mabus13

Investment Thesis

Teck Resources (NYSE:TECK) has a long-term plan to boost annual copper equivalent output from about 340,000 tonnes to 1.5 million tonnes by 2033 – representing growth of over 340% – as it rebalances its portfolio away from steelmaking coal amid the global net zero transition. Despite this pipeline and a solid record of profitable growth and cash flow generation, the stock is only trading at about 4x earnings and potentially up to 40% below its intrinsic value. Hence, we rate it a buy.

Performance

Although the stock price took a hit after the company reported a loss in Q3 driven by a $925 million impairment charge, it has outperformed the S&P 500 average by more than 10 points in the past year.

TECK Stock Chart – 1 Year Price Performance (Seeking Alpha)

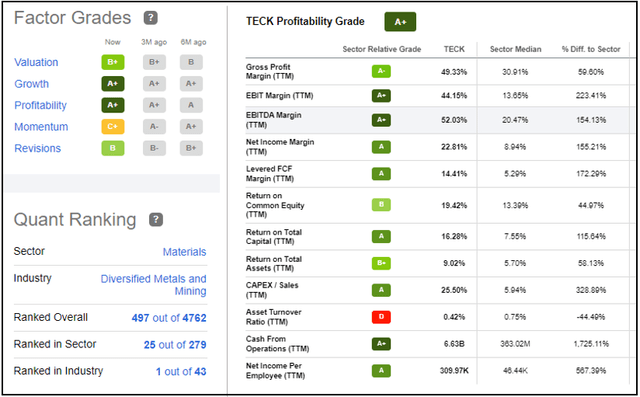

Teck is the number 1 stock in the diversified metals and mining industry, according to Seeking Alpha’s quant scores, 25th in the materials sector and almost falls within the top 10% of all 4,762 stocks ranked overall. Profitability is especially impressive relative to the materials sector, with an EBIT margin of 44%, EBITDA margin of 52%, and free cash flow margin of 14%.

TECK Quant Scores (Seeking Alpha Premium)

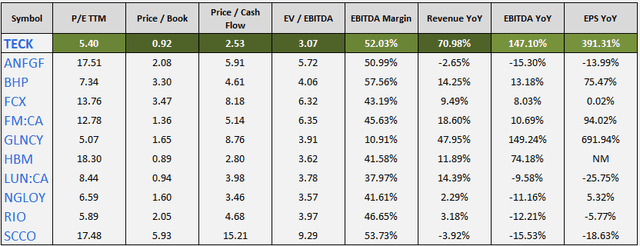

Growth has been solid overall with year-over-year sales up 70%, EBITDA 147%, and EPS 391%. It stacks up well against its direct diversified and copper mining competitors in key valuation, profitability, and growth metrics.

TECK vs. Peers in Key Metrics (Data: Seeking Alpha)

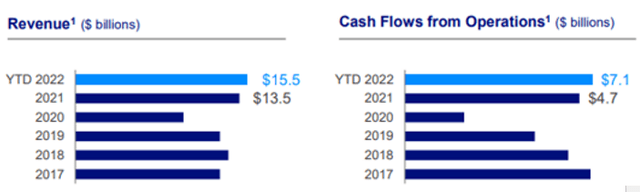

Teck delivered record annual sales of $10.1 billion ($C13.5 billion) in FY2021, a figure it has already exceeded in the first three quarters of 2022, driven by an all-time high $4.4 billion in quarterly revenue in Q2. As the below chart shows (in Canadian dollars), 2022 YTD cash flows from operations has also surpassed the previous year’s total.

TECK 2022 YTD Revenue/Cash Flows (TECK Q3 Earnings Presentation)

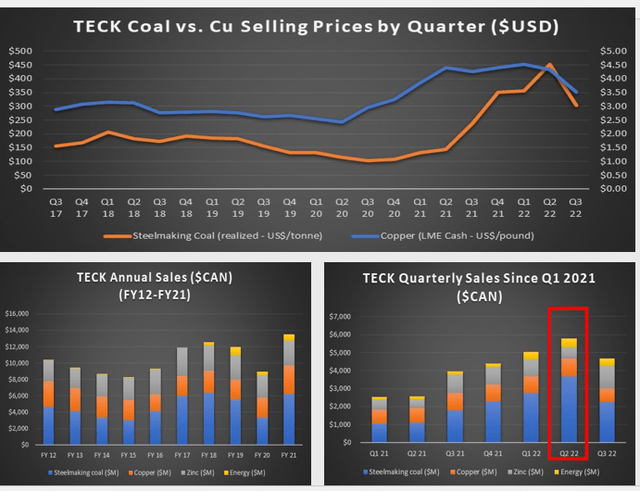

The second quarter record was largely the result of steelmaking coal selling at an all-time high of $450/tonne while copper prices remained above $4.00/lb. The third quarter figures softened as the prices began coming back down to earth, which illustrates the revenue sensitivity to commodity prices.

TECK Sales vs. Commodity Prices (Data: TECK Financials / Charts: MH Analytics)

Growth Picture

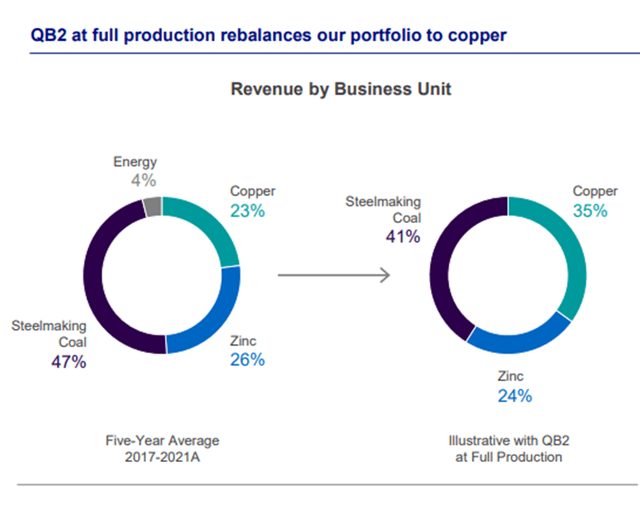

Going forward, the company will dramatically shift its revenue mix to the metal of electrification.

The company sold off its energy business unit while the four steelmaking coal plants in British Columbia are projected to run close to their combined capacity of 26-27 million tonnes annually, which is likely to remain constant as the copper business expands. Meanwhile, the zinc business output is expected to remain relatively flat at 885,000-925,000 tonnes per annum. The end result will be shifting copper as a percentage of revenue from 23% to 35% by the end of next year.

TECK Planned Revenue Mix Shift (TECK Q3 Earnings Presentation)

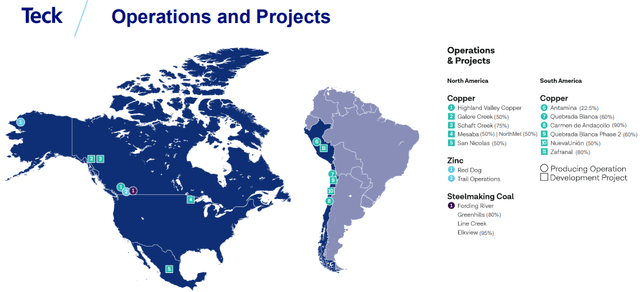

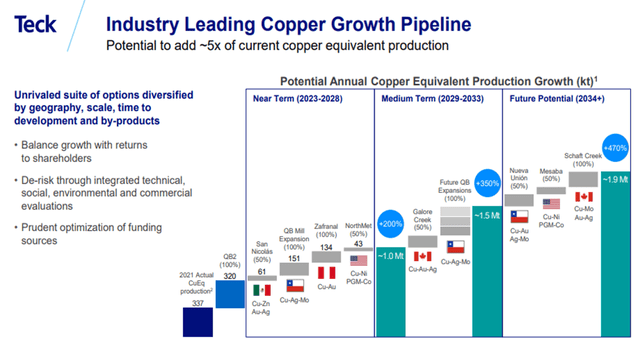

From 2026-2033, the company will look to boost copper production to around 1.5 million tonnes annually by expanding QB2 and through new projects including San Nicolas (Mexico), Zafranal (Peru), NorthMet (Minnesota), and Galore Creek (Canada).

Map of TECK Mines/Projects (TECK November Investor Supplemental)

They hope to reach close to 2 million tonnes of copper equivalent production beyond 2033 through three additional projects: Nueva Union (Chile), Mesaba (Minnesota), and Schaft Creek (Canada).

This chart illustrates the general estimated potential from 2023-2033, highlighting the possibility of adding five times the amount of copper to the production schedule.

TECK Projected Production (2023-2033) (TECK Q3 Earnings Presentation)

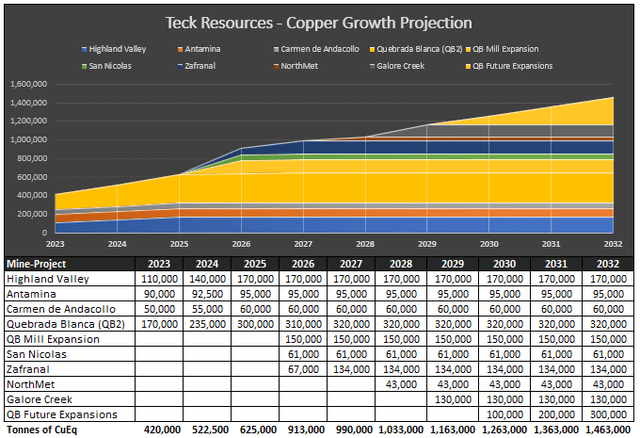

This chart represents implied allocation and growth based on the company’s general guidance ranges. If you combine QB2 and its subsequent expansions (yellow layers in graph below), Quebrada Blanca by 2032 could account for more than half of the total copper produced and sold by Teck.

MH Analytics’ TECK Production Estimates (Data: TECK Financials / Press Releases)

Valuation

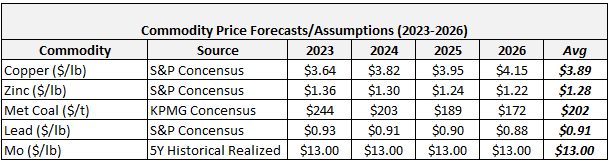

In order to generate a reasonable hypothetical revenue scenario from these projections, we need to establish estimates for commodity prices. For copper, zinc, and lead we used S&P Global Intelligence October 31 consensus target price estimates for 2023-2026. For years 2027-2032, we simply extended the average of the first four years. The steelmaking coal prices are based on consensus estimates collected and analyzed by KPMG. For molybdenum we simply used the average quarterly realized historical price paid for the past five years.

Analyst Commodity Price Estimates (2023-2026) (S&P/KPMG Consensus Estimates)

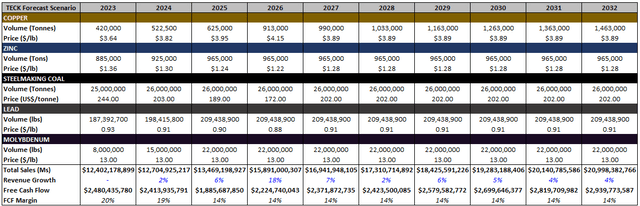

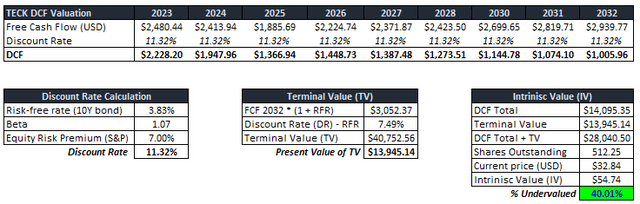

Based on the general guidance, we estimated what the production picture could look like from 2023-2032 for the basis of a discounted cash flow analysis. For the free cash flow margin % assumptions for 2023 and 2024 we used analyst consensus targets (pulled from Simply Wall Street) of 20% and 19%. The remainder we derived from the current FCF trailing twelve months margin of 14%.

TECK Production Estimate (MH Analytics)

In the DCF calculation, 10-year bond rate was used for the risk free rate and ERP comes from the S&P U.S. Equity Risk Premium Index (as of November 21, 2022). The DCF calculation suggests the stock price is undervalued by 40.01%.

TECK DCF Analysis (MH Analytics)

Even if we assume worst case scenarios for commodity prices, such as copper at $3.10/lb across all ten years, zinc at $1.20/lb, met coal at $160/tonne, lead at $0.88/lb, and molybdenum at $10/lb, the stock would still be undervalued by about 25 percent.

Conclusion

Teck Resources is on track to post record sales, cash flows, and profits in fiscal year 2022 and plans on doubling copper production next year to rebalance toward a low carbon profile. Moreover, it has a pipeline of projects that if realized will grow copper and equivalent production over 340% by 2033. Despite losses due to an impairment charge in Q3 and poor momentum in recent months, the stock trading at 4x earnings represents a bargain given the long-term forecasts. We project based on likely future discounted cash flows that TECK’s current stock price is 40% below its intrinsic value. Hence, we rate it a buy.

Investors should also take into account the risks associated with the conflict in Ukraine (which actually benefitted steelmaking coal prices) and policies that affect China’s consumption of commodities (like Covid lockdowns that hurt copper prices). This is critical because, bottom line, Teck’s upside hinges on the future price of met coal and copper, although the company is positioning itself to avoid too much exposure to any one commodity.

Be the first to comment