Lubo Ivanko

HSBC (NYSE:HSBC) upgraded its key profitability and dividend targets on August 1, as management rebutted calls for a separation of its Asia business. Managers will certainly hope that the bank’s better-than-expected Q2 results will demonstrate the value proposition of its global banking business model and earn them some respite against investor pressure.

“Look at the half-year results and you’ll see the value of the current strategy,” said Chief Executive Noel Quinn on Monday.

Rate Tailwinds

HSBC reported a pre-tax profit of $9.2 billion for the six months to 30 June, down from $10.8 billion a year ago, but higher than the $8.15 billion consensus analysts’ estimate.

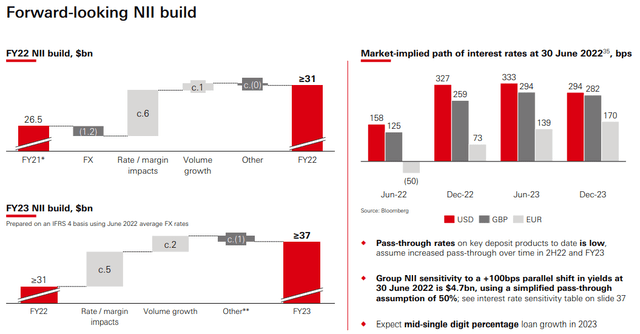

The main driver in the outperformance was robust growth in net interest income, which rose by 20% in the second quarter, following global interest rate rises and modest loan growth. Lending margins, which had been crimped by the recent low interest rate environment, have been improving rapidly, with net interest margin up a further 9 basis points to 1.35% in Q2 2022.

Encouragingly, non-interest income growth was positive too, with a 2% rise in Q2, following a strong foreign exchange performance at its investment bank, which offset adverse insurance market impacts and lower fee income in Wealth and Personal Banking.

One area of concern, however, is the impact of growing economic uncertainty on credit costs. Following big releases in loan loss provisions last year, the bank reported a net charge for expected credit losses of $448 million in Q2. This included a further $142 million charge relating to its Mainland China commercial real estate portfolio. Overall, HSBC has some $12 billion of exposure to the sector, with roughly a third of those loans already rated as substandard or impaired.

It’s too early for the deteriorating credit outlook to translate into signs of portfolio stress – stage 3 non-performing loans remain stable, at 1.8% of total loans. Looking ahead, management expects the ECL charge to normalize towards 30 basis points for the full year.

Shareholder Pressure

HSBC is reshaping itself after a turbulent decade during which returns repeatedly fell below its cost of capital. The bank has promised to speed up the restructuring of its unprofitable US and European businesses, and redeploy capital to more profitable parts of the business, particularly in Asia.

For some time now, HSBC has been under pressure from its biggest shareholder, Chinese insurance company Ping An Insurance Group, to consider alternative structures for the group’s operations – namely a separation of its Asia business in some form or another. Earlier this year, Ping An commissioned Hong Kong consultancy firm In Toto to consider whether a spin-off of its Asia business or just its Hong Kong retail operations could unlock shareholder value.

But against shareholder pressure, management redoubled efforts to make the case for its global business model. CEO Noel Quinn told investors that, in the past, investors could not appreciate the value of its “internationalism” because parts of the business dragged down the overall returns of the group to below its cost of capital.

International Connectivity

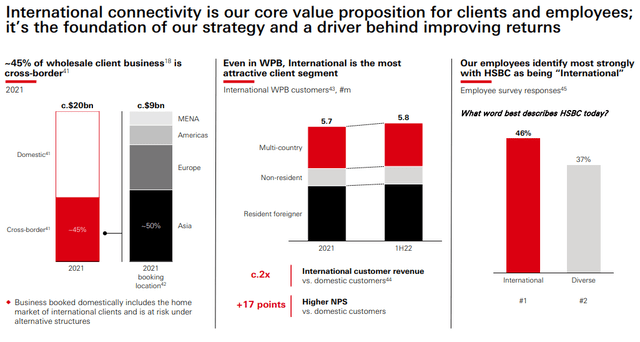

International connectivity is core to the bank’s entire value proposition, from both the client and employee standpoints, he said. Especially in Asia, its global network attracts clients and is crucial to how colleagues see the bank.

HSBC has a 157-year-long history in bridging capital and trade flows between global hubs. And although the bank books the majority of its profits in Asia, 45% of its global wholesale client business comes from cross-border customers.

HSBC 2022 Interim Results Presentation

“Similarly, in Wealth and Personal Banking, International is the most attractive and fastest-growing segment. Our product like Global Money and our wealth platforms… which are some of our highest return propositions, are specifically designed to capitalize on our international connectivity for our retail and wealth customers. You will continue to see more propositions from us in this space, and that’s because the average international customer revenue is around double the average domestic only customer.”

CEO Noel Quinn, HSBC’s Q2 2022 Earnings Call Transcript

Aside from these revenue synergies, there are significant funding, liquidity and cost risks that could be lost in a potential breakup of the group. And on top of this, there are multi-billion dollar one-off execution costs that will need to be incurred, from creating a standalone IT system for both businesses, refinancing debt, hiring external advisors and tax costs on restructuring.

It also comes at a time when banks globally are under pressure to accelerate the pace of digitization. In this area, there are advantages to having scale, especially when investments in its infrastructure can be spread across multiple franchises, lowering costs.

HSBC’s Upgraded Guidance

Due primarily to the tailwinds from rising global interest rates, HSBC raised its return on tangible equity target to 12% or higher from the 2023 financial year onwards, up from at least 10% previously.

HSBC 2022 Interim Results Presentation

It expects net interest income of at least $31 billion in 2022 and $37 billion in 2023, up from slightly under $27 billion in 2021. With some $10 billion in extra net interest income over a two-year period, HSBC should be able to weather a normalization in credit costs, as well as inflationary pressures on the cost front.

Despite strong inflation headwinds, management is confident of keeping adjusting costs stable in 2022 and is aiming to keep cost growth at around 2% in 2023. Key to controlling costs is its falling headcount, reducing commercial real estate footprint and restructuring investments announced during the depths of the health crisis in 2020.

Additionally, the bank has pledged to restore the dividend to pre-pandemic levels “as soon as possible”. HSBC, which has a particularly large retail shareholder base, had been under intense criticism by shareholders in Hong Kong for scrapping its dividend in 2020. The group later restored the dividend on a semi-annual basis, but only at around half the pre-COVID level – $0.25 per share.

Dividend growth will be driven primarily by higher returns, while the bank would target a dividend payout ratio of around 50% for FY2023 and FY2024. Additionally, the bank would reinstate quarterly dividends from 2023 onwards.

Final Thoughts

I think it’s important to remember that setting new targets is one thing; consistently achieving them is something else entirely.

And while rising interest rates would likely prove to be a powerful tailwind, macroeconomic risks cannot be underestimated. Slowing global growth would not only drive up credit costs but also possibly usher in a new downward cycle in policy rates once inflationary pressures ease. And given that so much of HSBC’s improved outlook is dependent on higher rates, it’s uncertain for how long HSBC can sustainably deliver on its upgraded targets.

Be the first to comment