Ralph Orlowski/Getty Images News

Introduction: Why is Henkel Stock Dropping?

We are downgrading our rating on Henkel AG & Co. KGaA (OTCPK:HENKY) from Buy to Hold, as we believe our investment case to be broken.

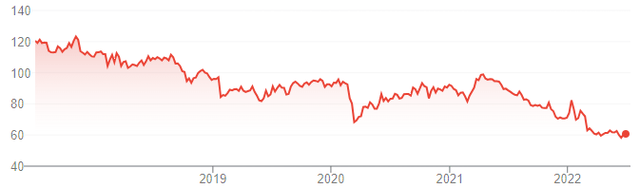

Henkel Preferred shares have halved in the past 5 years and are now at a level last seen in 2012:

|

Henkel Preferred Share Price (Last 5 Years)  Source: Google Finance (28-Jun-22). |

We initiated our coverage on Henkel with a Buy rating in June 2021, and last reiterated it in December 2021. Since our initiation, Henkel Preferred shares have lost 34% of their value (in EUR, after dividends).

We have lost confidence in Henkel’s business and its management. Our original investment case expected the turnaround since 2020 to succeed, and this has not happened. • High input cost inflation following Russia’s invasion of Ukraine in late February exposed continuing weaknesses in Henkel’s consumer businesses. An exit from Russia and Belarus, along with the conflict in Ukraine, reduced EBIT by a further 6%. The mid-point of Henkel’s 2022 guidance implies an Adjusted EPS that is 25% lower year-on-year and 37% lower than in 2019. Another restructuring program has been launched, with significant execution risks. The long-term picture for Henkel’s earnings is unclear.

What We Thought Would Happen

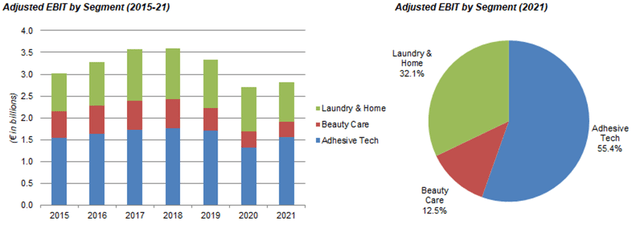

Henkel is a German-listed industrial/consumer conglomerate with global sales. At the time of our initiation, the company was organised in three segments: Adhesive Technologies, Beauty Care and Laundry & Home Care:

|

Henkel Adjusted EBIT by Segment (2015-21)  Source: Henkel company filings. |

Henkel’s EBIT had been falling in 2018-20. At our initiation, we expected earnings to recover from a combination of structural growth, a cyclical rebound after COVID-19 and a success in the turnaround program it has been executing since 2020. We expected management to be successful in delivering their mid- to long-term targets of 2-4% organic sales growth and mid-to-high single-digit Adjusted EPS growth at constant currency.

The evidence we had for our investment case included positive sales momentum in quarterly results (including organic sales growth of 15.2% in Q2 and 3.5% in Q3), relatively stable 2021 margin guidance, as well as management qualitative comments about operational improvements and market share gains in key businesses.

What Has Actually Happened

Henkel did deliver positive organic sales growth of +7.8% and a stable Adjusted EBIT margin of 13.4% in 2021; Adjusted EPS of €4.56 was in fact 2% higher than what we forecasted.

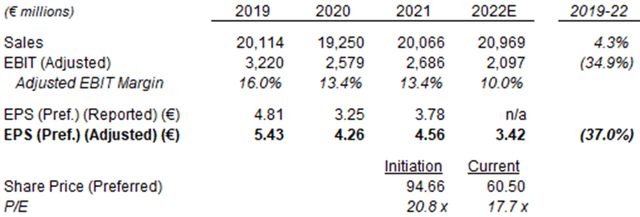

However, for 2022, Henkel is now guiding to an Adjusted EPS decline of 15-35%. At mid-point, this implies an EPS figure that will be 37% lower than in 2019:

|

Henkel Comparison – Current vs. Initiation  Source: Henkel company filings. NB. 2022E figures based on mid-point of guidance. |

The price of Henkel’s Preferred stock has correspondingly fallen from €94.66 at our initiation to €60.50, the decline of 36% being the product of a 25% reduction in current-year Adjusted EPS (at mid-point of the guidance) and a 15% shrinkage in the P/E multiple (relative to current-year Adjusted EPS).

(In this article we refer exclusively to Henkel’s Preferred shares, the class most commonly held by institutional investors. They carry no voting rights but are entitled to €0.02 more in dividends than the Ordinary shares.)

The main problem is margin decline, with management now expecting organic sales growth of 4.5%, a currency tailwind of low-single-digits (for sales), but an Adjusted EBIT margin of only 9-11%, compared to 13.4% in 2021.

While the decline in EBIT margin is mainly an indirect result of the Russian invasion of Ukraine in late February, Henkel was disproportionately impacted due to continuing weaknesses of its consumer businesses. Much of the damage appears to be permanent and an eventual recovery is far from certain.

Impact from Russia/Ukraine Conflict

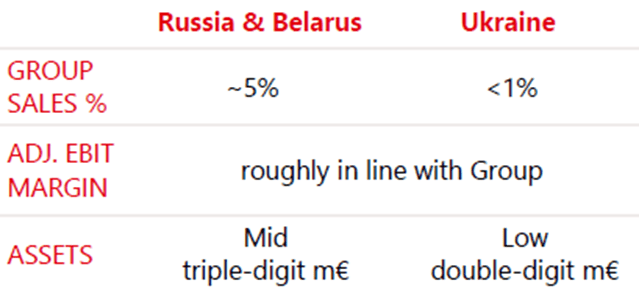

Henkel lost approx. 6% of its earnings as a direct impact of the Russian invasion of Ukraine, as it had approx. 5% of its sales in Russia and Belarus (which it is now exiting) and less than 1% of its sales in Ukraine (impacted by war):

|

Henkel Exposure to Russia/Ukraine Conflict (2021)  Source: Henkel profit warning presentation (Q1 2022). |

However, the indirect impact is far greater, due to the drastic increases in input costs worldwide as a result of supply chain disruptions. As of April 28, management estimated that price increases in Henkel’s direct materials to be in the mid-twenties percent range, worth approx. €2bn in 2022 (compared to 2021 Adjusted EBIT of €2.69bn).

Weakness in Consumer Businesses Exposed

High input cost inflation following Russia’s invasion of Ukraine has exposed continuing weaknesses in Henkel’s consumer businesses, as they were unable to fully offset input cost increases with price hikes. These businesses were already struggling before this year.

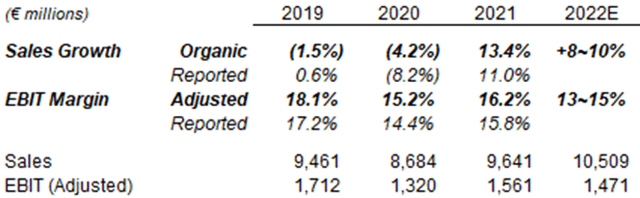

Adhesive Technologies, which we regard as a strong business, has performed well. It is now expecting an Adjusted EBIT of €1.47bn in 2022 (based on mid-point of guidance), almost flat year-on-year excluding the loss of EBIT from Russia, etc. The segment is cyclical, was in a down cycle before COVID-19 and was further disrupted by the pandemic, but its Adjusted EBIT has remained in a relatively tight range around €1.5bn:

|

Henkel Segment Sales & EBIT – Adhesive Technologies  Source: Henkel company filings. NB. 2022E figures based on mid-point of guidance. |

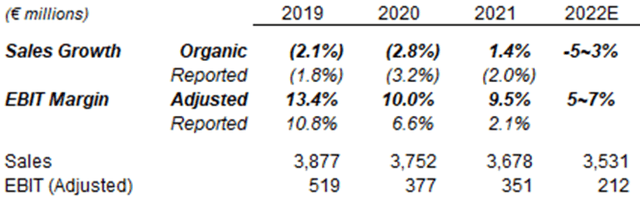

Beauty Care, a weak business, is expected to see an organic sales decline of -5% to -3% and an Adjusted EBIT margin shrinkage from 9.5% to 5-7%. The segment had negative organic sales growth even before COVID-19, lost more sales during 2020 and only recovered partially in 2021; its Adjusted EBIT margin has been falling every year:

|

Henkel Segment Sales & EBIT – Beauty Care  Source: Henkel company filings. NB. 2022E figures based on mid-point of guidance. |

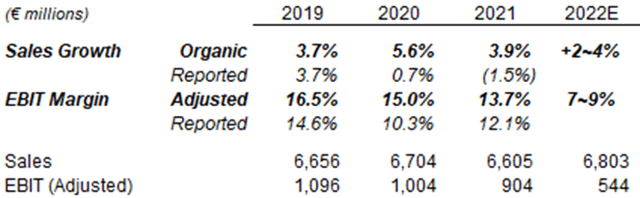

Laundry & Home Care, a mediocre business, is expected to see organic sales growth of 2-4% in 2022. Segment organic sales growth was atypically high in 2020, because COVID-19 boosted demand for cleaning products, and has been decelerating since. More worryingly, Adjusted EBIT margin has been falling every year too:

|

Henkel Segment Sales & EBIT – Laundry & Home Care  Source: Henkel company filings. NB. 2022E figures based on mid-point of guidance. |

The weaknesses in Beauty Care and Laundry & Home Care appear to be structural, and do not seem to have been remedied by the turnaround program that was initiated by current CEO Carsten Knobel in early 2020. In particular, sales in Western Europe fell year-on-year organically in both segments in Q1 2022. Among other things, management highlighted the segments’ inability to raise prices fully in face of opposition from retailers and traders.

The weakness in Henkel’s consumer businesses stands in sharp contrast to its larger, more successful competitors. For example, Procter & Gamble (PG), is guiding to a Core EPS growth of 3-6% for its FY22 (ending Jun 30), while Church & Dwight (CHD) is similarly guiding to an Adjusted EPS growth of 4-8% in 2022.

We believe many of Henkel’s problems are specific to the company.

More Restructuring & Execution Risks

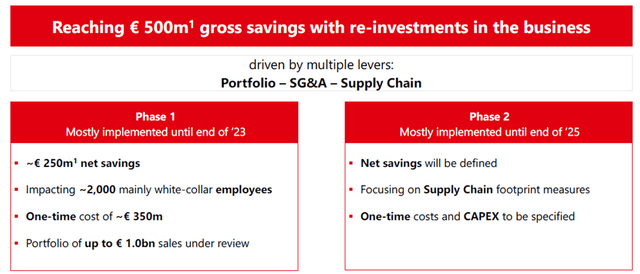

Henkel’s answer to weaknesses in its consumer businesses is a further round of restructuring.

Beauty Care and Laundry & Home Care are to be merged into a single Consumer Brands segment, with businesses of up to €1.0bn in sales to be reviewed for disposals or discontinuation, to generate €500m of gross cost savings by 2025 year-end (including €250m of net savings by 2023 year-end):

|

Henkel Restructuring Plan  Source: Henkel results presentation (Q1 2022). |

The stated rationale of the reorganization is to create more scale and allow further consolidation. Management hopes that merging the two segments would create synergies that would help offset the loss of scale from exiting unattractive businesses. The new merged unit will be headed by Wolfgang König, the current head of Beauty Care who only joined Henkel in summer 2021 (having worked in companies including Kellogg (K) and Colgate-Palmolive (CL) before).

We are cautious about this further round of restructuring. As we wrote in our initiation back in June 2021:

We believe Henkel’s problems stem from a period of poor execution, when it was too active in making acquisitions, too aggressive in cutting costs, and did not spend enough on innovations and growth – these boosted reported earnings temporarily but damaged Henkel’s competitiveness”

The current CEO has been executing a previous round of restructuring for two years. While the drastic rise in input costs is global and unprecedented, Henkel has fared disproportionately poorly, a sign that the underlying problems have not been resolved. We are not convinced that a further round of reorganisation and cost cuts would help. Further cuts come with their own execution risks – Henkel already experienced one breakdown in its consumer products distribution in North America in 2018, resulting in delivery problems and the loss of shelf-space at retailers.

Unclear Long-Term Earnings Picture

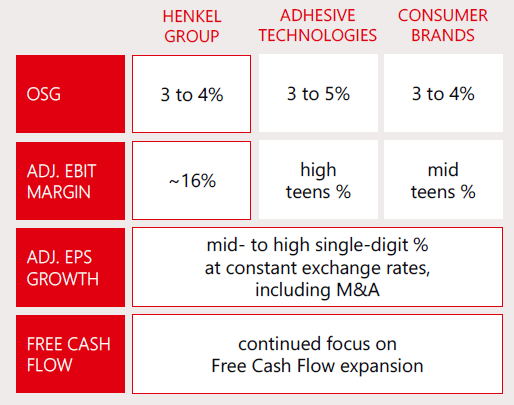

Henkel has ostensibly maintained its mid- to long-term target of growing Adjusted EPS at mid-to-high single digits at constant currency, raised its organic sales growth target to 3-4% (from 2-4%), and added a new target of reaching an Adjusted EBIT margin of 16%. However, there is no timetable attached to these targets.

|

Henkel Mid- to Long-Term Targets  Source: Henkel profit warning presentation (Q1 2022). |

Referring to the mid‐ to long‐term ambition margin target of around 16% … it’s also obvious and clear that we are not able to compensate all of that within the course of 2022. And by that, I think this is for me something which we assume will not be in the next couple of years a similar situation. So therefore, from a timing perspective, our financial ambition is meant to be achieved, as we mentioned it, over the mid‐ to long‐term. We are not giving a specific year on that”

Carsten Knobel, Henkel CEO (Q4 2021 earnings call)

The long-term picture for Henkel’s earnings is thus unclear.

Henkel Stock Dividend and Valuation

Henkel stock is not particularly cheap, considering its structural issues and the risks in its latest turnaround.

At €60.50, relative to the mid-point of 2021 Adjusted EPS guidance (€3.42, down 25% year-on-year), Henkel’s Preferred stock is trading at a P/E of 17.7x. The Preferred Dividend is €1.85 and represents a Dividend Yield of 3.1%.

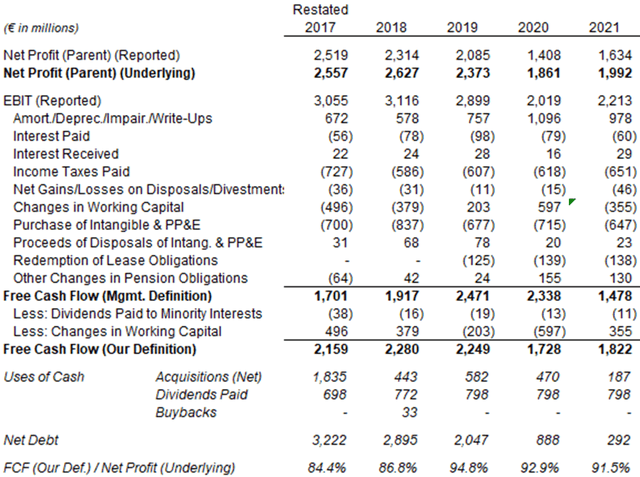

Cash conversion, from Underlying Net Profit to Free Cash Flow, has historically ranged from between 85% and 95%, excluding volatile working capital cashflows:

|

Henkel Profit & Cashflows (2017-21)  Source: Henkel company filings. |

Net Debt was €292m at 2021 year end.

Henkel announced a €1bn share buyback program in January, its first for many years. The amount was equivalent to 3% of Henkel’s market capitalization at the time, will be divided 80/20 between the Preferred and Ordinary classes, and will be completed by the end of Q1 2023.

Management has explicitly stated that the buybacks will not impact Henkel’s ability to make acquisitions, and the company purchased a 90% stake in Shiseido’s APAC Professional Hair business for €95m in February.

Is Henkel Stock A Buy? Conclusion

We are downgrading our rating on Henkel from Buy to Hold, having lost confidence in both its businesses and its management.

The mid-point of Henkel’s 2022 guidance implies an Adjusted EPS that is 25% lower year-on-year and 37% lower than in 2019.

High input cost inflation following Russia’s invasion of Ukraine has exposed continuing weaknesses in Henkel’s consumer assets.

Henkel is far more impacted than competitors. The turnaround since 2020 has not worked, and even more restructuring is coming.

At €60.50, Henkel’s Preferred stock is trading at a 17.7x P/E and a 3.1% Dividend Yield, not cheap enough for the risks involved. Avoid.

We downgrade our rating on Henkel AG & Co. KGaA from Buy to Hold. Investors should avoid the stock.

Be the first to comment