Joa_Souza/iStock Unreleased via Getty Images

Dear Readers,

In this article, we’re going to be taking a look at Braskem (NYSE:BAK). The company is an oft-overlooked international, Brazil-based petrochemical specialist company with operations spanning continents. While the company does come with a certain set of risks, its diversification and South American base means that to a higher degree it is insulated to some of the current energy and macro troubles that some of our European counterparts face.

A reader asked me to take a closer look at Braskem to see if it could be a fit – and I’m happy to do so.

With that said, let’s see what we have in Braskem.

Reviewing Braskem

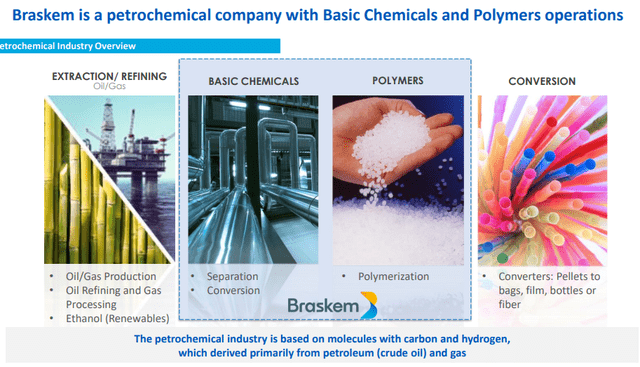

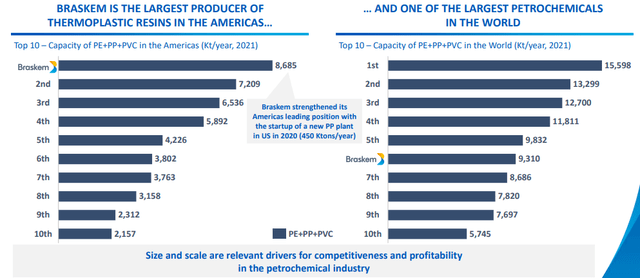

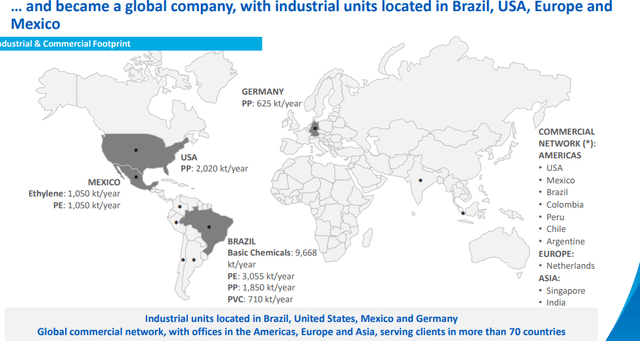

A high-level review of Braskem is simple. The company is the top thermoplastic resin producer in the Americas. With 36 industrial plants of massive size spread across the nations of Brazil, US, Mexico as well as Germany, the company has an overall capacity of over 15M tons of thermoplastic resins and petrochemical products, compounds and materials.

This company is the world’s leading producer of so-called biopolymers, which means that the company produces PE (for bags and the like) from sugarcane-based ethanol. We see these bags proudly featured in most of our grocery stores in Sweden as “made from sugarcanes”. Braskem has a plant with the capacity to produce 200,000 tons of the stuff.

The company is headquartered in Brazilian Sao Paulo and from its home serves the market of Brazil, the US, Argentina, Mexico, and Europe, with only very limited exposure to Asia.

The company has an interesting set of shareholders, combining Petrobras (PBR) at 32.15%, and the Brazilian Conglomerate Odebrecht S.A, more commonly known as Novonor, a private company. This in turn is a holding company for the largest engineering and contracting company in LATAM. It is said that Odebrecht through its 38.25% shareholding controls Braskem.

Braskem owns the three largest petrochemical “complexes” in Brazil. The company’s feedstock is primarily naphtha, but it also uses ethylene and propylene. It is also involved in the production of benzene, butadiene, toluene, xylene, and isoprene – mostly sold to other chemical companies which use the same sort of complexes, such as Dow Chemical (DOW).

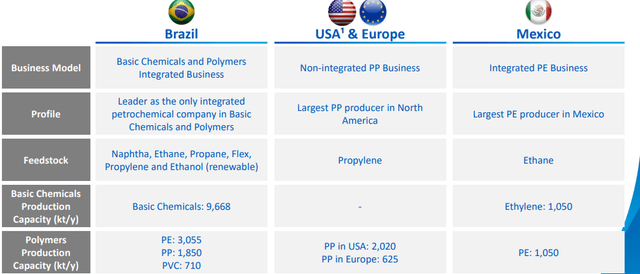

The end products that Braskem is primarily known for are PE, PP and PVC – or polyethylene, polypropylene, and polyvinyl chloride, where the company has the capacity to produce 5.7M tons on an annual basis in Brazil alone. The company is also the leader in the US polypropylene market, with 1.5 million tons of production capacity. In addition, its polypropylene capacity production in Germany is 545,000 tons.

Next to others in Germany, Braskem is fairly small.

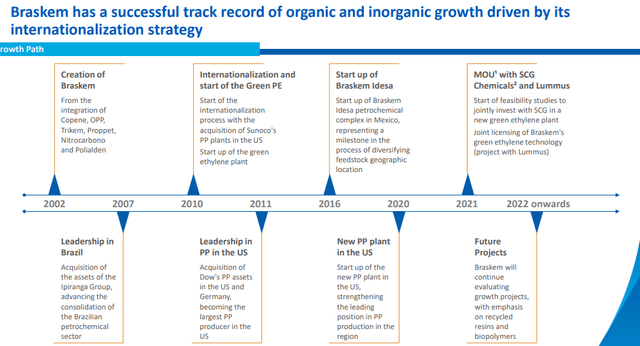

The company’s history goes back to 2002 when it was the leading petrochemical company in LATAM with units across the nation, but it consolidated based on no less than six companies at the time; Copene, OPP, Trikem, Nitrocarbono, Proppet, and Polialden. The company also M&A’ed Politeno, the third-largest PE company in Brazil

The company then joined Petrobras and Ultrapar the following year in the biggest merger in Brazilian history, when those three companies acquired Grupo Ipiranga for a purchase price of $4B.

While Petrobras and Ultrapar shared the fuel distribution operations, Braskem took over Ipiranga Petroquímica, Ipiranga’s former petrochemical operation as part of the deal.

That is more or less the company we’re looking at today in this article.

So, to review, it’s a market leader in the Americas, and on 6th place in the entire world (though a distant 6th place on a global scale, with #1 having close to double the capacity of Braskem).

… and its current production is located in appealing areas that don’t necessarily see much of the problematic macro we’re seeing in Europe at this time, with an attractive customer base and aim.

Usually, you might say that any company with high exposure to Brazil is a danger – and you’d not be wrong. But the company has been able to successively reduce its Brazil exposure through diversification, down from 72% in 2020 to 53% of recurring EBITDA from Brazil in 1Q22 – and it’s working to reduce it further. It bears noting however that over 50% is still a massive exposure to one market, one geography, and one currency, and this needs to be taken into account.

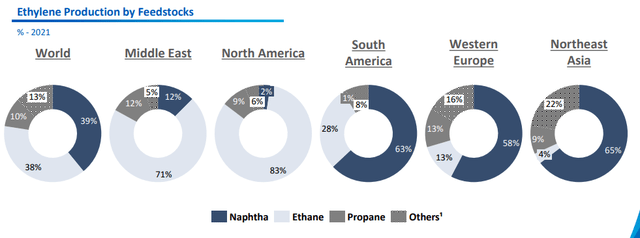

The other thing the company is doing is reducing its large naphtha exposure by introducing feedstocks such as Propylene, Gas, and Ethanol. Naphtha is down from a 47% feedstock profile to a 36% feedstock profile in less than 7 years. This is the main competitive element (or one of them) in the petrochemical industry, and usually represents over 60% of a company’s cost basis.

The company reports its operations on the basis of three geographical segments, and these are based on geographies, but also the types of feedstocks used and the types of productions in the company.

The company has a number of fundamental upsides across these segments, including market leadership in Brazil, where Braskem is the only integrated petrochemical company in basic chemicals and polymers with a great feedstock and supplier diversification. The company argues it has a natural hedge against FX because demand contraction on the home market tends to be followed by FX devaluation, which holds benefits for a dollarized business, which results in demand growth. The company also has a great amount of consolidation and export capacity here.

In USA and Europe, the company is the largest PP producer in NA, with a brand-new facility (Delta) online. In Mexico, the company is the largest PE producer with an integrated business model for ethylene production, as well as high-and-low-density PE.

The nature of the petrochemical segments and industries is the focused on the production of building blocks for the modern world. These building blocks that the company produces through the feedstocks of crude, coal, ethanol, and natgas as well as its derivatives, go into various materials such as plastics, fibers, rubber, paints, and coatings, which in turn make their way into every aspect of the modern market in the form of products in automotive, packaging, construction, medical, industrial, pharma, personal care, sports, textiles, electrical, aerospace, and electronics.

The main correlation of these companies is to feedstock pricing and demand volatility. Since these prices are given internationally, the potential for volatility is high, given the high correlation between Naphtha and Crude prices. However, Braskem has an increasingly diversified feedstock mix.

Braskem Feedstock Mix (Braskem IR)

And the expectations for the spreads between PE and Naphtha are already at above pre-war levels when considering the Ukraine situation.

The company’s revenues mainly follow the overall petrochemical demand and price dynamics primarily composed of a PE/PP mix, representing around 70% of the annual revenues. This in turn is correlated strongly to economic growth. Margins in this industry are primarily driven by industry spreads and scale. Braskem has a good EBITDA margin – but it’s grown even better. During the worst of the pandemic in 2021, the company managed as high as 28.8% margins due to the trends, which is now down to 18.1%, but still above the pre-pandemic 11-12% that was common to see. The company fully expects the petrochemical industry to continue to fluctuate but expects continued EBITDA recovery and margin progress going forward.

it’s also important to note that all geographical areas of Braskem are currently at very healthy, profitable levels. The company has also been able to generate positive amounts of free cash flow, even in the most downcycle of periods such as in 2020.

In terms of debt and leverage, the company has sufficient liquidity to handle its liabilities for the next 6 years. It also has an average debt maturity of 14 years. Its weighted average cost of debt inclusive of FX is around 5.3% which is high – but not worryingly so.

Most of the company’s debt is in USD to hedge against FX. That being said, Braskem is viewed with a wary eye by the debt market, and has investment grade at BBB- from S&P and Fitch, all reiterated in 2021 with stable outlooks. We would like to see it better here – but it’s “okay”.

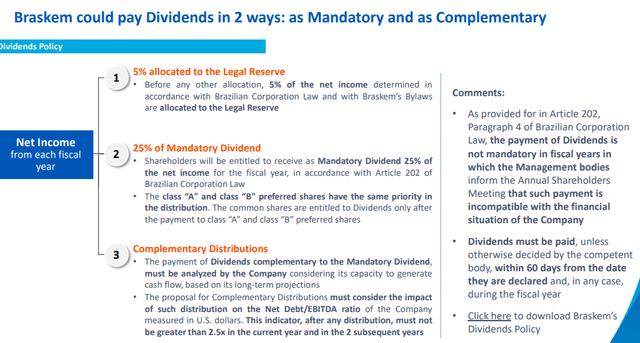

Dividends are a bit more complex.

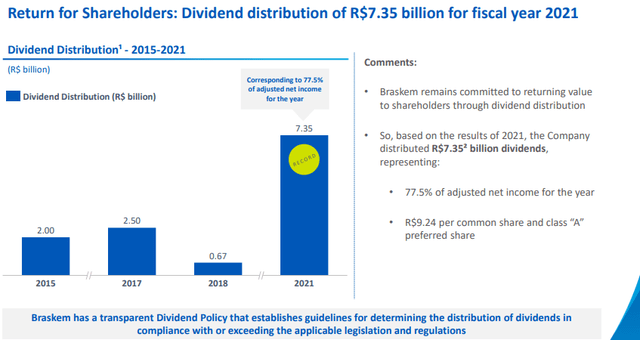

In essence, net income is 5% allocated to legal reserves according to laws and bylaws, 25% is allocated to a mandatory dividend (but since ‘net income’ might be negative, that might actually mean zero at times), and the company can decide to do supplementary/complementary distributions of its dividend as well. The specifics of these considerations can be viewed above, but it comes to a fairly complex dividend situation that has resulted in payouts in accordance with a mixed model of annual payouts with a total Braskem payout of $2.71 on a per-share basis payout for the ticker BAK, coming to a yield of nearly 20% for the year – which based on result forecasts is not a repeatable feat for 2022. This also corresponded to almost 78% of the company’s 2021 net income.

I agree that the policy is transparent, but I wouldn’t call it easily understood or forecastable to any degree – just as the company’s net income and earnings are not.

Still, recent results are fairly encouraging. The company managed a 15% net income margin, and the company produced a 56% YoY net income increase, though the company’s recurring EBITDA was down 27% YoY, owing to the normalization of international chemical and resin spreads, lower sales volumes of main chemicals, and FX.

Utilization and activity remained high at a 86% utilization rate, though the company had to provision R$11.7B for the Alagoas earthquake, R$7.2B of which was provisioned in 1Q22.

Other than that, sales were strong sequentially across other sectors, with specific sales growth in Mexico, though it’s fair to say that all of the company’s segments saw declines in overall EBITDA. The company did generate a fair amount of operating cash flow, but most of it only remained positive ex-impairments. Due to the Alagoas incident, the company reached a negative 1Q22 cash generation of R$178M.

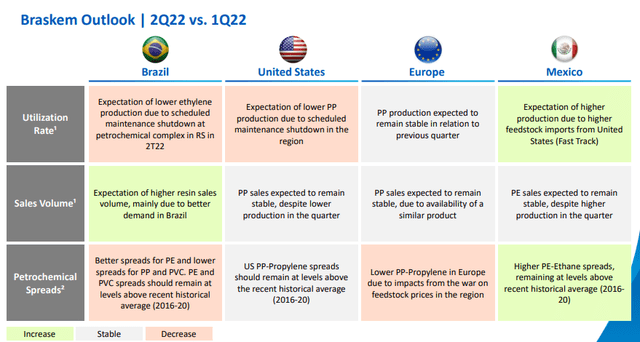

The company’s current outlook reflects some negativity, mostly stable, and some positivity in Mexico and Brazil.

The company itself markets itself as an “interesting investment opportunity”, which is curious wording. However, when you start looking at dividend and EPS performance, you start to understand some of the ambivalence that some investors have for the business.

Let’s look at the valuation for this business.

Braskem Valuation

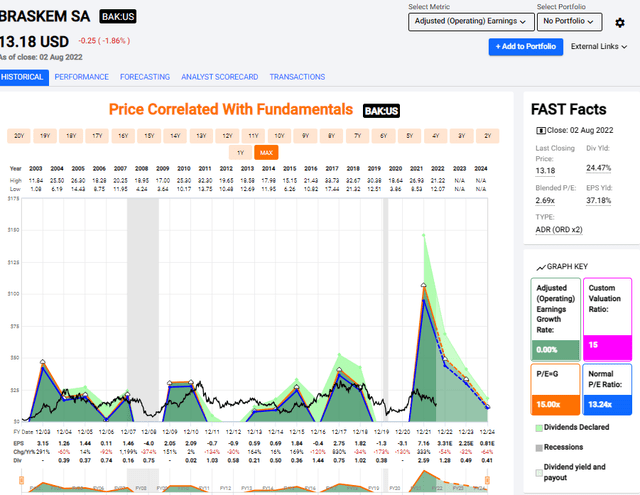

The reason for investor ambivalence is better expressed through graphics than wording.

Braskem Valuation/Earnings (Braskem IR)

Braskem makes its petrochemical peers look metastable by comparison, despite this being a volatile segment. The combination of Brazilian exposure, FX, and the overall volatility of this market makes for a very interesting investment. You can go years with zero dividends or EPS, as well as declines – just look at 2019-2020 or the like. Still, this is then weighed up by the “good years”, which see the company delivering double-digit yields and payouts.

All of this does come to a market-beating RoR of 1,391% for a 20-year basis, but there are a lot of ups and downs there. We want to make sure that we’re buying Braskem, not at its highs, but its lows.

Now, we’re not at COVID-19 levels where the company traded at negative P/E due to its earnings, but we’re also not at highs currently. The company’s average P/E is around 2.7x. This sounds incredibly low – but this sort of company is best compared to Russian or Chinese stocks – not European or North American (I’m liable to get some flak for that one, but I accept that). There are too many ups and downs here for this to be considered anything except speculative unless you’re buying the company at a massive discount.

Forecasts can’t be trusted here – the company either misses or beats the analyst forecasts 50% of the time on a 1-year basis with a 10% margin of error. What we can try is to establish some sort of overall trend, but even this can be put into question with these sorts of track records.

Because of this, I don’t tend to use DCF or forecast basis for Braskem to any major degree in my forecasts. Instead, NAV and peers will be the foremost method of looking and trying to give Braskem a target.

Let’s start with general S&P Global targets. 8 analysts follow Braskem, and 6 of them are either at a “BUY” or an “outperform” target for the company, with average targets of $12 as a low and $23 as a high. The average target for the company here is around $20.34, which implies an overall long-term upside of 54%.

Now, this is high – and these analysts do tend to have a favorable view of the company, averaging a 10-25% upside no matter when you look at Braskem. But this means that at 54%, the company is “cheaper” than when it is usually considered, causing potential interest here.

On a peer basis, the company trades among giants like Dow, Sherwin-Williams (SHW), PPG (PPG), LyondellBasell (LYB), and other companies along the Petrochemical value chain. What can be said is that Braskem trades at a significant discount in terms of revenue multiples (0.59x currently), as well as EBITDA (4.5x currently), as well as NTM, and non-average P/E (currently 5x). The company’s peers trade at least 7x, and up to 20x P/E. The multiples in these segments are, simply put, all over the place.

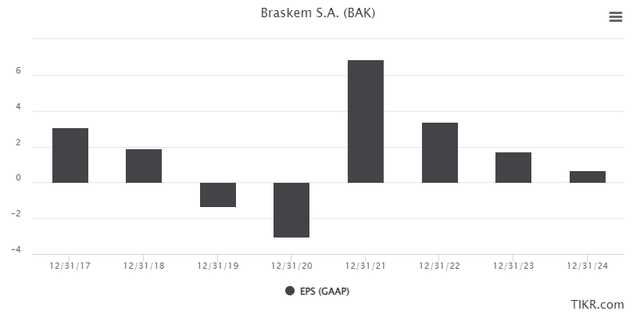

What can be said generally about the company’s forecast across all analysts, no matter where they are from, is a trend that 2021 was a top, and we’re moving down south from here on out. 2022E should decline about 30-40%, with another 20% in 2023E. If this were to materialize, coupled with the current macro, Braskem might have a hard time keeping its dividends at even a somewhat attractive level.

Braskem Earnings (TIKR.com/S&P Global)

In the end, even if we can state that Braskem is undervalued to most metrics – which it is – this is not necessarily indicative of future positive development, because the company has historically had a trough far lower than the current share price. COVID-19 saw share prices of below $5/share – which is almost a third of the current price.

The company’s valuation is far more attractive than any of its peers in terms of straight multiples – but there are risk explanations for this, and I wouldn’t jump into Braskem without knowing the risk.

That being said, I will state that if you had bought the company roughly at this price (or equivalent) or multiple in the past, you could usually count on a positive RoR – and the longer timeframe, the higher.

For that reason, I say that Braskem, also due to its multiples, is “undervalued” here.

I’m putting it at a cautious “BUY”, and saying that you can “BUY” Braskem at a PT of $14 or below, but I’m calling this one as “speculative” as it deserves to be. Because, unlike its German or American peers, this one is at higher risk. There is little limit to how high, or low it can go.

Thesis

My thesis for Braskem is as follows:

- Braskem is an attractive company from a fundamental viewpoint, and it does have the potential of granting you some massive returns if bought at trough and held to an upcycle. The recent 2021 is an excellent example.

- Based on this, it’s a speculative “BUY” when it’s cheap. While it can go lower from $13/share, I would say that at less than 0.6x revenues and lower-priced than almost every peer, I see it as a “BUY”.

- The company is undervalued here – though I want to really emphasize the speculative nature of the investment, and my initial position will likely be low to reflect this.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italic).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment