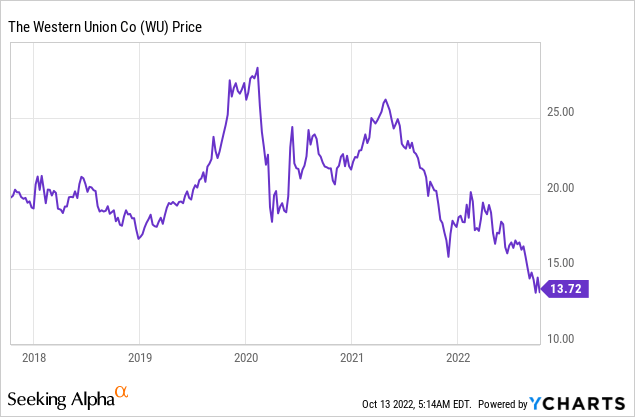

Western Union (NYSE:WU) is a legacy payments giant founded as a telegraph business in 1851, which then became a money transfer business by 1871. In 2006 the company IPO’d and decided to focus fully on cross-border payments. By 2020, Western Union had combined its retail network of over half a million retailers with its digital platform to provide cross-border payments. The company is now continuing to evolve and is executing on a business model shift. The cross-border payments industry is forecasted to increase from $150 trillion in 2017 to over $250 trillion by 2027. This is expected to be driven by a variety of factors including changing consumer preferences, improving technology, and increased trade in emerging markets such as Asia and Latin America. Western Union is poised to ride these growth trends but despite this its stock price is down 48% from its highs in April 2021. In this post, I’m going to break down the company’s evolving business model, financials, and valuation, let’s dive in.

wdstock

Evolving Business Model

Western Union has outlined its updated strategy which includes improving the performance of its distribution network, reinventing retail and digital customer experiences, and focusing more on emerging markets.

Latin America Opportunity

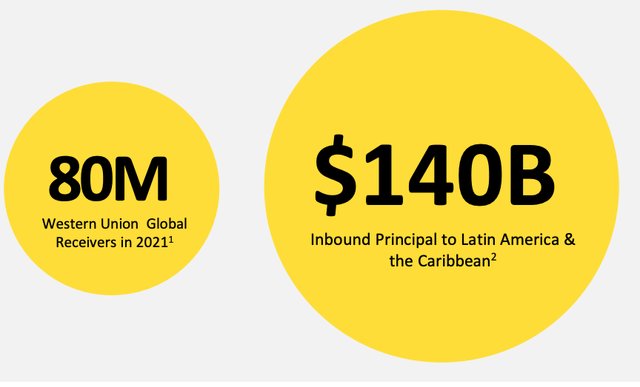

The company has ~80 million “receivers” around the world and huge potential in emerging markets. The Latin America and Caribbean regions generated $400 million in revenue for the company, but little of that revenue came from receivers embedded in the region. According to a World Bank Migration brief highlighted by Western Union’s management, Latin America and the Caribbean will see an extra $140 billion or 40% increase in inbound principal in 2022. Western Union plans to capture some of this potential using its variety of card-based and digital receiving products.

Historically, when doing Western Union money transfer, you would have to go into a corner shop which sometimes cannot offer the safest feeling of trust, especially when depositing larger sums of money. Therefore, it’s no surprise that, out of Western Union’s 1200 locations in Brazil, just 70 (or 5%) of its exclusive experience centers generate over 50% of the country’s revenue. These locations offer a much better customer experience and thus generate more revenue. Management plans to replicate this experience center model across many other locations moving forward.

Western Union stats (Q2 Report)

Digital Platform Updates

Western Union plans to improve its digital platforms (website) and applications through a series of new initiatives. Firstly, the business plans to consolidate the next-generation platform rollout from over 50 country-specific applications to 4 to 6 regional platforms. Its updated Western Union Digital App will also include an improved user experience and various new features to help improve retention. The company has launched in Canada, Australia and is now rolling it out across Europe. Its wallet-based digital banking platform launched in Germany and Romania has proven to be extremely popular with new users, with over 20,000 being signed up year to date.

Western Union has also recently (late September 2022) announced integration with Chinese super chat Weixin (WeChat) to offer cross-border payments to over 1 billion users.

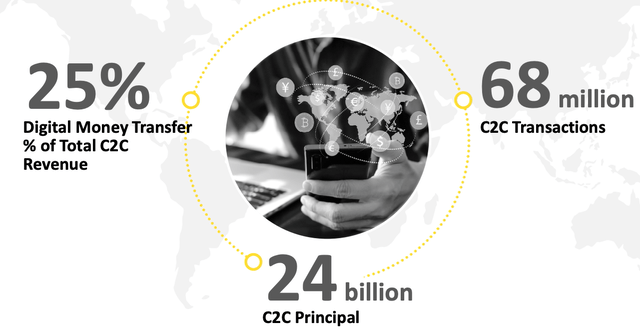

Globally the business has also driven down fraud by 10% year over year and prevented $1.9 billion in fraudulent transactions. Western union transacts ~$24 billion in consumer-to-consumer payments, with 25% of its C2C revenue being via its digital platforms.

Payments (Western Union Q2 report)

Mixed Financials

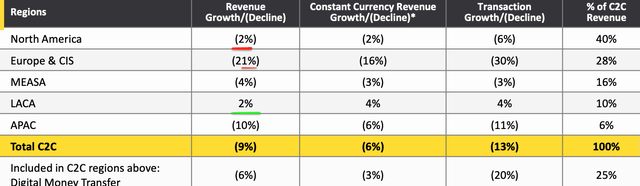

Western Union generated mixed financial results for the second quarter of 2022. Revenue was $1.1 billion which beat analyst estimates by ~$5 million and declined by 12% year over year. 3% of this decline was driven by the suspension of operations in Russia and Belarus. A strong portion of the revenue decline was also driven by a strong US dollar which impacted international revenues. For example, revenue declined by just 4% on a constant currency basis. The overall retail money transfer market had lower demand in the second quarter. The good news is Latin America and the Caribbean showed positive growth of +2% or +4% on a constant currency basis, which highlights the “untapped opportunity” mentioned prior.

Revenue by Region (Q2 Earnings Report)

By segment, Consumer to Consumer revenue decreased by 9% or 6% on a constant currency basis driven by the aforementioned reasons. Western Union website revenue declined by 1% on a reported basis, but actually increased by 1% on a constant currency basis, driven by strong cross-border revenue growth.

Western Union generated solid earnings per share of $0.50, which beat analyst estimates by $0.10 per share. However, this was down slightly from the $0.54 generated in the equivalent quarter last year. This was mainly driven by the gain on an investment sale that was reported in the prior year period. Therefore, if we adjust the EPS to account or this, it was actually up $0.51 vs $0.48 in the equivalent quarter last year. This was driven by a decreased share count and higher operating margin. The “adjustments” also don’t take into account many “one off” costs such as Russia-Belarus exit costs and non-cash expenses related the business pension plan.

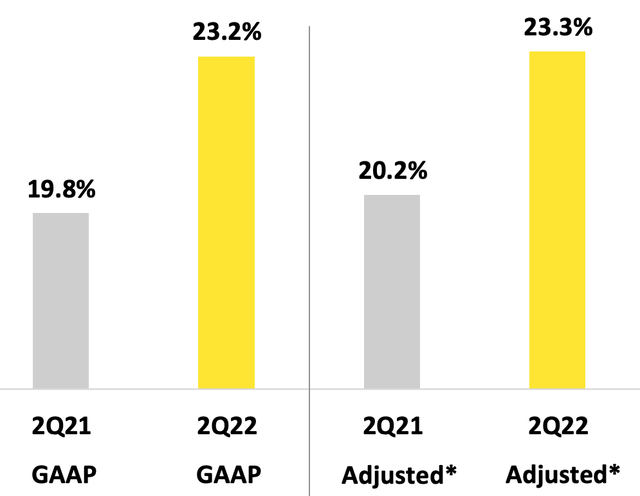

Western Union generates a solid operating margin of 23.2%, which is equivalent to the average of the software industry and thus fantastic, as Western Union really offers a hybrid model. Its Operating margin also increased from the 19.8% generated in the equivalent quarter of 2021. This was mainly driven by a higher margin product mix with more Consumer-to-Consumer transactions related to “other” revenue.

Margins (Q2 Earnings Report)

Western Union generated solid cash flow from operations of $307 million in the trailing 12 months. This includes a “transition tax payment” related to foreign earnings of $64 million.

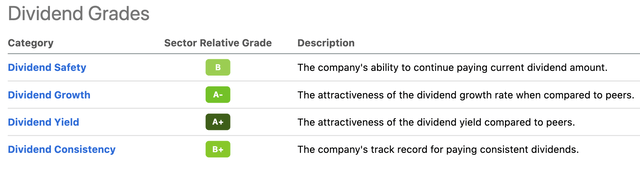

The company has a solid forward dividend yield of 6.85%, which has grown consecutively over the past 7 years. The company has A and B Grades all around for its Dividend safety, growth, yield and consistency which is a positive sign. In the second quarter, Western Union paid out $91 million in dividends and bought back $21 million worth of shares.

Dividend Grades (Western Union)

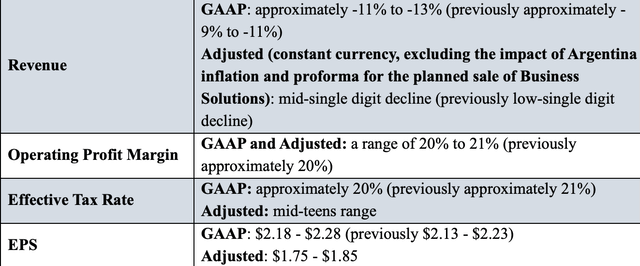

For the rest of 2022, the company expects revenue growth of between -11% and -13% which is mainly driven by macroeconomic tailwinds. The good news is Earnings Per Share is expected to come in higher than previous estimates at between $2.18 and $2.28 per share. Western Union has a solid balance sheet with $1.2 billion in cash and short-term investments. The company does have total debt of $2.7 billion, but the majority of this $2.4 billion is long-term debt, thus manageable.

Guidance (Q2 Earnings Report)

Advanced Valuation

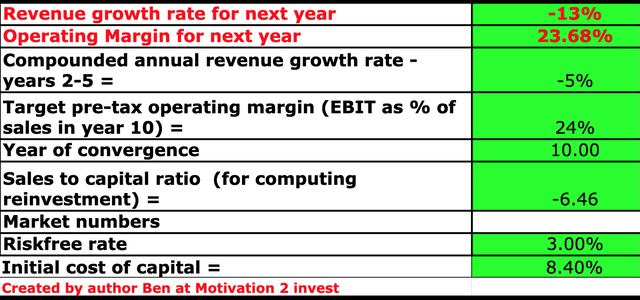

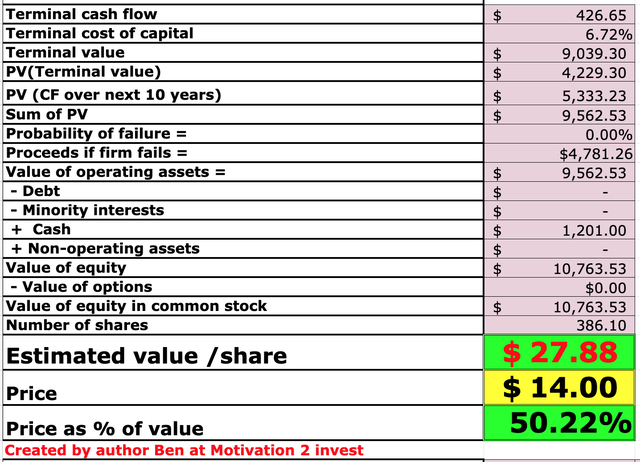

In order to value Western Union, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have conservatively forecasted revenue to decline by 13% next year and 5% per year for the next 2 to 5 years. This is very prudent given the opportunity in Latin America.

Western Union stock valuation 1 (Valuation Model)

I have forecast the business operating margin to stay fairly constant with a slight increase to 24% over the next 10 years. To improve the accuracy of the valuation I have added an “effective tax rate” of 20%, which is down from the 21% previously forecasted.

Western Union stock valuation (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of ~$28 per share, the stock is trading at ~$14 per share at the time of writing and is thus 50% undervalued. Given the estimates are conservative this offers a large margin of safety, as I expect growth in the Latin America region in years 2 to 5 onwards.

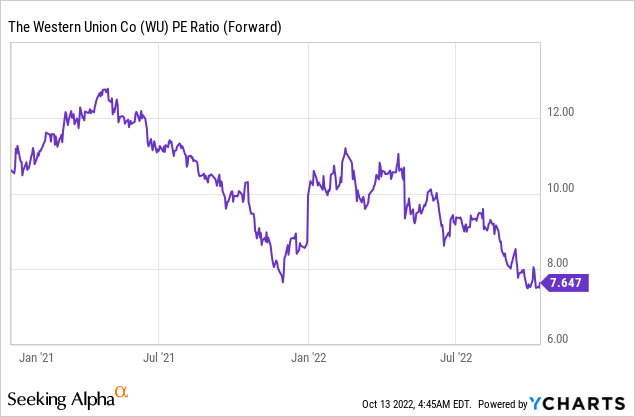

As an extra datapoint, Western Union trades at a forward Price to Earnings Ratio = 7.65 which is 30% cheaper than its 5-year average.

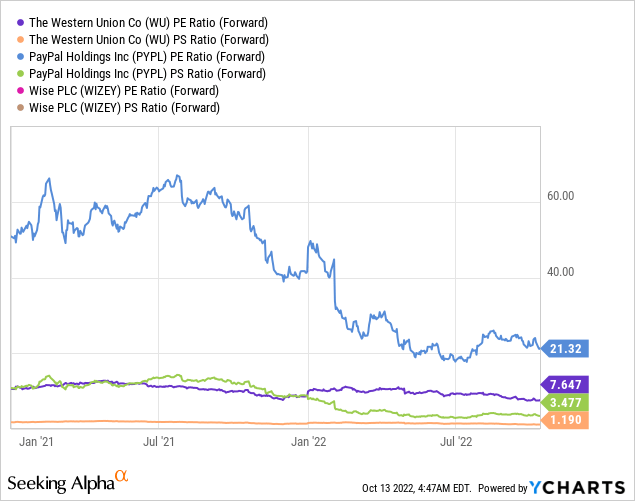

Relative to payment transfer peers such as PayPal (PYPL) and Wise (OTCPK:WIZEY) Western Union trades at a cheaper PE and PS ratio. Wise is a little glitchy on the graph below as a UK stock.

Risks

High Inflation/Recession

The high inflation environment raises input costs for consumers such as food and energy. This puts pressure on spending and thus slows down payment volume. The rising interest rate environment also raises debt servicing costs and impacts consumers and businesses in a similar way. Therefore it’s no surprise that many analysts are forecasting a recession. Even fears of a recession can impact a payment company such as Western Union.

Competition

There is no shortage of fintech payment providers which provide international transfers, from Paypal to Wise, Revolut, and more. This industry competitiveness is what makes each payment transfer provider hard to differentiate from one another. Generally, it comes down to fees Wise formerly transfer wise generally offers the lowest fees from my research. However, I have noticed Western Union is popular with transfers to China, Africa, and Latin America.

Final Thoughts

Western Union is shifting its business model to take advantage of the growing international payment opportunity in places such as China and Latin America. The company has a vast amount of potential and given its high profitability and low valuation, this offers a fintech opportunity for the long-term investor.

Be the first to comment