DNY59

The investment strategist, by definition, tries to look beyond the short term to see the intermediate and longer-term trends and be aware of how the investment environment is changing. Twenty years ago, I used to follow an institutional investment strategist who had a deep understanding of the fundamentals but also respected the technicals and seasonality. He used to say, “Charts are not pure hocus-pocus.”

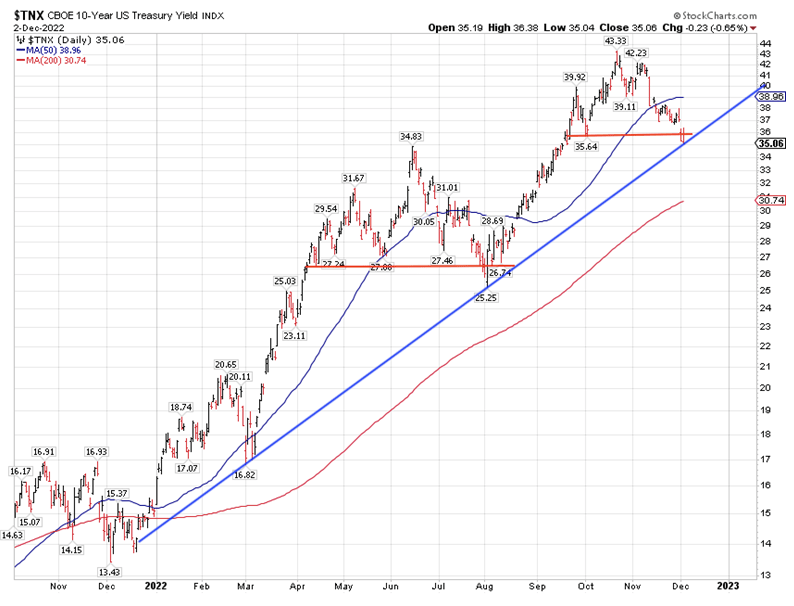

Let’s use some charts and technicals to look at bonds first.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

As Treasury yields have declined by a similar magnitude as to what they did last summer, stocks have rallied by a similar magnitude. With inflation moderating and the Fed slowing down, investors have been buying Treasuries as vigorously since early November as they were selling them a few weeks earlier.

Can the 10-year decline below 3.5%?

It can, but I don’t believe it will, by much. If the Fed funds rate reaches 4.5% at the FOMC meeting next week, and maybe 5% next year, Treasury yields should see 4% again. The question is: Will they start moving up this month? I simply do not know. It depends on economic data and Fed-speak. Powell offered conciliatory words last week, and if he keeps that tone, we could be OK until the end of this year. Suffice it to say, I do not see much downside in Treasury yields in the intermediate term, and I see more upside.

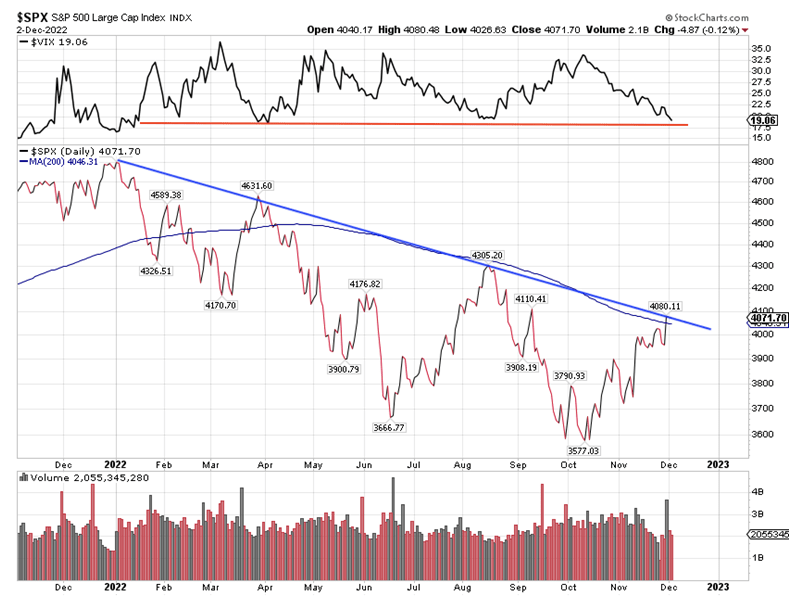

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The S&P 500 Volatility Index is a few ticks below its August low (on a closing basis) and close to its lows for the year, save for early January, when we had a bit lower VIX. The S&P 500 Index itself is a few ticks above its 200-day moving average. Since we started this downtrend, every time we have hit the blue line, there has been a negative reaction in stocks (on a closing basis) one to four days after we have hit it.

I am writing this on Sunday, and most of you will read it on Tuesday. Last Friday marked two days after we hit the downtrend, so Tuesday is Day #4. If the same dynamic holds, we should expect some type of reaction this week. That is not a guarantee, just an observation of what has happened often in history.

I am aware that December tends to be a positive month, but Jerome Powell and other factors can override history. He sure did in 2018, and he can do it again. It is possible that we hit the lows for this bear market in October if Powell delivers the desired soft landing in the economy, which we will not know until 2023.

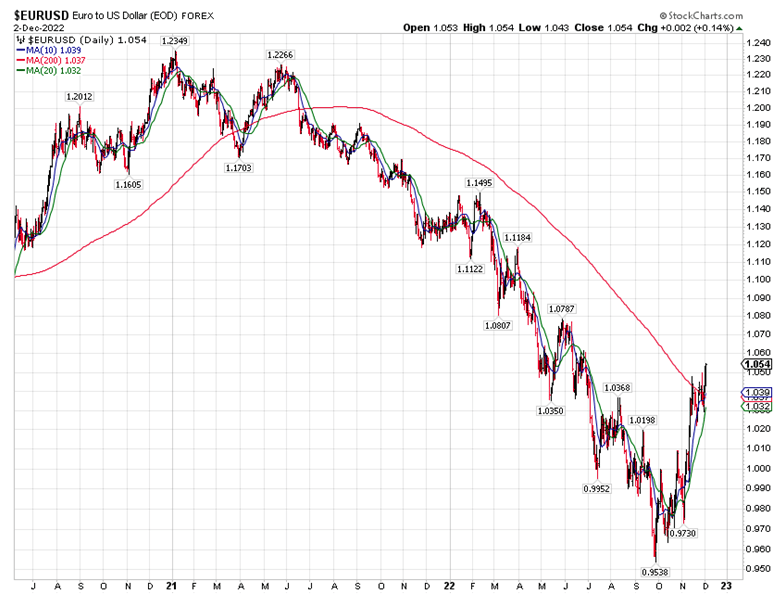

The Euro is Acting Like it has Bottomed

The sharp gains in the euro come as the Fed is expected to hike more slowly and the ECB is expected to catch up with the Fed, thus shrinking the interest rate differentials. Also, there have been some gains by the Ukrainian military, giving hopes to a truce or an end of the war. The Russians proposed a truce, but Ukraine rejected it. If there were a truce, the euro will rally further. It might even help the stock market.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

I do not believe the Russians will give up. So far, the Ukrainians are similarly minded, so a truce seems unlikely. If the war escalates, though, the euro seems ahead of itself and is likely to revisit parity again.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment