golero/E+ via Getty Images

We have tracked Danaos Corporation’s (NYSE:DAC) developments for the past five consecutive quarters, and with another trading period reported this week, the time has come for another update. If you are new to Danaos’ investment case, please go here and read my past updates, as this article assumes you are familiar with the broad idea of it.

In this short update, we are going over the key topics for which we got new developments. Specifically, we will discuss:

- ZIM Integrated Shipping Services (ZIM) taking the boot;

- The recent refinancing and Danaos’ net debt staying on track to reach 0;

- Danaos’ recent Buybacks and their future prospects.

ZIM Integrated Shipping Services Got The Boot

One of the biggest developments from Danaos’ Q3 report was that their remaining equity stake in ZIM was sold off entirely. In Q2, Danaos made no changes in its ZIM stake. Thus, seeing the company dump the rest of its shares only after ZIM declined further may have disappointed some investors.

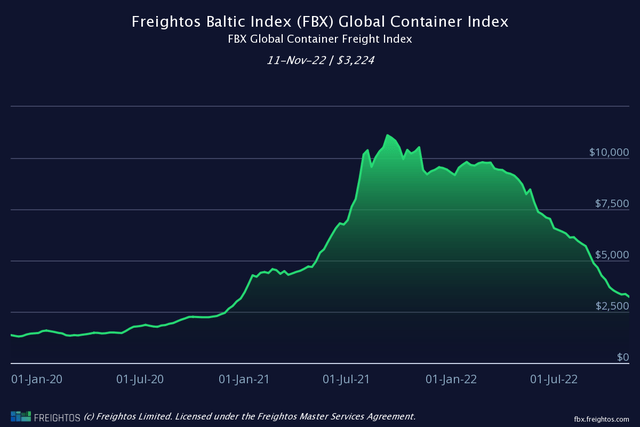

However, we have to remember that it would have been an incredibly hard to time the perfect exit. Unlike Danaos, which is a containership lessor, ZIM is a liner, with its earnings directly affected by the ongoing, violent changes in freight rates. As you can see, containership rates have been plummeting from last year’s unsustainable record levels, and shares of ZIM have followed the same path.

Global Container Freight Index (freightos.com)

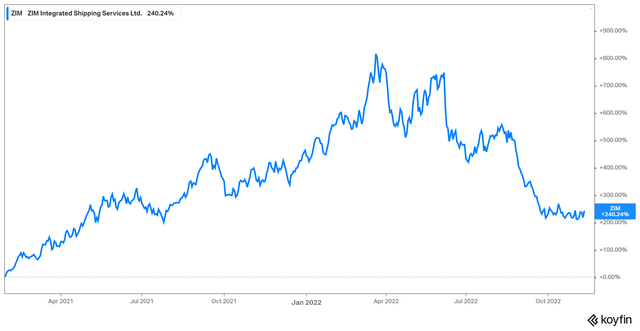

However, ZIM has also been considered rather undervalued in the shipping community lately, so we can see why Danaos’ management could have also been reluctant to sell earlier. Regardless, ZIM has been quite a profitable asset for Danaos. Sure, if Danaos had sold their shares close to $90, we would have made a boatload more money, but even by selling ZIM at an average price of $28.36 ($161.3 million in proceeds/5,686,950 shares), DAC benefited from ZIM quite substantially.

As you can see, even with shares of ZIM now trading close to $25, lower than Danaos’ average selling price, the stock has returned over 240%, including its massive dividends since its public listing. An 800% return would have been nicer, but it is what it is.

ZIM’s total returns since public listing (Koyfin)

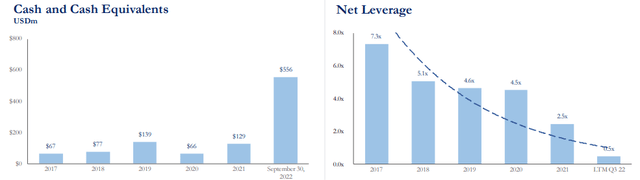

The combination of Danaos’ own operating cash flows, gains from its ZIM stake since its public listing (inc. dividends), and continuous repayment of its own debt have piloted the company to be on track to reach a net debt of $0 by the end of the year.

Danaos’ Net Debt On Track To $0

Danaos has made tremendous progress in reducing its net leverage over the past five years. From 7.3X in 2017, it stood at just 0.5X at the end of Q3. Besides the company’s own profitability resulting in cash accumulation and debt pay downs, ZIM’s share price gains over the past year, along with any dividends received from ZIM, have also contributed to the decline in net leverage.

Danaos’ Cash & Net Leverage (Koyfin)

Additionally, in Q3, the company reached an agreement with Citi and Alpha Bank to refinance the presently outstanding debt facility of $437.75 million, which will have two major effects on Danaos.

- A 2.5-year maturity extension of the refinanced debt by 2.5 years and the creation of a 5-year runway with no maturities before 2027; and

- Increased flexibility in the current revolving facility with Citi.

With that in context, in the company’s earnings call, Chairman, President, and Chief Executive Officer, Mr. Coustas, stated (emphasis added):

This means we have no significant capital requirements or re-financings until then [2027], and we have the necessary flexibility to pursue our strategy of growth, share buybacks, and acquisitions. In fact, our net debt will be very close to zero by the end of this year, which protects Danaos from the recent dramatic increase in interest rates.

That last point is quite important. Shipping companies have historically carried significant amounts of debt on their balance sheet, with heightened interest expenses killing their profitability. The fact that Danaos is insulated from rising rates, combined with the fact that, following the refinancing, Danaos will triple the unencumbered and debt-free fleet to 45 vessels versus 15 vessels currently, has resulted in its balance sheet being (one of) the healthiest one(s) in the industry.

Buybacks – Please, More buybacks

We have repeatedly discussed why Danaos’ asset base, combined with the value of its secured leases, should value the company significantly higher than its current market cap levels.

Based on our own estimates, along with some others we’ve seen from different analysts in the space, Danaos should be worth anywhere from $125 to $155 per share. It’s hard to come up with a specific number, as the underlying value of Danaos’ vessels can change over time, and each analyst may use different discount rates. Still, we believe that this range is relatively accurate.

With shares trading as low as $53 during Q3, we are quite certain that Danaos is trading at a massive discount to its NAV. We understand that the market may be scared of the ongoing decline in rates, along with the uncertainty regarding how rates will look beyond 2023 (when the company’s leases will start being renewed based on those rates at that time), which could result in a modest discount. The current discount, however, is entirely ridiculous.

Analysts and investors have practically begged management for buybacks at this point, and indeed, in its Q3 report, we learned that Danaos had already repurchased $28.6 million of stock as of November 7th under the $100 million share repurchase program announced in June.

On the one hand, that’s a decent amount of stock bought back. On the other hand, we already knew that Danaos had repurchased $25.1 million worth of stock as of its Q2 release date on August 1st. So this means that between August 1st and November 7th, only $3.5 million worth of stock was bought back, implying a disappointing deceleration. So what happens now?

The way things look, the stars have aligned for Danaos to ramp up buybacks dramatically. Their charter backlog of $2.3 billion through to 2028 is massive, the stock is dead cheap, net debt approaches $0, and the recent refinances have resulted in no maturities till 2027. Danaos’ current and forthcoming cash has to go somewhere.

In the above quote of Mr. Coustas, he did mention using Danaos’ cash for buybacks, but he also added the word “acquisitions” to the list of potential candidates for capital allocation. The thing is, it would be sad to see Danaos acquire anything other than its own stock at this point. Even if they go and buy an undervalued company, their stock is probably cheap here. When management was pressured further in the earnings call regarding the future fate of buybacks, Mr. Coustas stated (emphasis added):

Yes. Well, Omar, as I said, we will wait. We said — but we will continue with the share buybacks. And we’ll have to really wait and see when the opportunities come.

Ok, the last part is funny. What opportunities? Let the discount to NAV approach 80%? But still, we see that buybacks are on management’s mind, and with the most recent developments discussed, they should feel more comfortable with repurchases.

In the meantime, we wait. There’s nothing else to do. We will wait for Danaos to generate all these monster cash flows that will hit the balance sheet over the next two to three years while we collect the 5.3%-yielding dividend. And, as Danaos starts getting drowning in cash, we anticipate that either through buybacks (preferably), other acquisitions, or the P/NAV reaching absurd levels, Danaos Corporation stock will climb to the much higher price point it deserves.

Be the first to comment