NVS/iStock Editorial via Getty Images

In May 2022, we wrote an analysis on the McDonald’s Corporation (NYSE:MCD) business and we concluded that the stock, at that time, could be rated as “hold.” The analysis focused on pros and cons of buying MCD stock. The pros included: consistent share buybacks, safe and sustainable dividend payments and solid Q1 financial performance. On the other hand, we highlighted the uncertainty related to the Russia – Ukraine conflict and the relatively high valuation as the primary cons.

In this article, we are presenting additional arguments why we still believe after several months that the stock is not a buy yet, despite some positive pieces of news.

Let us start our argumentations again on the more optimistic side.

Financial performance remained strong in the second quarter

Many metrics have been indicating in the second quarter that the demand for MCD’s products remains high.

1.) Global comparable sales increased 9.7%, reflecting positive comparable sales across all segments:

- U.S. increased 3.7%

- International Operated Markets segment increased 13.0%

- International Developmental Licensed Markets segment increased 16.0%

2.) Consolidated revenues decreased 3% (increased 3% in constant currencies).

3.) Systemwide sales increased 4% (10% in constant currencies)

4.) Consolidated operating income decreased 36% (30% in constant currencies). Results included $1.2 billion of charges related to the sale of the Company’s business in Russia and a gain of $271 million related to the Company’s sale of its Dynamic Yield business. Excluding these current year net charges and prior year net gains of $98 million, primarily related to the sale of McDonald’s Japan stock, consolidated operating income was flat (increased 7% in constant currencies).

5.) Diluted earnings per share was $1.60, a decrease of 46% (41% in constant currencies). Excluding the net charges described above of $0.90 per share and nonoperating expense of $0.05 per share related to the settlement of a tax audit in France, diluted earnings per share for the quarter was $2.55, an increase of 8% (14% in constant currencies), when also excluding prior year net pre-tax gains of $0.10 per share and income tax benefits of $0.48 per share.

While the decrease in operating income and diluted earnings per share is significant, in our opinion, it removes the uncertainty related to the Russian business and enables investors to form a clearer picture about the firm’s operations in the near future. The sale of the business does not only provide more certainty, but also removes significant costs associated with keeping the closed restaurants. The closure of Russian locations since March has cost the company about $55M per month.

It is also important to point out that despite the strong U.S. dollar, MCD global comparable sales and systemwide sales have still increased, while consolidated revenues have declined by only about 3%.

In our view, the second quarter financial results, including the sale of the business related to the Russian operations, make the firm more attractive than in May.

Uncertainty related to the Ukrainian operation is reduced

In early August, the news came out that MCD would start reopening its restaurants in Ukraine in the coming months. McDonald’s has a total of 109 restaurants in Ukraine, which is substantially less than the 850 locations that they used to have in Russia. It is still unclear, however, how many of these 109 locations would be reopened in the near future. The firm is likely to open restaurants in territories farther away from the conflict, including the capital, Kyiv, and the western regions of the country.

We believe that this move also slightly reduces the uncertainty and gives an optimistic signal to shareholders and potential investors. With the reopening of some of the restaurants, we expect losses related to the Ukrainian part of the business to become narrower.

While the uncertainty that we wrote about in our previous article has been largely reduced, in our opinion the valuation of MCD’s stock still remains high, which is currently the main reason why we maintain our hold rating.

Valuation

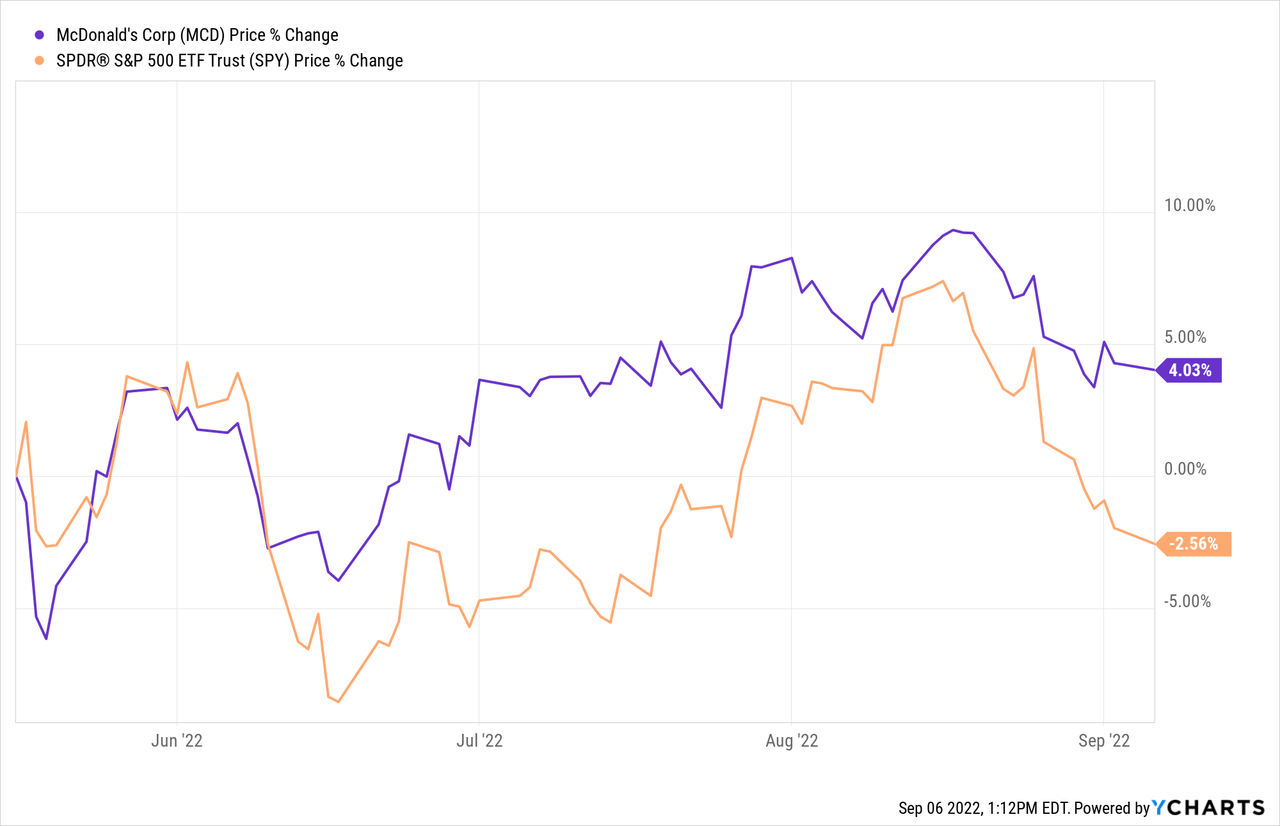

Since our previous article on May 16th, MCD’s stock price has increased by about 4%, while the broader market has declined by more than 2.5%.

On the other hand, despite the strong financial performance and the reduced uncertainty, the macroeconomic conditions and the fundamentals have not improved dramatically. High raw material and energy prices continue to create headwinds for the firms and the uncertainty of energy supply in Europe during the winter months may impact MCD’s business as well in the near term.

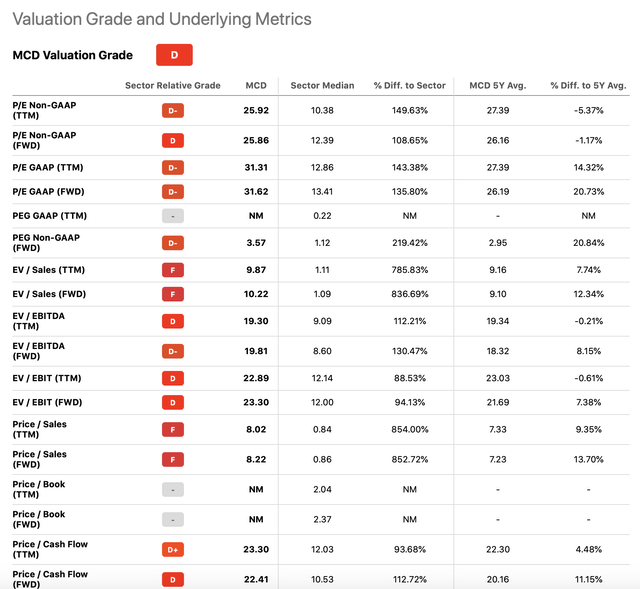

According to the traditional price multiples, while MCD trades about in-line with its own 5Y averages, it is trading at a more than 100% premium compared to the consumer discretionary sector median.

Despite the high quality business model, the superb brand recognition and customer loyalty, the firm’s long history of safe and sustainable dividends and share buybacks, in our opinion, such high valuations in the current market environment are still not justified. On the other hand, if you already own MCD’s stock, we do not recommend selling it, as it may be less volatile due to its “safer” nature than the broader market.

Key takeaways

Reduced uncertainty related to the Russian and Ukrainian operations may help shareholders and potential investors better assess the firm’s financial performance going forward.

The demand for MCD’s products has remained high and the second quarter financial performance showed comparable sales growth across all segments.

On the other hand, we believe that the valuation of the firm is still not justified, due to the continuing macroeconomic headwinds and the uncertainty of energy supply in Europe over the coming months.

For these reasons, we maintain our hold rating.

Be the first to comment