deepblue4you

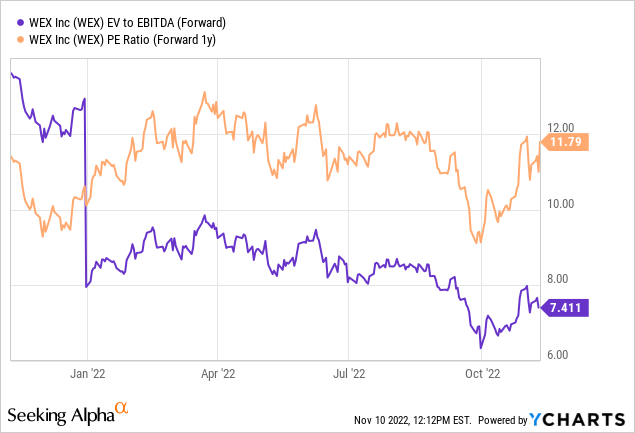

The story of payment processing and information management solutions provider WEX Inc.’s (NYSE:WEX) Q3 report was consistent with the prior quarter, with strong organic growth from a post-COVID travel rebound and higher fuel prices driving much of the P&L upside. Elsewhere, the on-the-road (OTR) portion of the fleet revenue base is holding up better than expected, allowing for the share repurchase program to be revised upward. Even if WEX goes through some macro turbulence, the long-term fleet card penetration thesis remains intact, in my view, along with the ongoing mix shift toward the growing Travel & Corporate and Health businesses. Yet, the stock trades at a discounted forward EBITDA multiple in the high-single-digits and well below key sponsor Warburg Pincus’ conversion price (~$200/share on the convertible notes), leaving ample re-rating potential from here.

Organic Growth Continues in Q3

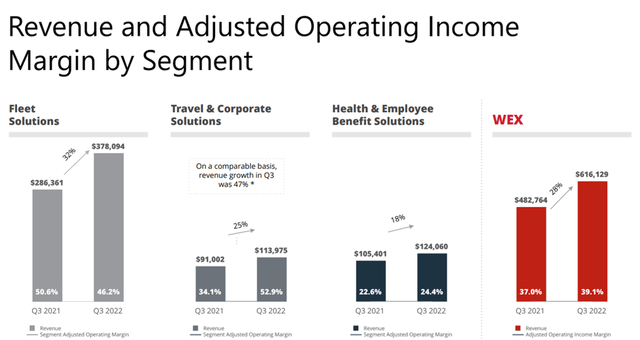

WEX delivered impressive headline revenue growth of 28% this quarter, and while the underlying organic growth (adjusted for fuel and FX benefits) was lower at ~19%, this was still a very strong performance given the consumer headwinds. Much like Q2, the key drivers include a sustained post-COVID recovery in travel volumes, which has allowed for incremental margins given the operating leverage within WEX’s business model. Higher fuel prices were a contributor as well, although it likely also led to higher-than-expected credit loss rates for the quarter (highest since H1 2020).

Beyond the macro and industry drivers, the buoyant new sales activity at WEX is a positive, along with modernization initiatives that are getting products to market at a faster pace. Of note, the digital payments platform, Flume, was also launched on schedule in Q3, paving the way for deeper penetration into the small-medium business market. Thus far, early signals here have been encouraging, with ~$7m of Q3 revenues coming from the sales of corporate payments to OTR customers. Assuming no hiccups on execution, this could turn into a significantly larger cross-selling motion down the line, as WEX further taps into product cross-selling opportunities across its >450k fuel customers and unlocks more upside to the take rate.

Credit Provision Spikes Higher

On the flip side, WEX did see its provision increase for credit losses to 31bps (~10bps higher than prior guidance). Per management, this was a precautionary measure to address a slowdown in the small fleet OTR business, which has underperformed the overall OTR book. More concerning, though, was that for a second consecutive quarter, ~11bps of the provision came from application fraud – hardly an advertisement for the existing implementation of controls. That said, this trend is likely to be seasonal rather than structural, as application fraud tends to spike alongside rising fuel prices before normalizing lower. Plus, WEX has singled out the key driver, which is isolated to a particular chain, so as long as management gets to grips with the issue, fraud losses should come down. Investments in fraud monitoring should bring this structurally lower over the mid to long-term as well.

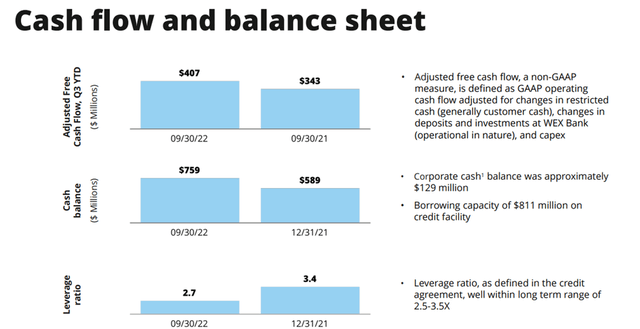

Expanding the Buyback Authorization

Exiting Q3, WEX is as well-capitalized as ever, with $759m of cash on hand (well above the $589m it held exiting FY21). Supported by $811m of borrowing capacity under the company’s credit agreement (up from $718m last quarter), the company’s liquidity position should allow it to weather any storms ahead. The leverage ratio has improved to 2.7x (down from 3.4x exiting FY21 YE) as well, which means WEX is now comfortably within its 2.5x-3.5x target range. With ample balance sheet capacity available, management could get more constructive on growth acquisitions, particularly now that valuations are down across focus areas like corporate payments and health.

Alternatively, management could also redeploy capital into buybacks. In Q3, WEX not only expanded the authorization by 30% but also accelerated the pace of deployment, highlighting its confidence in the outlook. Per the latest disclosures, WEX has already repurchased $75m in common stock in October, leaving $575m available subject to management’s discretion. With the company well within any debt/covenant-related constraints, I see a >500k quarterly buyback pace through FY23 as well within reach, providing useful downside protection to the stock as we head into a challenging macro.

Still an Attractive Secular Growth Story

All in all, WEX’s Q3 2022 numbers were good. Revenue outpaced consensus by a good margin, helped by higher fuel prices and the post-COVID travel recovery, as well as higher-than-expected late fees. Adj EPS also beat consensus, albeit by a narrower margin amid higher-than-expected credit losses, which should normalize lower in the coming months. While fuel prices will likely come down over time and the prospect of a recession remains a concern, WEX has levers on the cost side, with ~$100m run-rate of savings exiting FY24. Plus, the expanded buyback authorization should provide downside support through turbulence.

Over the mid to long-term, the move away from legacy fleet revenues toward the higher growth Travel & Corporate and Health businesses bode well for the overall mix. With the valuation down to ~7x EBITDA as well, there remains ample room for a multiple re-rate as the business transition gains momentum (note Bottomline Technologies, a potential comparable peer for its ex-fleet business, was recently acquired for ~24x forward EBITDA).

Be the first to comment