RoschetzkyIstockPhoto

Article Thesis

Rivian Automotive, Inc. (NASDAQ:RIVN) announced a recall for almost all of the vehicles it has ever produced. The market sent Rivian’s shares lower, as this recall will have an impact in the near term while also potentially impacting Rivian in the long run due to the potential brand damage this could cause. That being said, there is also some recent positive news when it comes to Rivian, as the company is sticking with its 2022 production forecast despite ongoing supply chain disruptions around the globe.

What Happened?

Rivian announced that it would recall around 13,000 vehicles. That may not sound like a lot relative to the recalls legacy automobile companies do from time to time, but for Rivian this is a huge issue — that number represents almost all the vehicles the company has ever produced, as Rivian only started producing vehicles for their customers late last year. The recall was issued due to problems with a fastener in its steering system.

While analysts and the company state that this will be an easy-to-fix issue that will not be especially time-consuming or costly to handle, Rivian could still be impacted in several ways. Not surprisingly, the market which has been jittery in recent weeks anyway, saw this as a reason to send Rivian’s shares lower by 9%, destroying around $3 billion in market capitalization — which might be an overblown reaction to this headwind.

Potential Near-Term And Longer-Term Fallout

This recall could impact Rivian in several ways. First, problems with its steering system could lead to increased quality controls for newly produced vehicles and might require some changes there, thus production could be impacted for a while. On top of that, the company will have to utilize resources for handling/managing the recall, which could hurt its progress in other areas, such as growing its sales channels or expanding awareness of its brand. On top of that, fixing the issue will cause some one-time expenses, meaning Rivian’s net loss and cash burn in the current quarter will likely be somewhat higher than previously thought. The fact that the fastener is easy to fix makes it likely that this recall will not be overly costly, however. These are short-term issues and should not impact Rivian in the longer run.

There is, however, also a longer-term impact to consider. Rivian’s vehicles aren’t especially cheap, and the company is marketing its EVs with a premium angle. Reliability or production issues could thus hurt Rivian’s brand perception in the eyes of some consumers, as EV buyers that spend at least $68,000 for one of Rivian’s trucks will want to receive a high-quality vehicle for that price. Rivian already had a recall not too long ago, and too many recalls in a short period of time could make some consumers believe that the company is having serious production issues. This also doesn’t paint a rosy picture when it comes to Rivian’s internal quality controls, as errors are ideally found before vehicles are sold and customers are impacted.

Other premium manufacturers have had recalls in the past as well, such as Mercedes-Benz (OTCPK:MBGYY), BMW (OTCPK:BMWYY), and Tesla (TSLA). This didn’t hurt their brands in the long run, and demand for these higher-priced products remains strong. The same could happen to Rivian, thus the recall is not necessarily an absolute disaster. That being said, I believe that Rivian should be highly interested in handling the recall well in order to not to anger its customers. The fact that Rivian has announced that loaner vehicles will be made available at no cost is a positive in that regard, showing that Rivian is not penny-pinching when it comes to offering a positive experience (considering the circumstances) for its customers that have paid a premium price for their vehicles.

The same holds, in principle, true for Rivian’s relationship with Amazon (AMZN), as the EVs built for Amazon are impacted as well. When Rivian handles the recall well and causes only minor issues for Amazon, Amazon should continue to hold onto its relationship with the EV manufacturer. If Rivian were to mishandle the issue with Amazon (which I do not see as particularly likely), Amazon might make some changes to its strategy of electrifying its fleet — which could hurt Rivian’s sales prospects in this space considerably in the long run.

We can thus say that this is not a non-issue for Rivian, as there are some near-term impacts and since this might also cause longer-term headwinds. But if the recall is handled well, the longer-term fallout shouldn’t be especially large, I believe, thus this does not seem like a company-threatening problem.

Production News Is Positive But Profitability Is An Issue

While news about this recall isn’t positive, not everything is looking bleak for Rivian. The company recently announced its Q3 production and delivery numbers that were better than expected. While many automobile companies, both EV startups and legacy companies, continue to face challenges due to supply chain disruptions around the globe (Russia-Ukraine war, lockdowns in China, etc.), Rivian has managed to continue growing its production levels despite these macro issues. The company produced 7,400 vehicles in Q3, for a hefty 67% increase on a quarter-to-quarter basis. That growth rate will not be maintained forever of course, but it shows that the company has managed to successfully ramp up its production relatively well in the recent past.

For the current year, Rivian is forecasting sales volumes of 25,000 vehicles, thus continuing to expect deliveries will come in around the level the company guided for previously. That should result in revenues of around $1.8 billion, calculated with an average sales price of a little above $70,000.

Unfortunately, Rivian will by far not break even with production numbers at this level. During the first two quarters of the current year, Rivian burned through billions of cash, and the company’s own guidance sees adjusted EBITDA coming in at -$5.5 billion for the year — that’s an EBITDA loss that is around three times as high as the expected revenue for the current year. Analysts aren’t very positive when it comes to next year’s expected profitability, either, as Wall Street is forecasting an EBITDA loss of $4 billion for 2023.

That makes it likely that Rivian will need to raise capital in the next couple of years. Morgan Stanley has estimated that Rivian will have to raise $6 billion in the 2023-2025 time frame — around 20% of the company’s current valuation. How many shares Rivian would have to sell to achieve that depends on the future share price, but at current prices that could cause a 20% increase in Rivian’s share count — on top of the regular share issuance to employees and management.

Is Rivian A Good Investment?

Rivian’s vehicles are well-engineered and have received pretty positive reviews. Recent recalls show that there are some quality control issues, but that may be expected from a still pretty new automobile company without a lot of production experience. As long as these recalls are handled well, they will hopefully remain a near-term issue without a large long-term impact. Rivian is ramping up production successfully, which is not a given in the current macro environment with all kinds of supply chain headwinds.

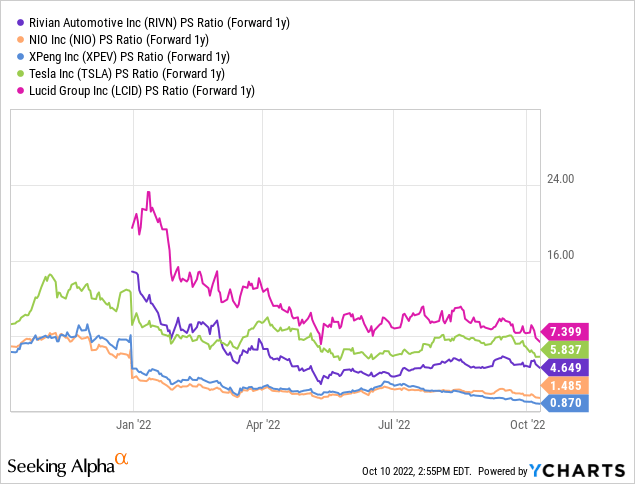

On the other hand, Rivian is burning large amounts of money, is far from profitable, and will likely have to raise capital again. And yet its valuation isn’t low. Based on current forecasts, Rivian trades for 5x next year’s revenue:

That’s a lower valuation compared to Tesla and Lucid (LCID), but a way higher valuation compared to EV players such as NIO (NIO), XPeng (XPEV), or BYD (OTCPK:BYDDY). With Rivian likely being unprofitable for the foreseeable future in a macro environment that gets harsher, both when it comes to accessing debt markets and equity markets, I personally do not deem the company especially attractive right here. Valuations across the whole industry might compress, and execution risk for Rivian is likely larger compared to EV manufacturers that have better scale and production experience already. All in all, I’m neutral on Rivian and currently not interested in buying into its shares.

Be the first to comment