ZargonDesign

“You can print money but you can’t print mountains…”

A very rich friend to the author at Zermatt, Switzerland 1995.

Sooner or later, we all need to escape the daily deluge of dour economic news which is cyclically inevitable. To me, the farther away the better always has seemed like the best strategy. In 1995, I went on a trek to casino venues where friends and former colleagues shared their impressions of how they were faring against the economy in general.

Overall, my friend believed that whether prosperity or recession gripped the economy, gambling was so deeply ingrained as a component of basic human need for a break from the humdrum, that their realty and business models could overcome most anything. As things have developed since, they were mostly proven right.

The current rebound in Las Vegas and U.S. regional casino revenues proves that point. “Pent up demand isn’t going away just because COVID has entered an endgame disruptive pattern. Recession ahead will test revenue targets, but we’ve been to that rodeo before,” said one CEO who has been a long-time consulting client.

Beyond my U.S. casino tour back then, I also flew to Switzerland for a session with an old colleague who had made an immense pile over the years investing in the leisure, recreation, and gaming sectors. (He made a boatload on Callaway Golf (ELY), buying it just before the Big Bertha driver debuted).

Fulfilling a life-long skier’s dream, he settled in a magnificent 19th century Alpine estate on Lake Geneva. We chatted over several days. I was not a skier, but we did hike through the forests and talked stocks.

Out of all those conversations in the Alpine woods, I took one of his fundamentals home with me. His believed that investing long term in ski resorts and outdoor sports was as foolproof as possible a strategy as he had ever had. It was over thirty years ago and I was preparing to move my gaming portfolio into a blind trust. His opinions, highly valued, guided some of my decisions as I turned over the reins to my money manager.

His basic theory of investing was that casinos were unique real estate because they are licensed and must live at the discretion of governments. Ski resorts, he said, live by the fundamental reality expressed in the quote above. “You simply can’t print mountains like money. Those that are, are those that will be. It’s Mother Nature’s printing press and it’s been shut down for millions of years. The U.S. Fed and the SEC can print money one way or another till eternity,” I recall him saying (paraphrased from memory).

The quote above summarizes many long hours of discussions on the dos and don’ts of investing in the consumer discretionary sector.

That, among other reasons, is the best distillation of a rationale that guided my decision to include outdoor leisure stocks in my blind trust. I have no idea now whether those stock are still there. But since then, I have still aimed a periodical eye on the ski/outdoor sector and found my friend was prescient.

No better vindication of his view than the growth and forward prospects today of Vail Resorts, Inc. (NYSE:MTN), pandemic or not, COVID lingering or not, recession or not, those one-only creations of nature globe will continue to make money.

Get on the T-Bar, look up: It’s a good ride ahead for Vail

Vail management at one time or another has made its share of bad decisions. I believe its new business model and marketing thrust better reflects forward prospects.

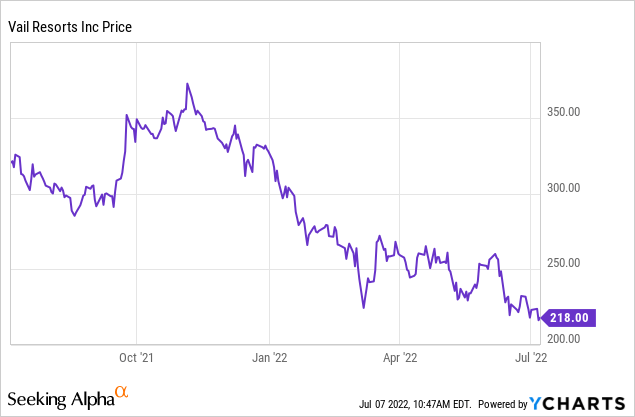

We like the shares of Vail Resorts here at $216.36, a steep discount off its year high of $372.51. It’s a company that has shown a CAGR quarterly earnings growth of 17. 8% over five years, sailing past recession, absorbing the covid-19 beating in 2020, and now, we believe, poised for a strong winter season ahead. But beyond quarterly performance, sustainability of yield in its dividends, we look at this company from the core perspective of my investor friend back in the day.

Vail operates 37 destination resorts in regional ski areas in the U.S. and Australia. In the U.S., its realistic addressable market is about 100m, totaling the population clustered around its U.S. resorts in ski areas of the West and Northern Mid-Atlantic/New England. The company divides its business between Mountain (skiing resorts) lodging (Rock Resorts), and real estate sales and management. Most analysis of its forward earnings prospects after a strong 3Q22 performance are to achieve EDBITDA or $828m to $842m (including its latest acquisition of the Seven Springs resorts in Pennsylvania).

Above: The company controls the mountains, the hotels and the activities extracting maximum consumer value per trip.

But, from our perspective, we see MTN as an asset play due to the uniqueness of the business that it conducts that is entirely a product of nature at its base. Its latest asset valuation is at $6.39b, up from $5.44b since pre-pandemic 2019. Its net worth is shown as $9b. But the fact is that the value of MTN’s assets are extremely difficult to pinpoint with any degree of accuracy using most any accepted measures.

If I may stretch a point to make a point, I view MTN’s asset valuation as similar in many ways to that of oil producers who count the value of oil still in the ground by their mostly accurate geological projections. There are proven reserves which are nominally not considered an asset until they are pulled up. Almost always the value of what lies beneath the ground, or the ground itself as it were, according to my very rich friend back in the day, is where much value lies. Potential oil reserves globally wax and wane, but in the end the total is finite. And so is the “supply” of skiable mountains.

Applying the concept of the finite asset to MTN’s valuation tells us that, as my friend said, they’re not printing any new mountains to accommodate demand. And any global areas with development potential as ski resorts immediately fall into MTN’s cross hairs before anyone else. So, when you have a finite asset as it were with virtually an impregnable barrier to entry in the U.S.’s top ski destinations, you have an asset base that can never be fully valued – yet it is there. That, to me, is the underlying fundamental that forms a very sound basis for a long term investment in MTN.

Above: When the weather cooperates, as it appears it will, no problem for the company to produce subscription skiers quickly.

The act of nature that created the mountains also rules the possibilities each season for add or subtract from revenue flow: the expected weather conditions in MTN geography. The latest update we found was the NOAA long range weather forecast for winter 2022. It appears we face the appearance of LA NINA, that is, a weather pattern that portends the sustained arrival of higher-than-average snowfall in the key upland areas of the U.S. where MTN’s majority of resorts are owned. The La Nina effect is the opposite of El Nino, which historically brings in its wake unusually warm winters.

Weather forecasting as we all know is capricious. All the technology available to forecasters these days does not immunize them from making bad calls. But in this instance, it would appear that if you are MTN’s management looking forward to the upcoming ski season, you are more likely to be smiling than beginning to hold your nose and gear up the artificial snowmaking machinery around the circuit.

We are looking for another beat in the all critical quarters ahead for MTN propelled by what appears to be a favorable long term forecast. We will see the skiers descending on the slopes in numbers that suggest pent-up demand in a pandemic endgame scenario will keep surging.

Some skeptics who follow the consumer discretionary sector have pushed the idea that pent-up demand has peaked as COVID eased. It has had its initial surge due to government pandemic handouts showing up, shut-in lives finally bored with video games, and Netflix and Instacart grocery shopping.

They further believe that expectations for sustained pent-up demand ahead are far below what optimists believe may be ahead. There have been sporadic outbreaks of COVID variants in the last few months, the overwhelming majority of which appear to produce mild symptoms and quick recoveries. In my view, looking at the numbers coming now from events in sports, concerts, dining casino arrivals, etc. tells me that while COVID has transformed many trends of the everyday for millions, it has not slaked the broader conviction among consumers. The mantra now is that one must find a way to live one’s life with a COVID overhang, at least until it’s final fade out is complete-if ever.

So, we believe that with a fairly favorable weather calendar ahead, an in-place, unchallenged network of ski resorts ready to roll, we could be looking at a significant earnings beat for the stock ahead that Mr. Market has apparently not yet believed will happen. That’s understandable given the overall chaos through which the consumer discretionary outlook has now been further blurred by imminent recession.

MTN’s business model accommodates reality ahead

Recognizing how the world has changed has put MTN’s marketing stress on the subscription model, 20% discounts, stresses on lift ticket multiple sales, and the tight focus on revamping its customer base targeted at long-term patron value. An analysis based on current trends in number of trips per year per customer, spread over its new price structure, produces ~$1,300 per head in lifetime value. With a population base of millennials now comprising over 22% and growing, the lifetime value of the 22m annual skiers and snowboarder seems reasonable. Bear in mind the age range naturally skews much younger due to the nature of the activity.

The average age of a U.S. skier is 38.5 years, which interestingly mirrors the total average age of the entire population of the country. However, by skewing much younger in general, the lifetime value will trend across a longer time span.

A rebound in progress

Market cap: $8.99b. In our view this undervalues the stock based on the principle of un-duplicable special land assets. Alphaspread puts the DCF of the shares at $203 with equity value of $8.28b. On this basis, one must conclude that the shares currently trading at $216 are fairly valued.

In the strict sense of applied metrics that guide investment decisions, that seems valid. But in our view, the literal control MTN has of irreplaceable, fixed-by-nature assets reaches far beyond these numbers. Unless you believe that participation in skiing, snowboarding, and winter sports in general is headed for a long-term decline (and there are those who do), you have to grasp how MTN assets are clearly undervalued by standard metrics.

Q3 revenue: $1.18b, a beat by $20m. That’s pent-up demand showing, and probably a trend that will accelerate of the weather forecasts hold hp.

EBITDA:$610.5m vs. $462.2m for the quarter.

EBITDA 2022E: $828m to $842m

Dividend: $7.64. Looking for yield, this is one place to get it going forward this year against a recession profile.

Outstanding shares: 40.25m

Revenue (ttm) $2.46b. We are looking for $2.6b for the year.

Balance sheet highlights:

Cash: $1.4b

Operating cash flow: $747m

Total debt (mrq) $2.97b

Current ratio: 2.22, which fits within the “good” designation among the S&P 500.

Conclusion

Depending on what you read and where, it would appear that there are many definitions among analysts as to what constitutes a moat for a given company. Most central in the rationale these days is either the sole, or highly limited, control of high demand, proprietary software, apps. Then there are those companies in businesses with a high barrier to entry. Add the early movers in industries that command long development ramps for new competitors.

What is often passed over in my view are companies like MTN, which singularly control income producing assets formed by nature that simply cannot be duplicated even if demand ramps exponentially.

No, MTN has no monopoly. There are other winter sports operators out there. But given its pivotal positioning in being first to scoop up smaller competitors as they may become available, adding to their huge portfolio, it presents a far more interesting investment proposition than what may seem to be the case based only on quarter-to-quarter performance.

Right now, you can buy MTN’s virtually priceless asset base at near its 52-week low coming into its peak season, where it will meet both presumably favorable weather as well as continuing pent-up demand.

On that basis, we are putting a PT of $275 on the shares by 1Q23, assuming it will beat current analyst 2022 earnings forecast of $7.92. We think a combination of favorable weather and pent up demand gets earnings above $8.25.

Be the first to comment