insta_photos/iStock via Getty Images

Investment Thesis

Etsy (NASDAQ:ETSY) has caught a strong bid, as the weakening USD in the past several days leads investors to clamber into and clamor for risk assets. The enthusiasm is palpable.

Investors welcome any respite from a trade that has largely been disappointing in 2022.

The bears are pushed back, even though they question whether Etsy is overvalued at 24x next year’s EPS.

While bulls retort that Etsy’s multiple has already been compressed and de-risked.

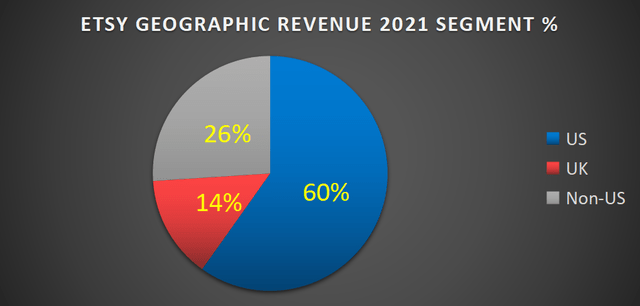

For my part, I remain on the fence. Even though I recognize that Etsy is highly profitable, I contend that since more than 40% of Etsy’s business comes from overseas, with a large portion coming from the UK, a country that’s embracing a cost of living crisis, there’s still a lot of risk left in the stock.

Hence, altogether, I am neutral.

What’s Happening Right Now?

Etsy has a short interest of approximately 9%. That means that there’s a lot of negativity being priced into the company’s prospects. Consequently, on days when there’s a broad short squeeze going on in the market, Etsy rallies, strongly.

For example, on Monday of this week, Etsy’s stock was up 6%. These strong and broad market rallies in ”risk assets” have often coincided with days where the USD has given back some of its strength.

This is pertinent to Etsy as it has significant overseas exposure.

Author’s work

As of full year 2021, 40% of Etsy’s revenues came from outside the US. Even though we don’t have any more current granular data, I believe that this is likely to be a fair approximation of how Etsy’s revenue split continues to be.

Consequently, with a widely reported cost of living crisis in the UK, as well as other European countries, I have to question just how strong can we expect those markets to be to Etsy’s prospects over the next year.

Etsy’s Near-Term Prospects

Can Etsy hold onto the progress it’s made? That’s the key question that plagues Etsy’s bear and bull case, with both sides uncompromising in their outlooks.

One significant driving force of Etsy’s revenues in Q2 2022 came from its consolidated take rate increasing to 19.3%.

And here again, this draws more bulls and bears into the equation. For their part, bulls make the argument that Etsy’s ability to increase its take rate, while its gross merchandise sales were flat y/y, speaks to the strength of Etsy’s underlying value proposition.

Bears push back that this tactic will sooner rather than later will come up against a ceiling and will seize to be a driving force to Etsy’s revenue growth rates. Particularly as gross merchandise sales are flat y/y as of Q2 2022.

The Bull Case is Built on Etsy’s Strong Profitability

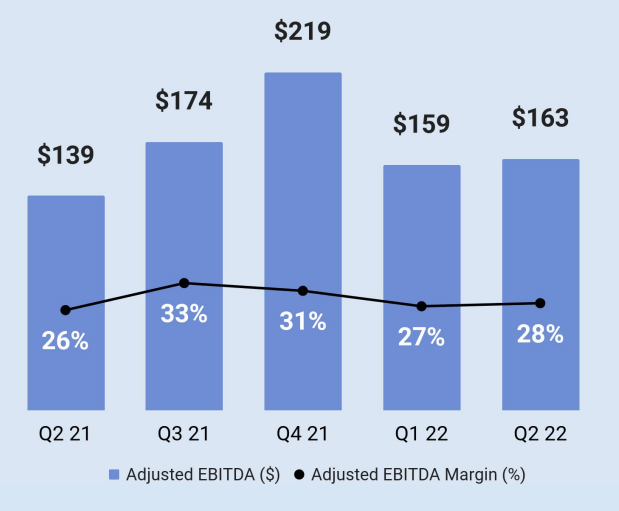

ETSY Q2 2022

Undoubtedly, the appeal of investing in Etsy is that unlike countless other e-commerce platforms it has already solved the issue of profitability.

There are two reasons why this is critical.

Firstly, this provides Etsy with plenty of flexibility. In fact, keep in mind that Etsy has approximately $1.3 billion of net debt, and if Etsy wasn’t profitable, its ability to refinance its 2019 notes, due 2026, would become an issue. Thus, clearly, this is not a headline risk.

Secondly, this provides Etsy with the firepower to take market share during the upcoming downturn, as other marketplaces are forced to cut back on advertising and growth strategies.

Even if Etsy’s Q4 2022 guidance was to end up seeing EBITDA margins of 24% to 26%, I’m inclined to believe that investors would welcome this news. Even if these EBITDA margins would be more than 500 basis points lower than Q4 of the prior year.

ETSY Stock Valuation – 24x Next Year’s EPS

Is Etsy a growth company? Or is too niche an offering that its revenue growth rates have now started to mature?

Having a strong conviction over this answer will go a long way to justify this underlying investment opportunity.

For my part, I struggle to get confident that paying more than 20x next year’s EPS affords me any margin of safety.

It’s difficult to make the argument that while interest rates are at 4%, investors should expect to see any multiple expansion in Etsy’s stock.

Consequently, what investors are left with is, if all goes well, and Etsy continues to see its profit margins expanding, investors could perhaps see 10% to 15% growth in intrinsic value.

All considered, as I look around and compare with other options available in this market, I’m not bullish enough.

The Bottom Line

I recognize that when it comes to investing in rapidly growing e-commerce platforms, the last thing one should do is consider the valuation. One should buy into the story or not. The valuation shouldn’t factor into the discussion.

Yet, because too many people thought like that, that’s why Etsy’s share price came down 60% in the past year.

This stock isn’t the worst performer, there have been worse performers in the past twelve months, but simply because the stock is down significantly doesn’t automatically mean that the stock is undervalued.

Be the first to comment