Justin Sullivan

D.R. Horton, Inc. (NYSE:DHI) operates as a homebuilding company in East, North, Southeast, South Central, Southwest, and Northwest regions in the United States. It engages in the acquisition and development of land; and construction and sale of residential homes in 31 states and 98 markets under the names of D.R. Horton, America’s Builder, Express Homes, Emerald Homes, and Freedom Homes.

Recap

In June 2022, we have published an article about the firm on Seeking Alpha, titled: “D.R. Horton is a great long-term play, but be aware of near-term headwinds.” In that article, we have highlighted the main pros and cons of investing in DHI’s business in the current market environment.

The pros were:

Strong financial and operational results in the first quarter of 2022.

Safe, sustainable and growing dividend payments

Low price multiples

Attractive share buyback program

The cons were:

Declining consumer confidence, potentially leading to less spending on durable goods and larger purchases

Increasing interest rates

Potential change in the number of building permits

Historic underperformance during economic downturns

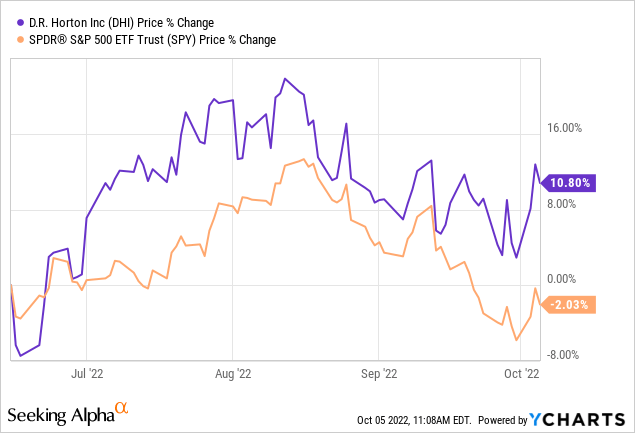

Since our last writing DHI’s stock price has increased by as much as 10% in contrast to the 2% decline of the broader market.

In our article today, we will revisit our thesis around DHI, and provide an updated view, taking the latest news, event and earnings into account.

Sentiment around the real estate market

The sentiment around the real estate market has become much poorer since June. Many articles, analysis and indicators are showing that the demand for homes is getting softer.

End of September, it was published that the S&P CoreLogic Case-Shiller House Price Index fell by 0.4% month-over-month in July, for the first time in 10 years. The change is also visible on an annual basis. Year-over-year, the increase in home prices has decelerated by the most in the index’s history. The FHFA index also indicated a softness.

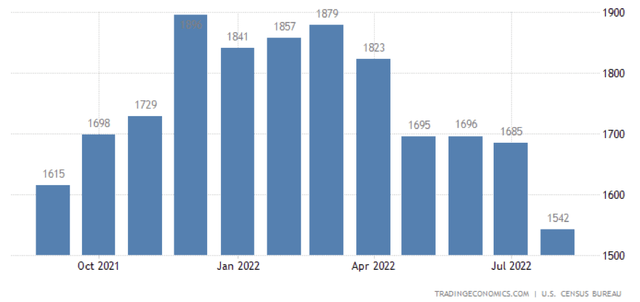

The number of building permits have kept declining further since our last article.

Building permits in the U.S. (Tradingeconomics.com)

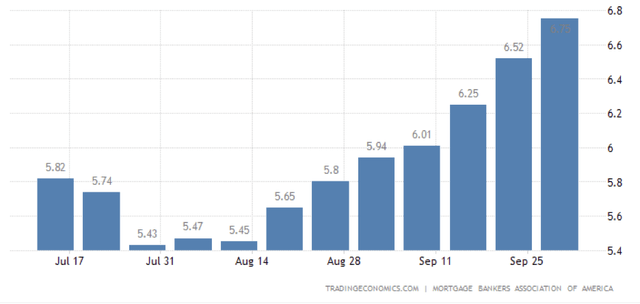

Mortgage rate has been also trending upwards, making the purchase of homes even more difficult.

United States MBA 30-Yr Mortgage Rate (Tradingeconomics.com)

The average rate on a 30-year fixed mortgage climbed to 6.7% this week, the highest since July 2007, up from 6.29% last week and 3.01% a year ago, according to a survey of lenders by mortgage giant Freddie Mac.

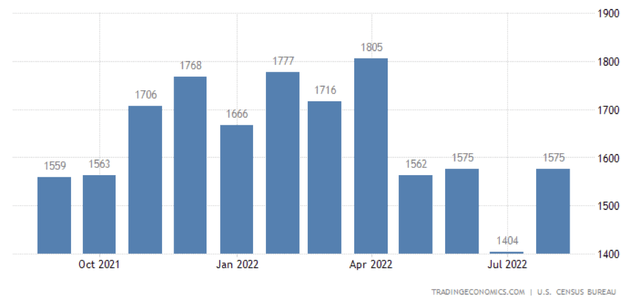

In contrast, the number of housing starts came in above expectations:

Housing starts in the US unexpectedly jumped 12.2% month-over-month to an annualized rate of 1.575 million units in August of 2022, beating market expectations of 1.445 million. It is the biggest increase since March last year, although figures for the previous months were revised lower to showed starts fell at a faster 10.9% in July.

U.S. housing starts (Tradingeconomics.com)

On the other hand, it seems that homebuilders are aiming to manage the negative sentiment and trying to keep the demand high by trimming prices. As a result, median sales price fell to $436.8K from $439.4K in July, while new home sales in August have increased by almost 29%.

While DHI’s fiscal Q3 earnings were strong, the negative sentiment was anyway visible.

The third quarter financial highlights presented by the company, in comparison to the year ago quarter, are:

• Net income per diluted share increased 53% to $4.67

• Net income attributable to D.R. Horton increased 48% to $1.6 billion

• Consolidated revenues increased 21% to $8.8 billion

• Consolidated pre-tax income increased 54% to $2.2 billion

• Consolidated pre-tax profit margin improved 540 basis points to 24.8%

• Home sales revenues increased 18% to $8.3 billion on 21,308 homes closed

• Net sales orders increased 8% in value to $6.9 billion on 16,693 homes sold

• Repurchased 4.7 million shares of common stock for $310.0 million

While net sales orders in value have increased by 8% year-over-year, reaching $6.9 billion, orders in terms of units have decreased by as much as 7% to 16.693 homes. The cancellation rates have also substantially increased year-over-year, to 24% from 17%, indicating that the low consumer confidence and the increasing interest rate are indeed negatively impacting the demand for homes. The Company’s sales order backlog of homes under contract at June 30, 2022 have decreased by 9% in terms of units but have increased by 8% in value.

In the press release, the firm has also pointed out that, while the first half of 2022 has remained relatively strong, in the second half of the year, a moderation of the housing demand can be observed:

During the first half of fiscal 2022 and most of our third quarter, housing market conditions remained strong. During the quarter, we were still selling homes later in the construction cycle to better ensure the certainty of the home close date for our homebuyers as we continued working to stabilize our construction cycle times. In June, we began to see a moderation in housing demand as mortgage interest rates increased substantially and inflationary pressures remained elevated. Although these pressures may persist for some time, we believe we are well-positioned to meet changing market conditions with our affordable product offerings and lot supply and our strong trade and supplier relationships.

In our opinion, shareholders and potential investors need to appreciate the risks associated with the worsening market sentiment in the real estate segment. The increasing interest rates, the increasing mortgage rates, the declining demand, the declining number of building permits, the declining mortgage size are all signaling that in the near-term homebuilders may face substantial difficulties.

For this reason, we take a conservative approach and downgrade DHI from “buy” to “hold”. While we believe that strength of the company’s balance sheet, liquidity and low leverage provide them significant financial flexibility in the near future, we see too many uncertainties in the upcoming quarters.

Key takeaways

Both sentiment and indicators are signaling that the demand for homes is getting softer and softer. The rising interest rates, combined with the low consumer confidence are playing a significant part in this trend.

While the fiscal Q3 financial performance of the firm was strong, the declining net sales orders in terms of units and the increasing cancellation rates are pointing to substantial headwinds in the upcoming quarters.

For these reasons, we do not recommend adding to existing positions or starting a new position at the current price levels.

We downgrade the stock from “buy” to “hold”.

Be the first to comment