MicroStockHub/iStock via Getty Images

Introduction

The oil and gas industry does not necessarily have a good reputation when it comes to shareholder returns after years of disappointments, especially the gas-focused Chesapeake Energy (NASDAQ:CHK) who entered bankruptcy during the severe downturn of 2020 after a drawn-out multiyear fight. Thankfully, following their subsequent Chapter 11 restructuring, they now enter 2022 as a dividend star with a high 8%+ yield on current cost.

Executive Summary & Ratings

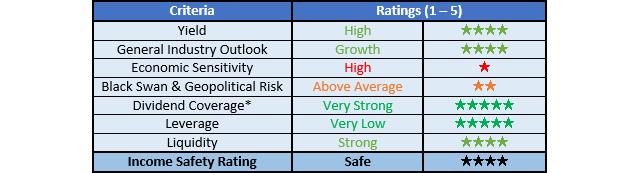

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

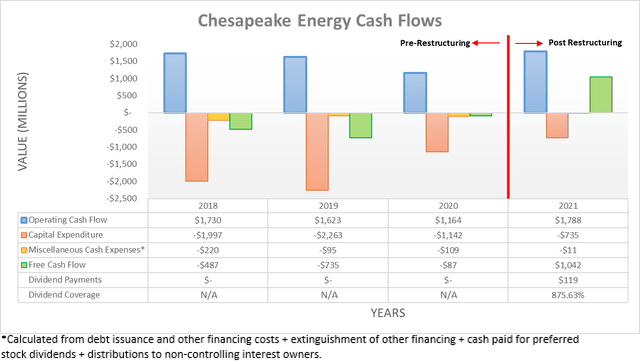

Thanks to gas prices strengthening during 2021 along with economic conditions, their operating cash flow recovered in tandem to end the year at $1.788b and thus broadly back around their usual level before the severe downturn of 2020 and their resulting bankruptcy. Meanwhile, their continued disciplined approach to capital expenditure saw their free cash flow reach the highest point in recent history since at least 2018 with a strong result of $1.042b, which excitedly, saw their first dividend payment begin during 2021. Despite only being a relatively small $119m, when looking at their guidance for 2022, very excitingly this appears poised to surge almost ten-fold, as the slide included below displays.

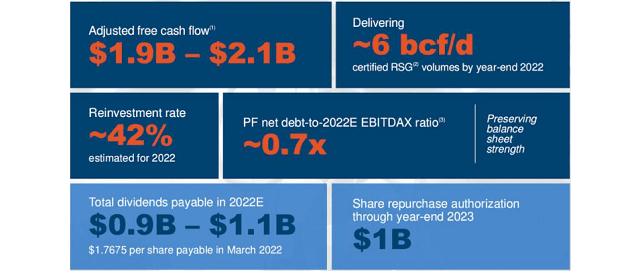

Chesapeake Energy Fourth Quarter Of 2021 Results Presentation

It can be seen management forecasts their free cash flow to essentially double year-on-year to $2b at the midpoint versus 2021 and even more excitingly, they also forecast to send their dividends surging to $1b at the midpoint, which should still see very strong coverage of circa 200%. On their current market capitalization of approximately $12b, which includes their recent equity issuance, this sees a high dividend yield of slightly above 8% on current cost that whilst already desirable, stands to grow even higher in the future.

Apart from the impacts of their accompanying $1b share buyback program that stands to remove circa 8% of their outstanding share count at current market prices and thus boost their future dividend prospects on a per-share basis, the outbreak of war in Eastern Europe stands to provide a very important medium to long-term tailwind. Importantly, their very impressive guidance for 2022 seems to be heavily driven by higher production with their guidance forecasting production of 680mboe/d at the midpoint, thereby representing a massive increase of 47.19% year-on-year versus their production of 462mboe/d during 2021, as per slide six of the fourth quarter of 2021 results presentation. This means that they are still capable of seeing further upside as they capture any higher gas prices in the future, which now seems very likely following the heavily discussed Russia-Ukraine war that has already pushed gas prices to north of $6mmbtu versus their level of circa $4mmbtu earlier in the year when they formed their guidance for 2022.

Even though Europe has only banned imports of Russian coal, thereby leaving oil and gas flowing, this massive geopolitical shock still strengthens their resolve to find new gas supply outside of Russia, thereby reducing their strategic reliance and the resulting national security threat. Despite not being a simple task that will take many years, it nevertheless stands to provide a boom to gas producers in the United States who should see additional LNG-related demand in the medium to long term, as was discussed in detail within my other article for any new readers. Only time will tell the exact extent this boosts gas prices, it nevertheless provides a very supportive outlook that will very likely boost their future financial performance and thus dividend prospects, notwithstanding the tragic loss of life. Even though the prospects to see a high 8%+ dividend yield sounds very exciting, it nevertheless is important to still assess their financial position to ensure these shareholder returns will not be short-lived and only result in another painful bankruptcy.

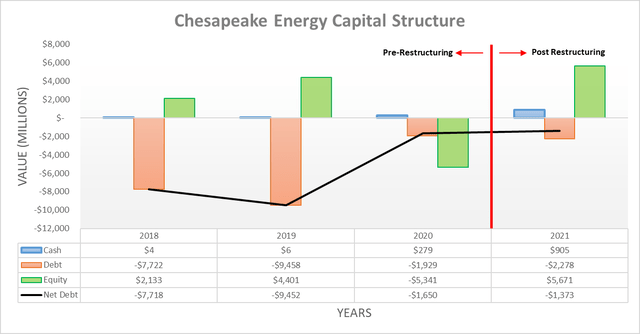

Whilst their chapter 11 restructuring is obviously a painful memory for their former shareholders, it still nevertheless saw their capital structure stabilized. This saw their net debt swapped for equity and thus now ending 2021 at $1.373b and thus well below the massive $9.452b where it ended 2019 heading into their subsequent bankruptcy. When looking ahead, their Chief E&D Holdings acquisition for $2b in cash will push their net debt considerably higher, although their accompanying $450m divestiture of Powder River Basin assets will offset a degree of this increase. Once netted out, this sees their net debt increasing by $1.55b, thereby a bit more than doubling its current level to $2.923b before considering the impacts of their retained free cash flow later in 2022, which will ultimately be determined by how high gas prices rally.

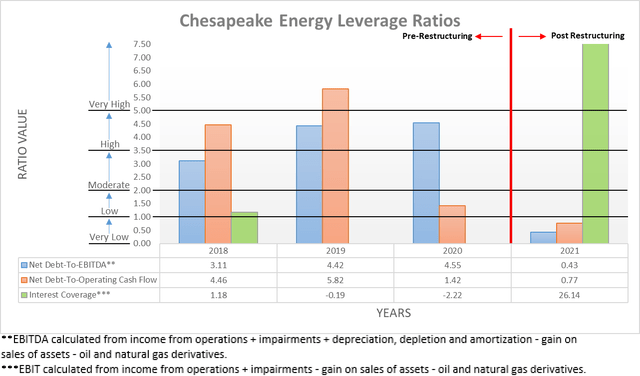

Thanks to their now significantly lower net debt, their leverage is no longer problematic with their resulting net debt-to-EBITDA and net debt-to-operating cash flow now sitting at only a mere 0.43 and 0.77 respectively, which are below the threshold of 1.00 for the very high territory. Meanwhile, their interest coverage is effectively off the charts at 26.14 and thus, unlike during 2018-2019 before their restructuring when it struggled at a very low circa 1.00 or less, they now have no issues serving their debt. Even more impressively, these ratios were derived from their 2021 financial performance that, whilst good, was not a result of particularly strong gas prices that spent the majority of the year below even $4mmbtu, let alone their current level north of $6mmbtu.

When looking ahead into 2022, their significantly higher net debt should be mostly offset by their forecast higher financial performance that, as previously discussed, sees their free cash flow approximately doubling even at lower gas prices than currently prevailing. Since their leverage is already very low, this means that they do not require any deleveraging and thus they can safely afford to fund their dividends and share buybacks, providing that their liquidity is sufficient.

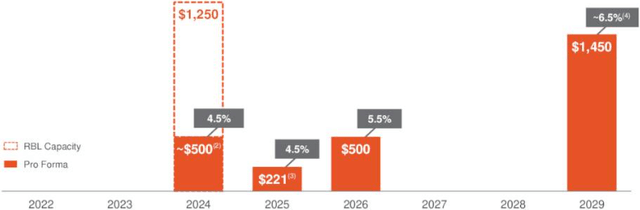

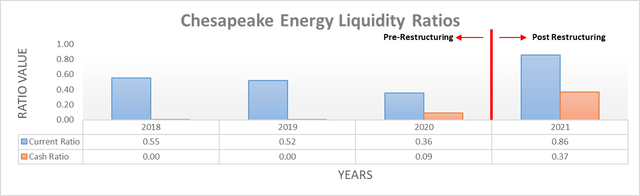

Thankfully their chronically very weak liquidity that preceded their bankruptcy is now firmly in the rear-view mirror with their current and cash ratios now 0.86 and 0.37 respectively. Meanwhile, they also retain a further $1.25b available within their credit facility and face no maturities until 2024, as the graph included below displays. Since this provides further fiscal breathing room to their already strong liquidity, they have no handbrakes upon their shareholder returns.

Chesapeake Energy Fourth Quarter Of 2021 Results Presentation

Conclusion

It feels somewhat odd to think about potentially receiving a high 8%+ dividend yield from a company that not long ago was bankrupt, although they are no longer the once debt-laden company that struggled for years. Apart from standing to generate ample free cash flow, their very healthy post-bankruptcy financial position easily provides support to their dividends, not to mention their share buybacks. When combined with the prospects for even higher dividends in the coming years on the back of potentially higher gas prices as Europe seeks supplies outside of Russia, it should be no surprise that I believe a buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Chesapeake Energy’s SEC filings, all calculated figures were performed by the author.

Be the first to comment