prmustafa/E+ via Getty Images

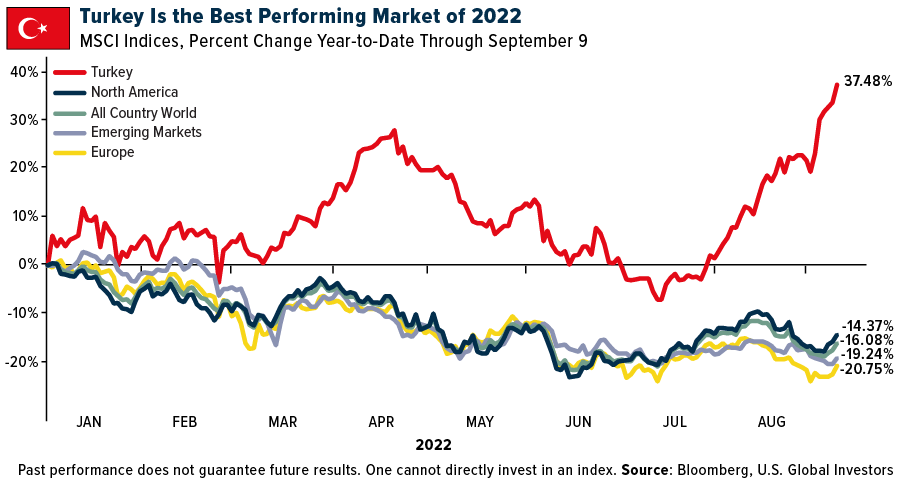

Stocks trading in Turkey were up an impressive 37% for the year as of Friday, September 9, making that the best performing equities market relative to other global markets. Given that most regions are still underwater in 2022 – including North America, Europe, and emerging markets as a whole – investors may ask what’s behind the Turkey rally.

Turkey is the best performing market of 2022 (Bloomberg)

Let’s start with the facts. Turkey is facing record-high inflation right now, with consumer prices up a jaw-dropping 80% in August compared to the same month last year. President Recep Erdogan, who enjoys unorthodox control over the country’s monetary policy, responded by cutting the interest rate to 13% from July’s 14%.

This isn’t the expected way to address inflation, as you probably know. To combat surging prices, policymakers at central banks ordinarily raise, rather than lower, borrowing costs, which can have the desired effect of slowing demand. The U.S. fed funds rate, for instance, has been hiked four times so far this year, with another increase all but guaranteed after the Labor Department’s report showing that annual inflation remained at 40-year highs in August. Earlier this month, the European Central Bank (ECB) made the biggest rate hike in its history, raising it to 0.75%.

But Turkey’s Erdogan is different. He would prefer to keep the economy chugging along unabated, and so the benchmark rate is currently down approximately 600 basis points (bps) from August 2021, and down a whopping 1,100bps from June 2019.

Trying To Beat Inflation In A Low-Yield Environment

Trying to beat inflation, I believe, is the main contributing factor to Turkey’s blistering stock rally. Turkish investors appear to be plowing money into the country’s equities in an effort to beat inflation, perhaps with little regard for the fundamentals. Monetary policy is being loosened at the moment, so government bonds won’t do the trick. (Falling interest rates tend to make bond prices rise and yields drop.)

Again, these are the facts: The yield on Turkey’s 10-year bond is currently trading at around 10%, well below the 80% inflation rate. A number of Turkish stocks, meanwhile, have increased over 100%, 200%, and even 300% year-to-date in U.S. dollar terms, despite historically high inflation. Where is a Turkish investor to put his or her money?

It’s not just local investors who are participating. Historically, foreign investors have made up a small minority share of total investors in Istanbul-listed stocks. However, according to Bloomberg, many of them ramped up their purchases of Turkish stocks in August at the fastest pace since November.

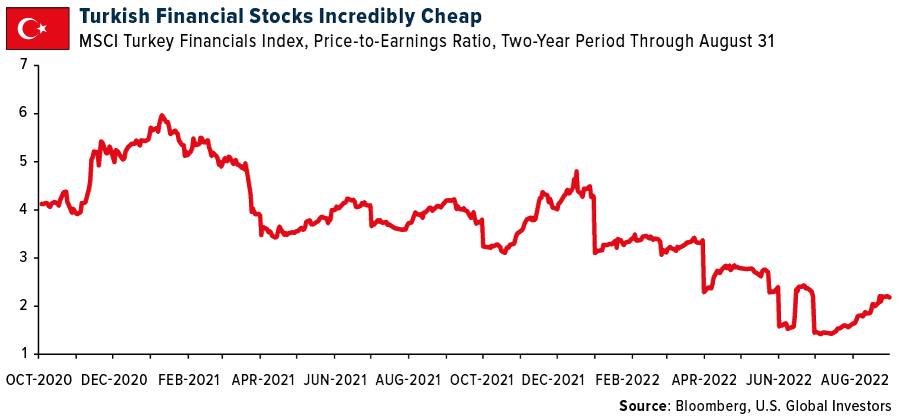

Extremely Low Valuations For Financials

Another catalyst for the rally could be that Turkish stocks are incredibly cheap right now on a price-to-earnings (P/E) basis. According to JPMorgan, Turkey is currently the cheapest market in the entire CEEMEA (Central & Eastern Europe, Middle East and Africa) region. That’s especially true of Turkish banks and financial firms, which had an ultra-low P/E of 2.2 at the end of August, down from a recent high of 6.0 at the beginning of 2021.

Turkish financial stocks are incredible stocks (Bloomberg)

Turkish banks have been in the news in recent months, with at least five of them agreeing to adopt Russia’s Mir payments system following the country’s removal from SWIFT (Society for Worldwide Interbank Financial Telecommunications) in response to its invasion of Ukraine. Although Turkey initially criticized Russian President Vladimir Putin for the move, it has refrained from imposing sanctions on a country similar to the U.S. and Europe. In early August, President Erdogan predicted that Turkey’s payment in Russian rubles for imported Russian energy would be a great source of financial support for both countries.

He wasn’t wrong. Many Turkish banks had a phenomenal June quarter. Yapı Kredi – the country’s fourth-largest bank – reported $1.3 billion in net income in the first half of 2022, an approximately 180% increase over the same six-month period a year earlier. Yapı Kredi was up 96.08% for the year as of September 9.

Be the first to comment