Richard Drury

By Jeff Shen | Rich Mathieson | Christopher DiPrimio

The Federal Reserve (“Fed”) remains committed to controlling inflation – raising concerns over potential damage to economic growth. Is the U.S. nearing a recession? BlackRock’s equity experts weigh indicators of recession risk as policymakers take action to bring down price pressures.

The Federal Reserve’s (“Fed’s”) aggressive policy stance has raised concerns over whether a US recession is on the horizon. After several years of steady growth and low inflation, policymakers now face a delicate tradeoff between bringing down inflation or sustaining economic growth amid heightened macro and market volatility. Given the Fed’s continued emphasis on combatting inflation, a few key questions arise: how much will they need to suppress demand to reduce price pressures and what is the likelihood of a U.S. recession?

In our view, answering these questions and understanding the current macroeconomic backdrop calls for a different toolkit and more dynamic investment approach than investors have needed over the past several decades. While traditional economic reports and government statistics provide a 30,000-foot view of the economy, understanding what’s driving these headline figures can hint at where the economy is headed.

As systematic investors, we use a process that transforms vast sets of unstructured data into useful investment information. This provides insights faster, at greater scale, and with more granularity than traditional reports as we navigate evolving inflation and recession risk.

Inflation continues to prompt Fed action

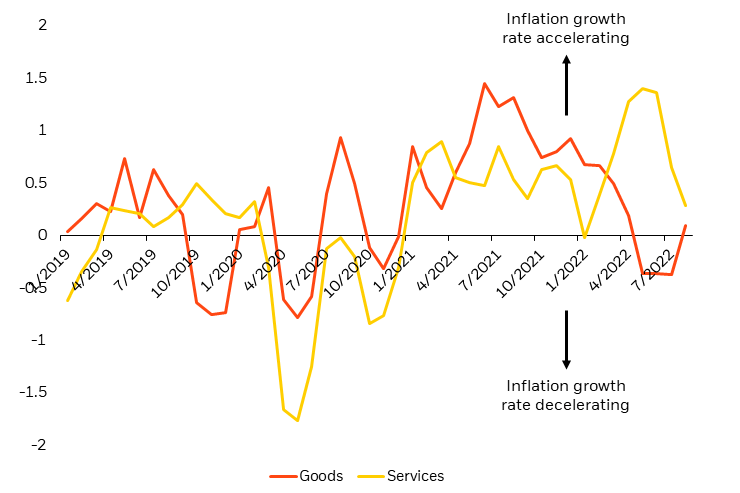

Throughout the economic reopening, the acceleration, or rate at which prices of goods are increasing, started to fall as consumer demand shifted back towards services. Recent stronger-than-expected inflationary data reveals an increase in the growth rate of goods inflation even with some signs of supply chain improvements and falling energy prices. Importantly, services inflation remains very strong and continues to accelerate.

The falling rate of service price increases shown in Figure 1 doesn’t mean that inflation is easing, but rather that it has remained elevated over time. In our view, sustained price pressures are largely driven by services which present unique challenges to an inflation-fighting Fed.

Figure 1: Acceleration across goods and services inflation 6m inflation acceleration shown as time series (z-score) (Source: BlackRock, Pricestats, as of September 2022. )

| Chart shows goods and services inflation acceleration, the second derivative of growth in inflation, expressed as time series (z-score). Figures above 0 indicate growth in the rate of price increases. |

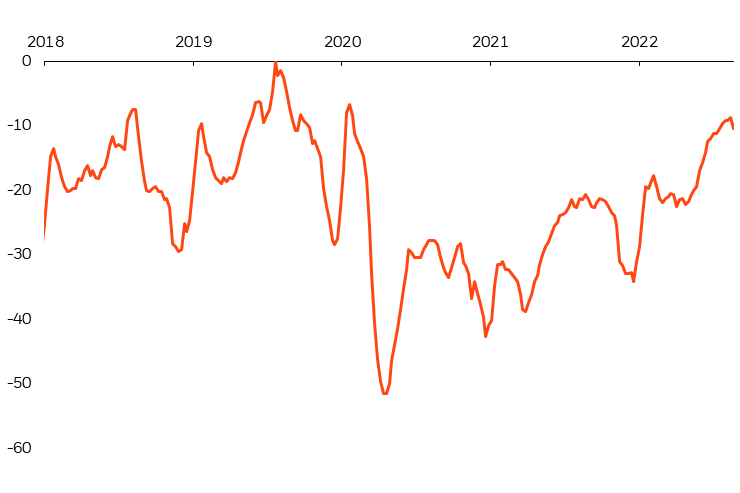

Services inflation is particularly difficult for policymakers given that they have a limited ability to control what we view as a main driver of price pressures – labor supply. The labor shortage has remained a key production constraint since the pandemic caused many people to leave the workforce. To forecast changes in workforce participation, we monitor the volume of online job search activity across various websites in real-time. Our analysis suggests that labor supply remains roughly 10% below peak levels despite making a significant recovery from pandemic lows, as seen in Figure 2 below.

Figure 2: Job search volumes haven’t returned to peak levels Job search intensity distance from peak from 2018 – 2022 (%) (Source: BlackRock, Indeed.com Google Search, September 2022)

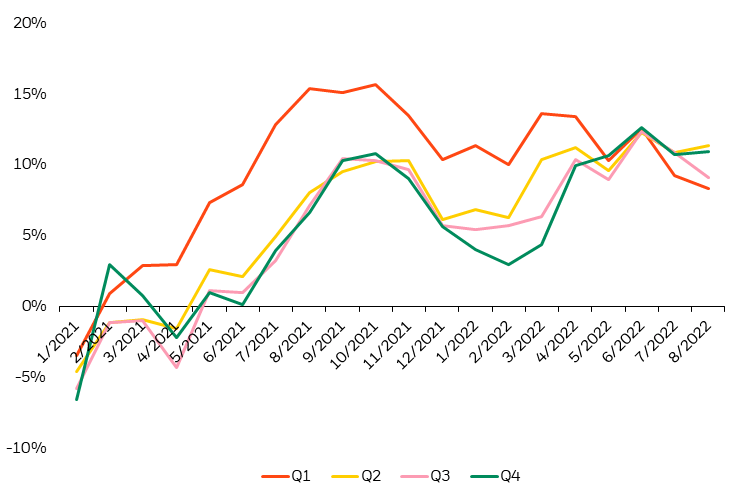

We also measure the strength of the labor market using data from online job postings which provides a 3-6 month forecast of realized employment cost data. Earlier this year, job postings showed a reacceleration in wages that’s now being reflected in average hourly earnings data. Figure 3 illustrates that despite an anticipated moderation in wage growth in the coming months, wage pressures are likely to stay elevated and labor market tightness may persist.

Figure 3: Wage pressures remain elevated Wage growth per income quartile (Source: BlackRock, Burning Glass Technologies, as of September 2022.)

| Q1 is the lowest income quartile, Q4 is the highest income quartile. |

Overall, inflationary pressures remain at a level that is unlikely to spur a change in course for policymakers. We expect the Fed to remain committed to aggressive rate hikes until we see normalization of the labor market and a sustained decrease in prices, which will be challenging given the remaining strength in spending data shown in the following section.

So what does this mean for recession risk?

Are we nearing a U.S. recession?

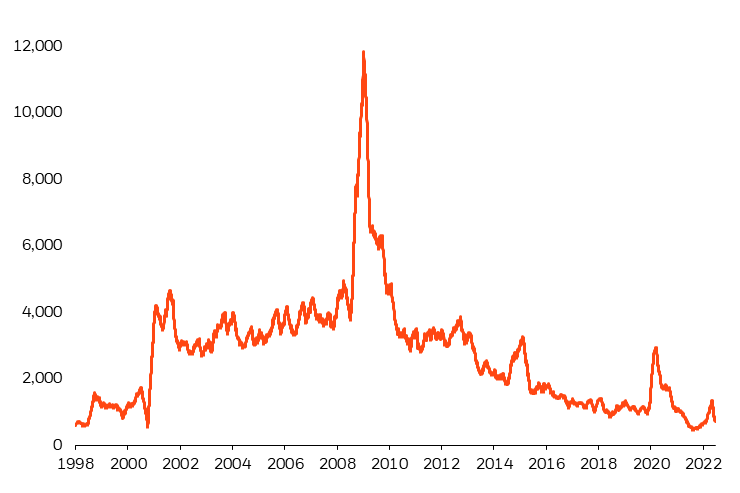

As recession concerns rise, we’re monitoring news articles and company releases for language related to job cuts and hiring freezes. As shown in Figure 4, we have yet to observe an uptick in mentions anywhere near highs seen during previous periods of declining growth such as the Great Financial Crisis and onset of the COVID-19 pandemic. Increasing mentions related to hiring slowdowns and job cuts are mainly concentrated in the technology sector and, to a lesser degree, the financial services industry.

Currently, we view this as a sector-specific trend rather than a reflection of the aggregate economy. We’re watching for signs of increasing mentions across a broader set of industries that would signal growing recession risk.

Figure 4: Job cut language isn’t broad-based Job contraction mentions across global markets (Source: BlackRock, DataStream, September 2022.)

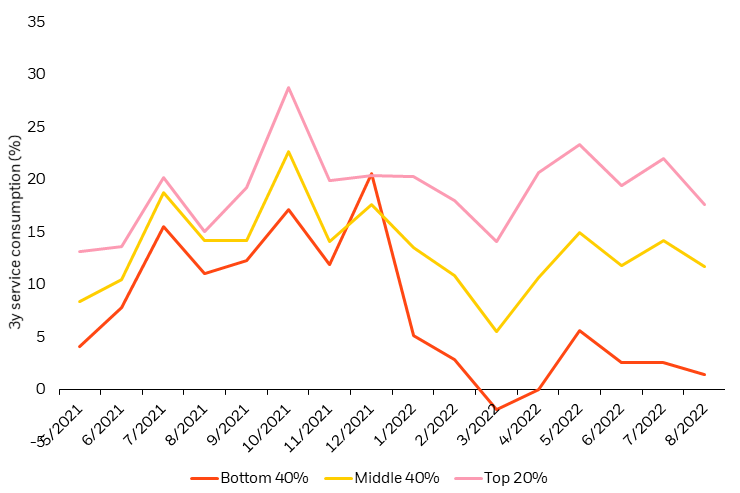

We also measure the strength of the economy using real-time consumer transaction data across different income thresholds. Given the shift in spending from goods to services throughout the reopening, zooming in on service consumption allows us to see how inflation and recession fears are impacting activity where spending has remained the most robust.

While service spending for lower income cohorts is softening amid rising prices, activity remains relatively strong for middle- and high-income individuals (Figure 5). As we continue to monitor this, a broader retrenchment in service consumption across all income levels would indicate heightened risk of a near-term recession.

Figure 5: Continued divergence in service spending Discretionary service consumption by income cohort (Source: BlackRock, Earnest Research, September 2022.)

Navigating recession risk in 2022 and beyond

Our economic indicators remain mixed as inflationary pressures remain, but stable consumer activity and labor market strength point to a low probability of a near-term recession. The latter generally aligns with market expectations that the economy will remain healthy through the start of next year. However, in our view, persistent inflation will require the Fed to raise rates more than markets are currently pricing, ultimately causing this data to worsen over time. We expect investors will face more volatility and uncertainty in the coming months as the inflation vs. growth tradeoff continues to develop.

Braving the current regime of persistent inflation, lower growth, and heightened macro and market volatility will likely require a more nuanced and dynamic investment approach than what’s been needed in recent history. This starts with using alternative data for a real-time, more granular view into how the economy and markets are evolving ahead of traditional reports. Paired with expert human insight, this information edge allows us to remain nimble during a time where dynamism matters most-navigating market complexity and uncovering opportunities along the way.

|

© 2022 BlackRock, Inc. All rights reserved. This material is prepared by BlackRock and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of September 2022 and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, BlackRock funds or any investment strategy nor shall any securities be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained visiting the iShares ETF and BlackRock Mutual Fund prospectus pages. Read the prospectus carefully before investing. Stock and bond values fluctuate in price so the value of your investment can go down depending upon market conditions. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. The principal on mortgage- or asset-backed securities may be prepaid at any time, which will reduce the yield and market value of these securities. Obligations of US Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the US Government. Investments in non-investment-grade debt securities (“high-yield bonds” or “junk bonds”) may be subject to greater market fluctuations and risk of default or loss of income and principal than securities in higher rating categories. Income from municipal bonds may be subject to state and local taxes and at times the alternative minimum tax. Index performance is shown for illustrative purposes only. Indexes are unmanaged and one cannot invest directly in an index. Investing involves risk, including possible loss of principal. Prepared by BlackRock Investments, LLC. BlackRock Fund Advisors, an affiliate of BlackRock Investments, LLC, is a registered investment adviser. ©2022 BlackRock, Inc. All rights reserved. BLACKROCK and iSHARES are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners. USRRMH0922U/S-2418743 |

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment