B4LLS

A Quick Take On Weave Communications

Weave Communications (NYSE:WEAV) went public in November 2021, raising approximately $120 million in gross proceeds from an IPO priced at $24.00 per share.

The firm provides customer communications software to small businesses.

Until management can make meaningful progress toward operating breakeven while maintaining or increasing topline revenue growth, I’m on Hold for WEAV.

Weave Overview

Lehi, Utah-based Weave was founded to develop a SaaS software platform aimed at helping small businesses better communicate with and engage customers and prospects.

The company’s current industry focus includes various healthcare and home service providers.

Management is headed by Chief Executive Officer Brett White, who has been with the firm since July 2020 after joining the Board of Directors and was previously CFO and COO at Mindbody, CFO at Meru Networks, and VP Finance at Oracle.

The company’s primary offerings include:

-

Messaging

-

Email

-

Reviews

-

Analytics

-

Payments

-

Scheduling

-

Team Communications

The firm uses a combination of direct sales, industry events, channel partnerships, and digital marketing efforts to reach small and medium size businesses.

Weave’s Market & Competition

Digital customer communication solutions are the next wave of customer engagement and are being adopted by various industry verticals to improve customer experience and loyalty while reducing operational costs.

Based on type, the global customer communications market is segmented into customer communication management [CCM], interactive customer relationship management [ICRM], and customer experience management [CEM].

According to a 2021 market research report by MarketsandMarkets, the global customer communications market will be an estimated $1.3 billion in 2021 and is forecast to reach $2.2 billion by 2026.

This represents a forecast CAGR of 11.2% from 2022 to 2026.

The main drivers for this expected growth are the growing adoption of digital customer communication solutions tailored for various industry verticals, with the North American region expected to retain the largest market share through 2026. Still, APAC is expected to grow at the fastest rate of growth.

Also, the COVID-19 pandemic likely has pulled demand forward for digital customer communication solutions, and businesses of all sizes sought to retain and enhance customer relationships despite the pandemic’s dislocations.

Management estimates the addressable market for all of its offerings in the U.S. to be $11.1 billion.

Major competitive or other industry participants include:

-

Zendesk (ZEN)

-

Open Text (OTEX)

-

CEDAR CX Technologies

-

Messagepoint

-

Doxim

-

Topdown

-

Napersoft

-

Ecrion

-

Hyland

-

Braze (BRZE)

-

HelpCrunch

-

Front

-

Podium

-

Others

Weave’s Recent Financial Performance

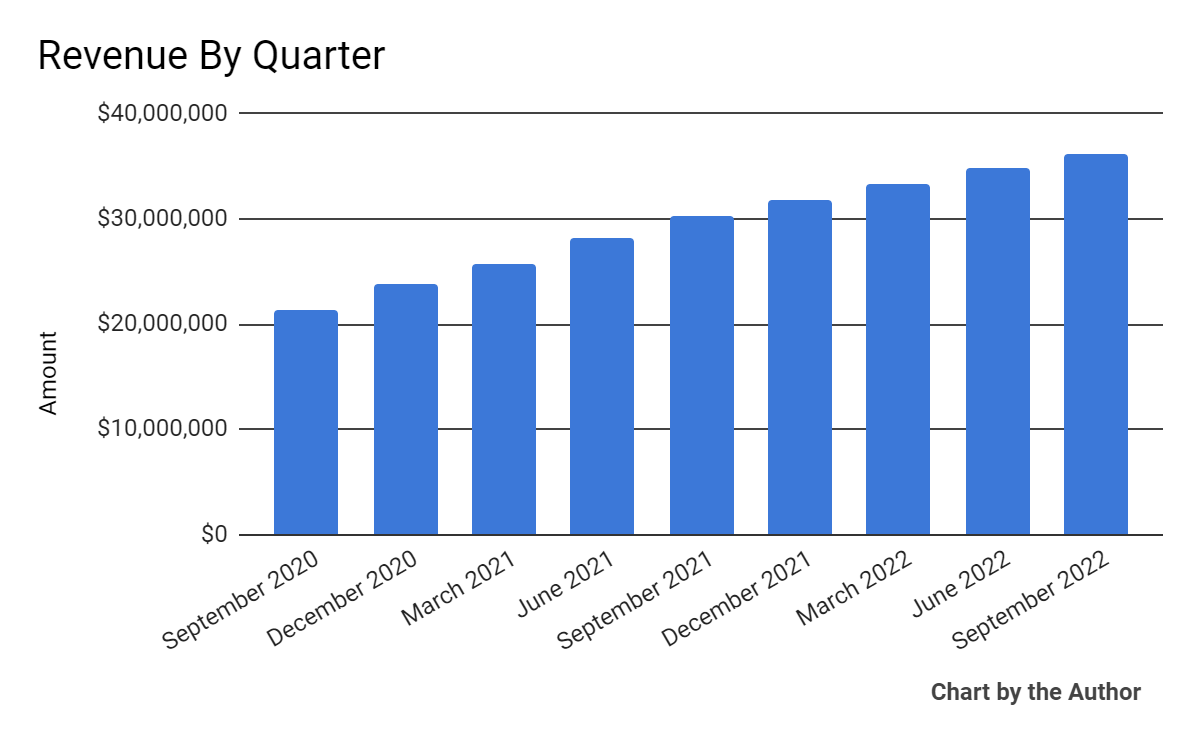

-

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

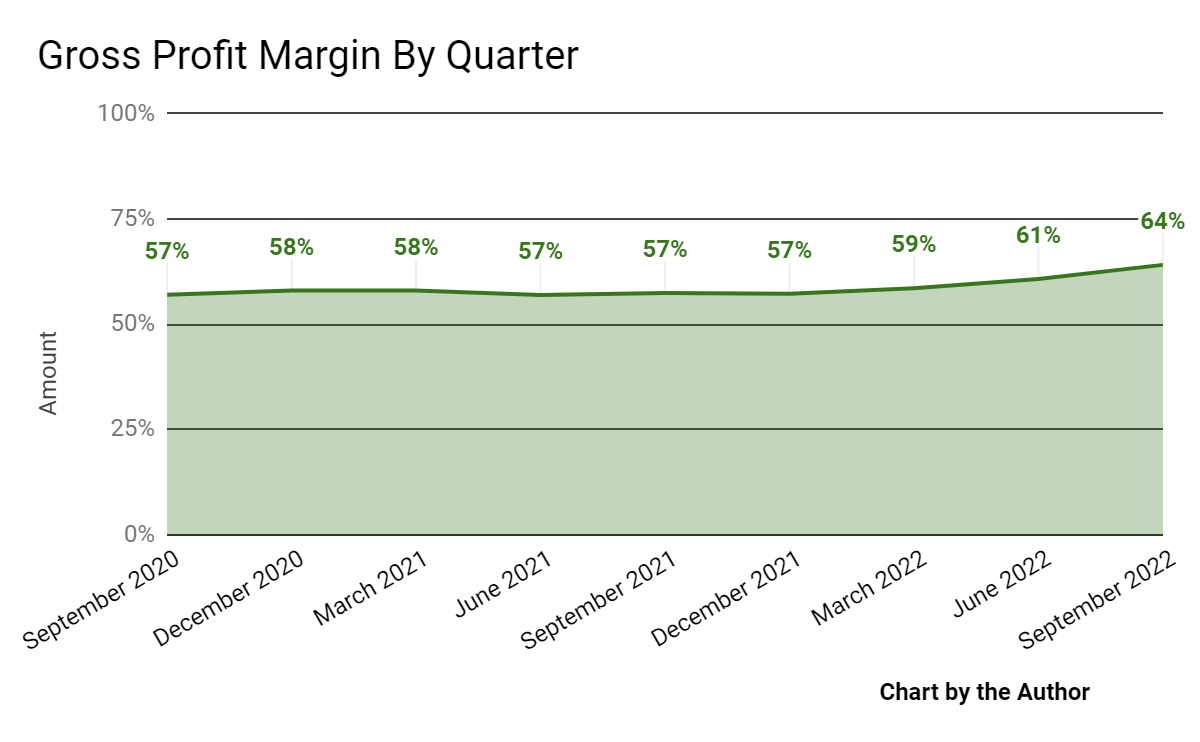

9 Quarter Gross Profit Margin (Seeking Alpha)

-

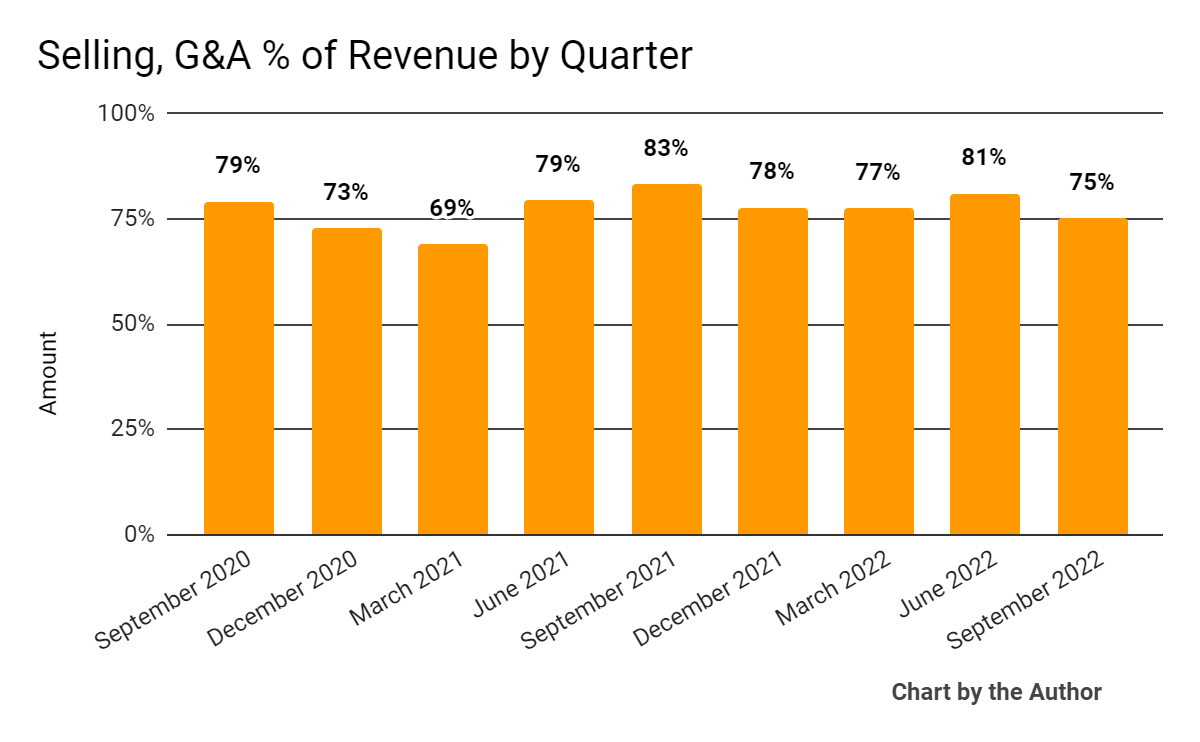

Selling, G&A expenses as a percentage of total revenue by quarter have produced the following results, with no discernible trend:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

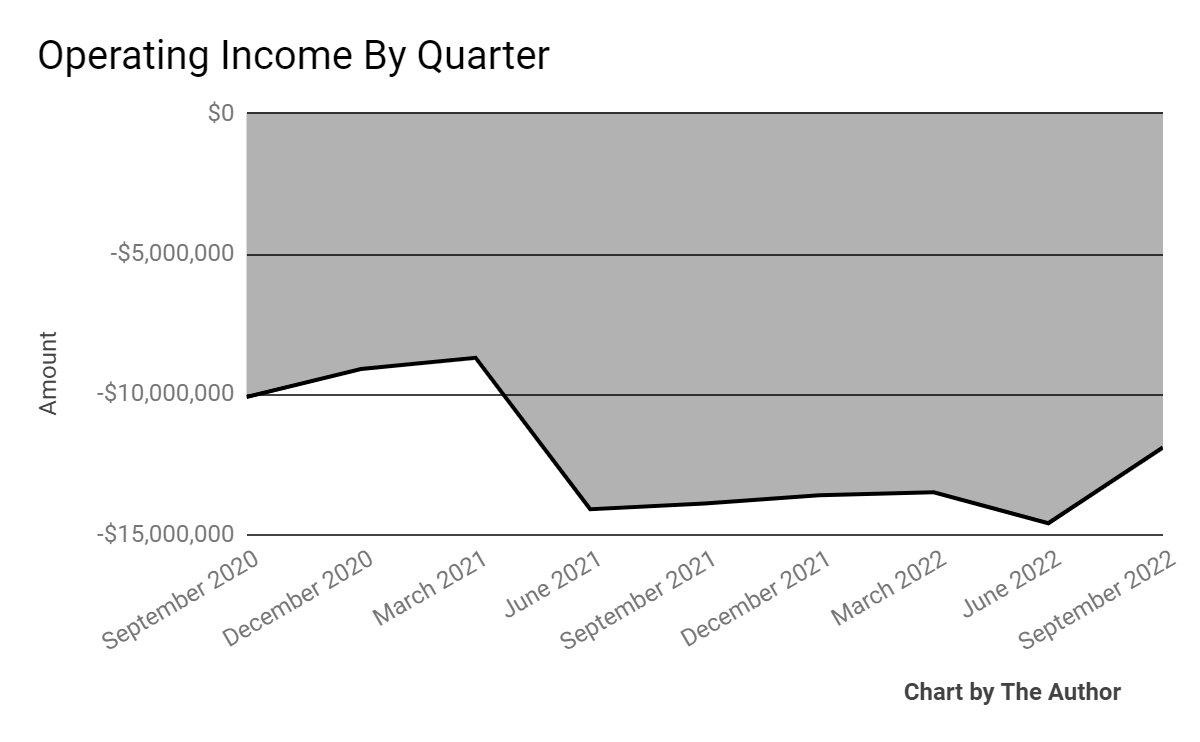

Operating losses by quarter have worsened in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

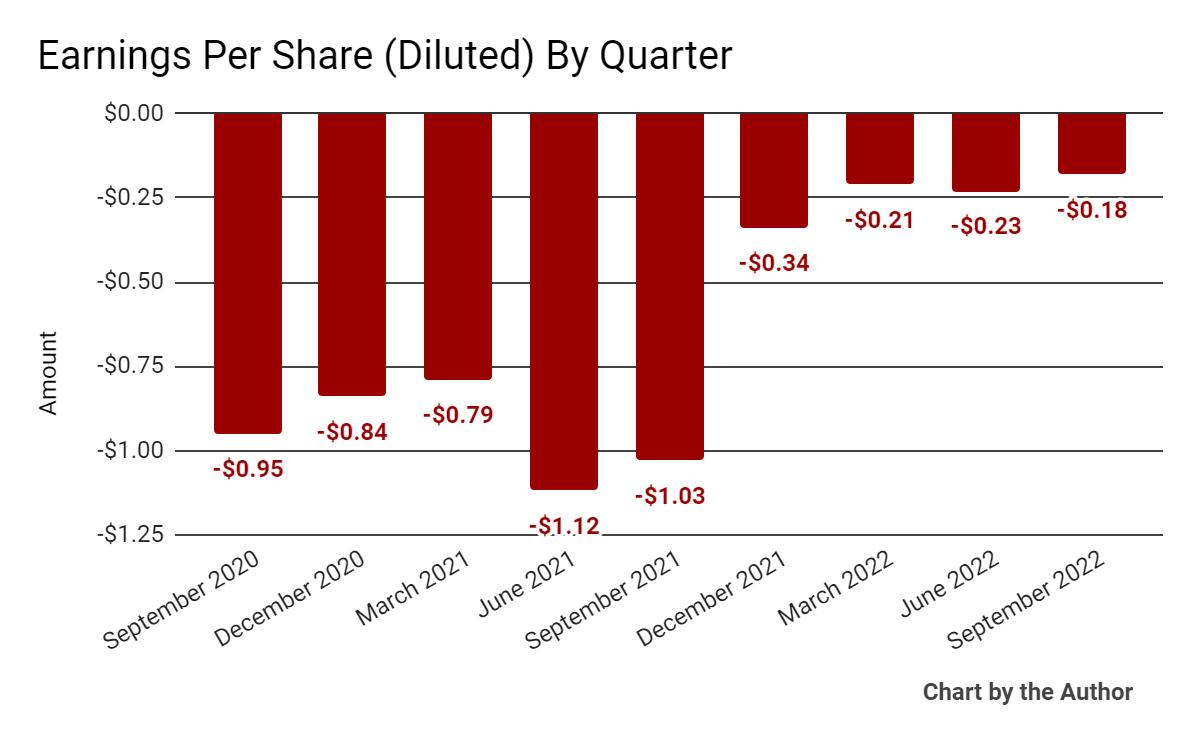

Earnings per share (Diluted) have remained heavily negative, as the chart shows below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

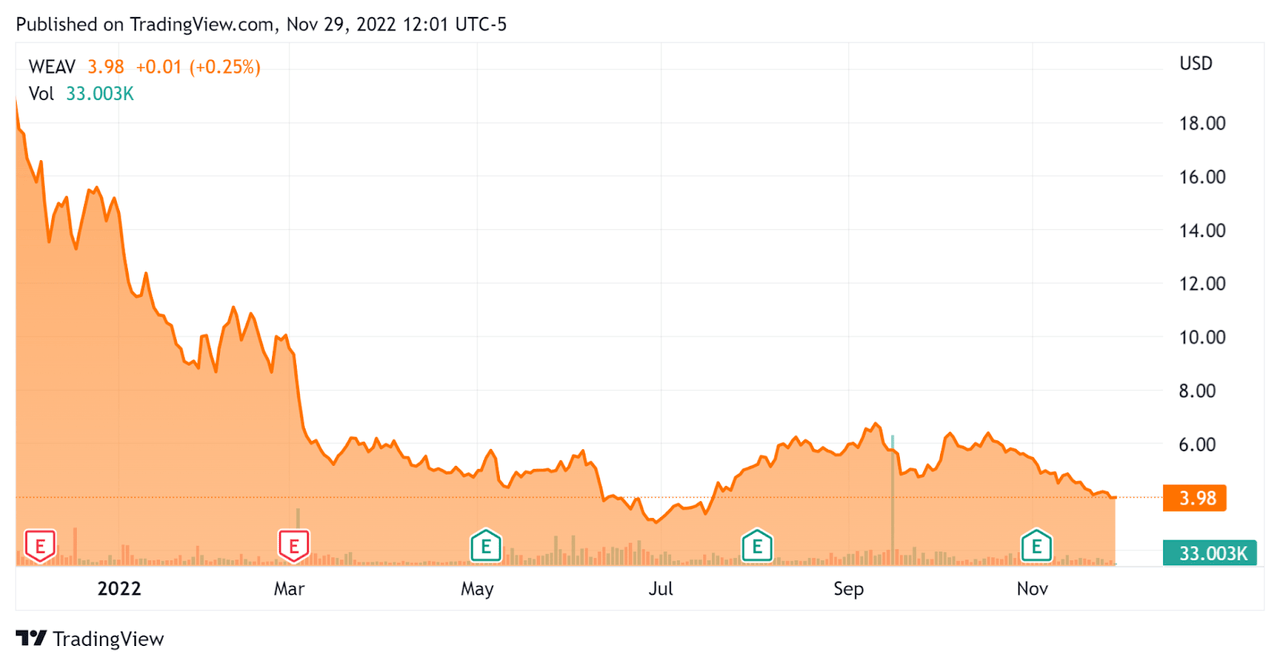

Since its IPO, WEAV’s stock price has fallen 79.3% vs. the U.S. S&P 500 index’s drop of around 15.1%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Weave

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.7 |

|

Enterprise Value / EBITDA |

0.0 |

|

Revenue Growth Rate |

26.4% |

|

Net Income Margin |

-40.0% |

|

GAAP EBITDA % |

-29.9% |

|

Market Capitalization |

$272,170,000 |

|

Enterprise Value |

$227,930,000 |

|

Operating Cash Flow |

-$19,980,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.96 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Braze; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Braze |

Weave Communications |

Variance |

|

Enterprise Value / Sales |

6.5 |

1.7 |

-74.1% |

|

Revenue Growth Rate |

60.3% |

26.4% |

-56.2% |

|

Net Income Margin |

-41.5% |

-40.0% |

3.7% |

|

Operating Cash Flow |

-$25,380,000 |

-$19,980,000 |

21.3% |

(Source – Seeking Alpha)

A complete comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

WEAV’s most recent GAAP Rule of 40 calculation was negative (3.4%) as of Q3 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

26.4% |

|

GAAP EBITDA % |

-29.9% |

|

Total |

-3.4% |

(Source – Seeking Alpha)

Commentary On Weave Communications

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the company’s record revenue and growing in-person industry events, which have historically produced growth in its new customer acquisition.

Management also said it has produced lower sales team attrition and better sales lead closing results.

The firm also continued to expand its technology offerings with additional capabilities, which have been especially helpful to healthcare practice management functions that have been strained by labor shortages.

As to its financial results, topline revenue rose 20% year-over-year, driven primarily by new customer additions in the past year.

The company’s net retention rate was 101%, indicating passable product/market fit and moderate sales & marketing efficiency.

The firm’s Rule of 40 results have been poor, with a negative (3.4%) result over the past 12-month period.

Non-GAAP gross margin improved by 6.6% year-over-year, while operating losses continued to be significant.

For the balance sheet, the firm finished the quarter with cash and equivalents of $118.4 million and $10 million in the current portion of long-term debt.

Over the trailing twelve months, free cash used was $22.8 million, of which capital expenditures accounted for $2.8 million the firm lost $20.0 million in cash from operations.

Looking ahead, for the full year of 2022, management expects total revenue to be around $141 million at the midpoint of the range and non-GAAP operating loss to be $33.5 million at the midpoint.

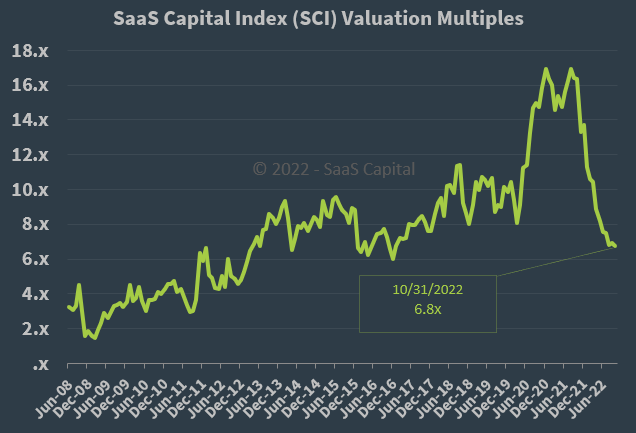

Regarding valuation, the market is valuing WEAV at an EV/Sales multiple of around 1.7x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at October 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, WEAV is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of October 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession going into 2023, which may accelerate new customer discounting, produce slower sales cycles and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include better sales productivity as management focuses its efforts on this critical area through various initiatives.

While some may see value in Weave’s currently low stock price, the market continues to punish tech companies that are not at operating breakeven or quickly on their way there.

Until management can make meaningful progress toward operating breakeven while maintaining or increasing topline revenue growth, I’m Neutral on WEAV.

Be the first to comment