MoMo Productions

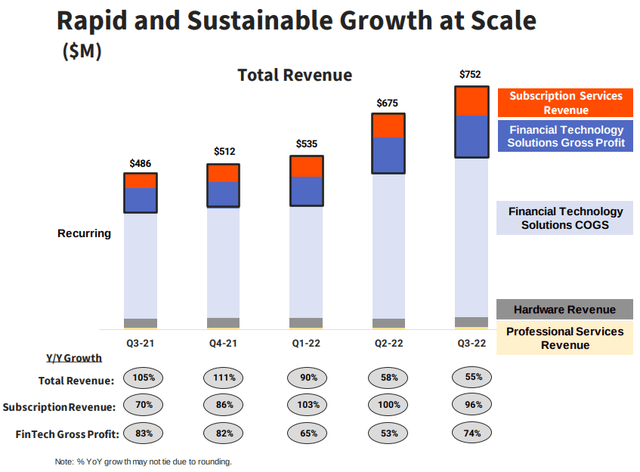

Toast (NYSE:TOST) just reported third quarter results, and we are encouraged by the numbers. The big news is that Toast has now surpassed $100 billion in annualized gross payments volume (GPV) for the first time. The company grew revenue 55% y/y to $752 million, and ARR was up 60% to $868 million.

A big positive was strong location growth, with the company adding approximately 5,500 net new locations and ending the quarter with approximately 74,000 total locations. This is particularly important, as we view location growth as the most sustainable source of growth for the company, and the foundation for add-on services and module sales. With respect to add-ons, the company announced Toast invoicing, a new product to help restaurants manage catering and wholesale orders alongside their in-store take out and delivery businesses.

One fact shared during the earnings call that we found particularly interesting, and which has been a tailwind for the company recently was that the company is seeing that the cost of food at home is growing faster than the cost of food away from home. This has encouraged consumers to eat out more often at restaurants.

The big takeaway for us this quarter is that growth remains strong and the company still has a long runway of growth, with less than 2% of the $55 billion US market it still has a huge opportunity ahead.

Q3 2022 Results

Revenue and adjusted EBITDA both come in above the high end of the prior guidance given by the company. Annualized Recurring Run-Rate (ARR), which is the core operational metric for the company, ended Q3 at $868 million, up 60% y/y. Total revenue grew 55% y/y to $752 million. We are happy to see that ARR is growing faster than total revenue, as this is the most attractive type of revenue for the company.

Subscription revenue and fintech gross profit totaled $224 million, up 82% y/y, driven by continued location growth and healthy average revenue per user (ARPU) increases across both SaaS and fintech solutions.

Financials

The company delivered a gross margin of 21.8%, with improvement in each of their reporting lines, which led to an over 300 basis points gross margin improvement compared to Q2.

The take rate in the quarter was 53 basis points, with two factors driving the take rate increase. One is payment optimization, with the other being healthy demand for its Toast Capital product. Total Q3 adjusted EBITDA was negative $19 million, resulting in a negative 2.6% margin. Still, this was a 230 basis points improvement quarter over quarter.

The company sounded confident that through operating leverage it should manage to deliver a quarterly adjusted EBITDA profit by the end of 2023. It expects operating leverage particularly in its G&A expenses.

Growth

We were pleased to see that revenue growth was underpinned by strong location growth. The company has grown locations from ~52,000 in Q3 2021 to ~74,000 at the end of Q3 2022. This has resulted in very healthy total revenue growth, and importantly, subscription revenue and FinTech Gross Profit have grown faster than overall revenue.

One area where we think the company could be more aggressive is international growth. There was a question during the Q&A session of the earnings call that asked about these international opportunities, and this is what CFO Elena Gomez has to say about it:

I’ll start by saying we’re super early in the international opportunities but very encouraged already by what we’re seeing, but I would view — we view 2022 is really a building year and into 2023, frankly.

We talked earlier in the year about our investment level. It hasn’t changed. We’re kind of on the low end of the range of $10 million to $20 million that we talked about. And I would tell you, as the year has gone on, the investment has been increasing, obviously, as we’re building the team out.

But it’s still early. We’re evaluating all the things that you would expect the go-to-market motion, making sure we understand the product that we want to put out there in international.

We’ve got a few early customers in Canada, Dublin and U.K. So we’re learning from our early customers. And so far, the feedback has been really encouraging. So we’re going to continue to make that investment into 2023.

Balance Sheet

The balance sheet remains quite healthy with more cash and short-term investments than long-term debt. It is clear, however, that the company is currently burning cash, and cash has been decreasing. At the end of Q3 cash and cash equivalents were $644 million, down from $809 million at the end of December 2021. Marketable securities (short-term investments) were $409 million at the end of the quarter, compared to $457 million at December 31st 2021.

While we are reassured that the company still has over a billion dollars in cash and short-term investments, we will be watching the cash burn closely as the company has yet to turn operating cash-flow positive.

Guidance

For Q4 Toast expects revenue to be in the range of $730 million to $760 million, which represents 46% y/y growth at the midpoint, with adjusted EBITDA expected to be in the range of negative $30 million to negative $20 million.

For the full year revenue is expected to be in the range of $2.69 billion to $2.72 billion, a 59% y/y increase at the midpoint. The updated full year adjusted EBITDA guidance range is negative $127 million to negative $117 million, a nearly $30 million improvement at the midpoint from the company’s previous guidance.

Importantly, Toast expects net location adds to be in a similar range as Q3.

Valuation

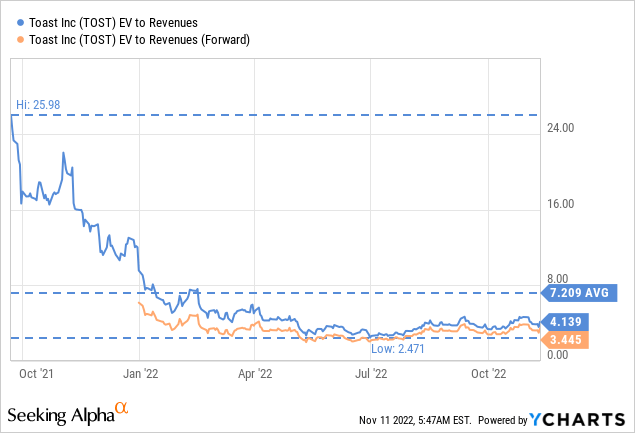

It is difficult to value Toast given that it has yet to become profitable. It is currently not even adjusted EBITDA profitable, so we have to rely mostly on its revenues to judge the current valuation. Given how quickly Toast is growing its business, and the fact that it estimates it could turn adjusted EBITDA profitable by the end of 2023, we believe its current valuation to be reasonable. Its enterprise value is currently ~$9 billion, which is roughly 10x its Annualized Recurring Run-Rate, and its forward EV/Revenues multiple is ~3.4x.

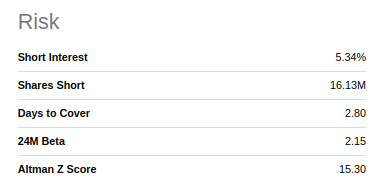

Risks

The biggest risk we see with an investment in Toast is that the company has yet to become operating cash flow positive, and it maintains a relatively high cash burn. On the positive side, the company is showing profitability improvements and has a healthy balance sheet with significant cash and short-term investments. The company has a strong Altman Z-score of ~15.3x.

Seeking Alpha

Conclusion

Toast delivered a strong quarter, maintaining high growth while showing profitability improvements. The big takeaway for us this quarter is that the opportunity in front of the company remains quite large, meaning it still has a long growth runway ahead. Toast believes it could potentially turn adjusted EBITDA profitable by the end of 2023. At roughly 10x Annualized Recurring Run-Rate we view shares as reasonably valued.

Be the first to comment