Justin Sullivan

Thesis

The title of this article is an obvious steal from James Carville, the strategist in Bill Clinton’s successful 1992 presidential campaign. The title jumped out at me when I saw the news about the Tesla (NASDAQ:TSLA) AI Day scheduled on September 30. Investors, myself included, are eager to get a glimpse of what the future will be like, not only TSLA’s future but also the future of the general technology landscape. According to this SA news article, this event is expected to provide updates on a range of highly-anticipated developments such as:

… full self-driving cars, the Dojo supercomputer, the robotaxi program, and a potential unveiling of the Tesla Bot. Optimus is described as a 5-foot 8-inch robot that can perform human tasks such as carry heavy objects. The eventual goal of Project Optimus is to deploy thousands of the humanoid robots at factories before exploring other uses for them including in the home. Elon Musk has teased that the robot business could eventually be worth more than Tesla’s car business. Other topics that could come up are timetable for Tesla Cybertruck and information on the more powerful Supercharger V4.

The title jumped out at me for a good reason. Just as Clinton’s campaign pointed out, given the then-prevailing recession in the United States, the main issue for the presidential election is the economy, the thesis of this article is to argue that battery is the key issue behind the whole TSLA story.

And as you will see in the remainder of this article, my view is that TSLA is leading the competition in this key area. The battery technology it developed with its partner Panasonic was the most advanced in the market since a few years ago. Furthermore, my estimates show that it’s also about 20% cheaper than the next best competitor in the market. Recently, it has substantially expanded its internal capacity to produce 4680 battery cells. As we will detail next, these news cells not only provide 5 times the energy capacity of the older 2170 cells but also can trigger other higher-order benefits. And finally, a superior battery can strengthen the thesis of pretty much every product line, both existing and future, ranging from the Model 3, to the Tesla Bot, and to the Cybertruck.

TSLA’s battery plan

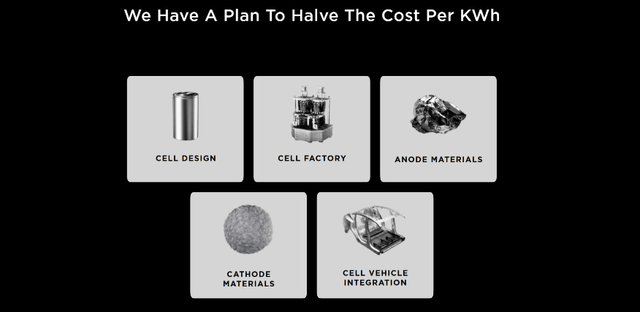

In my view, the battery future is the EV future. TSLA (and other EV players too) has come to the same recognition a long time ago. For example, back in its 2020 Battery Day presentation, TSLA announced a battery plan to improve design, build its own cells, and better integrate the cells into the vehicle. And by all accounts, my view is that TSLA is leading the competitors, probably by a large margin by my estimates, in this crucially important area. In my view, the battery technology Tesla developed with its partner Panasonic is not only the most advanced in the market but also about 20% cheaper than the next best competitor according. For example, according to a UBS analysis, after tearing down a total of 7 battery models used by various competitors, the results show that TSLA still has a comfortable lead and continues to out-innovate.

TSLA 2020 Battery Day presentation,

Fast forward to 2022, TSLA celebrated its one-millionth 4680 cell production earlier in the year as you can see from the following Twitter message sent out by Elon Musk. As commented in my earlier article (quoted below), in-house production of 1 million cells is only a baby step, but it has the potential to trigger nonlinear benefits down the road, as detailed next.

It’s a baby step admittedly. Each model Y needs about 1k of these cells. So 1 million 4680 cells are only enough for about 1,000 Model Ys. But it is a good start. Because the next steps can be so nonlinear that a small step can create far-fetching ripple effects. The lack of standardization and the convolution of many non-technical factors can potentially create a winner-take-all situation.

Tesla Official Twitter account

Battery could trigger a winner-take-all situation

TSLA already enjoys the largest scale and the largest benefits from the economy of scale as argued in my earlier articles. Looking ahead, its battery lead and in-house production capability could further expand its scalability. And given the nonlinear effects in the EV space, a winner-take-all situation is not impossible. TSLA has long recognized that batteries can be a bottleneck and breaking this bottleneck could be a game-changer. For example, it announced back in 2017 about the importance of the 2170 cells (the emphases were added by me):

Production of 2170 cells for qualification started in December and today, production begins on cells that will be used in Tesla’s Powerwall 2 and Powerpack 2 energy products. Model 3 cell production will follow in Q2 and by 2018, the Gigafactory will produce 35 GWh/year of lithium-ion battery cells, nearly as much as the rest of the entire world’s battery production combined.

Fast forward to 2022, its in-house production of 4680 battery cells marked another important milestone. A bit of technical background on these cells. The details are provided in my earlier article, and a brief summary is provided here for ease of reference:

Both the 2170 and 4680 batteries are cylindrical in shape, and the series number represents the dimensions of the cell. So, for example, a 4680 cell measures 46 millimeters in diameter and 80 millimeters in height. The energy a cell can hold is proportional to its volume. You can easily confirm that each 4680 cell can hold about 5x the energy of each 2170 cell.

With this background, we can better appreciate why the in-house 4680 cell production is a big deal. First, it is a key component of TSLA’s broader vertical integration vision. Second, the 5x capacity gain would mean that TSLA can employ 1/5 of the 4680 cells for the same driving range compared to 2170 cells. Such a dramatic decrease can lower manufacturing costs, logistics overhead, and production and assembly costs. All told, its lead on battery technologies, both at a cell level but also at module and pack levels, could lead to large cost savings. Especially when combined with TSLA’s existing scale, these cost savings could be tremendous. For example, this Bloomberg article opined that the new 4680 battery cells are a key enabler towards $25,000 EVs.

Risks and final thoughts

TSLA faces many risks. And most of them have been thoroughly discussed by other SA authors already. Thus, here I will just limit myself to the risks in terms of its batteries. The complication of dry electrode coating and raw materials shortage could delay its battery plan. In particular, the current supply chain constraints have caused a substantial rise in raw materials prices, particularly lithium. TSLA recognized the strategic importance of lithium supply years ago. For example, on its 2020 Battery Day, TSLA announced its planned entry into lithium mining. The plan was to start with buying lithium claims on 10,000 acres in Nevada. However, it has not made too much progress since then and Musk Tweeted recently about “actually” getting on with this with the recent surges in Li prices (the emphases were added by me):

“Price of lithium has gone to insane levels! Tesla might actually have to get into the mining and refining directly at scale, unless costs improve. There is no shortage of the element itself, as lithium is almost everywhere on Earth, but pace of extraction/refinement is slow.”

To conclude, I view battery technology as the underpinning issue not only for TSLA but also for the whole EV enterprise. Despite TSLA’s multitude of products ranging from EVs, to robotics, to Cybertrucks, the battery is the bottleneck, and breaking it would be a game changer. The good news for Tesla investors is that it is leading the technology curve and production curve with its strategic collaboration with Panasonic. It recently added the capability to produce 4680 battery cells in-house. Such capability is a key enabler towards $25,000 EVs and also other future products.

Be the first to comment