gorodenkoff

Author’s note: This article was released to CEF/ETF Income Laboratory members on September 29, 2022. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Data is taken from the close of Friday, September 23rd, 2022.

Weekly performance roundup

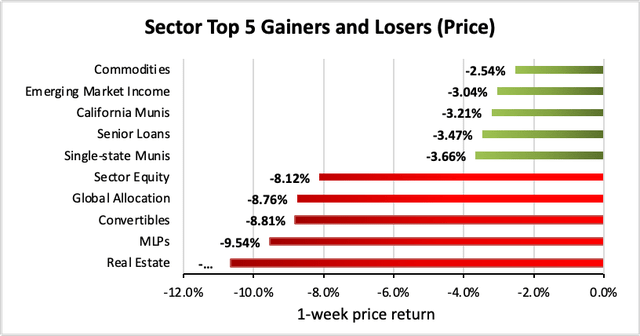

0 out of 23 sectors were positive on price (same as 0 last week) and the average price return was -5.77% (down from -3.43% last week). The lead gainer was Commodities (-2.54%) while Real Estate lagged (-10.66%).

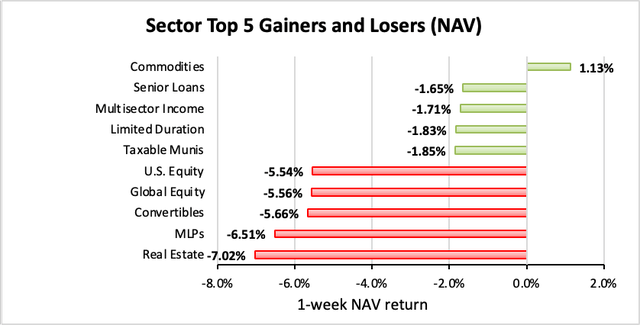

1 out of 23 sectors were positive on NAV (same as 1 last week), while the average NAV return was -3.41% (down from -2.33% last week). The top sector by NAV was Commodities (+1.13%) while the weakest sector by NAV was Real Estate (-7.02%).

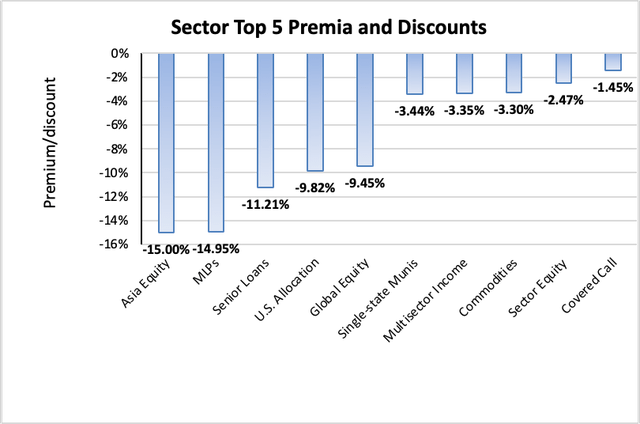

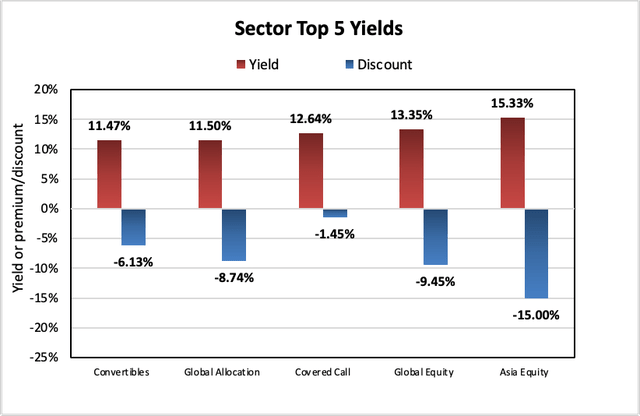

The sector with the highest premium was Covered Call (-1.45%), while the sector with the widest discount is Asia Equity (-15.00%). The average sector discount is -7.14% (down from -5.29% last week).

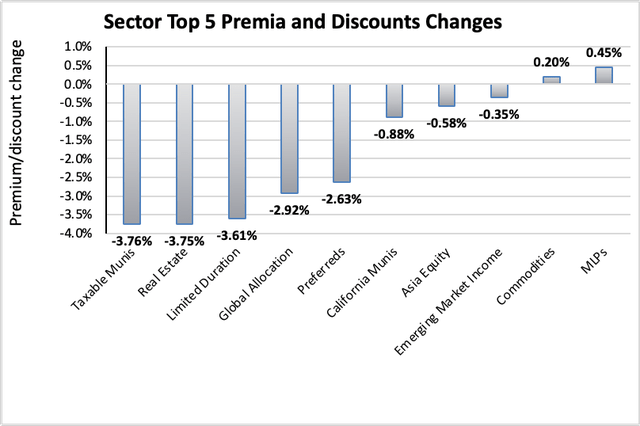

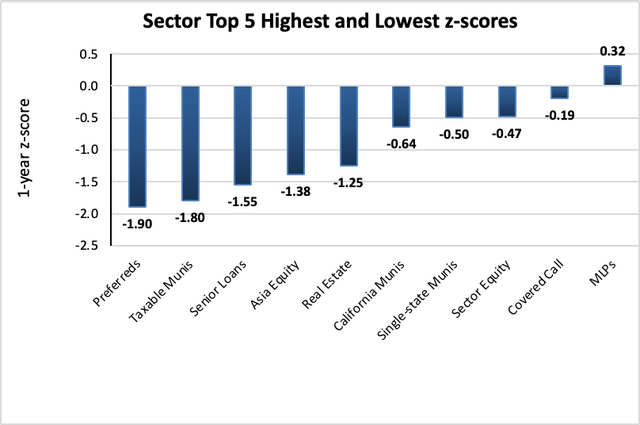

The sector with the highest premium/discount increase was MLPs (+0.45%), while Taxable Munis (-3.76%) showed the lowest premium/discount decline. The average change in premium/discount was -1.85% (down from -0.85% last week).

The sector with the highest average 1-year z-score is MLPs (+0.32), while the sector with the lowest average 1-year z-score is Preferreds (-1.90). The average z-score is -0.95 (down from -0.36 last week).

The sectors with the highest yields are Asia Equity (15.33%), Global Equity (13.35%), and Covered Call (12.64%). Discounts are included for comparison. The average sector yield is +9.27% (up from +8.69% last week).

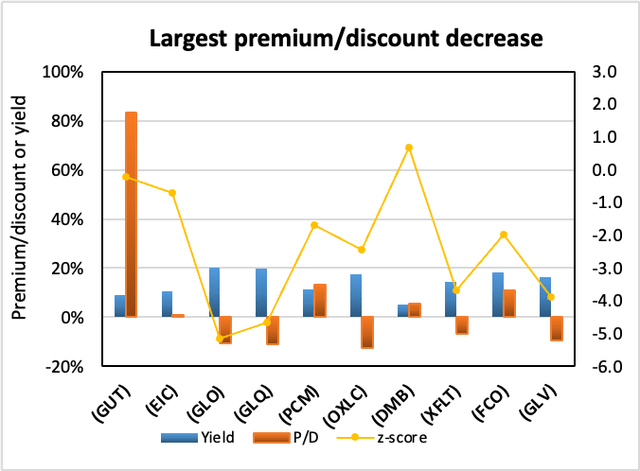

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

| Fund | Ticker | P/D decrease | Yield | P/D | z-score | Price change | NAV change |

| Gabelli Utility Trust | (GUT) | -16.35% | 8.92% | 83.38% | -0.2 | -12.26% | -4.43% |

| Eagle Point Income Co Inc | (EIC) | -10.48% | 10.73% | 1.08% | -0.7 | -8.15% | 0.00% |

| Clough Global Opportunities | (GLO) | -10.02% | 20.06% | -10.48% | -5.1 | -15.57% | -6.11% |

| Clough Global Equity | (GLQ) | -9.99% | 19.98% | -11.08% | -4.7 | -15.39% | -5.88% |

| PCM Fund | (PCM) | -9.53% | 11.19% | 13.19% | -1.7 | -9.21% | -0.65% |

| Oxford Lane Capital Corp | (OXLC) | -9.39% | 17.58% | -12.45% | -2.5 | -11.27% | 0.00% |

| BNY Mellon Muni Bond Infrastructure Fund | (DMB) | -9.24% | 5.20% | 5.43% | 0.7 | -10.53% | -2.68% |

| XAI Octagon FR & Alt Income Term Trust | (XFLT) | -9.05% | 14.24% | -6.68% | -3.7 | -10.61% | -1.93% |

| Aberdeen Global Income Fund, Inc. | (FCO) | -8.69% | 18.22% | 11.08% | -2.0 | -10.49% | -3.49% |

| Clough Global Dividend and Income | (GLV) | -8.66% | 16.20% | -9.45% | -3.9 | -11.83% | -3.39% |

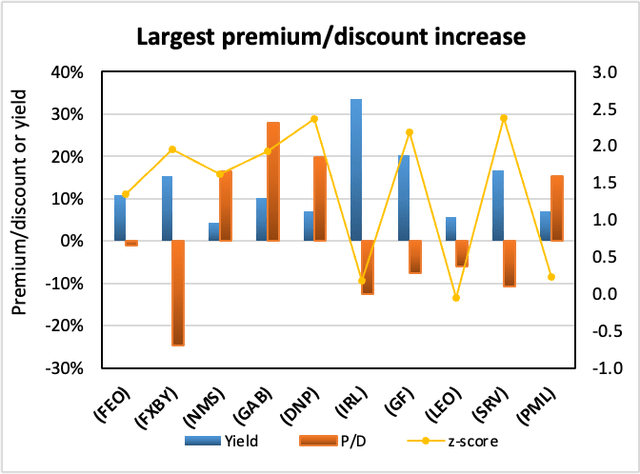

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

| Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

| First Trust/abrdn Emerging Opp | (FEO) | 10.84% | 10.92% | -1.08% | 1.4 | 5.90% | -5.70% |

| FOXBY CORP | (OTCPK:FXBY) | 5.25% | 15.37% | -24.58% | 2.0 | 1.64% | -5.43% |

| Nuveen MN Quality Muni Inc | (NMS) | 4.30% | 4.23% | 16.39% | 1.6 | 0.77% | -2.94% |

| Gabelli Equity | (GAB) | 4.29% | 10.29% | 27.85% | 1.9 | -3.32% | -6.56% |

| DNP Select Income | (DNP) | 3.45% | 7.13% | 19.85% | 2.4 | -2.50% | -5.29% |

| New Ireland | (IRL) | 3.14% | 33.56% | -12.48% | 0.2 | -6.85% | -3.70% |

| New Germany | (GF) | 2.61% | 20.23% | -7.48% | 2.2 | -5.41% | -8.07% |

| BNY Mellon Strategic Municipals | (LEO) | 2.46% | 5.73% | -5.99% | -0.1 | -0.16% | -2.77% |

| Cushing® MLP & Infras Total Return | (SRV) | 2.39% | 16.64% | -10.78% | 2.4 | -10.48% | -12.84% |

| PIMCO Municipal Income II | (PML) | 2.27% | 7.07% | 15.30% | 0.2 | -1.18% | -3.12% |

Recent corporate actions

These are from the past month. Any new news in the past week has a bolded date:

September 27, 2022 | RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. Announces Final Results of Rights Offering. RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

September 26, 2022 | RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. Announces Preliminary Results of Rights Offering. RiverNorth/DoubleLine Strategic Opportunity Fund, Inc.

September 19, 2022 | Virtus Total Return Fund Inc. Completes Rights Offering.

Upcoming corporate actions

These are from the past month. Any new news in the past week has a bolded date:

September 20, 2022 | First Trust/abrdn Emerging Opportunity Fund Announces Approval of Liquidation.

September 8, 2022 | BlackRock Corporate High Yield Fund, Inc. Announces Terms of Rights Offering.

August 11, 2022 | Abrdn’s U.S. Closed-End Funds Announce Special Shareholder Meetings Relating to Proposed Acquisition of Assets of Four Delaware Management Company-Advised Closed-End Funds. The Board of Trustees of each of the Acquiring Funds, listed below, announces the proposed reorganization of several closed-end investment companies advised by one or more affiliates of Delaware Management Company into the respective Acquiring Funds (“Reorganizations”). The proposed Reorganizations are subject to the receipt of necessary shareholder approvals by each Fund:

Acquired Fund Acquiring Fund Delaware Ivy High Income Opportunities Fund (“IVH“) abrdn Income Credit Strategies Fund (“ACP“) Delaware Enhanced Global Dividend and Income Fund (“DEX“) abrdn Global Dynamic Dividend Fund (“AGD“) Delaware Investments Dividend and Income Fund, Inc. (“DDF“) Macquarie Global Infrastructure Total Return Fund Inc. (“MGU“) abrdn Global Infrastructure Income Fund (“ASGI“)

The combination of the merging funds will help ensure the viability of the Funds, increasing scale, liquidity and marketability changes that may lead to a tighter discount or a premium to NAV over time. Following the Reorganizations, shareholders of each Acquiring Fund will experience an increase in the assets under management and a reduction in their Fund’s total expense ratios. There are no proposed changes to the current objectives or policies of the Acquiring Funds as a result of these Reorganizations, including the Funds’ monthly distribution policies. Individually, each Board believes that the Reorganizations are in the best interest of their Fund’s shareholders recognizing the strategic objective of creating scale for the benefit of shareholders. Shareholders of the Acquiring Funds will be asked to approve the issuance of shares at a special virtual shareholder meeting tentatively scheduled for November 9, 2022 (the “Meeting”). Each Acquiring Fund Board has fixed the close of business on August 11, 2022 as the record date for the determination of shareholders entitled to vote at the Meeting and at any adjournment of the Meeting. Each approval of the special resolution of the shareholders authorizing the issuance of new shares will require the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote. It is currently expected that each Reorganization will be completed in the first quarter of 2023 subject to [i] approval of the Reorganization by the respective Acquired Fund shareholders, [ii] approval by the respective Acquiring Fund shareholders of the issuance of shares of the Acquiring Funds, and [iii] the satisfaction of customary closing conditions. No Reorganization is contingent upon any other Reorganization. The Board of Trustees to each Acquired Fund and the Board of Trustees of each Acquiring Fund believe that the proposed Reorganization is in the best interests of the shareholders of that Fund.

Recent activist or other CEF news

These are from the past month. Any new news in the past week has a bolded date:

None

————————————

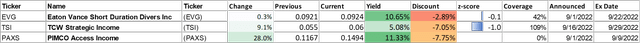

Distribution changes announced this month

These are sorted in ascending order of distribution change percentage. Funds with distribution changes announced this month are included. Any distribution declarations made this week are in bold. I’ve also added monthly/quarterly information as well as yield, coverage (after the boost/cut), discount and 1-year z-score information. I’ve separated the funds into two sub-categories, cutters and boosters.

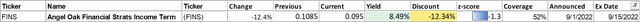

Cutters

Be the first to comment