Inok

In late October, I wrote a bullish article on Wheaton Precious Metals Corp. (NYSE:WPM), arguing that WPM and other “gold producers could be the main beneficiaries of a Fed Pivot, as precious metal prices remain very sensitive to changes in interest rates, inflation expectations, and foreign exchange rates.”

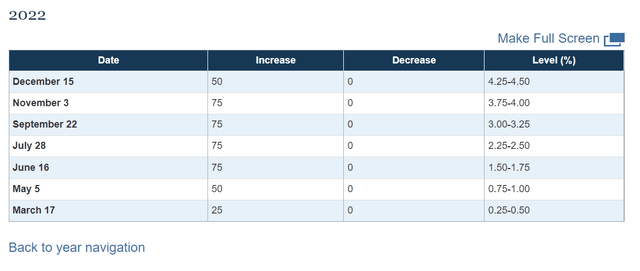

Since my article, the Fed has slowed the pace of its interest rate hikes to 50 bps in December (Figure 1).

Figure 1 – FOMC open market operations (federalreserve.gov)

With slowing headline inflation, the Fed is widely expected to further downshift its hiking pace to 25 bps at the upcoming FOMC meeting on February 1st.

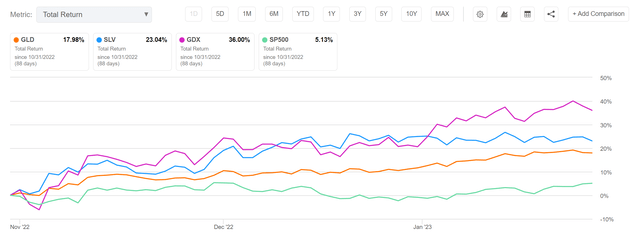

As I predicted in my previous article, precious metals have been the chief beneficiary of the ‘Fed Pivot’. Since October 31st, gold prices as measured by the SPDR Gold Trust ETF (GLD) have appreciated by 18% while silver prices as measured by the iShares Silver Trust ETF (SLV) have climbed 23%. Gold producers as measured by the VanEck Vectors Gold Miners ETF (GDX) have rallied 36%. All three securities have vastly outperformed the market, as represented by the SPDR S&P 500 ETF Trust (SPY) (Figure 2).

Figure 2 – gold and silver have outperformed the markets since Fed Pivot (Seeking Alpha)

As we face another FOMC rate decision in a few days, what are my current thoughts on WPM, given that WPM’s shares have rallied 35% since my article?

Brief Overview

First, for those who are not familiar with Wheaton Precious Metals, perhaps it would be beneficial to give a brief overview of the company. Wheaton Precious Metals is one of the world’s largest precious metals royalty and streaming companies. WPM’s business model is to provide non-dilutive financing to mining companies in exchange for a percentage of production (royalty) or the right to purchase production at discounted prices (streaming).

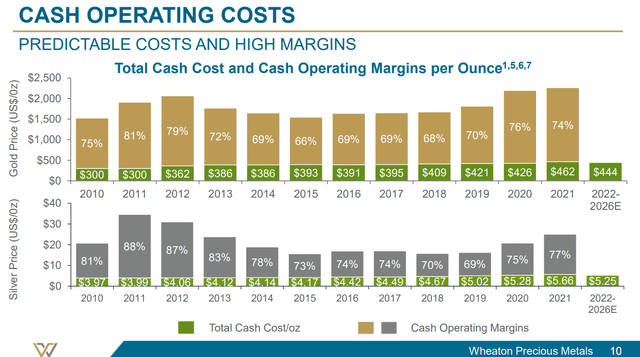

The major advantage of WPM’s business model shows up when we look at the operating costs for the company’s ‘production’. In the past year, we have seen many mining companies miss on earnings due to soaring inflation. However, for a royalty company like WPM, its ‘production costs’ are highly predictable and fixed due to contractual agreements struck when WPM originally provided its financing (Figure 3). This allows WPM to consistently ‘produce’ precious metals at first quartile costs.

Figure 3 – WPM has first quartile production costs (WPM investor presentation)

Readers who want more details on Wheaton’s business model are encouraged to take a look at my initiation article, which covers the royalty business model in more detail.

Too Much Fed Easing Priced In?

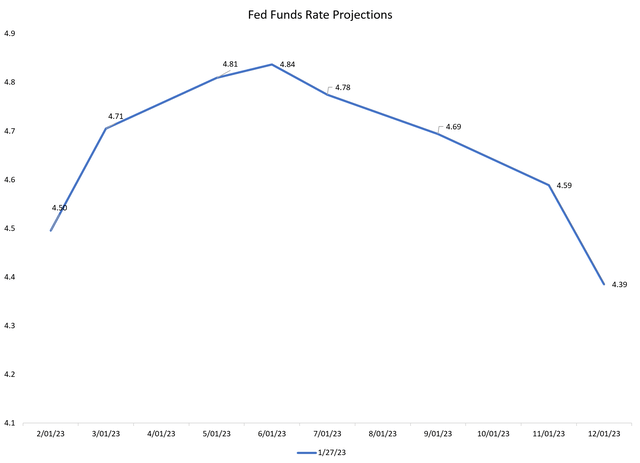

As mentioned above, traders overwhelming expect the Fed to raise interest rates by 25 bps at the upcoming February meeting. In fact, after February, market expectations are only for another ~30 bps of additional interest rate increases in the first half of 2023, before the Fed is expected to rapidly cut interest rates in the second half to 4.39% by year-end (Figure 4).

Figure 4 – Fed Funds Rate projections expect Fed to cut rates in 2nd half (Author created with data from CME)

While I agree with the market’s expectations for a 25 bps hike in February, I believe traders may have gotten ahead of themselves by expecting rate cuts as July.

Recall in the December FOMC meeting, Fed Chair Powell explicitly said that the Fed will have to raise interest rates to a restrictive level and stay there for a period of time to ensure inflation falls back to the Fed’s 2% target. While a decline in headline CPI inflation to 6.5% YoY in December is welcome news, it is still far from the Fed’s 2% target.

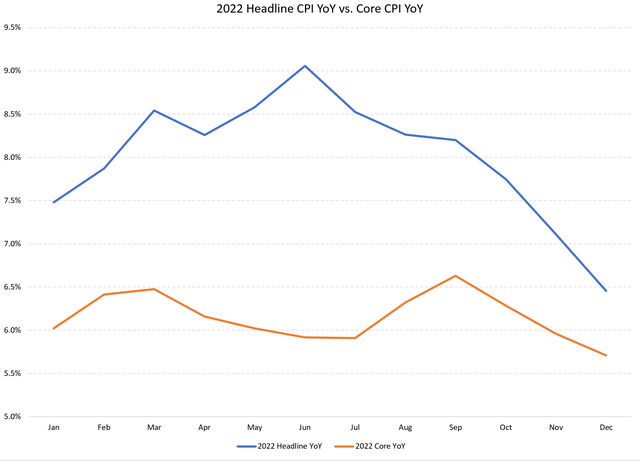

Furthermore, although headline inflation has declined rapidly from June’s 9.1% YoY figure to 6.5% in December, core inflation has proven to be much stickier, hovering between 5.5% to 6.5% for the whole year (Figure 5).

Figure 5 – Headline vs. Core CPI Inflation YoY 2022 (Author created with data from bls.gov)

Finally, there are signs that headline inflation may be picking back up in recent weeks, with wholesale gasoline prices rebounding by 50 cents per gallon in the past month (Figure 6).

Figure 6 – Wholesale gasoline prices (tradingeconomics.com)

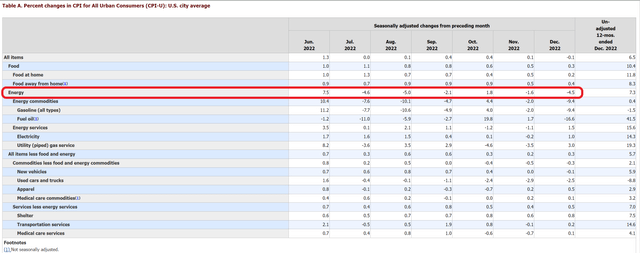

Readers should note that much of the decline in headline inflation in the past few months have been driven by declines in energy prices, as wholesale gasoline prices plunged after the peaks in June (Figure 7). If energy prices start to go up again in the coming months, expect headline inflation to make a comeback.

Figure 7 – Energy prices were the main driver of headline inflation decline (bls.gov)

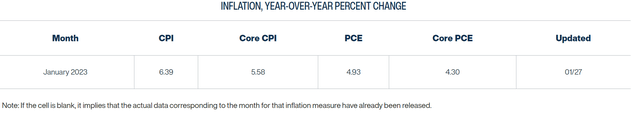

The Cleveland Fed has a useful tool called ‘Nowcast’ that gives a real time estimate of inflation. This tool predicted December’s headline and core inflation figures at 6.6% and 5.9% YoY vs. actual figures of 6.5% and 5.7%, so it is directionally accurate.

It is currently predicting January headline and core inflation of 6.4% and 5.6% YoY, a slight decline from December’s rate, but far from sufficient for the Fed to declare ‘Mission Accomplished’. (Figure 8).

Figure 8 – Nowcast is forecasting 6.4% headline inflation for January (clevelandfed.org)

Without a consistent decline in core inflation, it is simply too soon for the market to expect the Fed to cut interest rates by July.

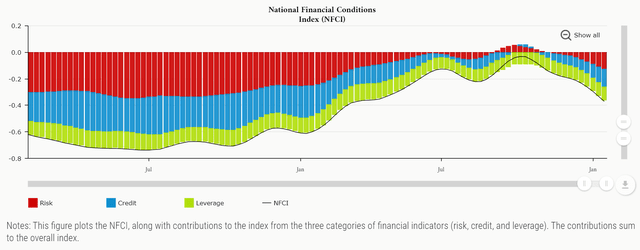

Financial Conditions Are Too Easy

One of the stated goals of the Federal Reserve’s rate hikes in 2022 was to tighten financial conditions to restrictive levels in order to tame soaring inflation. However, since October, a rebound in financial markets and tightening of credit spreads have caused a massive loosening of financial conditions. According to the Chicago Fed’s National Financial Conditions Index, financial conditions are now as loose as it was in the Spring of 2022 (Figure 9).

Figure 9 – Financial conditions have loosened to March 2022 levels (chicagofed.org)

If the Fed were to relent to the market’s expectations and start to cut interest rates by the second half, then all the work that they have done in 2022 would be for naught and inflation may make a roaring comeback in the coming quarters.

Technicals Coming Into Resistance

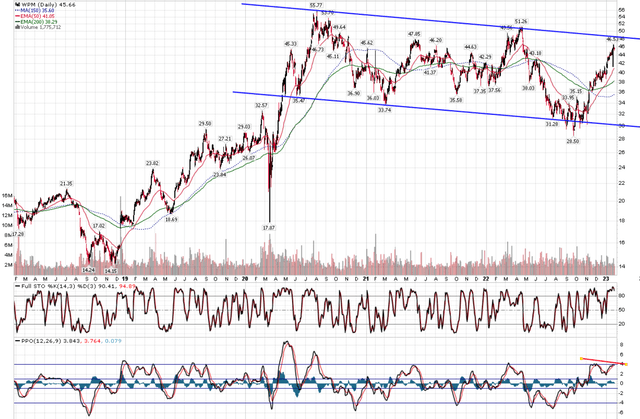

In my last article, I highlighted the chart in figure 10, arguing that the risk/reward in WPM shares was favourable at the time, with the stock trading at the bottom end of a sideways consolidation with positive divergence in the PPO momentum indicator.

Figure 10 – WPM nearing resistance (Author created with price chart from stockcharts.com)

Unfortunately, after a 35% rally, the opposite is true and WPM shares are now nearing the top end of the trading range with a negative divergence in momentum building.

Seasonality Still Has Room To Run

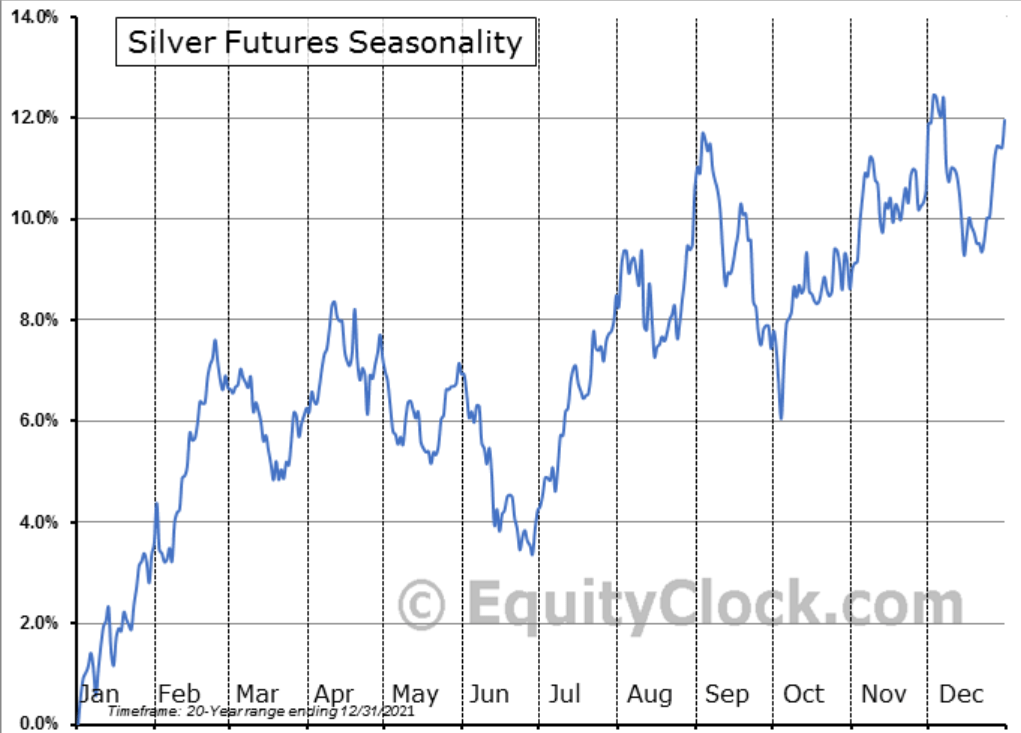

On the positive side, seasonality for silver remains constructive, as the precious metal typically peaks in late February to early April (Figure 11). So perhaps precious metal producers like WPM has a few more weeks of upside left.

Figure 11 – Seasonality for silver remains constructive (equityclock.com)

Risks To Wheaton

The biggest near-term risk to Wheaton Precious Metals is the price of the underlying commodities. As I highlighted above, investors appear to have gotten overly optimistic on the path of the Federal Reserve’s monetary policy and the upcoming FOMC meeting on February 1st could see some pushback from Fed officials.

On the other hand, if Fed officials do not push back against market expectations in the upcoming meeting, then precious metals and WPM may have further room to run.

Conclusion

After an explosive rally in the past few months based on a shift in the Fed’s monetary policies, I believe the pendulum may have swung too far and investors may have gotten too optimistic. While I still like WPM long-term, I would recommend investors take the opportunity to lock in some profits ahead of the pivotal FOMC meeting on February 1st.

Be the first to comment