BackyardProduction/iStock Editorial via Getty Images

WeWork (NYSE:WE) has gotten a lot of bad press, and much of it deserved. It over-extended itself financially, prioritized growth over profitability and stability, and came close to collapsing. However, the company has an interesting product and one that has been surprisingly resilient during the post-pandemic period. New management has also taken a lot of steps to reduce expenses and rationalize the cost structure. Over the last two years, starting in Q4 2021, the company has cut its expenses by over $2.6 billion on an annualized basis. It has also exited non-core businesses such as Meetup and Flatiron School.

Green shoots

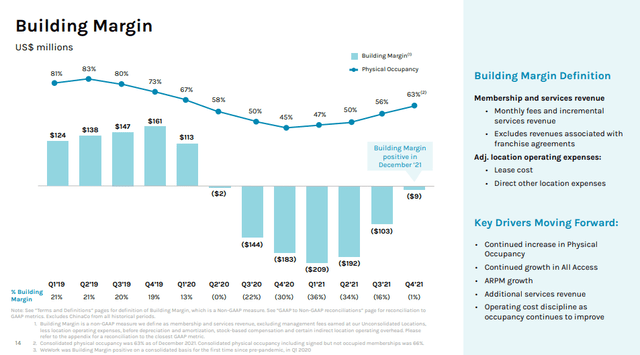

We are starting to see several green shoots, or signs that things are finally turning around for the company, and that it might be on a path to profitability. The company reported in its Q4 2021 earnings call that it was building margin positive in the month of December for the first time since the start of the pandemic. What this means is that the core of the business was slightly profitable during December, but not yet enough to support the centralized SG&A and other headquarters corporate costs. Still, it is a very positive sign and it shows the company is going in the right direction. For the whole quarter, adjusted building margin was still negative $9 million in Q4, a $94 million improvement quarter-over-quarter and a $174 million improvement year-over-year. And as previously mentioned, it crossed into positive territory in December.

Another green shoot is that seven markets had greater than 90% occupancy, including cities such as Miami, Milan, Nashville and Munich. These seven markets had an average occupancy of 94% and a building margin of 41%.

More good news include the fact that physical occupancy was 63% at the end of the quarter, a seven percentage point increase in Q3. If the 21,000 net memberships that were already contracted to move in are counted, then physical occupancy including signed but not occupied members would increase to 66% as of the year-end 2021.

WeWork Q4 2021 Investor Presentation

Finally, there have been some insider purchases. A sign that the people closest to the business are seeing business improvements and an undervalued share price. CEO Sandeep Mathrani purchased 30K shares of common stock at $6.55 for a total consideration of $196.5K.

Financials

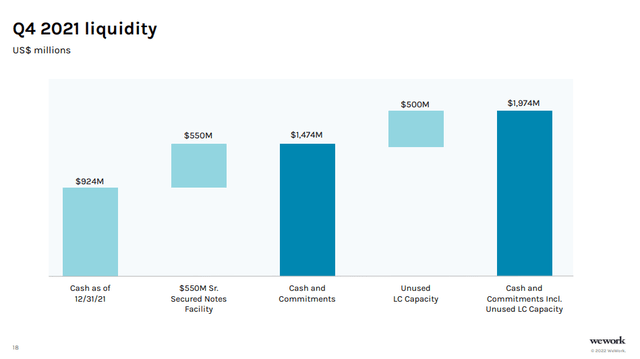

WeWork ended the year with approximately $2 billion in cash and unfunded cash commitments. This includes approximately $924 million of available cash on hand, $550 million available on its senior secured note facility, and an additional $500 million from the letter of credit facility capacity. We believe that this level of liquidity should be enough to fund the company till it reaches profitability, if things go according to plan.

WeWork Q4 2021 Investor Presentation

Looking forward, the company expects financial improvements to continue. For example, it expects first quarter revenue to be between $740 million and $760 million at a midpoint of $750 million. It then expects second quarter revenue to be between $775 million and $825 million at a midpoint of $800 million. The company has high confidence in this guidance given that over 90% of their second quarter revenue is committed to date, which gives them a high level of confidence that they will achieve these numbers.

For the full year, they are expecting to achieve $3.8 billion to $4 billion of system-wide revenue and $3.35 billion to $3.5 billion of consolidated revenue. This would mean that they believe they can reach $900 million to $1 billion of revenue in Q3 and Q4 each, which is a range where they believe they can become adjusted EBITDA positive.

Flexible Work Post-pandemic

One of the surprising results of the pandemic is that it introduced a lot of uncertainty for companies on whether they need or should lease office space, resulting in many opting for flexible arrangements such as the ones offered by WeWork. This has been the case for both large corporations, and small and medium sized businesses. During the last earnings call CEO Sandeep Mathrani summarized this trend in a very helpful way:

Choice and flexibility are no longer a nice to have, but a must have. WeWork has established itself as one of the organizations that’s positioned to support our employees today, want to work in this hybrid and flexible environment.

Before COVID, we saw many companies adopted amenity-rich on-campus experience as a foundation for the employee culture and recruitment strategy. Throughout the pandemic, we’ve heard from these organizations that their priority is finding a way to maintain and foster the same sense of culture and connection in a hybrid world. […] CBRE and JLL have projected flex becoming between 13% and 30% of total office in a post-pandemic world in the US alone, which represents a revenue opportunity of between $45 billion and $105 billion from $7 billion in 2019.

What’s more, the trend appears validated by the percentage of market demand it has taken, which has been much higher than the percentage of office stock that the company represents. As explained during the earnings call:

As we have said in the past few quarters flex office and WeWork in particular has taken an outsized share of the market demand. In 2021, WeWork represented approximately 0.5% of all commercial states in the United States yet made up the equivalent of 9% of the square feet leased in the year. At the market level, WeWork 2021 gross sales in Manhattan were equivalent to 16% of the traditional office market leasing on a square foot basis while WeWork’s portfolio of 5 million square feet accounts for approximately 1% of the total office stock. […] The same is true internationally. WeWork represented approximately 0.5% of commercial office space in our European market yet solely equivalent of 8% of the total square feet leased in 2021.

Equity Issuance

One potential concern for investors is that the company might have to issue new capital to fund losses. But we are not too worried given that the company has enough liquidity to execute its plan, and if it works as expected the company should still have ample liquidity by the end of 2022, and by then it should be adjusted EBITDA profitable. During the Q&A session of the earnings call Sandeep was asked about it and this is what he replied:

So effectively you’re right, we have no intent to issue equity. We were never in the market to have a broader equity issuance. And so I want to reaffirm that. There was a strategic who approached us to make a $100 million investment at a substantial premium through the closing part of Thursday. So we were never in the market. And unfortunately during the trading day, we were prevented from responding to market rumors. So I want to clear the air.

Again, we would only issue equity at a premium to where the PIPE investors came in and we’ve only issued if there was a use for equity. We don’t intend to increase the indebtedness of the company between the LC facility and the senior secured; it’s about $1.50 billion. If anything we may replace the LC capacity with senior secured but it will be more of a mix than anything else. And per our documents, we have the ability to put up $1 billion of senior secured, which we haven’t tapped yet.

Valuation

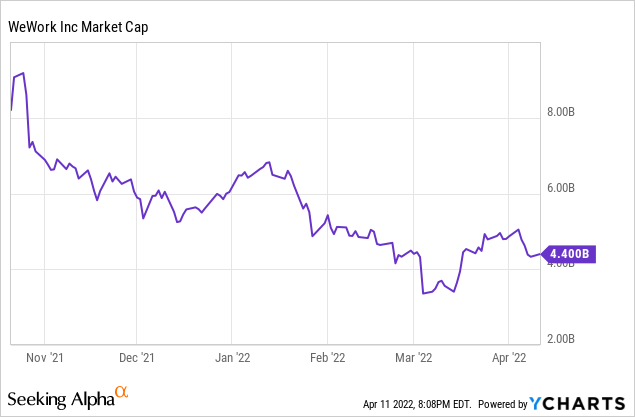

It is difficult to value WeWork given that it currently has negative earnings and much will depend on how occupancy behaves moving forward. That said, we believe the current market cap of ~$4.4 billion offers significant potential upside if the company manages to become profitable. For comparison, management is expecting to reach an annual run-rate of ~$4 billion in revenue by the end of 2022. If at some point the company manages to reach >90% occupancy, we think shares can go up multiples of the current price.

Conclusion

WeWork made a lot of mistakes and destroyed a lot of goodwill with investors. However they seem to have a product that the market likes, and the company is now controlled by new management. The uncertainty that came with the post-pandemic world appears to have benefited the company, with a lot of customers looking for the flexibility that WeWork’s product offers. Their spaces are pre-built, which prevents clients from experiencing supply chain issues or inflated construction and build-out expenses.

There are many green shoots showing positive trends for the company, and if everything continues to go in the right direction the company could become adjusted EBITDA profitable by the end of 2022. We believe the company remains very speculative, but that it offers a high risk / high return, and that is why we have a small percentage of our portfolio invested in WeWork. We would advise against investing too much, as there are still significant risks, but the current share price offers a good potential reward if things turn out okay for the company.

Be the first to comment