TkKurikawa/iStock Editorial via Getty Images

Introduction

The Bermuda-based Teekay Tankers Ltd. (NYSE:TNK) released its fourth-quarter 2021 results on February 24, 2022.

1 – 4Q21 And Full-Year 2021 Results Snapshot

The company posted a quarterly adjusted loss of $0.74 per share compared to a loss of $1.21 per share a year ago. The results were slightly better than expected due to higher spot tanker rates.

Net income is again a loss of $39.81 million compared to $73.29 million a year ago. It is the sixth consecutive quarterly loss for the shipper.

TNK: Highlights 4Q21 Presentation (Teekay Tankers)

CEO Kevin MacKay said in the conference call:

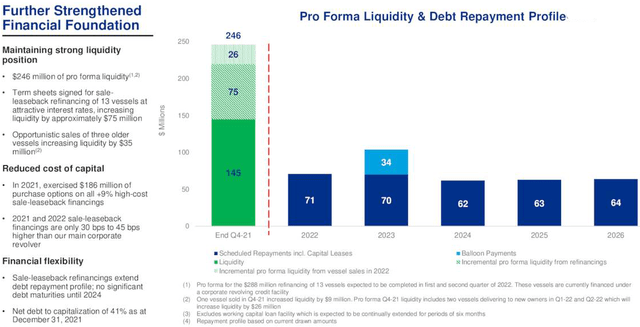

Despite a challenging year, we continue to maintain a strong liquidity position. We have signed two term sheets to refinance 13 vessels with new flexible low-cost sale leaseback financing. These new sale leasebacks have competitive interest rates, only slightly higher than our main corporate revolver and will increase liquidity by $75 million. Including the sale of three 2004 built vessels, Teekay Tankers had a pro forma liquidity of $246 million and a net debt to capitalization of 41% at the end of 2021.

Teekay Tankers is one of the three companies of the “Teekay Group” that I am covering on Seeking Alpha.

However, as you all know, Teekay LNG (TGP) and Stonepeak completed the merger on January 22, 2022.

All common units will convert into the right to receive $17.00 per common unit in cash, subject to deductions of applicable withholding tax. The common units, which trade on the New York Stock Exchange (“NYSE”) under the ticker symbol “TGP”, will be suspended from trading today and delist from the NYSE within 10 days.

The Partnership’s Series A and B preferred units, which trade on the NYSE under the ticker symbols “TGP PR A” and “TGP PR B”, respectively, will remain outstanding and continue to trade on the NYSE.

With the acquisition completed, the Partnership has changed its name to Seapeak.

The Partnership intends to convert to a limited liability company during the first quarter of 2022, at which time it will change its name to Seapeak LLC and change its Series A and B preferred units ticker symbols to “SEAL PR A” and “SEAL PR B”, respectively.

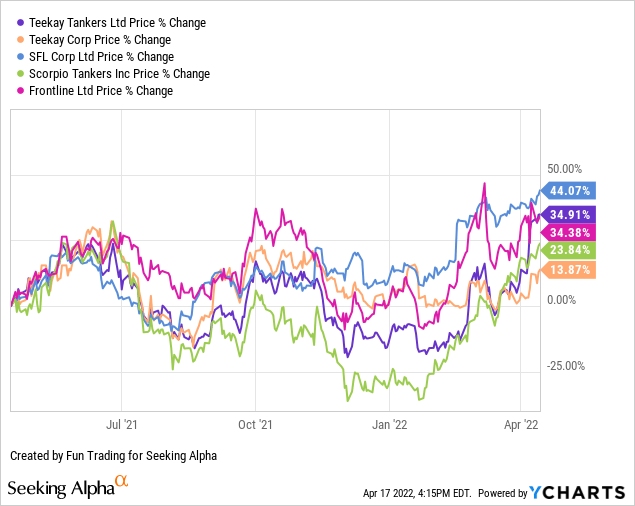

2 – Stock Performance

As we can see below, TNK is quite strong and is now up 35% on a one-year basis.

3 – Investment Thesis

The investment thesis for TNK is not an easy exercise because of the inherent extreme volatility of the Tankers industry.

We have recently experienced some encouraging signs about the ongoing recovery in spot tanker rates, but the market is still weak and, above all, unpredictable.

| Total fleet: Type | 4Q20 | 4Q21 |

| Suezmax | 9,283 | 12,294 |

| Aframax | 10,015 | 15,679 |

| LR2 | 10,555 | 12,223 |

Source: TNK releases.

TNK fleet is specialized in crude oil and refined petroleum products tankers:

| Segment | Number of vessels |

| Owned vessels | 48 |

| Chartered-in vessels | 5 |

|

Total |

53 |

One issue with TNK is that it is very specialized and therefore lacks diversity. Furthermore, the stock is not paying dividends.

It is the two primary reasons I prefer SFL Corp (SFL) in this segment. I recommend reading my recent article on SFL by clicking here.

Thus, I recommend short-term trading LIFO and taking advantage of the market’s wild swings. However, it is also critical to build a small long-term position waiting for the industry’s rebound that seems well underway.

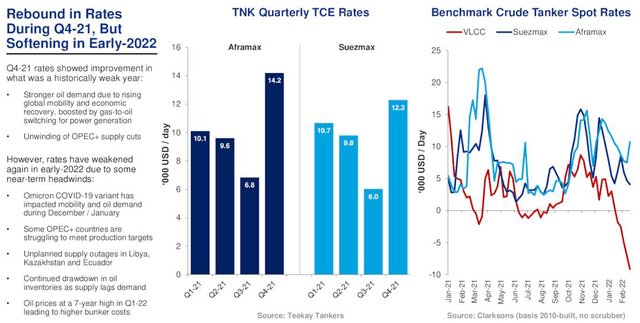

4 – Crude Tanker Spot Rates

Crude tanker spot rates were much better in the fourth quarter of 2021. However, the market remains weak. CEO Kevin Mackay said in the conference call:

In the freight market, fourth quarter spot tanker rates improved to the highest point in 2021, but remain weak on a historical basis as the Omicron variant constrained oil supply and high bunker prices emerged with near-term headwinds. Mitigating this weakness, our vessels engaged in full service lightering were employed at $22,200 per day in the fourth quarter, providing support for our Aframax rates. The company also out chartered 1 Aframax for $18,000 per day for a 12-month period.

TNK: Spot Prices in 4Q21 rebound Presentation (Teekay Tankers)

TNK – The Raw Numbers: Fourth Quarter Of 2021 And Financials History

| Teekay LNG Partners L.P. | 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 |

| Total Revenues in $ Million | 127.80 | 142.75 | 123.42 | 115.89 | 160.31 |

| Net Income in $ Million | -73.29 | -21.37 | -129.14 | -52.06 | -39.81 |

| EBITDA $ Million | -15.87 | 15.96 | -95.07 | -18.31 | -5.77 |

| EPS diluted in $/share | -2.17 | -0.63 | -3.83 | -1.54 | -1.17 |

| Operating cash flow in $ Million | 0.13 | -27.45 | -18.26 | -38.40 | -23.21 |

| CapEx in $ Million | 7.14 | 0.91 | 6.32 | 7.93 | 6.28 |

| Free Cash Flow in $ Million | -7.01 | -28.36 | -24.58 | -46.33 | -29.48 |

| Total Cash $ Million | 97.23 | 87.60 | 60.50 | 60.72 | 50.57 |

| Long term Debt (including current) In $ Million | 253.0 | 599.7 | 596.4 | 631.3 | 355.29 |

| Shares Outstanding (Diluted) in Million | 33.74 | 33.74 | 33.76 | 33.90 | 33.90 |

Source: Teekay Tankers release

Note: More data are available to subscribers only.

Analysis: Revenues, Earnings Details, Free Cash Flow

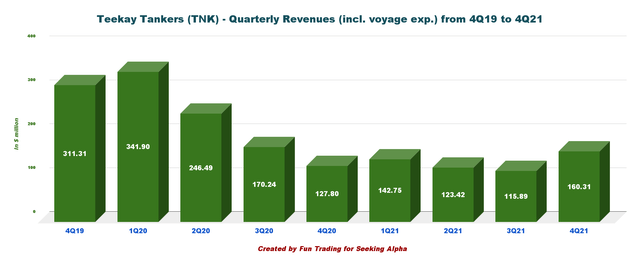

1 – Operating revenues were $160.31 million in 4Q21

TNK: Chart Quarterly revenues history (Fun Trading)

Teekay Tankers announced a total adjusted net loss of $24.96 million, or $0.74 per share, during the fourth quarter, decreasing from a loss of $50.15 million, or $1.48 per share, in the fourth quarter of 2020.

The better quarterly results were primarily due to higher average spot tanker rates and full-service lightering revenues, a lower number of scheduled dry dockings, and lower accrued freight taxes. They were partially affected by the expiration of specific fixed-rate time charter contracts at higher rates during 2021.

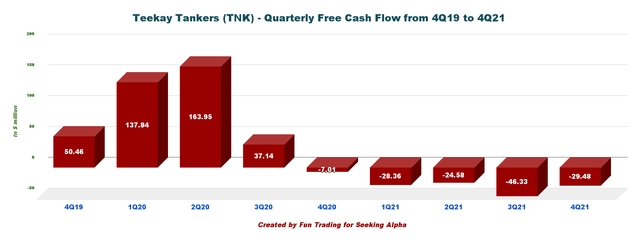

2 – Free cash flow was a loss of $29.48 million in 4Q21

TNK: Chart Quarterly Free cash flow history (Fun Trading)

Note: Free cash flow is cash from operations minus CapEx.

Trailing 12-month free cash flow was a loss of $128.75 million with a quarterly free cash flow loss of $29.48 million in 4Q21. The company is not paying a dividend.

3 – Debt Analysis

3.1 – Debt Analysis

Net debt is $294.72 million in 4Q21 (or $579.43 million, including current and long-term obligations related to finance leases). Pro-forma liquidity is $246 million.

TNK: 4Q21 debt and liquidity Presentation (Teekay Tankers)

Note: The company has indicated a net debt of $583.844 million with a different calculation (non-GAAP), including short-term, current, and long-term debt and current and long-term obligations related to finance leases less cash and equivalents and restricted cash.

As of December 31, 2021, the company had total liquidity of $246 million compared to $209 million as of September 31, 2021.

The net debt to total capitalization is 41% in 4Q21, up from 39% in 3Q21.

3.2 – Recent Transactions:

- In December 2021, Teekay Tankers sold a 2004-built Aframax vessel for $13 million.

- In January 2022, Teekay Tankers entered into agreements to sell a 2004-built Aframax vessel and a 2004-built Suezmax vessel for total proceeds of $28.6 million.

- In December 2021 and February 2022, signed term sheets for new, low-cost sale-leaseback financings to refinance 13 existing vessels, which are expected to be completed in the first and second quarter of 2022 and increase the Company’s liquidity by approximately $75 million. Including these refinancings and the two vessels agreed to be sold in early-2022, Teekay Tankers’ pro forma liquidity was approximately $246 million as of December 31, 2021.

- In January 2022, chartered out one Aframax vessel for $18,000 per day for a 12-month period.

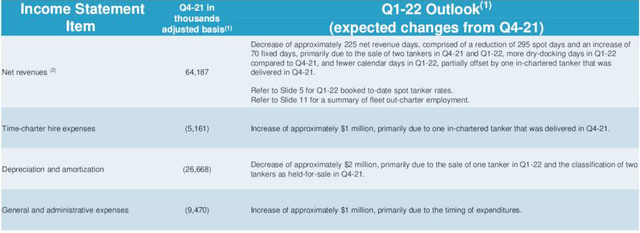

4 – First Quarter Of 2022 Outlook

4.1 – The company forecasts a weaker first quarter of 2022 revenues and expects more dry-docking days and lower calendar days.

TNK: 1Q22 outlook Presentation (Teekay Tankers)

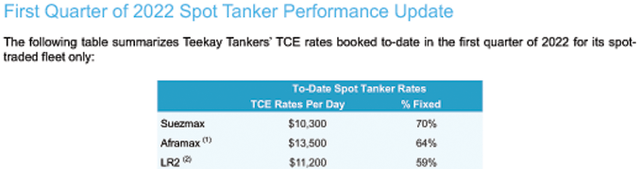

4.2 – Below is indicated the Spot tanker to date.

TNK: 1Q22 rates Presentation (Teekay Tankers)

Technical Analysis And Commentary

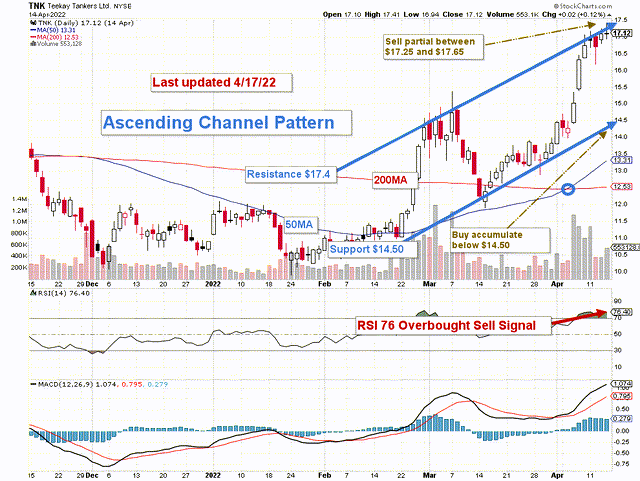

TNK: TA chart short-term (Fun Trading)

TNK forms an ascending triangle pattern with resistance at $17.40 and support at $14.50.

The short-term trading strategy is to trade LIFO about 65%-70% of your position. I suggest selling between $17.25 and $17.65 and waiting for a retracement at or below $14.50 on any weakness. TNK could experience a breakdown if the recent increase in daily rates loses momentum and retest the lower support I see between $13.3 and $12.5.

Conversely, if the rate’s nascent recovery continues, TNK could break out and retest $18-$19, but it is still unlikely.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support.

Be the first to comment