Fahroni

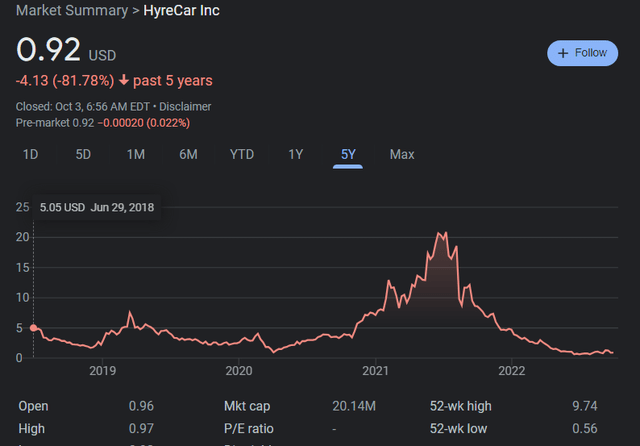

Shares of HyreCar (NASDAQ:HYRE) have experienced exceptional volatility over the past years, while the business has made steady progress. From a low of around $1.70 in 2018 it peaked 340% higher at $7.50 to end up just above $2 in most of 2019 and putting in another rally to $4 in February 2020. Covid hit the stock extremely hard, it being an unprofitable, tiny microcap in a world that was seemingly shutting down. The stock bottomed at new lows of around 90 cents. As it turned out, demand for ridesharing and cars drastically went up however, and HyreCar’s story is in that sense not too dissimilar from Hertz Global, which went bankrupt and then saw its business explode. HYRE went on to appreciate more than 20X from the lows to above $20. That peak optimism didn’t hold though and slower than hoped progress on the business side forced the stock back to earth and below. Shares bottomed at 56 cents recently amongst economic slowdown and dilution fears.

HYRE chart (Google Finance)

Clearly HYRE is not for the faint of heart. Nonetheless, in this piece I will make the case why I believe shares are drastically undervalued at these prices if management can execute towards its plans of first getting to breakeven, then adding up to 10k cars from the current 3.5k on the platform, and as a 2025/2026 goal getting up to 50k cars. Success is not guaranteed, and fellow contributor Henrik Alex laid out very well recently that tremendous risks remain. But in case of success, the upside is many multiples. I believe a return of 6X is quite feasible with only the near term goal of 10k cars and should the company fulfill the long term strategy HYRE could become a more than $1B company for a possible return of 40X and more.

Business Model

HyreCar is a carsharing marketplace for ridesharing that allows car owners to rent their idle assets to rideshare drivers safely, securely and reliably. The company operates a dual-sided marketplace allowing vehicle owners the opportunity to earn money on their idle vehicle assets while providing access to reliable options for drivers looking to rent cars for rideshare companies like Uber (UBER) and Lyft (LYFT).

The proprietary car-sharing marketplace was developed to onboard owners and drivers, it matches them and logs rental activity for them. All transactions related to the rental happen on the HyreCar platform. Drivers and owners can access their rental or car dashboards after logging in. Drivers can initiate, terminate or extend a rental through the platform while owners can manage their car or fleet through the platform as well.

One of the competitive advantages is the commercial automobile insurance policy covering both owners and drivers. The policy is specifically designed to cover the period of time in which a driver is operating the car without driving for a ride-sharing platform, such as Uber or Lyft. During the periods when drivers are actively operating on a ride-sharing platform, the insurance subordinates to the state mandated insurance provided by the third party ride-sharing business. It is my understanding that HyreCar is the only provider of this car-matching service utilizing such a tailormade insurance product. I should point out that there were some unpleasant surprises with this insurance in the past as the company has incurred additional expenses due to under-reserving and other issues – excusable, considering the business was new and novel. However, those problems are solved and management has learned from those mistakes.

How does HYRE make money?

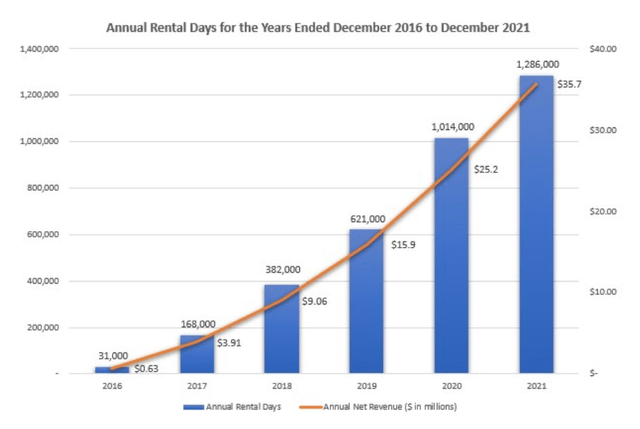

With a rental agreement the driver is charged a base rental fee that is negotiated between driver and vehicle owner, a 10%-20% HyreCar fee on that base rental fee, and a daily insurance charge. All of these fees are based on the number of days the vehicle is rented within the contract. HyreCar retains 15-30% of the base rental fee and remits the remaining portion to the vehicle owner. Overall the net revenue works out to around $30 per rental day to HyreCar making the number of rental days the determining factor for revenues.

HYRE annual revenue and rental days (HYRE 10-K)

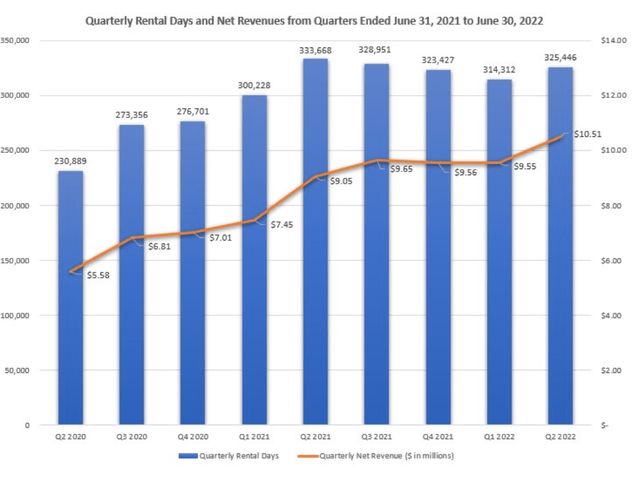

Recently however, the number of rental days has stalled and with this dwindling growth, the stock has cratered.

HYRE quarterly revenue and rental days (HYRE 10-Q)

The crucial bottleneck has always been car supply on the platform, which brings me to the highly significant recent announcement of the $100M warehouse line of credit and AmeriDrive collaboration.

A transformational agreement

This agreement is nothing short of transformational for HyreCar. It has been over a year in the making and management has often enough made reference to it in past calls, but now they have delivered. Finally, there is enough financial firepower to really ramp car supply without burdening the balance sheet of tiny HyreCar.

As then-CFO Serge De Bock stated on the associated call “this transaction does not change the unit economics of HyreCar” and it opens the possibility to reaccelerate rental days by increasing the car supply. The goal is to add 1,500 vehicles over the next 6 months and make more meaningful use of the facility over 18 months. This should enable the company to double the current rental base and achieve breakeven within 12 months, which in my reckoning and management commentary should take about 6700 cars. The roll out is slower than I would like, but if it is necessary to guarantee flawless execution in the year afterwards, I will happily accept that. On said call CEO Joe Furnari also reaffirmed the eventual goal of 50,000 cars on the platform, although he did push the date slightly out to 2025/2026. Is this sure to happen? Of course not! But as my modelling below will show, if it does happen, the company will most likely be wildly profitable and the upside to the stock will be extreme.

Show me the numbers!

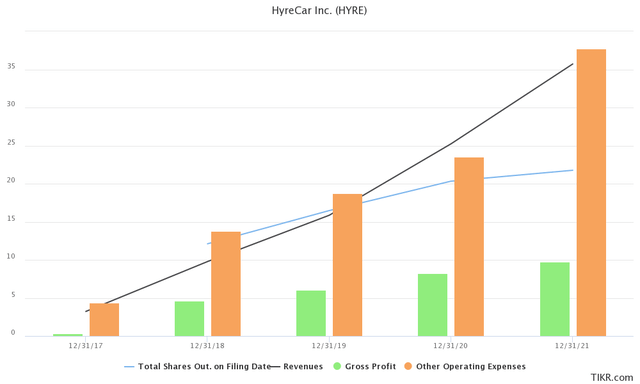

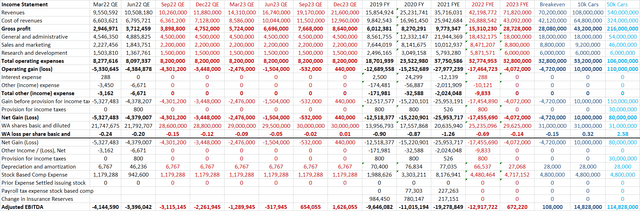

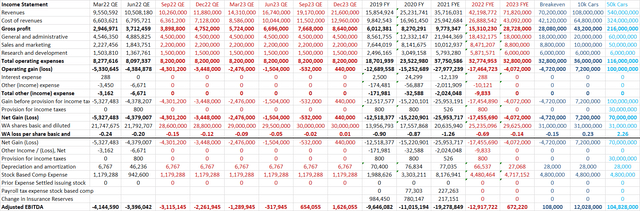

As the below chart shows, HYRE has not been shy to dilute shareholders, the most recent number is about 30M shares. At the same time, while they did manage to grow revenue equally exponentially, expenses and thus losses grew as well.

HYRE financials (TIKR)

The number of rental days obviously directly scales with the number of cars on the platform, which has grown at a similar pace. After all utilization cannot grow or decline sustainably over time. Currently and for the past quarters there have been about 3,500 cars rented out.

All told we have a company with about a $30M market cap. Assuming a return to 40% gross margin according to the plan management has laid out the below picture emerges. Gross margins have been under pressure due to higher insurance costs and increasing claims as the company scaled and properly reserved for insurance purposes. This will be offset by “targeting insurance products, improved driver screening and additional incentives to retain our drivers with low-risk profiles” and also better pricing models such as the dynamic pricing model recently introduced.

HYRE financials base case (Own calculations, SEC filings)

Just the near to medium term goal of getting to 10k cars should enable the company to earn $10M. For a P/E of 3. You read that correctly. The upside is even more extreme for the 50k car scenario, where net income should easily scale towards $80M and EBITDA beyond $110M.

Why the disconnect between share price and potential upside? Clearly investors do not believe that the company can resume its growth trajectory but I would argue the recent funding announcement changes that calculus. It is not far fetched to say that few people besides traders are paying attention to a microcap like HYRE and companies of that size are generally not in favour right now. Investors might also weigh the risks (see my section below) more heavily than I do or lost trust in management to execute on plan and on budget. Having followed HYRE for years now I do believe that management can pull it off. To this point they have managed to fix prior errors and I am willing to give them the benefit of the doubt. Furthermore, this announcement makes clear that partner AmeriDrive plans for exactly the 10k car scenario within the next 2 years while acting immediately with first purchases:

- Initial tranche of vehicles purchased with 1,500 more vehicles to be purchased over the next 6 months

- AmeriDrive expects to add 800 to 1,000 cars in current and new markets by the end of 2022

- AmeriDrive plans to increase its fleet by 6,000 to 7,000 cars over the next 18 months for exclusive listing on the HyreCar platform

Even assuming higher SG&A expenses, the net income numbers work out to $7M and $70M.

HYRE financials with higher SG&A (Own calculations, SEC filings)

Now of course, the company is still burning cash and more dilution is likely coming. But even assuming 35M fully diluted shares I could see shares trading for $4-6 in the 10k car scenario (at P/E ratios of around 20x) and around $40 in the 50k car scenario (EV/EBITDA of around 15x). The numbers obviously look much better with more modest (and to me more likely) further dilution of additional 1M shares.

If we assign only a 10% probability towards the 50k car scenario and a 90% chance of complete failure with no recovery at all, the expected return over those 5 years would be a 15% CAGR. Not too bad!

Similarly assuming 50% probability of achieving the 10k car scenario and another 50% of catastrophic failure, would yield an expected return of around 60% if it takes two years. Even better!

Risks

Plenty of risks remain of course and HyreCar’s history does not necessarily stimulate investor trust until proven otherwise.

Management turnover is certainly questionably high, with another CFO replacement just recently. With Serge De Bock a very capable CFO who has done a tremendous amount of work to make the company financially much more robust, is leaving and one would like to know why.

I mentioned risk of further dilution above, and all that can be said, is that it is likely to happen but even then the potential upside is very significant.

Can the company execute on increasing the car supply by leveraging the warehouse facility. I believe so, but even adjusting probabilities of them doing so down in a draconian way yields extremely attractive expected return projections.

What about demand for cars? So far it has never been an issue. Sure, as we head into a possible recession that could change but as major source of demand on the HYRE marketplace I would just cite Uber.

Goldman Sachs Communacopia + Technology Conference 2022:

So while I would say, generally, if you look at our major markets, we’re still undersupplied by 5% to 10% versus where we need to be. The number of earners we have on the platform is an all-time high. The number of drivers we have on our mobility platform is very close to kind of pre-pandemic highs as well and the number of active drivers continues to increase as well.

Uber Technologies, Inc., Q2 2022 Earnings Call

yes, we did add the statement in there about 2024. Yes, we feel really good about how the business is operating today. Yes, we can’t control the macro world. And so I don’t really want to give you a GB guidance for delivery for next year. But the business continues to grow well, and we are making investments. And again, we’re not through the close recovery, number one. Number two, the business continues to grow well, and so we have a lot of ramp left.

I did mention issues with insurance above, and certainly investors should appreciate that with any insurance operation, latent risks remain. However, I am quite confident that HyreCar has sufficiently learned to deal with those risks.

Finally, I would highlight that the extreme growth management anticipates could well come with some pain again. We have seen cost escalation with prior exponential growth and there is no guarantee that this will not happen again. Still, even modelling much higher costs on the administrative side, selling and marketing would yield satisfactory outcomes. Clearly, in the end though we have to make a bet here on management executing and I appreciate that most investors will not be prepared to do so.

Conclusion

No question, shares of HyreCar are very risky and a volatile investment. Yes, management has a history of diluting shareholders, overpromising and underdelivering and not holding back with substantial stock based compensation. As I have detailed above though, the potential upside is too high for me to ignore. Not only could returns of 40X be possible within the long term goals, but just the near to medium term objective of 10k cars, if realized, could help investors realize up to 6X in appreciation. Discount these numbers with suitable probabilities and the expected returns are still extremely attractive.

Be the first to comment