shotbydave/E+ via Getty Images

Investment Thesis

Caterpillar’s (NYSE:CAT) products and services are experiencing strong demand. However, due to supply chain constraints, the sales of machines to users have been impacted. This has led to elevated backlog levels at the end of Q2 FY22. In 2H FY22, the company’s revenue should benefit from the elevated backlog levels, easing commissioning delays in the Resource Industries segment, and higher price realization. The funding from the Infrastructure Investment Jobs Act (IIJA) along with the EU infrastructure program should benefit the long-term growth of the company. The margins in 2H FY22 are expected to be better than in 1H FY22, driven by pricing actions. The stock looks attractive trading at a discount to its historical valuation multiple.

Revenue Outlook

CAT is experiencing healthy demand for its products and services. However, supply chain constraints are affecting the volume growth of the company. In Q2 FY22, the company generated double-digit Y/Y sales growth due to better pricing and increased services revenue, partially offset by lower sales to users. Sales to users declined 3% Y/Y due to supply chain constraints. These constraints were primarily due to the component shortages, resulting in production delays and shortfalls against the company’s schedules. In the Construction Industries segment, the sales to users decreased 4% Y/Y due to weakness in China and supply chain constraints in North America, partially offset by increased sales in Latin America and the APAC region. The demand in the EAME region is moderating.

The sales to users in the Resources Industries segment decreased 2% Y/Y due to supply chain constraints and one-off disruptions, including commissioning delays. In the Energy & Transportation segment, sales to users were flat Y/Y. Oil & Gas sales to users were down in the quarter due to lower turbine and turbine-related services, partially offset by continued improvements in reciprocating engines. Solar turbine new equipment shipments were down in the first half of FY22 due to longer lead times.

The order rate in the quarter remained solid, with the total backlog increasing by about $2 billion, led by Energy & Transportation. The backlog in Resource Industries and Construction Industries remains elevated.

Looking forward, in the Construction Industries, the non-residential market in North America is expected to be strong due to the higher construction backlogs. Additionally, the ramping of projects from the Infrastructure Investment and Jobs Act (IIJA) funding is expected to start in FY23. The growth in the non-residential construction market should be partially offset by the moderation in residential construction. Residential construction is expected to moderate due to increased interest rates and higher inflation. As the demand for residential construction moderates, the company plans to reallocate its resources to areas where demand is stronger and manage the supply chain more efficiently.

In China, the above 10-tonne excavator market is expected to be below 2019 levels due to the slowdown in the construction industry. However, except for China, the rest of the APAC region is expected to grow due to increased infrastructure investments. Even though demand has moderated in the EAME region, the infrastructure investment package should benefit the company in the long term.

In the Resource Industries segment, despite the moderation in demand in the mining industry, the production and utilization levels are expected to remain elevated. The energy transition in the mining industry is creating additional demand for many commodities, which should expand CAT’s addressable market and provide growth opportunities. The commission delays experienced in 1H FY22 in the segment are expected to ease, benefiting the sales growth in 2H FY22. In Energy & Transportation, the strength in reciprocating engine orders, especially engine replacements due to increased asset utilization, should support the growth. The increased order rate for solar new equipment in 1H FY22 should support the sales growth in 2H FY22 and FY23. Strength in power generation, data centers, construction, and electric power markets should support the order rates in 2H FY22 and beyond. Apart from healthy demand, the sales of the Energy & Transportation segment in 2H FY22 should benefit from seasonality. The total revenue in 2H FY22 is expected to be better than in 1H FY22, driven by strong demand and healthy backlog levels.

Margins

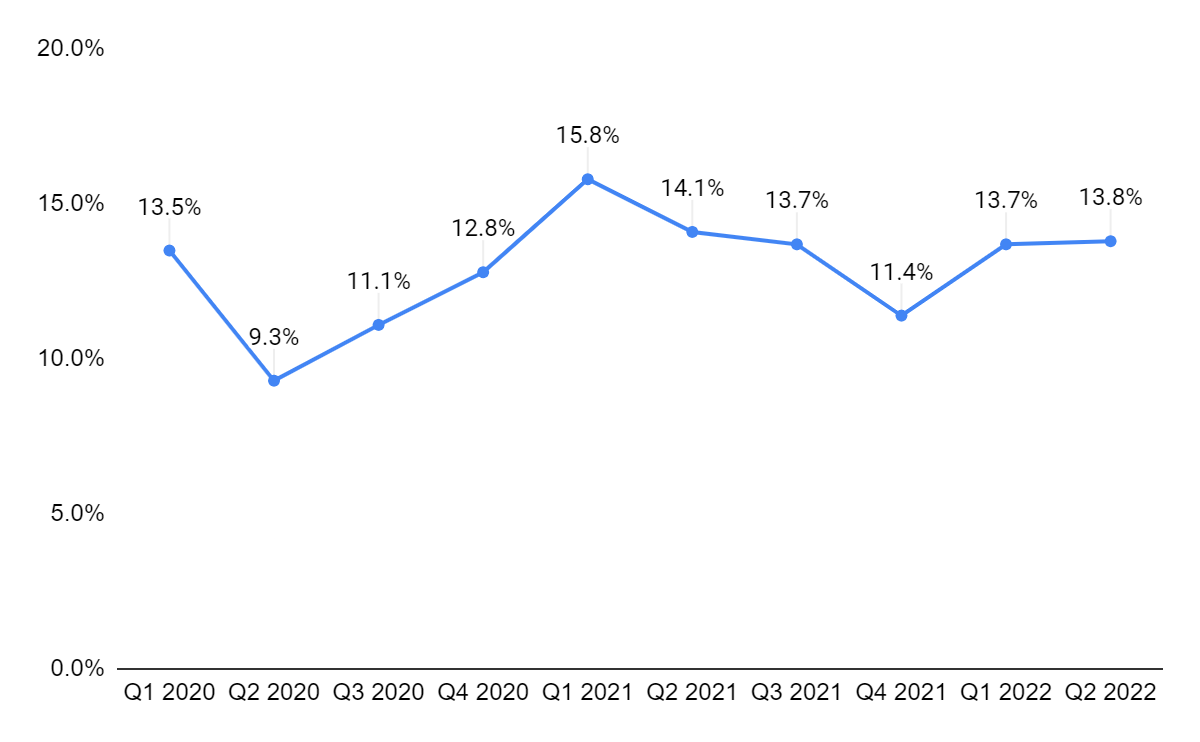

The manufacturing costs for CAT have been higher due to continued material and freight cost pressures as well as the impact of the supply chain on factory performance. As a result, in Q2 FY22, the adjusted operating margin was down 30 bps Y/Y to 13.8%. The company is taking price hikes to offset the inflationary pressures and the net impact of higher prices and increased manufacturing costs was neutral last quarter, which is an improvement versus Q1 22 when higher price realization was not able to offset increased manufacturing costs.

CAT’s adjusted operating margin (GS Analytics Research, Company data)

The adjusted operating margin is expected to be better in 2H FY22 compared to 1H FY22. In 2H FY22, pricing is expected to improve and more than offset the inflationary cost pressures, driving the margin growth for the full fiscal year 2022.

Valuation & Conclusion

The stock is currently trading at 15.34x FY22 consensus EPS estimate of $12.54 and 13.86x FY23 consensus EPS estimate of $13.88, which is lower than its five-year average forward P/E of 18.29x. The healthy demand in the end markets and elevated backlog levels should support the revenue growth in the near term, whereas the funding from the U.S. IIJA and EU infrastructure investment in the EAME region should benefit over the long term. The lower valuation and good growth prospects make Caterpillar an attractive buy.

Be the first to comment