vzphotos

Editor’s note: Seeking Alpha is proud to welcome FinDay Stocks as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Western Digital (WDC) has been on the rise, and since the beginning of the month, the stock price has already increased by more than 10%. After performing a DCF analysis, we believe that the stock still has the potential to go higher. Based on our analysis, the fair value of the company is $41.69 per share, and major valuation multiples show that the company is undervalued. Because of all this, our investment call on WDC is that it’s a buy.

About the company

Western Digital is an American company best known for the production of internal and external hard drives. It offers a wide range of products, with hard drives released in six varieties that are divided by their potential purpose – from high environmental friendliness and energy efficiency to those designed for round-the-clock use and high loads. In addition to hard drives, the company produces hardware and software solutions to support data centers, peripheral computing centers, and IoT devices.

Revenue for fiscal year 2022 is $18.79 bln (+11.05% YoY) and breaks down as follows:

- Flash – $9.75 bln (+12.02% YoY)

- HDDs – $9.04 bln (+10.02% YoY)

Here’s out it all breaks out in terms of geography:

- Asia – $10.05 bln (42.7% of total revenue)

- America – $5.87 bln (37.6% of all revenue)

- Europe, Middle East and Africa – $2.87 bln (19.7% of all revenue)

Growth Triggers

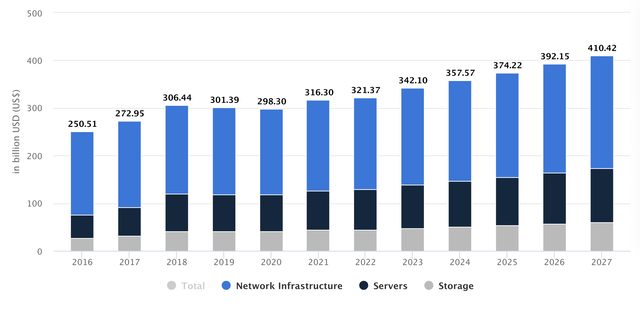

The main and fastest-growing market for the company is cloud infrastructure products, which accounted for more than $8 billion in 2021 (40% annual growth). The growth of the data center market could contribute to the further growth of the company’s cloud segment. According to Statista, the data center market was $250.51 billion in 2016, is expected to be $321.37 billion by the end of 2022, and is projected to grow to $410.42 billion by 2027. In this case, from the end of 2022 to the end of 2027, the average annual growth rate will be 5.01%.

The storage market, which is a part of data center market, is expected to grow in monetary terms. In 2022, the storage market is expected to be $44.7 billion (2.45% annual growth), and by 2027 the market is expected to have reached $59.52 billion, as shown in the chart below.

Statista

The consulting company BlueWeave Consulting is a bit more modest in its forecasts and expects that by the end of 2028 the total size of the market will have accounted for $404.9 billion. An exceptionally positive outlook is given by the research company Technavio, predicting that the market will grow to $615.96 billion over the period of 2022-26. However, we think that the forecast made by Technavio is too optimistic and believe more in the forecasts of Statista and BlueWeave Consulting. So, market growth is expected to be high, which should stimulate further growth of Western Digital.

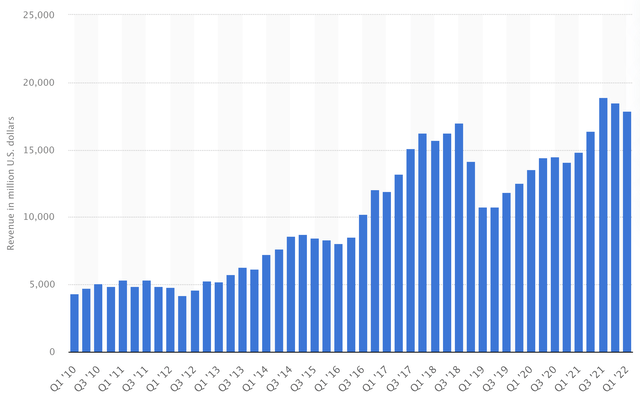

Another trigger for the company’s growth is the growth of the NAND flash market. In the first quarter of 2022, the total revenue of all companies in this market was $17.9 billion. This value is very close to the record volume of $18.7 billion, which was achieved in Q3 2021. The bar chart below shows the dynamics of this indicator.

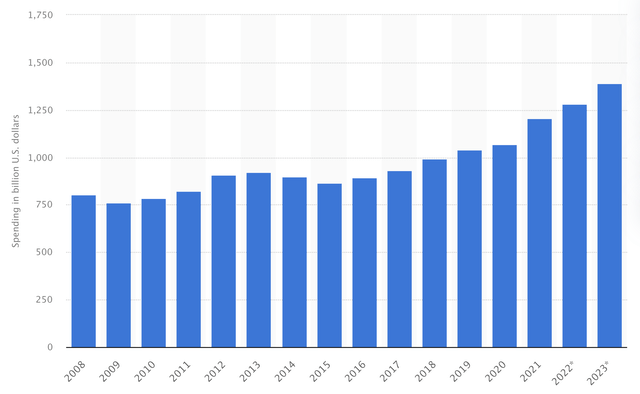

The growth of the company might also be affected by the increase in spending on IT services around the world. Below is a forecast of IT spending until 2023. However, this forecast might not consider recession risks.

Finance

The company has a high gross margin, amounting to 26.72% and 31.26% in 2021 and 2022, respectively. Despite the fact that projected sales significantly dropped in the current fiscal year 2023, we do not expect the gross margin to decline. We believe that in the long term the gross margin will be 31%.

The company’s profitability is at a good level as well. In 2022 the net profitability was almost 8%, compared to 4.85% a year ago. In the next five years, we expect the net profitability to decrease to 5-6%.

The company has a fairly high debt load, with net debt of almost $4.7 billion. However, the current liquidity of Western Digital looks good and equals 1.8. Also, interest expenses are decreasing and the amount of cash on the balance sheet is sufficient, so the company will not have any problems with debt servicing in the foreseeable future.

Western Digital has no problems with cash flow; the P/OCF ratio is 6, with a median value of the company equal to 12.9. By way of comparison, its main competitor Seagate (STX) has a P/OCF of 6.8. As for free cash flow, in 2022 it amounted to $758 million. Considering the decrease in sales in 2023, we can also expect a decrease in FCF, but its size will still remain at a fairly good level.

Risks and Competition

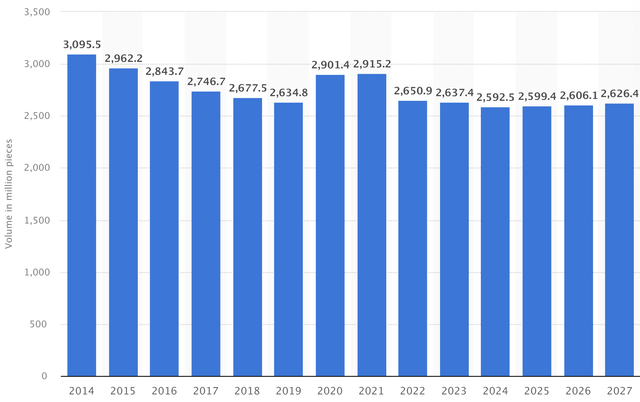

The volume of storage units worldwide is decreasing. Statista predicts that from 2021 the volume of storage units will decline until 2026, after which it will continue to rise again, as shown in the chart below. We hope the growth comes sooner.

Statista

The company has a well-known brand, but the “customers” and “clients” segments, which are not related to the cloud solutions market, are stagnating. This year, the overall decline in these segments was 3.77%. The volume of global shipments of HDD is also falling – in 2021 these shipments amounted to 258.9 million units (a year-over-year decrease of 2%). The largest shipment was in 2010, when more than 650 million units were shipped. The decrease in shipments is also associated with an increase in the capacity of hard drives and an increase in demand for solid state drives (SSDs), which are also the company’s products. As a result, we do not expect a sharp increase in sales of these segments in Western Digital in the next few years.

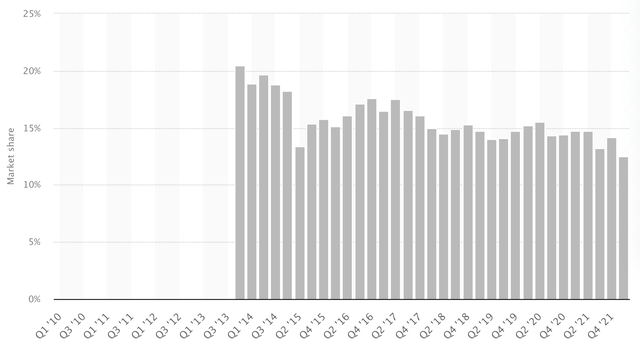

It should be noted that the company operates in a fairly competitive market. Its main competitors include well-known companies such as Seagate, Dell (DELL), Micron (MU), etc. It’s not easy to withstand such serious competition, and for this reason, WDC’s market share in the NANT flash market is declining, as shown below.

Western Digital is also behind its main competitor Seagate in the market of HDD supplies, with a market share of 36% at the end of 2021. Seagate is the market leader with a 43% market share. However, most competitors are currently priced higher than Western Digital.

Evaluation

According to multipliers, the company is estimated quite cheaply. At the current level of capitalization, and given the expected decline in revenue in 2023, by the end of next year, we forecast P/S around 0.7, which is still below the Western Digital median of 0.9. By way of comparison, the company’s main competitor, Seagate, has a P/S of 1. Western Digital’s P/E ratio is around the industry average of 7.5, while Seagate’s is slightly better at 6.8. In terms of book value, Western Digital is also valued at a discount. The company’s P/B ratio is 0.9 with a median value of 1.5. This figure looks especially good compared to Seagate, whose P/B is 103.5 due to high debt.

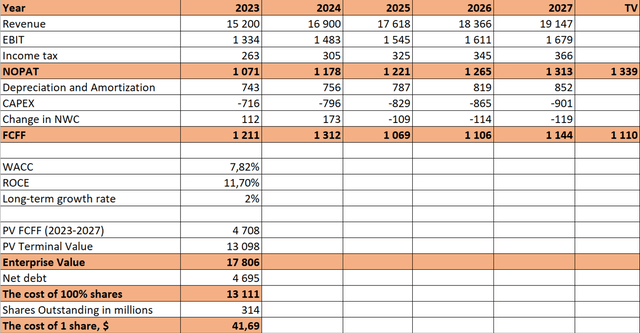

DCF analysis

Although the result of DCF analysis is always a range of values, below is the calculation of the fair price according to the “base” scenario, which is the most probable. All data are presented in millions, except for the value of one share. It’s important to keep in mind that most analysts and investment houses, in our opinion, have an overly positive outlook on the target value of the company’s stock. In our forecast, we proceeded from the principle of conservatism and have come up with a fair price of $41.69 per share.

DCF analysis of WDC by FinDay

Conclusion

The company has a strong and well-known brand and produces high-quality products for various purposes and tasks. The amount of spending on IT services is growing worldwide, which is why the cloud storage market is expected to grow in monetary terms. However, it’s necessary to think about recession and its possible impacts. SSD shipments are growing along with increased sales of NAND flash products worldwide while HDD shipments are falling. As a result, we expect Western Digital’s sales to decline over the next few years.

Despite the decline in sales, Western Digital has a high level of financial strength and is still at a discount to the current capitalization. Given all of this, our recommendation is to buy shares.

Be the first to comment