svetikd

Co-produced with Treading Softly

It seems that when people know you’re good at something, they look for free advice.

Ever been an artist and someone expects you to draw them a picture just because they know you?

Good at cooking, and they expect you to make them a meal?

It’s extremely common, strangers expect you to do something for nothing, simply because they want you to.

You work hard to become skilled and effective at what you do. I respect that. In The Dark Knight, the Joker famously said:

If you’re good at something, never do it for free.

So why do so many expect their money to freeload in their portfolios? I have learned through decades of working in the financial sector and investing in the market that nothing makes money, quite as money does.

There are no freeloaders in my portfolio. When I’m paid a dividend, either it is coming out of my portfolio to provide income for my personal budget, or it is swiftly put to work to earn my portfolio more cash.

I know there is a lot of fear and stress in the market right now. I get that and see it. Unlike so many, I don’t share that fear and worry. Why? The income generated by my portfolio is still growing due to reinvestment and dividend raises.

Today, I want to look at two outstanding income sources that will never leave you without income in good times or bad times.

Let’s dive in.

Pick #1: EPD – Yield 7.6%

Enterprise Products Partners L.P. (EPD) is an MLP that has been tested through the energy bear market. If you’ve been an investor in the energy space, you are well aware of the collapse in 2015 that put stress on a lot of U.S. energy businesses as prices collapsed, and the expansion was stopped in its tracks.

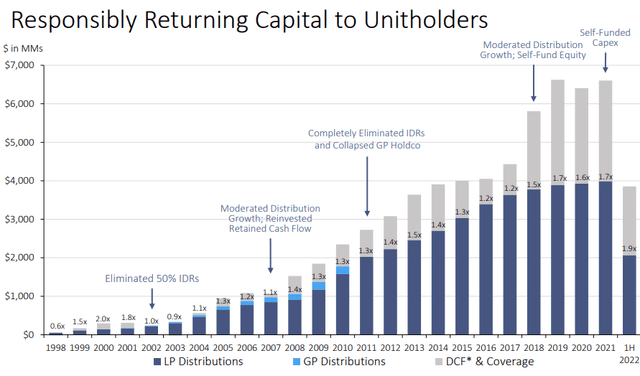

EPD wasn’t immune. Its price fell like everything else in the sector. Do you know what didn’t fall? It’s distribution. In fact, despite the bear market in energy, EPD kept raising its distribution and now has 24 years of distribution hikes under its belt.

Despite hiking its distribution every year, EPD has had superior distribution coverage in recent years compared to its own history and has had enough left over after the distribution to fund its cap-ex without raising capital.

This healthy distribution coverage and an ability to fund cap-ex from cash flow have created a very strong balance sheet. At BBB+, EPD has one of the highest credit ratings in the sector.

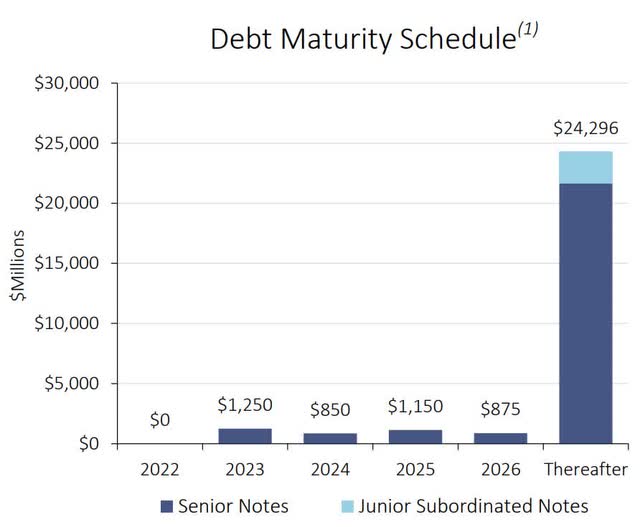

What about rising rates? EPD has minimal near-term debt maturities.

EPD has locked in long-term fixed rate debt, ensuring that its interest expense is stable and it will not need to focus on refinancing debt in an unfavorable rate environment.

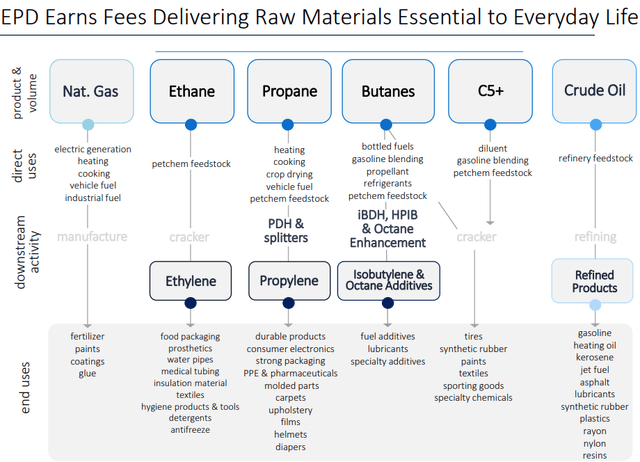

In addition to significant cash flow and a strong balance sheet, EPD has been able to create stability in its earnings by diversification. Enterprise “Products” Partners has diversified its business to cover numerous products.

As a result, when crude oil has an off day, and EPD follows it down because traders knee-jerk sell anything “oil-related,” EPD is a great option to buy. Its diversified business model, strong balance sheet, and substantial cash-flow cushion all help ensure that earnings are stable and that the distribution will keep rising.

Note: EPD issues a K-1 at tax time.

Pick #2: PFFA – Yield 9.9%

With interest rates rising, fixed-income markets have been hit hard. 2022 is continuing to etch its place in history as one of the “worst” years for fixed-income in decades.

What does that mean? It’s actually excellent news for fixed-income investors. For years, the greatest challenge for fixed income has been low yields. Over the long run, the vast majority of your gains from fixed income will be from coupon payments.

How is a “bond bear market” measured? By the change in prices. Defaults on bonds and preferred are historically low. Companies are continuing to pay their bills at record levels. So it is a “bear” market in fixed income solely based on the change in prices, not driven by realized losses.

If you are holding to maturity/call, then it doesn’t matter what the price is. At maturity/call, you will receive par. Until it matures or is called, you will receive the coupon. For fixed-income investors, the opportunity to roll repaid principal into new investments at a higher yield without taking on additional risk necessarily results in higher total returns. Yes, I am saying that fixed-income investors should be happy when prices fall, their total return will be higher because of it.

When it comes to investing in preferred and baby bonds, we have a large portfolio. For those who want to increase exposure, Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is our exchange-traded fund (“ETF”) of choice. If HDO were to operate a preferred ETF, it would look a lot like PFFA. Just look at their top 10 holdings:

You’ve seen us talk about many of these opportunities in recent weeks. RLJ Lodging Trust (RLJ.PA) is one of our favorite “busted convertibles”, and Algonquin Power Equity Units (AQNU) are our preferred way to invest in AQN.

What separates PFFA from other preferred ETFs is its active management and use of leverage. While other preferred funds like PFF were paying well above par for preferred shares when prices were high, PFFA remained strategic – focusing on higher-yielding, lower-priced opportunities. As rates rise, higher-yielding preferred have been impacted less.

If you want a quick and liquid way to increase your exposure to the types of preferred in the HDO Model Portfolio, PFFA is a great option!

Shutterstock

Conclusion

In retirement, the bills never stop coming. I wish I could tell you that when you retire, you get a reward for a life of hard work well spent, and now you get a free ride until you die. That just isn’t how the real world works.

Your bills never stop coming. Your power bill will meet you every month. Your grocery store isn’t a charity for the elderly. Nor does Uncle Sam stop holding out his hand looking for his cut.

I can tell you that an investment in EPD and PFFA is an excellent way to get income from the market. Regardless of interest rates, the strength of the U.S. dollar, or unemployment levels, EPD and PFFA are two investments that will keep cash flowing into your portfolio.

That’s the kind of investment we all could use more of these days. Our High Dividend Opportunities Model Portfolio is filled with other examples of this type of income, enabling you to create a portfolio of at least 42 unique holdings to keep your income flowing from many different sources.

That’s the beauty of income investing. That’s the opportunity for you today. All you have to do is take it.

Be the first to comment