Nordroden/iStock via Getty Images

The Q1 Earnings Season for the Gold Miners Index (GDX) is just around the corner, and one of the most recent companies to report its results is Wesdome Mines (OTCQX:WDOFF). Unfortunately, the company had a slow start to the year with much lower production sequentially at its Kiena and Eagle River mines. While this might be a disappointment short-term, the long-term picture remains solid, with Wesdome boasting industry-leading grades and growth. Given its unique combination of growing production at increasing margins, I see Wesdome as a name to keep a close eye on if we see sector-wide weakness.

Kiena Mine Operations (Company Report)

Wesdome Mines released its preliminary Q1 results last week, reporting quarterly production of ~25,600 ounces of gold, a 38% decline on a sequential basis (Q4 2021: ~41,600 ounces). The main culprit for the weaker production results was Kiena, where production slid to ~5,100 ounces, down from ~16,900 ounces in the previous quarter. However, Eagle River also saw a sharp dip in production, with just ~19,300 ounces produced, well below its average quarterly run rate. Let’s take a closer look below.

Production

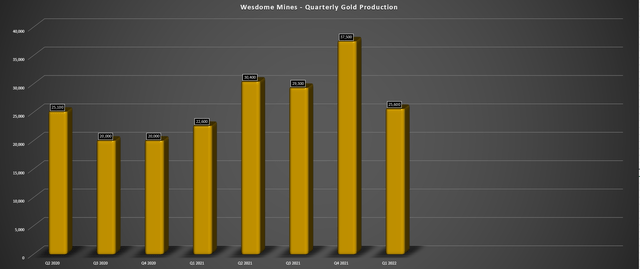

As the chart below shows, Wesdome just came off an exceptional quarter in Q4, with consolidated production of ~37,500 ounces despite limited contribution from its Mishi Mine. This was related to higher throughput and grades at its flagship Eagle River Mine, with ~56,200 tonnes processed at an average grade of 13.7 grams per tonne of gold. Meanwhile, the Kiena Mine also had an outstanding quarter, with ~38,000 tonnes milled at an average grade of 14.1 grams per tonne of gold. However, while it was no surprise that Q1 was a weaker period sequentially, as it often is for gold producers, some negative developments dented the Q1 production results more than investors likely anticipated.

Wesdome Mines – Quarterly Gold Production (Company Filings, Author’s Chart)

As the chart below shows, Kiena’s production fell to even lower levels than its Q3 2021 during its ramp-up phase. This was due to processing just ~21,200 tonnes in Q1 at a much lower grade of ~7.7 grams per tonne of gold. However, this had little to do with negative grade reconciliation, which might be a concern, but instead was related to equipment delays and staff absences related to COVID-19, which impacted development rates. Unfortunately, this was further exacerbated by unscheduled downtime associated with the underground crusher.

Wesdome – Quarterly Gold Production by Mine (Company Filings, Author’s Chart)

Meanwhile, at Eagle River, the mine saw lower production sequentially and on a year-over-year basis, with just ~53,200 tonnes processed at nearly 10% lower grades (~11.6 grams per tonne of gold vs. 12.8 grams per tonne of gold). This led to the production of just ~19,300 ounces of gold, a 10% decline from Q1 2021 levels. Finally, at Mishi, production was up sharply on a sequential basis, helped by increased tonnes milled at higher grades. However, this mine is Wesdome’s smallest by a wide margin, so the sharp increase on a percentage basis didn’t do much to move the needle and pick up the slack at Kiena.

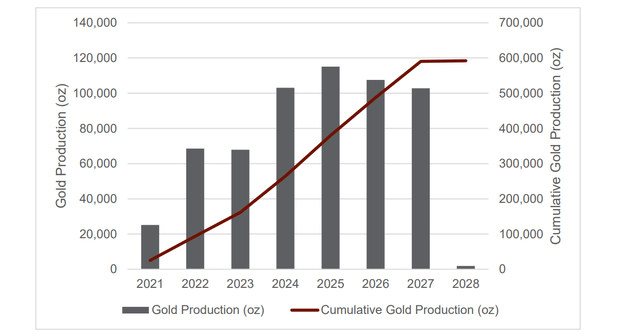

At first glance, a ~25,000-ounce quarter certainly doesn’t look good for meeting the guidance mid-point of ~170,000 ounces, but it’s important to note that H2 2022 should look much different than H1 2022. This is because Kiena should reach commercial production at mid-year, translating to significantly higher quarterly gold production, with a ~70,000-ounce production profile in years 2 and 3, followed by a ~100,000-ounce year in Year 4 (2024). So, with the challenges mostly behind the company and Kiena gearing up for significant growth, Wesdome still has a decent shot at meeting its FY2022 guidance (160,000-180,000 ounces) with a strong second half.

Exceptional Grades & Growth

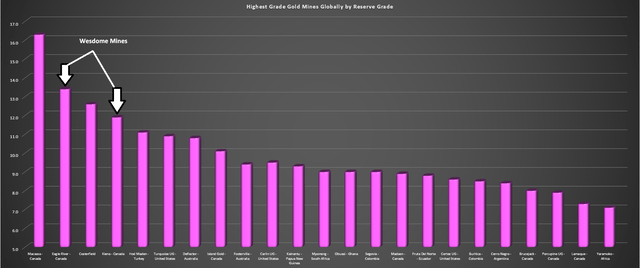

Typically, the addition of a second mine is a very positive development for a producer, given that it allows the company to shed its single-asset producer status, de-risking the company with any issues no longer being magnified due to having only one cash-flowing asset. However, in Wesdome’s case, this isn’t just any second mine; it’s the 4th highest-grade mine globally from a reserve grade standpoint and one capable of producing upwards of 100,000 ounces per year (~84,000 per annum average) at industry-leading costs below $700/oz.

Highest Grade Gold Mines Globally (Company Filings, Author’s Chart)

It’s worth noting that this production profile assumes average annual throughput of ~248,000 tonnes per annum (Years 2 through 7) vs. an existing capacity of ~306,000 tonnes per annum and a permitted capacity of more than 700,000 tonnes per annum. It’s also worth noting that the current mine plan does not include discoveries made recently, including the subparallel Footwall Zone, where drilling has intersected 18 meters at 34.1 grams per tonne gold, 51.1 meters at 41.2 grams per tonne gold, and 12.3 meters at 27.7 grams per tonne gold.

Kiena Initial Mine Plan (Company Technical Report)

These holes are strictly from the newly discovered Footwall Zone, appear to be higher grade than the current reserve grade, and come in at very impressive widths. This zone extends over 300 meters down-plunge right near existing infrastructure, suggesting limited work and capital to access this material. Not only will this extend the mine life at Kiena, but it could contribute to higher production later in the mine life, given the increase in reserve ounces per vertical meter.

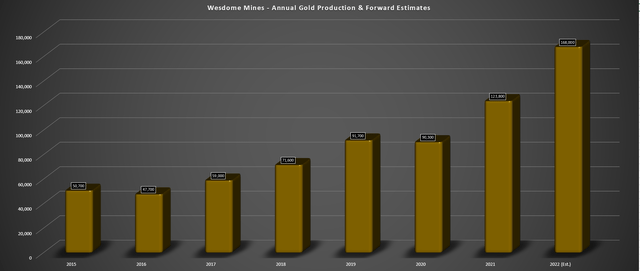

So, while Wesdome may be a ~124,000-ounce producer as of FY2021, and a ~170,000-ounce producer this year, there is a path to 250,000 ounces per annum potentially later this decade. If we assume further upside from Eagle, which also has excess capacity at the mill, we could see Wesdome’s production head north of the 270,000-ounce mark just from its existing mines. Obviously, this is all upside that isn’t yet included in a study yet. Still, given the high-grade nature of recent near-mine discoveries and the ability to leverage existing infrastructure (mill, underground development), I don’t think it’s a stretch to look at Wesdome as a potential ~245,000-ounce per annum producer from 2026 through 2029.

Wesdome – Annual Gold Production & Forward Estimates (Company Filings, Author’s Chart & Estimates)

Costs & Margins

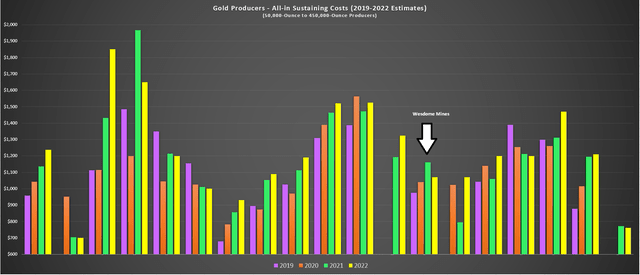

The other key differentiator for Wesdome, which is a result of its operational excellence and related to operating two high-grade underground mines, is its cost profile. As shown below, while many producers have seen their costs trend higher at a torrid pace due to inflationary pressures, Wesdome benefits from being a high-grade producer with a lower environmental footprint and fewer tonnes of rock moved per ounce produced. At a time of rising fuel, labor, and consumables prices, it’s the high-grade underground producers that are insulated the most among the producer space.

All-in Sustaining Costs (2019-2022 Estimates) – Junior/Mid-Tier Producers (Company Filings, Author’s Chart)

However, while the above chart shows a very subtle increase in Wesdome’s all-in sustaining costs relative to peers ($975/oz to $1,070/oz), it’s worth noting that this profile barely included Kiena, which is still pre-commercial production. However, we should see a dramatic decline in all-in sustaining costs on a consolidated basis beginning in 2024, with AISC set to decline sharply as Kiena benefits from economies of scale at a higher throughput rate. This makes Wesdome, like Yamana Gold (AUY), one of the better producers to choose from sector-wide, given the latter’s predominantly high-grade, relatively low volume operations (ex-Canadian Malartic).

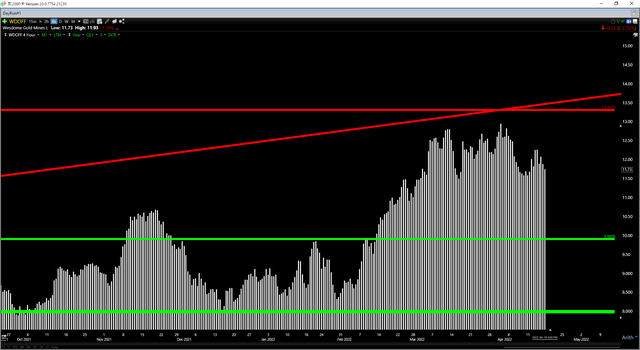

Technical Picture

While Wesdome checks all the boxes from a growth, grade, and operational excellence standpoint, it’s difficult to justify paying up for the stock here from a technical standpoint. This is because the stock is currently trading in the upper portion of its expected trading range, with an overbought zone at US$13.30 and no strong support until US$9.90, or a reward/risk ratio of 0.87 to 1.0. The current reward/risk ratio is based on the stock’s potential upside to the overbought zone relative to the potential downside to the next support level.

WDOFF Daily Chart (TC2000.com)

Generally, when it comes to high-margin small-cap producers, I prefer a minimum reward/risk ratio of 5.0 to 1.0, and this would require a much steeper pullback than what we’ve seen materialize over the past month. Hence, while Wesdome is arguably a top-10 producer, I don’t see a low-risk buy point on the stock just yet. Having said that, if the stock were to dip below US$10.20, this would offer a low-risk area to start a position.

Eagle River Operations (Company Presentation)

Wesdome may have had a slow start to the year, but it has a transformative year ahead, with patient investors on track to see the fruits of the hard work restarting the high-grade Kiena Mine. Assuming commercial production is achieved on time, Wesdome will be one of the highest-growth stories sector-wide in 2022, with further growth to come in 2024 as throughput increases to more than 270,000 tonnes per annum.

This makes Wesdome a special story, given its combination of growing production at improving margins with a dearth of producers fitting this bill sector-wide. Given this unique investment proposition, I see Wesdome as a stock to keep a close eye on, especially because it’s also arguably a top-10 exploration story sector-wide, releasing some of the intercepts behind Brucejack (OTCPK:NCMGF) and Windfall (OTCPK:OBNNF). For now, though, I remain on the sidelines, with a larger pullback needed to bake in a meaningful margin of safety for new positions.

Be the first to comment