JHVEPhoto/iStock Editorial via Getty Images

Valvoline (NYSE:VVV) stands to benefit from several macro tailwinds and from its continued strategy to grow its service segment. The company has cemented itself as a leader in preventive maintenance and as a trusted manufacturer of its flagship product – Valvoline Motor Oil. In this article, I’ll outline Valvoline’s recent financial milestones, a near term catalyst, and a few other reasons why I believe the stock warrants consideration for a long position. The outlook for 2022 is particularly bright, highlighted by free cash flow of $260M – $300M, 9-12% growth in same store sales (SSS), AEBITDA of $675M – $700M, and a projected store count of 1,700 by year end.

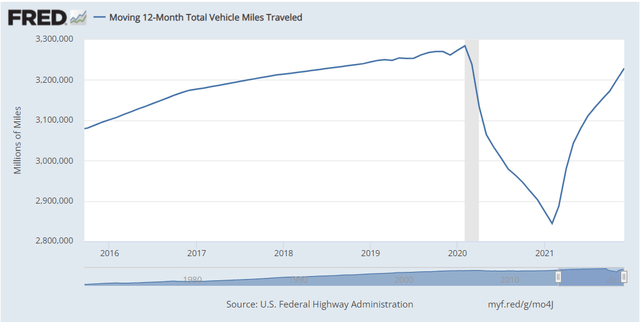

Americans are quickly returning to the roads with the number of miles driven over the last twelve months close to pre-pandemic highs. As illustrated below, the abrupt rebound in miles driven shows that Americans are getting back to their pre-COVID19 lifestyle. With airfares now soaring, many consumers will likely lean towards driving for their next vacation. Further, used car prices remain at all-time highs forcing many Americans to invest in their vehicles in order to extend their useful life. This has created immediate and sustained demand for Valvoline’s products and services.

Moving 12-Month Total Vehicle Miles Driven (U.S. Federal Highway Aviation)

Overview

Valvoline has been in business since 1866, providing the automotive market with oil and lube products and more recently growing into the second largest chain for preventive maintenance in the US. Valvoline also operates the third largest chain in Canada and has sales in more than 140 countries. The company’s flagship product, Valvoline Motor Oil, is ranked as the No. 3 passenger car motor oil brand in the DIY market. Express Care, the Valvoline service center, has grown to over 1,630 locations. According to the most recent 10-K, the company estimates there are 10,000 quick lube locations in the US and Canada thereby pointing to significant growth opportunities as weaker independent operators sell out and larger, more established companies like Valvoline increase their presence.

Recent Financial Performance

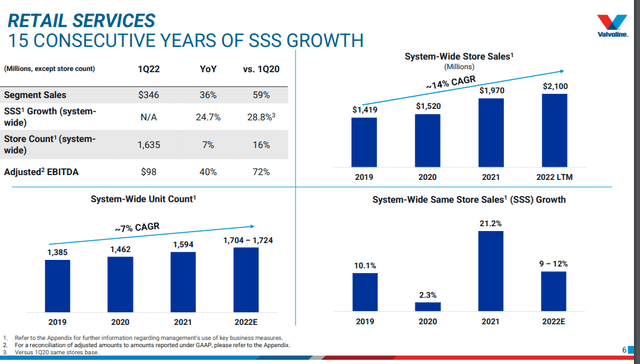

On February 8th, 2022, the Company reported a fantastic set of first quarter results. Total sales grew 31% led by a 36% gain in Retail Services. Consolidated Adjusted EBITDA (AEBITDA) grew 5% while adjusted EPS grew 12% YoY. The retail service division grew SSS by ~25% year over year due to growth in the number of transactions and an increase in the average ticket (or sale).

The most recent quarter continued the trend of superior SSS growth. Valvoline has been growing SSS steadily, even through the pandemic. The estimated SSS growth rate is a health 9-12% and the system-wide store sales and system-wide unit count have 14% CAGR and 7% CAGR growth rates, respectively.

Retail Service SSS Growth (Valvoline Investor Relations)

The investment and focus into Retail Services continues to bear fruit as this segment overtook the Global Product segment in terms of total sales during 2021. Just four years ago, this segment only accounted for 35% of adjusted EBITDA and it now accounts for more than 60%.

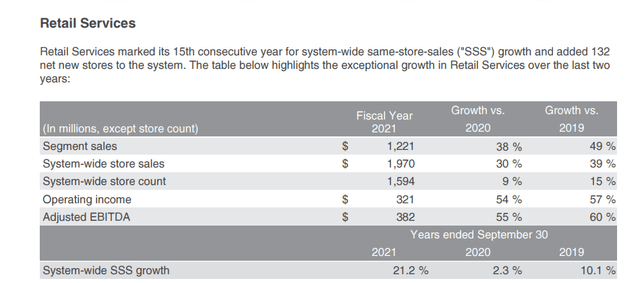

Fast forward to today and the Retail Services segment has exploded, eclipsing 28.3% AEBTDA margin on $346M in revenues. Both sales and AEBITDA were record highs for the company. Free cash flow followed suit as discretionary free cash flow grew $21M YoY to $59M for the first quarter. Valvoline has dialed in on Retail Services through studying customer habits, driving higher retention, incentivizing the use of its mobile app through coupons, and engaging customers through its digital marketing campaigns. More Customers are choosing Valvoline’s network for their oil changes and purchasing additional add-on services such as fluids, air filters, wipers, tire rotation, battery installation because their time is limited and see the value versus paying a premium for dealership maintenance. I see the growth in cash flow as a testament to the effectiveness of management’s strategy. In recapping the most recent fiscal year, the Retail Services division posted handsome gains not only against 2020, but also 2019 thus indicating this is a stronger company post COVID.

Retail Services 3 Year Performance (Valvoline Investor Relations)

In October 2021, the company announced formal plans to split Global Products and Retail Services into separate business units as a means to create more shareholder value. The timing around when this is expected to occur was raised by Jeffrey Zekauskas, Analyst at JP Morgan, and answered by Sam Mitchell, CEO, during the Q1 2022 conference call:

Jeffrey Zekauskas: “And then lastly, do you think you’ll separate your businesses this year? And in terms of talking to your investor base, will we know what you’re going to do before you do it?

Sam Mitchell: “……And so, I expect good outcomes in a timely fashion. And so, yes, I would expect that in this fiscal year.”

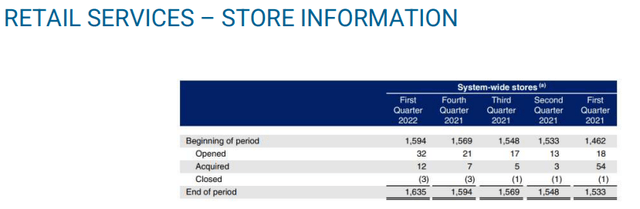

The growth rate is buoyed by not only growing average ticket prices but also Valvoline’s strategy towards growing its footprint through a balanced approach of adding company-operated stores, closing poor performing stores and acquiring independent operators.

Store Count (Valvoline Investor Relations)

Global Products Shows International Growth and Consistent DCF

Global Products also performed well during the first quarter as total sales grew to $512M, or 28% higher YoY. US based sales grew to $304M, or 27% YoY and 32% higher than Q1 2020. Sales were driven by price increases plus a 13% increase in volume. AEBITDA, however, declined 18% YoY as Valvoline was caught in the middle of raw material price increases and higher supply chain costs, including logistics. Discretionary free cash flow was $52M, or 17% lower YoY yet 2% higher than Q1 2020.

Perhaps the biggest surprise of the quarter was the extent of the growth in its Asia Pacific Division which accounted for $104M in product sales which was $21M, or 25% higher YoY. Contributing to the growth is the recently completed construction on its new lubricant facility in China in late 2020. This facility now supplies all of the lubricant volume for the Chinese market which is expected to be a continued growth driver for 2022 and beyond.

Investors saw notable margin contraction, however, as Valvoline couldn’t raise prices fast enough to offset rising raw material costs. Fortunately, these types of environments are typically temporary in nature and leave companies with pricing power once raw material costs stabilize. I’ll be looking for the price lag effect to reverse later in 2022 as supply chains improve thereby benefiting the Company through lower input costs and higher average prices. The “bridge” of Q1 2021 to Q1 2022’s AEBITDA did point a notable concern and that was a $16M increase YoY in SG&A expenses. This was led by higher advertising costs, variable compensation for record growth and investments in IT. I expect the formal separation of its business lines has led to some instances of duplicate costs and this may be a minor weakness to take note of for future quarterly results.

Liquidity, Leverage and Shareholder Returns

Including the ~$585M in availability on its revolver, Valvoline ended the quarter with over $700M in liquidity. For the year ended September 30, 2021, cash flows from operations reached $404M, an all-time high. For 2022, capital expenditures are expected to remain in the 4-5% range of total revenue while maintenance is expected remain at 1% of revenue. This is appealing as I see an asset-light model carrying less risk as it leaves more opportunity for shareholder returns and debt service. Long-term debt as of December 31st, 2021, was $1.66B, relatively unchanged from a year earlier. Net interest expense for Q1 2022 was $17M which implies a modest annual interest rate expense of ~4%.

Digging further into the 10K reveals the debt is structured in two tranches:

1. Fixed rate notes due in 2030-2031 yielding 3.6% – 4.25% totaling $1.1B.

2. A $475M floating rate term loan, payable quarterly, maturing April 2024.

Fortunately, it appears that long-term debt peaked in 2020 at $1.96B. Including the pension obligations, the company’s leverage was ~2.7x TTM EBITDA, which is a higher than I would like. With rates moving higher, the market is recognizing best of breed operators and those companies with less leverage are at an advantage. I expect Valvoline to capitalize on the free cash flow in 2022 by taking meaningful steps to improve its leverage.

In May 2021, the company announced a three-year $300M repurchase plan, which is ~6% of the float. In Q1 2022, the Company returned $54M to shareholders through $23M in dividends and $31M of share repurchases. The dividend, which yields ~1.4%, has more than doubled since 2017 and has a payout ratio of only ~40% thereby leaving the door open for future raises.

Getting Ready for the Electric Vehicle (EV) Market

Valvoline investors should be encouraged by the Company’s progress in preparing for the growing EV market. In late October 2021, Valvoline announced it had brought to market its own set of fluids for electrical and hybrid vehicles. The company also launched a pilot program within its service division geared towards electric vehicle maintenance for EV owners, original equipment manufacturer (OEM), and company fleets. The company is offering basic services such as key fob replacement, 12-volt battery replacement, cabin air and wiper replacement, all of which are considered basic maintenance measures EV owners are expected to undertake. This program was announced just a few months after Arrival (ARVL) selected Valvoline as a service partner in Arrival’s Service Network Program. I see Arrival’s decision to partner with Valvoline as affirmation that Valvoline has the reach and expertise to make this a successful program.

Stock & Outlook

Even after returning more than 65% in the last three years, I believe there is more room for the stock to run. With an enterprise value of $7.2B and a market cap of just $5.6B, the stock is inexpensive trading at less than 15X forward earnings which is on the low end of its historical range. In reviewing peer comparisons, many of the deemed competitors are chemical manufacturers with little earning growth potential. Given the company’s large moat and transformation towards higher margin offerings through its Retail Services division, one can argue the stock price doesn’t reflect this transition and a higher multiple is justified. I expect for the stock to breakout over the short-term as dividend increases and a spin-off of either division are on the table.

P/E GAAP ((TTM)) Chart (Seeking Alpha Charts)

Recap & Recommendation

In summary, Valvoline enjoys pricing power through its products and services thanks in-part due to the inelastic demand of the company offerings. A diverse and transparent shareholder return policy should provide assurance to existing and prospective investors. The recent performance, guidance for 2022, and abundance of free cash flow for the foreseeable future helps to solidify my position of classifying Valvoline as a BUY.

Be the first to comment