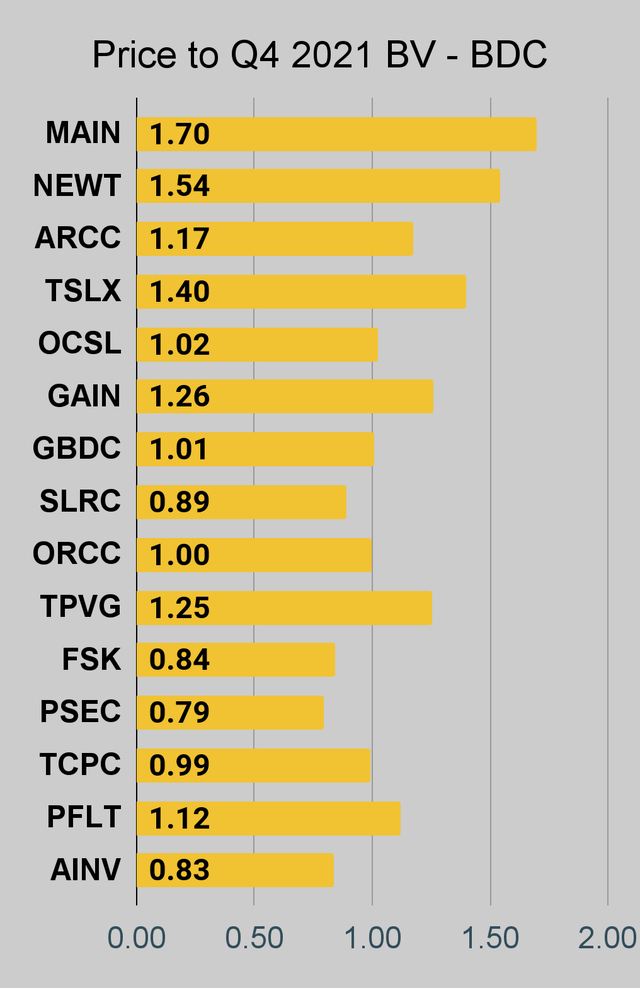

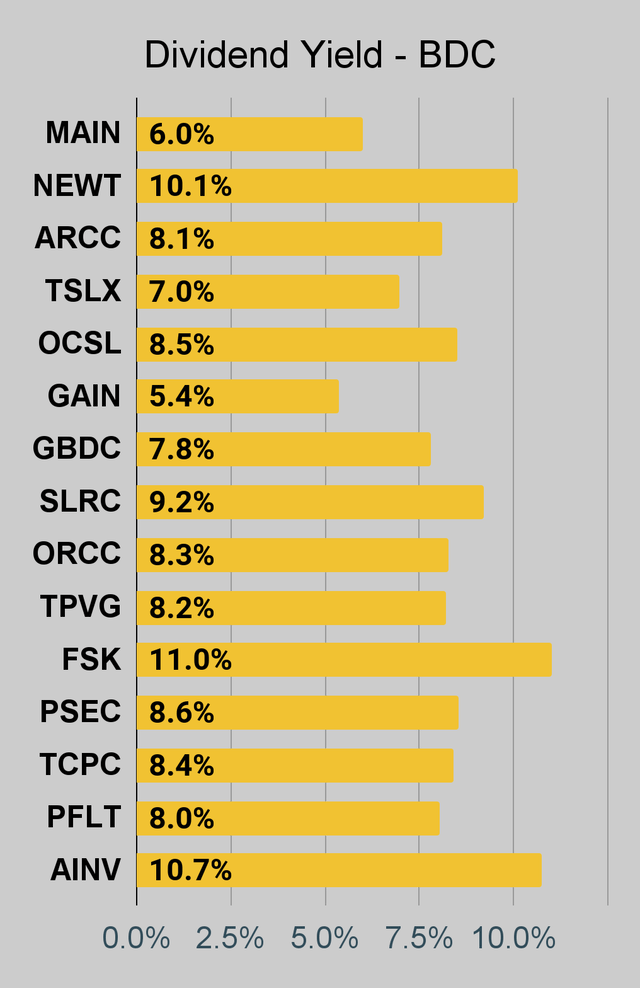

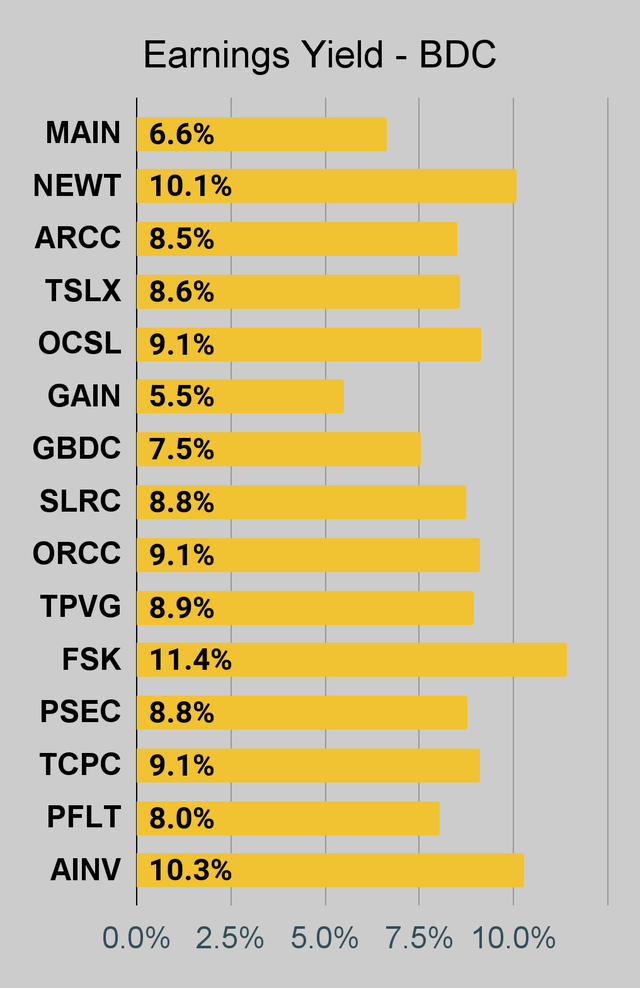

BDC Charts

The REIT Forum |

The REIT Forum |

The REIT Forum |

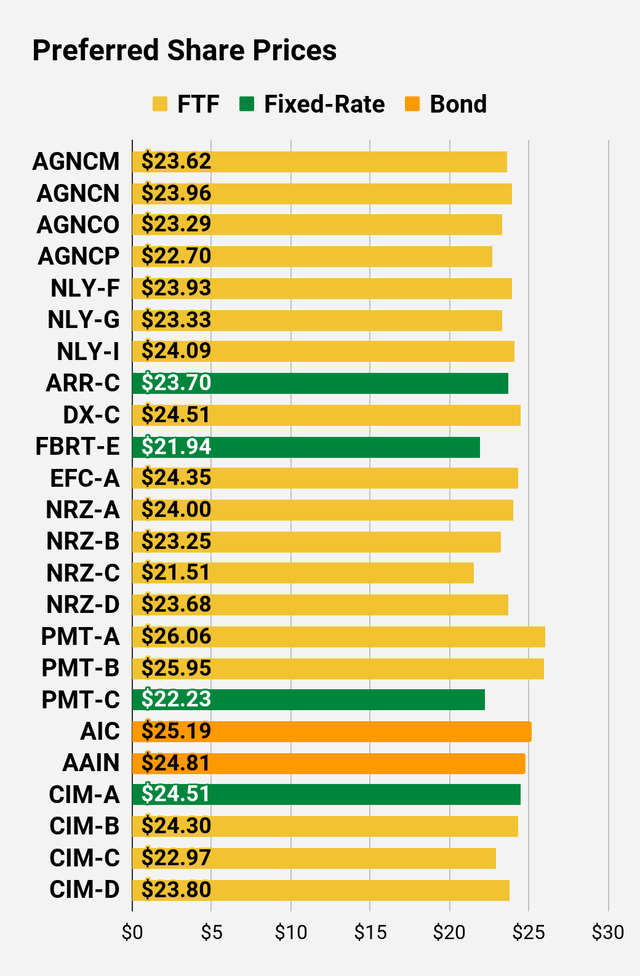

Preferred Share Charts

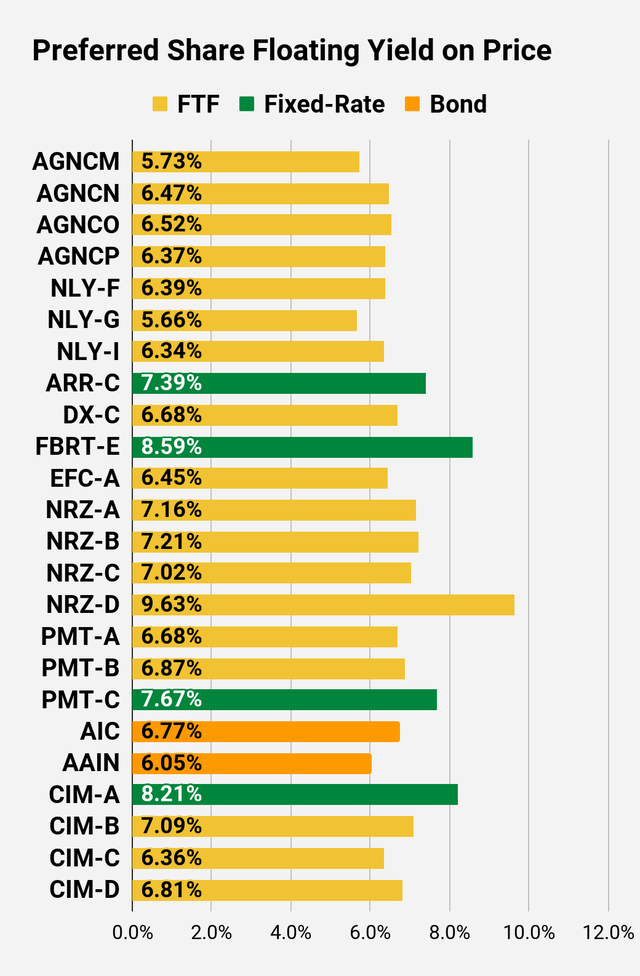

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

The REIT Forum |

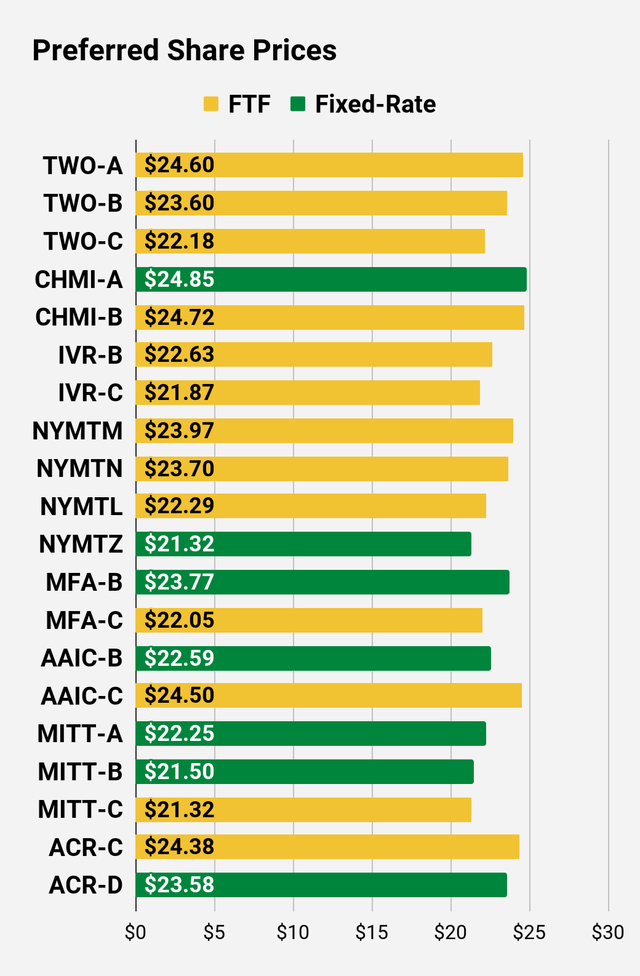

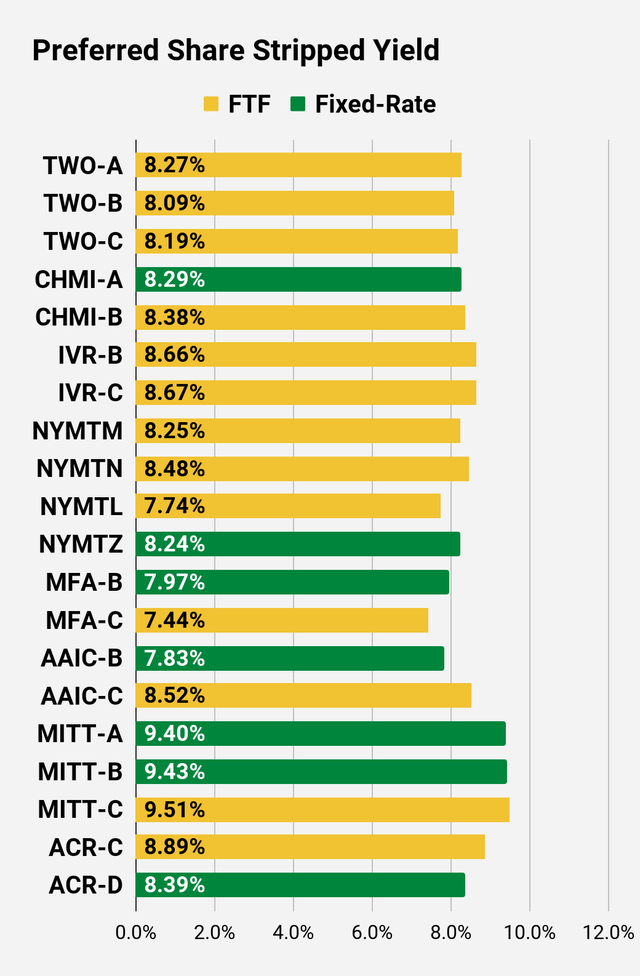

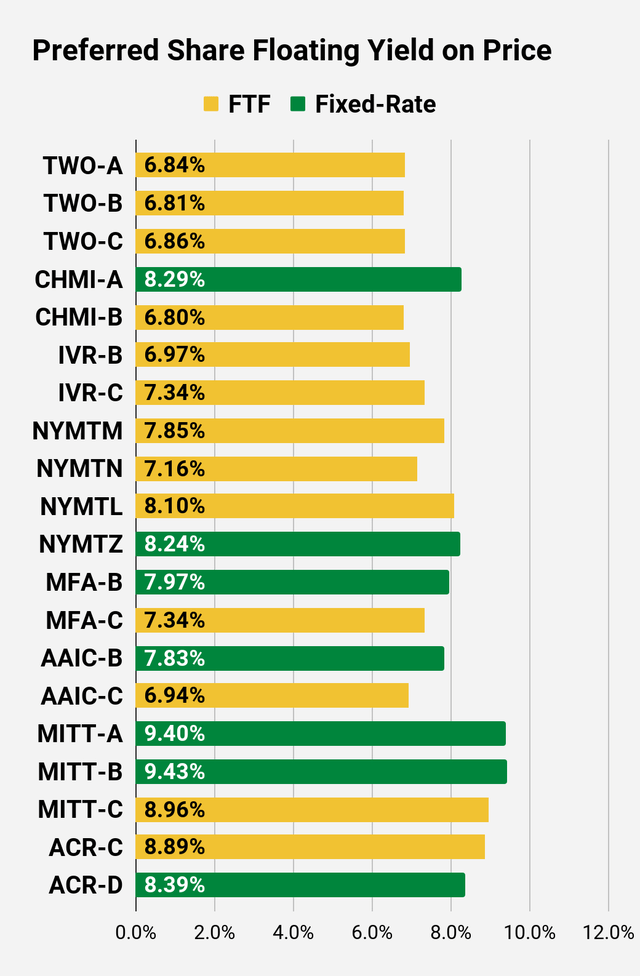

Preferred Share Data

Beyond the charts, we’re also providing our readers with access to several other metrics for the preferred shares.

After testing out a series on preferred shares, we decided to try merging it into the series on common shares. After all, we are still talking about positions in mortgage REITs. We don’t have any desire to cover preferred shares without cumulative dividends, so any preferred shares you see in our column will have cumulative dividends. You can verify that by using Quantum Online. We’ve included the links in the table below.

To better organize the table, we needed to abbreviate column names as follows:

- Price = Recent Share Price – Shown in Charts

- BoF = Bond or FTF (Fixed-to-Floating)

- S-Yield = Stripped Yield – Shown in Charts

- Coupon = Initial Fixed-Rate Coupon

- FYoP = Floating Yield on Price – Shown in Charts

- NCD = Next Call Date (the soonest shares could be called)

- Note: For all FTF issues, the floating rate would start on NCD.

- WCC = Worst Cash to Call (lowest net cash return possible from a call)

- QO Link = Link to Quantum Online Page

Second Batch:

Strategy

Our goal is to maximize total returns. We achieve those most effectively by including “trading” strategies. We regularly trade positions in the mortgage REIT common shares and BDCs because:

- Prices are inefficient.

- Long-term, share prices generally revolve around book value.

- Short-term, price-to-book ratios can deviate materially.

- Book value isn’t the only step in analysis, but it is the cornerstone.

We also allocate to preferred shares and equity REITs. We encourage buy-and-hold investors to consider using more preferred shares and equity REITs.

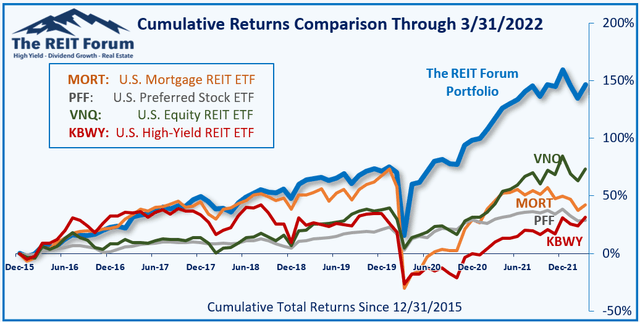

Performance

We compare our performance against 4 ETFs that investors might use for exposure to our sectors:

The 4 ETFs we use for comparison are:

|

Ticker |

Exposure |

|

One of the largest mortgage REIT ETFs |

|

|

One of the largest preferred share ETFs |

|

|

Largest equity REIT ETF |

|

|

The high-yield equity REIT ETF. Yes, it has been dreadful. |

When investors think it isn’t possible to earn solid returns in preferred shares or mortgage REITs, we politely disagree. The sector has plenty of opportunities, but investors still need to be wary of the risks. We can’t simply reach for yield and hope for the best. When it comes to common shares, we need to be even more vigilant to protect our principal by regularly watching prices and updating estimates for book value and price targets.

Ratings:

Bullish on preferred share NLY-F, bearish on NLY common shares.

Be the first to comment