Tryaging/iStock via Getty Images

Investment Thesis

Nippon Yusen Kabushiki Kaisha (OTCPK:NPNYY), or NYK, is coming off both record earnings and stock prices within the last 12 months, yet has been cautious about its near-term outlook as the tailwinds from supply chain disruptions have significantly subsided and consequently container shipping rates have rolled over.

We too worry that the substantial fall in shipping rates will ultimately pull back earnings and the stock price closer to pre-pandemic levels. However, we think that the company is still on track for stellar earnings this financial year, and coupled with compelling valuations and a possibility of returns of last year’s windfall earnings to shareholders, we feel the stock represents a low-risk investment which frontloaded returns.

The Company

NYK is a Japanese shipping and logistics company and operates in the Liner (container), Air Cargo, Logistics, and Bulk Shipping segments.

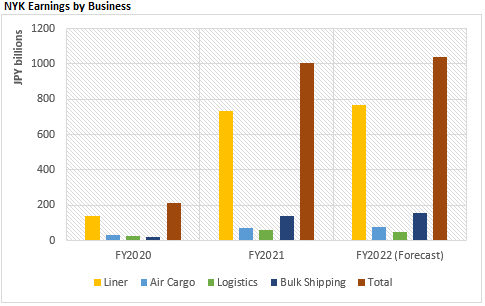

The company reported record earnings of just over JPY1trn for financial year 2021 – a near 10-fold increase on 2020. The driver was record high container shipping rates, driven by a multiplicity of disruptions to the supply chain. Indeed, a breakdown comparing the earnings contribution of the 4 main businesses shows the magnitude of the outsized contribution by the Liner business. The company has guided 2022 earnings to be broadly in line with the prior year’s performance, on the back of continued container shipping strength.

The Liner business has emphatically been the driver of earnings in the last few years. (collated from company financial results)

For the sake of simplicity, we have found ourselves focusing solely on the Liner business to evaluate the near-term profitability of the company.

Container Shipping Market

NYK runs its Liner business in the form of Ocean Network Express (ONE), a joint venture with its two main Japanese peers – Mitsui O.S.K. (OTCPK:MSLOF) and Kawasaki Kisen (OTCPK:KAKKF). ONE is currently ranked the 7th largest container ship operator by container capacity.

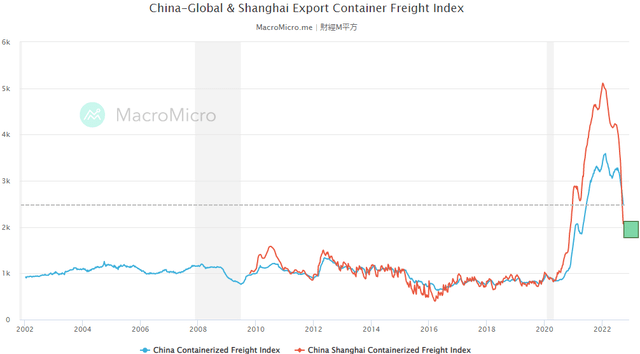

The company references the China Containerized Freight Index when referring to freight spot prices, appropriate due to the many services that it routes through the country. Historical trends show that the index broadly tracked close to 1,000 until 2021, enjoyed a 250% increase that topped out in early 2022, and currently is in freefall seeking a post-pandemic normalized level.

Indeed, 2021 earnings reflect the high shipping rates, however, at first glance there appears to be a disconnect between 2022 forecasts and recent spot price. The difference is explained by a significant portion of ONE’s business secured on long-term contracts. These contracts often are mostly renewed annually, at the beginning of the calendar year. On this basis, we expect to see ONE posting strong earnings for the remainder of 2022.

Looking further out to 2023, the price at which long-term contracts will be struck will depend on how spot prices move in the period preceding it (i.e., movement in the coming 3 months). We observe that shipping rates are falling in sync with global economic growth slowdown, and see this backdrop continuing to exert downward force on spot prices in the near term. However, we note that despite the continuous downtrend so far this year, current levels are still 150% above pre-pandemic levels. Therefore, we think that although on a prior-year comparative level 2023 spot is likely to be lower, there is high possibility that prices settle at healthy levels around 2,000.

Even after falling from early 2022 highs, current levels (dotted line) are 150% higher than pre-pandemic levels of 1k. We see the index finishing the year around 2k (green box), which would support long-term contract renewals at healthy rates for 2023. (MacroMicro) The move in NYK’s stock price correlates to the movement of the CCFI, although it has shown relative resilience so far in 2022. We worry that a delayed drop in the stock price is imminent. (Interactive Brokers)

Valuation

Because of the correlation with container spot price, we see NYK’s stock price being suppressed in the near term. To that point, we remain sidelined until we see signals that shipping rates appear to be bottoming.

However, we have long been attracted to the valuation of the company. Earnings per share for 2021 were just below JPY6,000, a level which is expected to be repeated again this financial year. That represents a P/E ratio slightly over 2x if applying the record-high stock price of JPY12,500 achieved in March this year, and just above 1x at current valuations. Furthermore, the company is committed to paying 25% of profits as dividends. In other words, even at the most expensive levels, an investment in NYK will have paid itself back in roughly 2 years, with a quarter of that investment back in the investor’s pocket as dividends.

Additionally, we see a number of factors that may help current year earnings to exceed the current forecast of JPY960bn. For one, the forecast assumes an average USDJPY rate of 128, with a stronger dollar environment (such as currently experienced) being a positive for the company’s earnings. We calculate the positive translation impact to be worth around JPY50bn if the full-year rate averages closer to 140.

Also, bunker prices have fallen significantly year-to-date, and currently below the assumed full-year rate (US$832) and trending lower. A continuation of this trend for the rest of this year will result in higher margins and profits.

We also note that ONE is currently sitting on a significant amount of cash, and calculate that NYK’s portion is at least JPY700bn (US$5bn). We sense a possibility that a capital return program such as a special dividend or share buybacks could be announced to release some of this back to shareholders.

Conclusion

We view that the likely direction of the stock price (downwards) is moving somewhat counter to the imminent earnings of the company (upwards), and on that basis, we are taking a hold-and-watch approach.

We think that the stock price is being largely influenced by shipping rates, and therefore a continuation of weakening rates will likely pull the stock price down further this year. We foresee a more enticing entry point coinciding with the bottoming of spot prices presenting itself within the next 12 months.

However, we predict that softer freight rates will impact company earnings with a lag, and therefore 2022 performance will continue to be resilient and perhaps even exceed 2021’s record. To this point, we feel it is wise to have exposure in a stock that is on track to crystallize earnings this year equivalent to at least half an investor’s initial capital outlay.

Furthermore, we think there is potential for a one-off capital return announcement on top of a generous dividend payout policy, and holding a position in NYK will allow an investor to take advantage should this eventuate.

(USDJPY=144 assumed in analysis)

Be the first to comment