Makhbubakhon Ismatova

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on October 27, 2022.

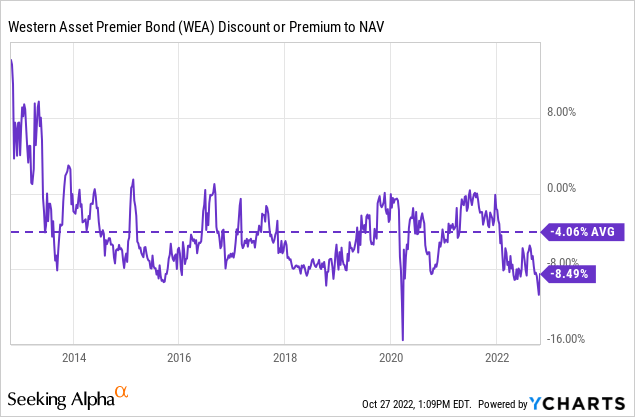

Western Asset Premier Bond Fund (NYSE:WEA) is moving to a wide discount as interest rates tick higher. This is a bond fund that invests in both quality investment-grade positions and high-yield corporate bonds. Most of its portfolio is invested in higher quality investment-grade positions but that hasn’t helped the fund as losses have come quite rapidly.

This split approach of the fund allows them to be flexible when constructing a fixed-income portfolio. Greater flexibility can help them navigate through different periods. On the other hand, due to the closed-end fund structure, the fund must also grapple with discounts/premiums. Additionally, the fund is quite highly leveraged. For a higher quality portfolio, that generally isn’t a problem until these sorts of periods.

Western Asset was founded in 1971 and specializes in global fixed-income investments. The fund itself, WEA, certainly has been through some interesting periods since its inception in 2002.

The Basics

- 1-Year Z-score: -0.86

- Discount: 8.49%

- Distribution Yield: 7.99%

- Expense Ratio: 0.92%

- Leverage: 35.40%

- Managed Assets: $199.05 million

- Structure: Perpetual

WEA’s investment objective is “seeks current income and capital appreciation.” To achieve those objectives, the fund will invest in a “diversified portfolio of primarily investment-grade bonds.” They also “emphasize team management and extensive credit research expertise to identify attractively priced securities.”

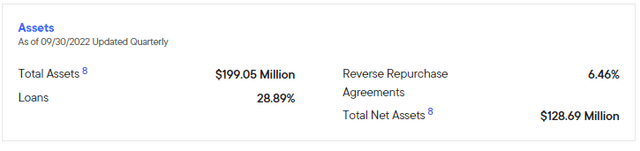

When looking at the fund’s leverage, we can see it is quite elevated. Of course, that is a natural result of a portfolio that is in decline. For the most part, investment-grade-oriented funds can generally be fairly aggressive in their utilization of leverage. There are generally fewer risks associated with these types of investments overall.

WEA Asset Information (Western Asset)

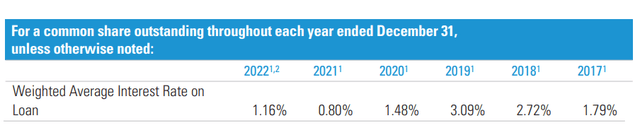

As we can see, the fund employs both loans and reverse repurchase agreements. So this can be another important factor in rising interest rates and WEA’s operations. The costs of this leverage are going to be rising, that’s for both reverse repos and loans. At the end of June, the average interest rate for the previous six months was 1.16%. That was a rise from the average in 2021 at 0.80%. Since rates have risen even further, the cost for this leverage is expected to have only climbed even further.

They don’t have hedges in place to minimize these interest rate impacts either, at least according to their last semi-annual report for the period ending June 30, 2022. I’d be primarily looking for interest rate swaps or being short on Treasury securities.

That being said, they do have some limited exposure in their portfolio to floating rate debt. These come from primarily collateralized mortgage obligations, asset-backed securities and senior loans. These make up only around 9% of the entire portfolio.

The fund’s expense ratio is rather low for a CEF. When including the interest expense, it comes to 1.22%.

Performance – Interest Rates Wreaking Havoc

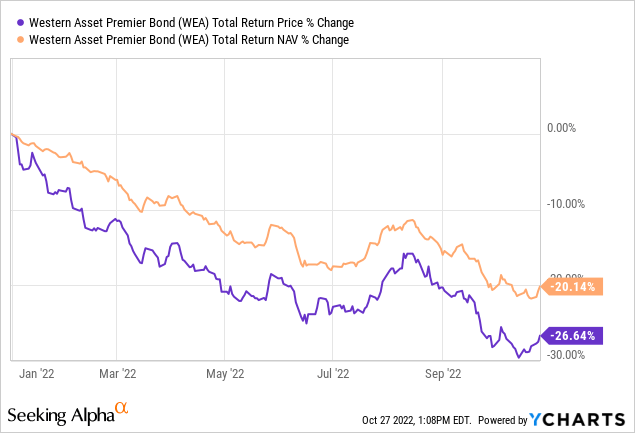

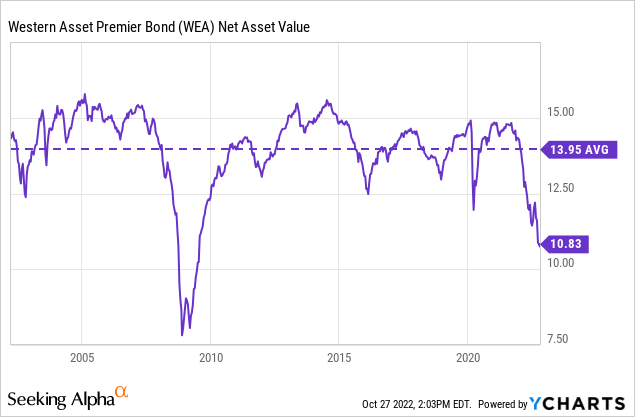

WEA’s performance for the year can be seen below. Certainly not the most encouraging results.

Ycharts

Of course, this isn’t the only fixed-income fund experiencing losses, as rapidly rising interest rates are wreaking havoc across the board. In fact, investment-grade quality is getting hit even harder than their high-yield counterparts. The primary reason, they are more interest rate sensitive.

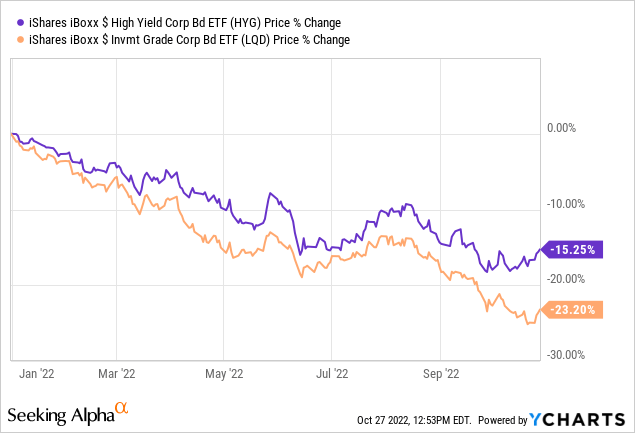

To get a clear picture of this, we can look no further than a comparison of two ETFs. We have the iShares iBoxx High Yield Corporate Bond ETF (HYG) and iShares iBoxx Investment-Grade Corporate Bond ETF (LQD). On a YTD basis, not including any distributions, HYG has outperformed. This isn’t by a little bit; it’s by a meaningful amount.

Ycharts

While HYG has to deal with more credit risk headwinds going into a potential recession next year, that still hasn’t overridden the hit that quality is taking from interest rates. In general, the higher yields and short-maturities on below-investment-grade bonds are what leave them less sensitive to interest rates.

Of course, that does mean that the opposite is true – if rates start to fall, below-investment-grade bonds should rise more rapidly too. So now that rates have risen so rapidly and the discount on WEA is opening up, is it time to start buying investment-grade?

While I’d love to give a clear and concise answer, it really isn’t certain at this time. One of the problems is that inflation continues to come in hotter than expected. Therefore, the expectations for an even more aggressive Fed happen where peak rate expectations climb.

Now, if you are a longer-term investor, it is certainly looking much more appealing than at the beginning of the year. We are coming close to the end of 2022. The general consensus is that the Fed won’t have to be aggressively raising in 2023 the way they were through 2022. In fact, some think that the Fed could pivot and start easing in 2023. Thus, that would be a boon for a fund such as WEA.

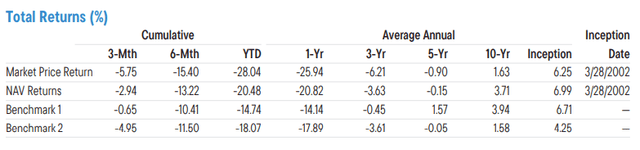

The longer-term results of the fund have been fairly competitive with the benchmarks that they’ve included. This was as of September 30, 2022, from their fact sheet. Benchmark 1 is the Bloomberg U.S. Corporate High Yield, and Benchmark 2 is the Bloomberg U.S. Credit Indexes.

WEA Annualized Returns (Western Asset)

The other main factor that makes WEA more interesting at this time is the fact that the fund’s discount has widened relative to its historical range. In fact, it is quite near its lowest point in the last decade, excluding 2020’s COVID crash.

Ycharts

Distribution – Fully Covered, But Only For Now

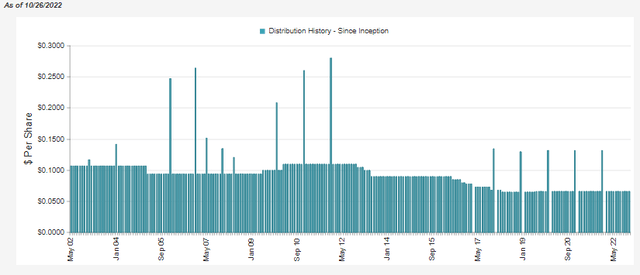

One of the benefits of decreasing value in the underlying portfolio and the fund is that the yield rises. The distribution rate on WEA comes to 7.99%, with a NAV rate of 7.31%.

Over the years, the fund has adjusted as needed. In particular, we can see quite a drop from 2015 to 2018. This could have been the result of interest rates rising at that time.

WEA Distribution History (CEFConnect)

With rates rising more rapidly this time, coverage could come under pressure even faster. Looking at the 2018 report shows us that for both the 2018 and 2017 years, the net investment income coverage came in light. Perhaps unsurprisingly, the fund’s expense ratio in 2015 was 1.43%, which then rose to 1.93% in 2018.

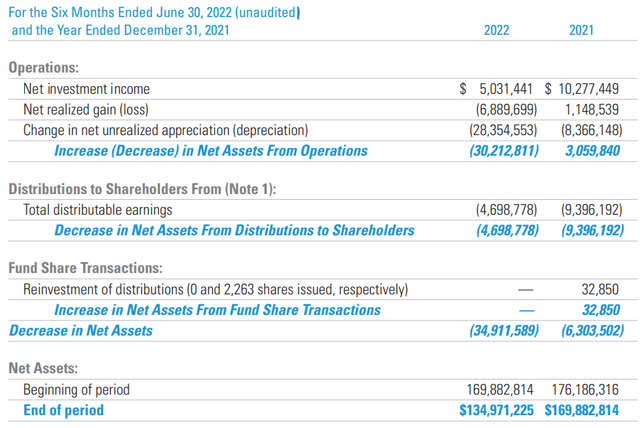

In their last report, they showed that the distribution was covered entirely by NII.

WEA Annual Report (Western Asset)

Fortunately, that’s exactly what we want to see. But unfortunately, just as we saw expenses rising from 2015 to 2019 for the fund, we know expenses are rising again.

WEA Interest Costs (Western Asset)

In 2019, we saw the interest rate on the loan top out at 3.09%. At this time, it is likely to top out even higher as interest rates are now going higher than they did previously and at a much faster pace.

The interest expenses came to $373.696k with this last six-month report. If that tripled, which isn’t a stretch of what could happen, we would see interest expenses climb to $1.121 million. That would be an increase of $747.392k, which would reduce the NII to around $4.284 million for a six-month period. Therefore, the actual distribution would then not be covered, and I would expect a cut at some point.

Of course, CEFs can pay out just about whatever they want for as long as they want. This is also not considering any pivot from the Fed that could send interest rates lower. If the Fed reduces rates, the leverage expenses would also reverse.

The silver lining here, if there is one, is that new bonds are issued with higher yields. So if rates actually stay elevated for years, we could see the reverse start to happen as they can invest in higher-yielding bonds. The portfolio should receive par back from the underlying bonds; then, they can invest in those higher coupon bonds.

For CEFs, though, the higher expenses of interest rates are immediate, and the higher yields don’t come until later. The average life of WEA’s holdings is 9.47 years – that’s quite a long period but reflects the nature of the investment-grade portfolio. The effective duration of the portfolio is 6.53 years. Of course, they are also actively managed funds. Meaning they are constantly buying and selling underlying holdings.

WEA’s Portfolio

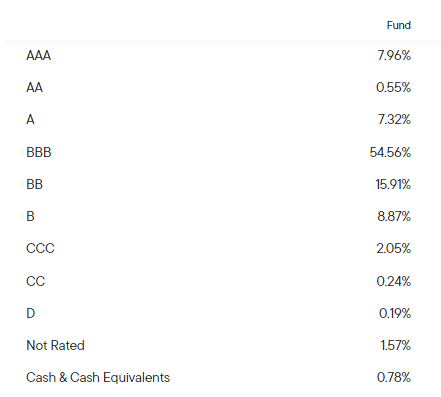

As I’ve been saying through this article now, the portfolio is split but is overweight to investment-grade bonds. Here’s the actual breakdown of the credit quality of their portfolio at the end of September. We can see that around 70% is BBB and above. There is a small portion in “Not Rated” and then another smaller portion in cash and cash equivalents. The remainder is in below-investment-grade bonds.

WEA Credit Quality (Western Asset)

This tells us that the portfolio is quite safe. The number of defaults and bankruptcies should be fairly limited in the underlying portfolio. Of course, any catastrophic crisis could still result in above-average defaults or at least sharp drops in WEA’s portfolio. In the GFC and COVID crash, that became quite apparent.

For the most part, the underlying portfolio has stayed relatively flat at around the $14 mark. This is also a function of the fund paying a distribution that is generally covered.

Ycharts

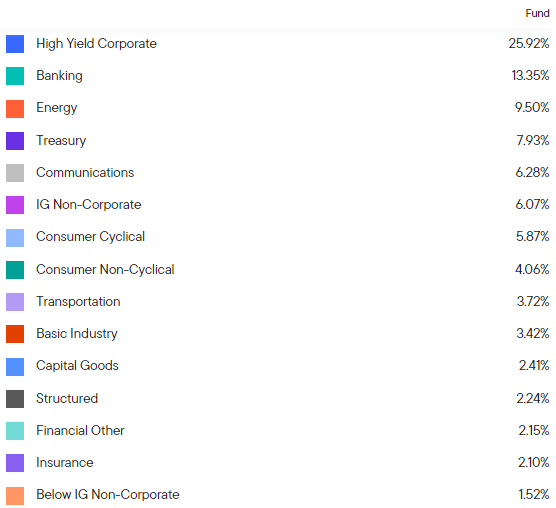

In looking at the sectors that WEA is invested in, they are true to their policy that they are “diversified.” These are the top 15 listed, but their website contains the full list.

WEA Asset Allocation (Western Asset)

In total, they put the total number of positions at 314 holdings. That’s quite a significant number, but it is fairly common for CEFs. In particular, high-yield bond funds tend to focus on a significant number of holdings. Therefore, no single position carries a disproportionately large allocation.

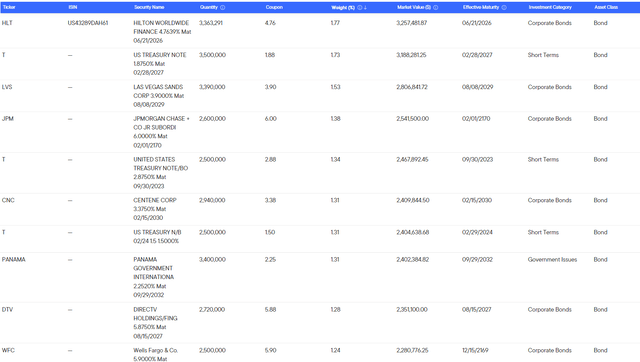

Here is a look at the top ten holdings for the fund. As we can see, we have a good mixture reflecting what we see in the broader categories above. We have a bit of junk corporate bonds showing, several risk-free, safer Treasury holdings, and some investment-grade corporates making the list.

WEA Top Holdings (Western Asset)

Conclusion

Investment-grade bonds haven’t been a safe haven through 2022. In fact, they have been hit harder than high-yield bonds, even though 2023 is expected to bring a recession. For high-yield bonds, that means credit risks can be a major concern. With some significant drops in investment-grade bonds, I would say we are seeing potential opportunities to start initial positions. WEA’s discount also adds to the overall appeal, as it comes near its widest discount in a decade.

At the same time, it isn’t a risk-free investment. Further interest rate increases over what is expected could cause WEA (and other fixed-income funds) to take another leg lower. Additionally, higher interest rates are having an impact on the leverage costs of WEA. The fund’s distribution is fully covered but is very likely not to be fully covered going forward due to the higher interest rate costs. That is unless they adjust the payout lower, which they have a history of adjusting to sustainable levels.

Another factor to consider is if the Fed does pivot next year and eases interest rates. If that happens, there is a good chance this fund could see some reversal to the losses we’ve seen this year. At this time, that seems less likely, but it certainly isn’t impossible.

So overall, I’d say it is quite attractive, but it isn’t entirely clear skies going forward. Utilizing a dollar-cost averaging approach could be the most appropriate for a longer-term investor looking to build up a position.

Be the first to comment